Yesterday, Tesla released its second quarter update, citing Q2 2023 as “a record quarter on many levels” due to a confluence of production and deliveries. With revenue approaching $25 billion in a single quarter, the company was overall pleased with the results, citing the challenges of overcoming the current “macroeconomic environment” as “exciting.”

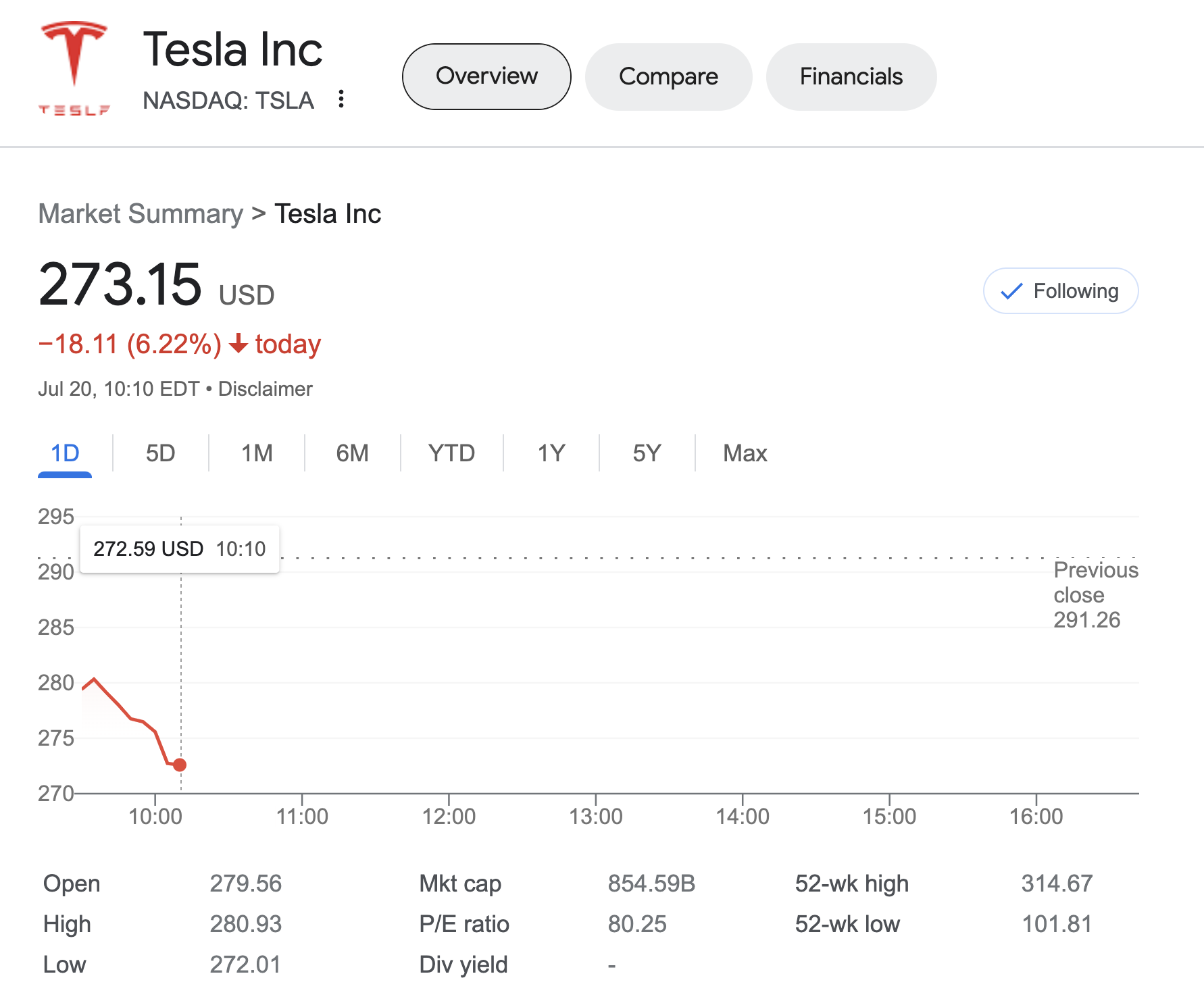

The market wasn’t quite as thrilled, as perceived Tesla volatility after the Q2 2023 update on Wednesday has pushed the company’s stock price down several percent. The dip may be partially due to CEO Elon Musk’s downbeat comments, as he told analysts on a conference call, “One day it seems like the world economy is falling apart, next day it’s fine. I don’t know what the hell is going on. … We’re in, I would call it, turbulent times.”

Yet Tesla’s operating margin remained healthy at approximately 10%, even with price reductions in Q1 and early Q2. The company lists the following factors as directly related to the operating margin:

- its ongoing cost reduction efforts;

- the continued production ramp success in Berlin and Texas; and,

- the strong performance of its energy and services as well as other businesses.

Wall Street predicted that Tesla would bring in around $24.9 billion in revenue for the quarter, which is nearly 50% higher than year-ago sales of $16.9 billion. Tesla’s stock has climbed 168.62% since the start of the year. It closed at $290.38 Monday afternoon, riding the high of the news that the first Cybertruck was finally built over the weekend.

The company said its Q2 2023 productive performance was directly related to artificial intelligence (AI) development, which entered a new phase with initial production of Dojo training computers. The Dojo supercomputer will be able to process massive amounts of data, including videos from its cars, to further develop software for self-driving cars. Tesla’s complex neural net training needs will be satisfied with this in-house designed hardware, as the company has determined that “the better the neural net training capacity, the greater the opportunity for our Autopilot team to iterate on new solutions.”

A future Tesla focus area that was outlined involved continuing cost reduction. An ongoing price war will likely compress the company’s margins. Other factors included new product development alongside continuous product improvement, investments in R&D, improved vehicle financing options, and generation of free cash flow.

Profitability: Tesla’s operating income decreased slightly year over year (YoY) to $2.4 billion in Q2, resulting in a 9.6% operating margin. YoY operating income was primarily impacted by reduced average selling price (ASP) of the company’s vehicles.

Importantly, Musk suggested in the conference call that he thinks “it does make sense to sacrifice margins in favor of making more vehicles.”

Other factors were due to cost of the production ramp of 4680 cells and other related charges; increase in operating expenses driven by the upcoming Cybertruck; AI and other large projects; negative foreign exchange market rate for currencies (FX) impact; growth in vehicle deliveries, despite what Tesla described as “margin headwind from under-utilization of new factories;” lower cost per vehicle, which includes lower raw material costs as well as financial benefits from the Inflation Reduction Act (IRA) credit; and, gross profit growth in energy business/ services.

In all, Tesla announced a $2.7 billion in generally accepted accounting principles (GAAP) net income and $3.1 billion in non-GAAP net income.

The company related that it is poised to continue to implement innovations to reduce the cost of manufacturing and operations. However, over time Tesla expects its hardware-related profits to be accompanied by an acceleration of AI, software, and fleet-based profits.

Cash: Tesla says it has ample liquidity to fund its product roadmap, long-term capacity expansion plans, and other expenses.

The company intends to manage the business so that it maintains a strong balance sheet during what it terms as this “uncertain period.” There was an operating cash flow of $3.1 billion and free cash flow of $1.0 billion. A $.7 billion increase in cash and investments quarter over quarter (QoQ) equaled $23.1 billion. Total revenue grew 47% YoY in Q2 to $24.9 billion. YoY revenue was impacted by growth in vehicle deliveries and other parts of the business, reduced ASP YoY (excluding FX impact), and a negative FX impact of $0.6 billion.

Operations: Tesla confirmed rumors that the Cybertruck factory tooling is on track. The company is producing release candidate (RC) builds, which are the builds released internally for testing purposes to check if any critical problems have gone undetected during the previous development period and whether the model is ready for early commercial production.

The Model Y became the best-selling vehicle globally in Q1 and the midsize crossover appears to be hitting full maturity this year. The Model Y’s success is built on global appeal and Tesla’s strong multi-regional approach.

Quarter-end cash, cash equivalents, and investments increased sequentially by $0.7 billion to $23.1 billion in Q2. These numbers were driven mainly by a free cash flow of $1 billion and partially offset by other financing activities, including debt repayments.

Product: The Cybertruck remains on track to begin initial production later this year at Gigafactory Texas. The long awaited battery electric pickup truck from Tesla reportedly has more than 1.5 million reservations pending. With a possible 350 mile range, the Cybertruck could follow the popularity route of the Model Y. Though, Elon Musk’s stated expectations for it are a bit lower.

Tesla’s Q3 production is expected to decrease slightly due to downtime stemming from factory upgrades. In addition, Tesla continues to make progress on its next-generation vehicle platform.

Volume: Tesla is planning to grow production in alignment with its 50% CAGR target that it began guiding to in early 2021. The compound annual growth rate (CAGR) is the rate of return (RoR) that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each period of the investment’s life span. The company advises that in some years it may grow faster, and in others they may grow slower, depending on a number of factors.

For 2023, Tesla expects to remain ahead of the long-term 50% CAGR with around 1.8 million vehicles sold in the year.

The Tesla Q2 2023 report findings lead the company to believe they “have the right ingredients for the long-term success of the business through a variety of high potential projects.”

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Have a tip for CleanTechnica, want to advertise, or want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Former Tesla Battery Expert Leading Lyten Into New Lithium-Sulfur Battery Era:

CleanTechnica uses affiliate links. See our policy here.