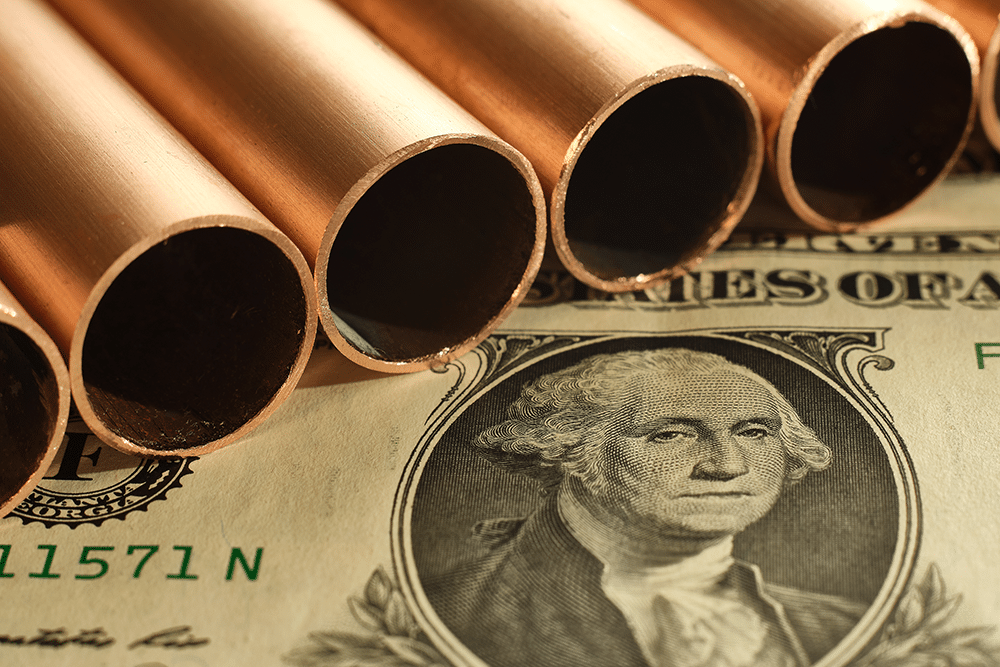

Overall, the Copper Monthly Metals Index (MMI) moved sideways, with a 1.49% rise from August to September. Following roughly two months of declines, the price of copper stabilized during August after they found a bottom on August 8.

Prices saw a modest rebound following rate cut cues from the Fed. However, the rally proved short-lived, as prices failed to create a new higher high before prices retraced. This accounted for a modest 1.94% month-over-month increase during August.

Copper and other commodity markets are constantly shifting. Get all of the latest updates with MetalMiner’s weekly newsletter.

Will the Rate Cut Copper Price Bounce Last?

After trading sideways throughout August, a 50 basis point rate cut from the Federal Reserve, the first in four years, offered an at least temporary boost to the price of copper throughout September. Prices closed September 20 at $9,526/mt, their highest level since July. This disrupted the series of lower highs created since prices hit an all-time high in May, which prevented the confirmation of a strong downtrend.

While many expect lower rates to ease pressure on the U.S. economy, uncertainty remains as to what lies ahead. Just as their onset had a lagging effect, so too will their ultimate unraveling. The U.S. manufacturing sector has yet to sustain growth for more than a month since 2022. As of August, the ISM Manufacturing PMI stood at a disappointing 47.2, which suggests contraction.

A Closer Look at the Fed Rate Cut

Although the size of the rate cut came as a surprise to markets, the timing did not. The Federal Reserve cued markets after their previous meeting about what was to come in September, as it always does, to prevent an outsized response by markets.

Nevertheless, the rate drop appeared to help the overall price of copper find a bottom after sharp retracement throughout the summer months. Still, as of late September, an uptrend has not been confirmed, and it remains uncertain whether prices will sustain the rebound witnessed during the first three weeks of the month.

MetalMiner Insights covers price points, correlation charts and price forecasting for a full suite of industrial and precious metals. See our full metals catalog.

Current Price of Copper: Funds Show Muted Response

Investment funds, whose large positions have an outsized impact on price direction, showed a tepid response in the lead-up to the Fed’s latest cut as investors remain cautious. By September 13, funds had increased long positions only slightly. This served to halt the pullback of positions since late May, but it did not indicate funds had reentered the market with strong bullish conviction.

Throughout Q2, the sharp increase in long positions among funds, which indicates the expectation of higher prices, drove copper prices to a new all-time high. Long positions have subsequently dwindled, which will limit copper price momentum. However, short positions among funds also declined in recent weeks.

This could suggest expectations that copper prices will remain relatively stable within their current range. It is also important to note that conviction among funds could change at any time depending on what cues the market offers in the coming months.

Bullish and Bearish Cues for 2025

Many factors belie the current uncertainty within the copper market. Although some copper price drivers remain the same, the outlook for 2025 has shifted from the previous year, which will force the market to redefine demand forecasts in the years ahead.

While spending and development remain ongoing, the renewable outlook has not lived up to forecasts. In the U.S. alone, offshore wind has continued to face setbacks in recent months, which, according to the U.S. Energy Information Administration (EIA), will mean reduced U.S. capacity.

This trend appears emblematic of the larger renewable sector. While funding remains ongoing, with around 70% of the Inflation Reduction Act’s $120 billion climate-related grants already awarded, projects face increasing hurdles. According to a Lawrence Berkeley National Laboratory survey, firms cancelled one-third of solar and wind projects, while half faced delays of at least six months.

These constraints range from zoning problems, grid connectivity issues and local opposition. While states like Illinois passed laws limiting the power of local authorities, many have not and appear unlikely to do so. Beyond that, push back from communities appears to be increasing, and laws passed by states like Illinois do little to resolve other issues, such as connecting to the grid.

Read the 5 biggest mistakes companies make when purchasing copper.

Other Signs for the 2025 Copper Market

Meanwhile, the rising growth of data centers and the copper required to power them will remain a strong headwind to setbacks within renewables. Estimates by BHP suggest these centers currently account for less than 1% of global copper demand. However, that figure will rise to 6-7% by 2050. Each data center requires 27-66 tons of copper per MW of power. For example, according to the Data Center Knowledge and CNET, Microsoft’s Chicago data center required 2,177 tons of copper.

AI and the data centers AI requires are far from a passing fad in the U.S. and worldwide. While renewable development and global net zero targets appear likely to underwhelm previous forecasts, emerging trends like data centers could offset this loss. Many other things will still impact copper demand in the years ahead, including the mining sector and the economic performance of the U.S. and China. Still, the balance between all of these factors will ultimately determine to what extent projected copper supply deficits materialize.

Biggest Copper Price Moves

Read what’s next for copper prices in this month’s Monthly Metals Outlook. The report provides both short-term and long-term forecasts as well as buying strategies, giving you the edge to navigate market volatility. Secure a free sample report.

- Chinese copper scrap prices moved sideways, with a 1.79% rise to $10,393 per metric ton as of September 1.

- Chinese copper wire scrap prices halted declines, with a modest 1.5% rise to $9,303 per metric ton.

- Korean copper strip prices rose 0.63% to $11.62 per kilogram.

- Meanwhile, U.S. producer prices for copper grades 110 and 122 slid by 0.19% to $5.24 per pound.

- Chinese copper wire prices declined by 1.54% to $10,208 per metric ton.