The Netherlands saw an increase in plugin registrations to 18,792 units in June, with the Dutch plugin vehicle (PEV) market reaching 45% last month. That pulls the year-to-date (YTD) score to 42%. That’s mostly thanks to pure electrics (33% of new vehicle sales), which jumped 89% year over year (YoY). The overall market is also rising. It got up to 41,366 registrations, although at a slower rate (+38% YoY).

Expect the final plugin share for 2023 to end close to 50%, probably around 47%, which could mean that the Dutch market could have its EV transition finished before the end of the decade!

Looking at the BEV vs. PHEV breakdown, pure electrics jumped to 73% of total plugin sales in June, pulling the YTD average to 69%. Expect this share to continue rising through the year, probably ending the year at 80% share for BEVs, a significant advance over the 69% share of 2022, which might mean that PHEVs will lose relevance in this market by 2025 and it will become a BEV-based market from then on.

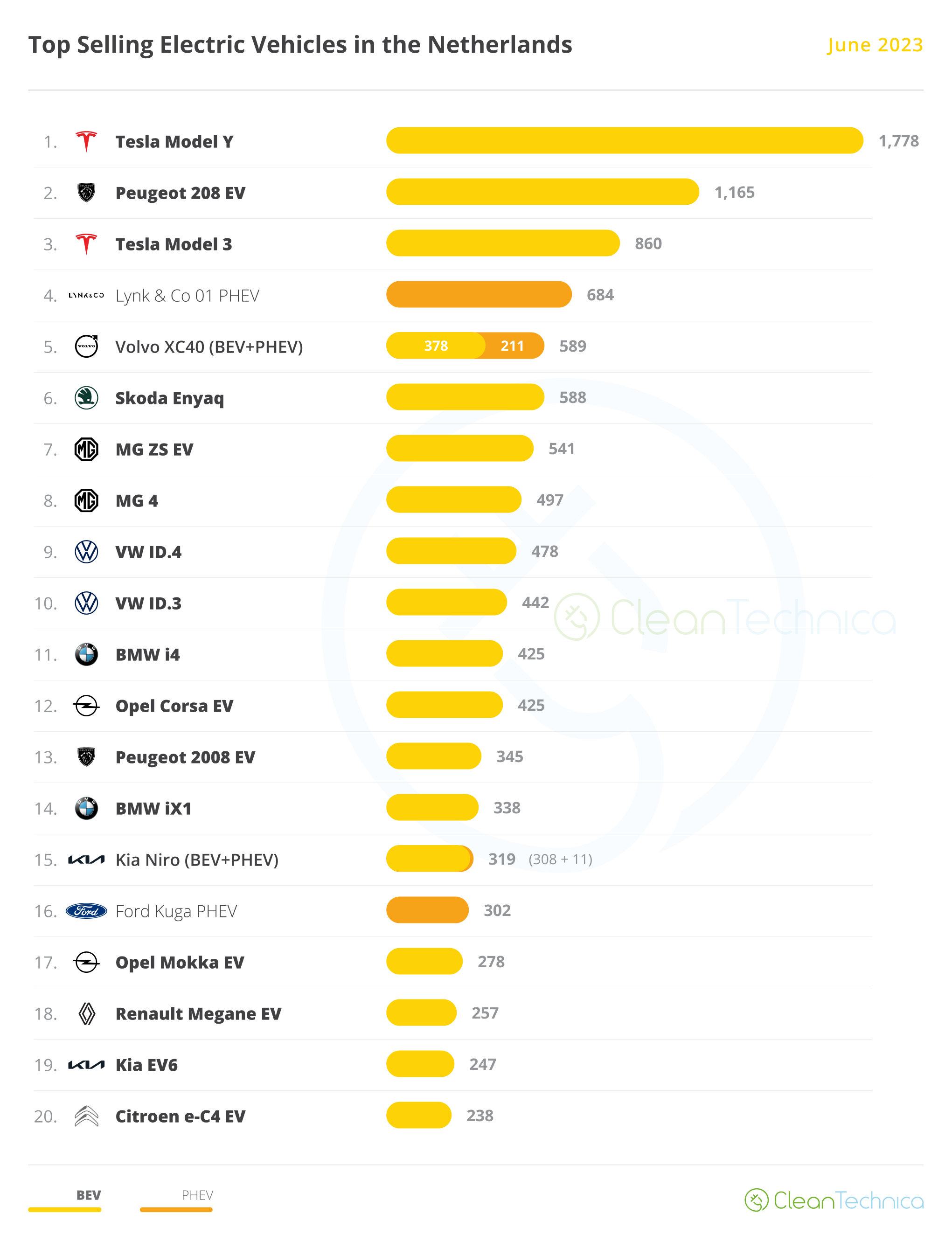

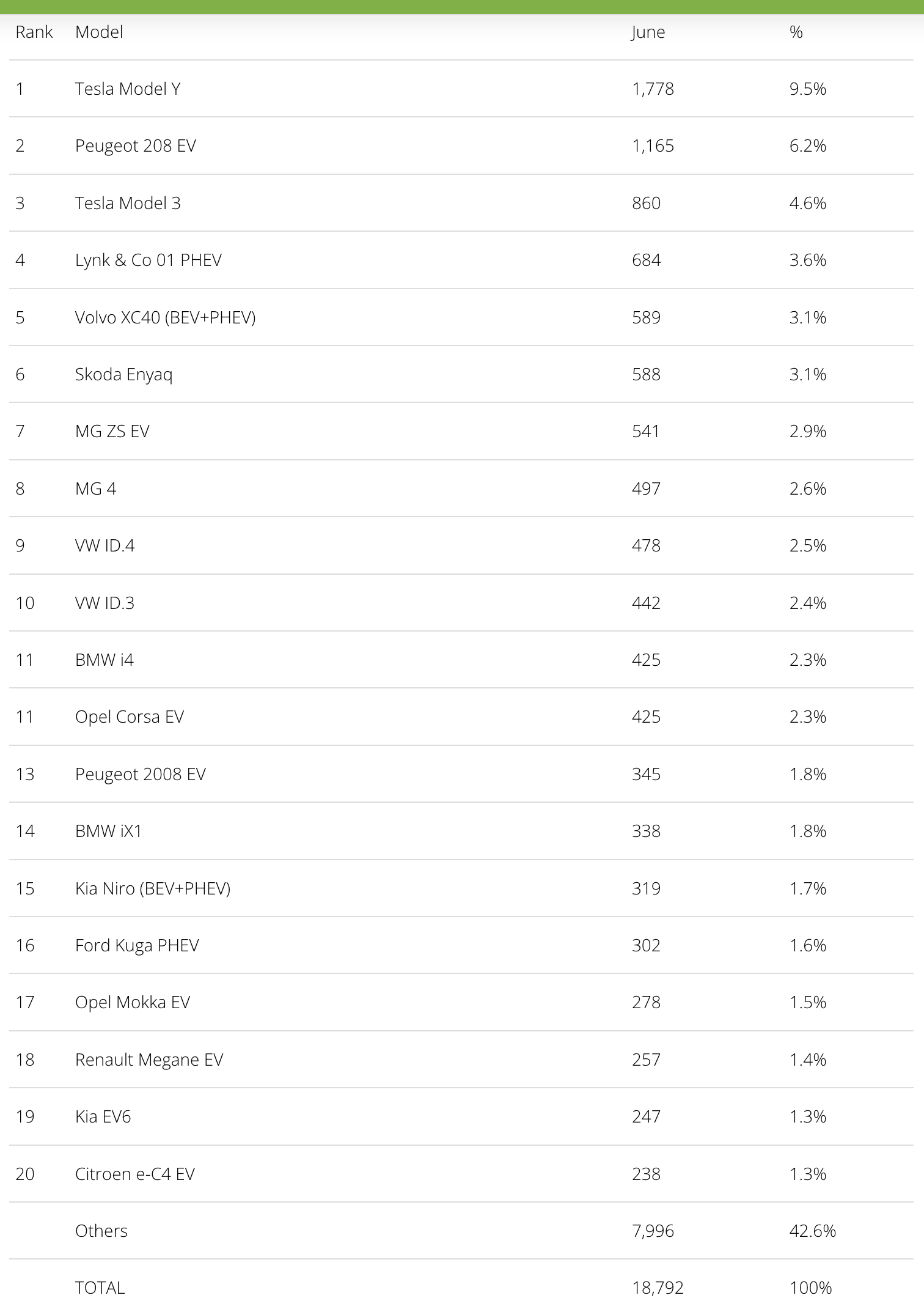

In June, the Tesla Model Y was #1 in the EV race, with 1,778 registrations. In fact, it was #1 in the overall auto market ranking as well.

The Model Y was followed by the #2 Peugeot e-208 EV, which had a record 1,165 registrations, an amazing result considering that the little lion is soon headed for a significant refresh. Maybe Peugeot decided to clear the backlog?

In any case, that allowed the French EV to end the month in the second position overall, representing 3 out of 4 Peugeot 208’s sold in Dutch lands in June. And as we can see on the table below, the 45% plugin share in the overall market is already visible in the top positions, with 4 four plugin models in the top 6 positions!

It wasn’t just the top two shining — in the 3rd spot, we have the Tesla Model 3, with a surprising 860 deliveries, its best score in this market since December 2021.

This meant that both the Lynk & Co 01 PHEV and Volvo XC40 were kicked off of the podium. The Swede even had to defend its 5th position from a surging Skoda Enyaq, which ended the month just one unit behind it with 588 units, its best score in 14 months.

But the real threats to Geely’s cousins are to be found behind the Czech model, with both the MG ZS EV (541 units) and the MG4 (497 units) hitting record results. The hatchback in particular could be a candidate for podium presences soon, and with two new competitive versions coming soon (a Long Range version with 77 kWh battery and 530 km of WLTP-rated range and an X-Power version with dual motors and 320 kW/435 PS), I wouldn’t be surprised if the pointy hatchback even wins a couple of monthly trophies by the end of the year. … If SAIC makes them in enough volume, of course.

As a matter of fact, MG was on a roll, because it wasn’t just these two models hitting record numbers. The MG 5 station wagon also got a record best, with 232 deliveries.

And this last result is kind of embarrassing to European OEMs. Station wagons are to the European markets what pickup trucks are to the US market — this is what sets them apart from other markets. And yet, European buyers had to wait for a Sino-British make to market an affordable BEV station wagon. Where is the VW ID.3 SW? The Renault Megane SW? True, Stellantis will bring the Opel Astra SW EV and Peugeot e-308 SW, but they will land years after the MG 5 has joined the market. … It is simply absurd! (end of rant)

Further below, the highlights go to Stellantis, which placed four models in the lower half of the table (the #11 Opel Corsa EV and #17 Opel Mokka EV, #20 Citroen e-C4 EV, and #13 Peugeot e-2008 EV), with the Peugeot crossover scoring its best result in 12 months.

On the other hand, the Renault Megane EV was only #18 in June, with just 257 units, or about half of what the MG 4 and VW ID.3 scored. Even the quirky Citroen e-C4 EV ended the month just 19 units behind the French hatchback. I believe this is something for Renault management to think about, and maybe it is time for the French make to slash the price of its hatchback if it wants to remain relevant until the arrival of the future Renault 5.

Outside the top 20, June witnessed the ramp-up of the big, fat Audi Q8 e-tron, which rose to 217 units delivered, its biggest score since the flagship SUV got a facelift (and a name change). Meanwhile, and highlighting Stellantis’ positive month, its MPV/van-with-windows lineup posted some significant results. The highlight was the Citroen e-Spacetourer, which scored 169 registrations in June, its best result in over a year.

A model that was very close to reaching the table was the Mini Cooper EV. It ended the month just 28 units behind the #20 Citroen e-C4 EV, with the British hot hatch reaching 210 registrations, its best score since January 2022.

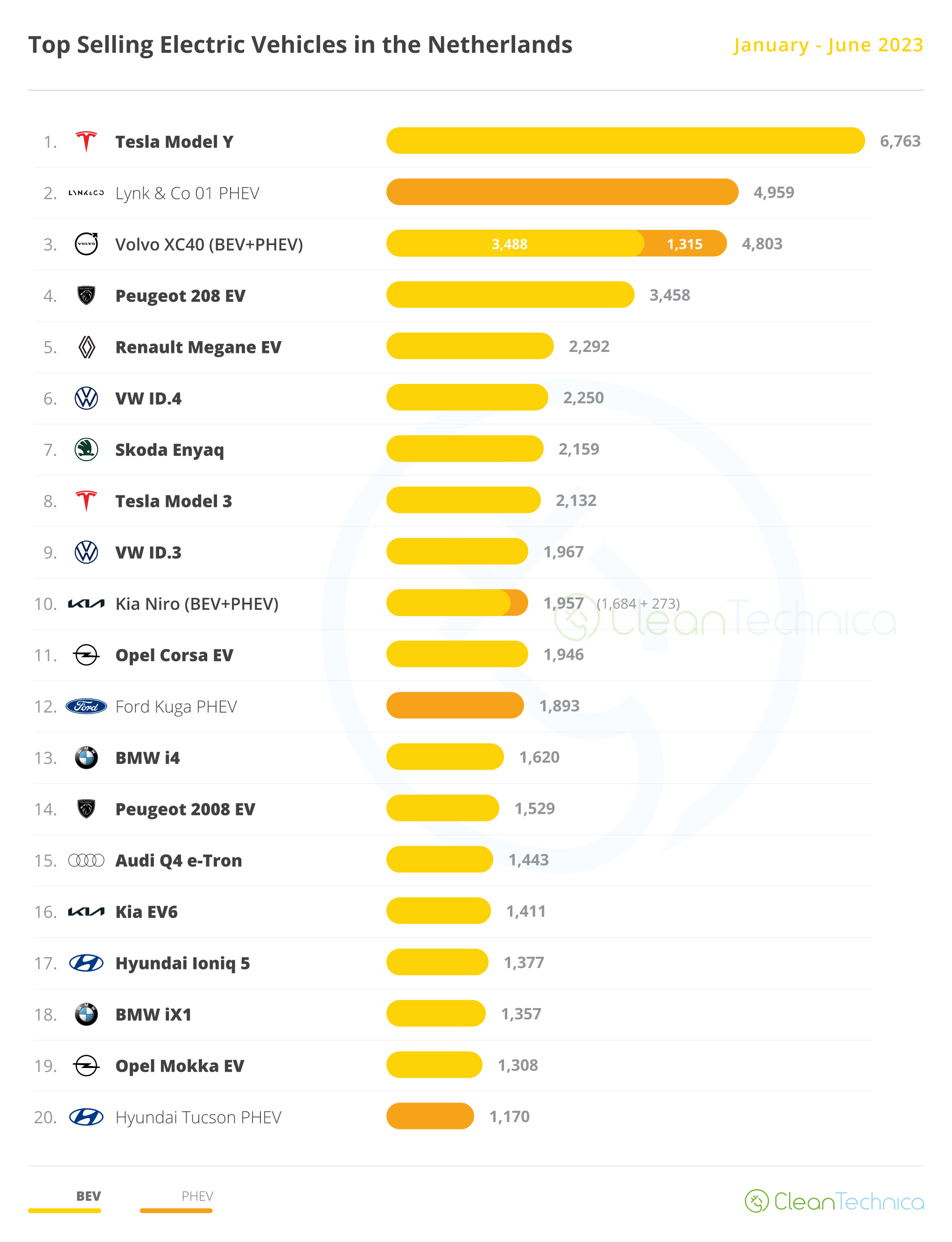

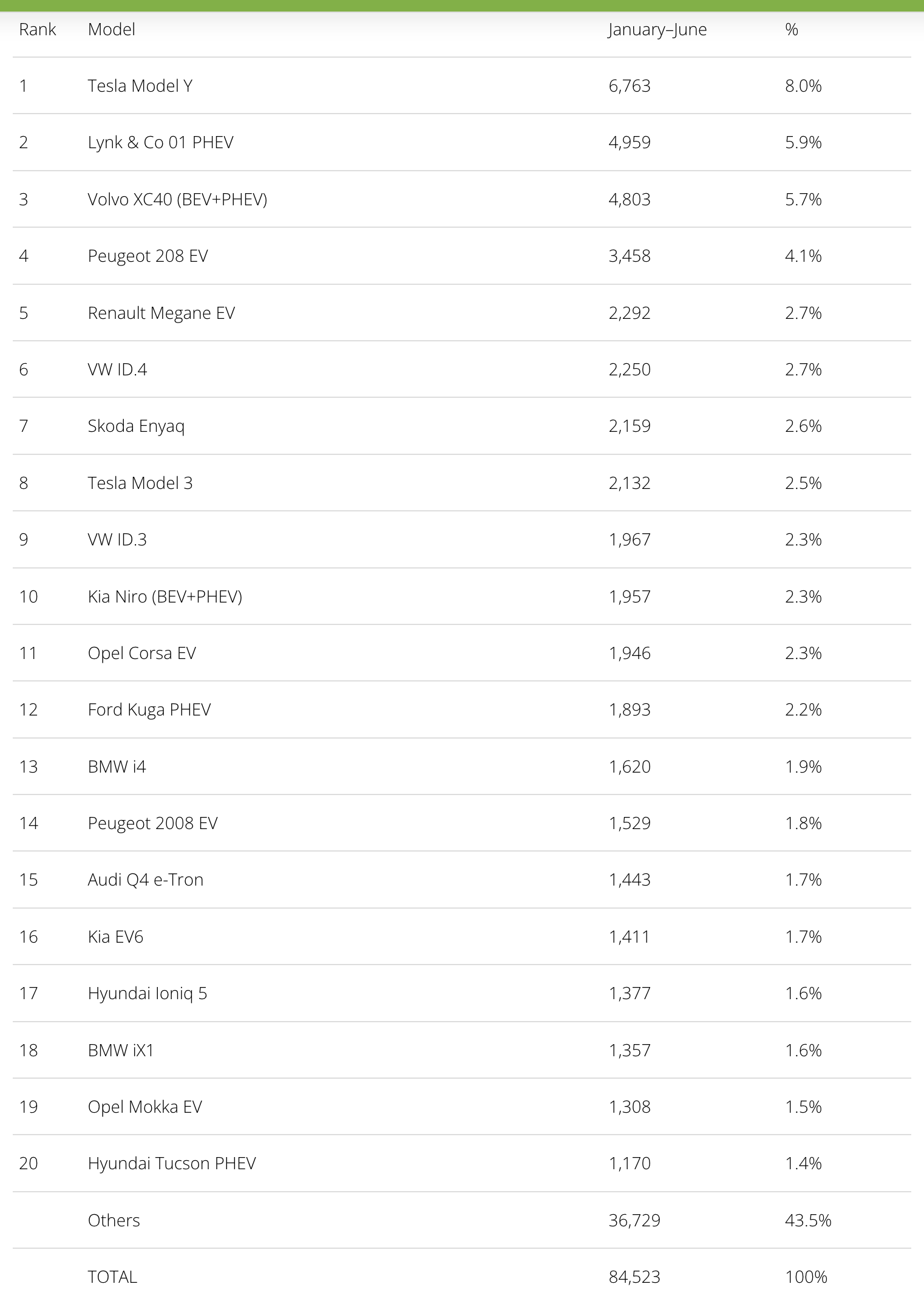

Looking at the 2023 ranking, the Tesla Model Y has enough distance over runner-up Lynk & Co 01 PHEV to remain comfortable in the lead. The compact Chinese SUV has to protect the silver medal from its cousin, the Volvo XC40, which is just 156 units behind.

Off the podium, the Peugeot 208 EV gained significant ground over the #5 Renault Megane EV, and if the transition to the refreshed model goes smoothly, we could even see the little Pug aim for a podium position. Will it get there?

On the other hand, we have the #5 Renault Megane EV. It doesn’t help that VW’s MEB-based models are also on the rise, as proven by the VW ID.4, which is now just 42 units behind and could surpass the French hatchback in July. Meanwhile, the Skoda Enyaq was up to #7 and the VW ID.3 climbed to #9.

The Tesla Model 3 was also up, benefitting from the end-of-quarter peak, allowing the sedan to jump four positions to 8th.

In the second half of the table, the highlights come from the BMW stable. The i4 climbed to 13th, while the new iX1 crossover was up to #18. Expect the iX1 to continue climbing in the table, probably becoming the brand’s new best selling model.

Finally, the Peugeot e-2008 EV crossover was up to #14, while the Hyundai Tucson PHEV returned to the table at #20. But do not expect the Korean SUV to stay for long, because in #21 we have the rising MG 4, which is just 48 units behind. Expect the compact hatch to join the table in July, and it should jump a few more positions in the future.

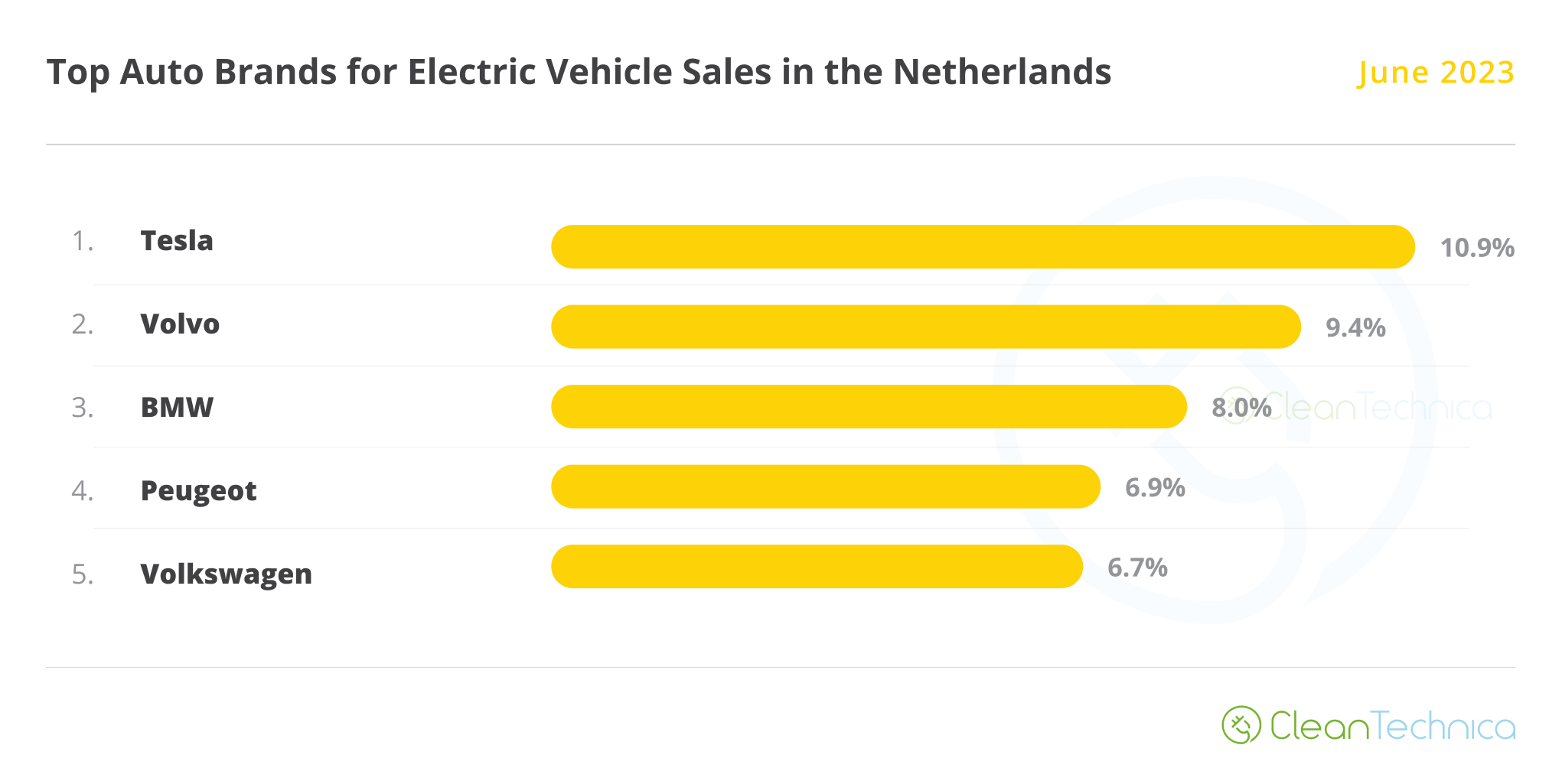

In the manufacturer ranking, Volvo (9.4%, down 1.2%) lost the leadership position, switching positions with Tesla (10.9%, up from 10%), which benefitted from its end-of-quarter peak. Meanwhile, BMW (8.0%, up from 7.9%) remained in 3rd, while Peugeot (6.9%, up from 6.2%) shot up from 7th in May to its current #4 position thanks to the strong results of its 208/2008 small car family.

Looking at the overall ranking, we can see the differences compared to the plugin one, with Volkswagen (9.4%) leading, followed by Kia (8.4%) and Peugeot (6.3%). This means that VW and Kia are behind the curve, Peugeot is more or less surfing the wave, while Volvo, BMW, and especially Tesla (only 4.6% in the overall ranking) are ahead of it.

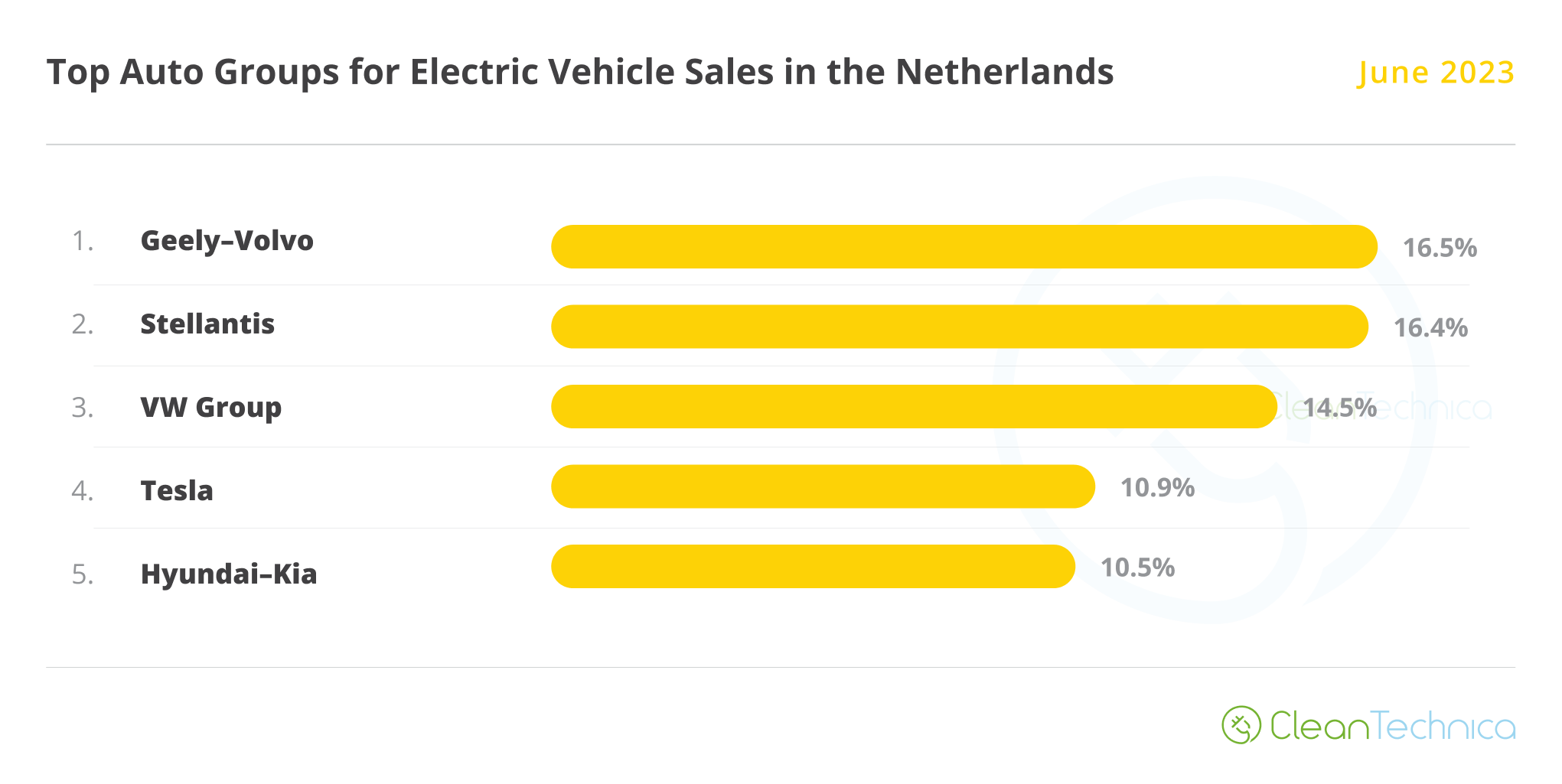

As for OEMs, the leader, Geely–Volvo, lost share, going from 18.3% down to 16.5%. That was mostly due to Volvo and Lynk & Co having a slow month, but it was still enough to guarantee the leadership position for another month. #2 Stellantis continues on the rise (16.4%, up from 15.2%) thanks to positive performances from Peugeot, Opel, and Citroen, thus securing the runner-up status. Will the multinational conglomerate be able to become the leader soon?

Tesla (10.9%) benefitted from its end-of-quarter peak and climbed to 4th, surpassing Hyundai–Kia (10.5%, down from 10.9%), while BMW Group (9.2%, up from 9%) is comfortable in 6th.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Have a tip for CleanTechnica, want to advertise, or want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Former Tesla Battery Expert Leading Lyten Into New Lithium-Sulfur Battery Era:

CleanTechnica uses affiliate links. See our policy here.