By Geoffrey Cann

If there is one industry that evolves very slowly, it would have to be the liquefied natural gas industry, and yet, digital is even making an impact here.

Way back in 2016, I scored an invite to LNG18, a once-every-three-years global conference for the liquefied natural gas (LNG) sector, which was held that year in Perth Australia. The event moves around the globe to different cities reflective of the global nature of LNG. These are big events—the booths alone are two and three storeys tall, with footprints the size of small houses. The global gas giants were all there—Qatargas, Exxon, Shell, Petronas, Engie, Total…

The key messages back in 2016 were about pricing (prices were really high, and contracts very restricted), the impact that the US would have on the market (considerable, it turns out), and the prospects for further global expansion. There was some discussion about gas being useful to help meet the COP21 GHG commitments, but mostly the presenters worked themselves into a lather talking up the future demand for LNG.

Fast forward to last week in Vancouver at LNG 2023, and the message from the stage had changed quite dramatically. The world wants reliable energy (thank YOU, intermittent sunshine and wind), secure energy (thank YOU, Russia), and sustainable energy (thank YOU, coal). Gas is a reliable and secure two out of three, and with carbon capture, it’s a sustainable trifecta. But it must compete with the counter narrative—all hydrocarbons bad, all the time everywhere for any reason, AND renewables good, all the time everywhere for everything. More on this in a subsequent article.

LNG 2023 was actually supposed to be LNG 2022 and held in St. Petersburg, but Russia unwisely chose to blow up its gas industry in exchange for territorial expansion (like the country isn’t big enough already). The event skipped a year and pivoted to the most unlikely of cities—Vancouver, ground zero for green thinking in Canada, home to Uber greenie David Suzuki, and e-everything. But in about 24 months, Canada will ship its first LNG cargo, so here we are.

As a digital nerd, I was alert to any digital developments at LNG 2023, but I was also curious what I had written back in 2016. At the time my weekly article series was called Fuel Up LNG, and chronicled Australia’s staggering rise from a gas exporting bit player to global LNG giant. From the archives, I found this passage from an article written specifically about take-aways from LNG 18, where I speculated about digital innovation coming to the sector:

I’ve written about some transformative technologies that should be coming to the LNG sector, but surprisingly few were on display on the trade show floor. There was a lonely drone display tucked away in a corner, but nothing on 3D printing, nanotechnology, revolutionary materials, or wearables. Two booths had some Virtual Reality headsets to play with, but frankly not overwhelming. Looks like we’ll have to wait another year or two.

I regret to inform you that not much has changed, really. It takes seven years to move an LNG project from conception to reality, if not longer. There’s not much iterative technology development happening, because the capital project life cycle is so long—a project is effectively just one iteration. Perhaps an expansion project can adopt some innovations, but there will be pressure on the project to stick with the status quo to capture scale economies.

However, there were still a few pearls to share. Here are four key takeaways about the impacts that digital is having on the LNG sector.

Island and remote economies are often dependent on liquid fuels like diesel for all of their energy needs. Diesel fuel is used for base load power generation, back up and utility power, transportation, marine and many other applications. However, diesel fuel also leaves behind a toxic soup of contaminants and carcinogens when it’s burned, polluting the air and contributing to poor health outcomes.

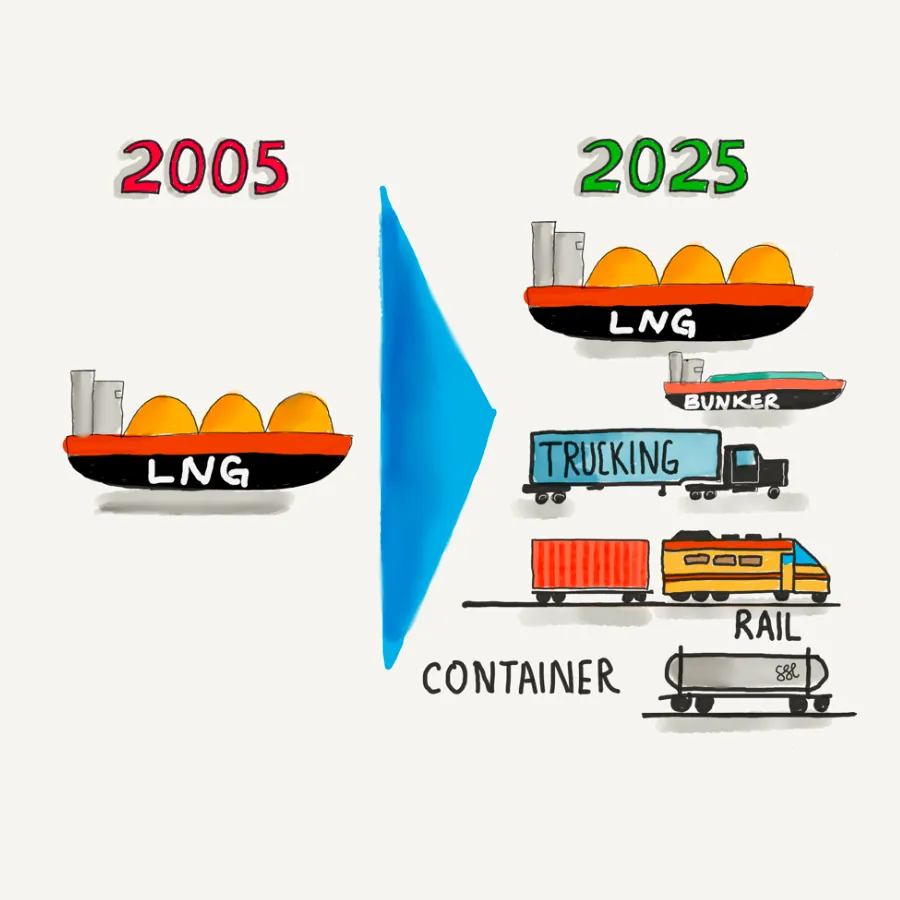

The Paris Climate Accord to reduce GHG emissions has given new impetus for these economies to find alternative energy and fuel sources. LNG is a strong candidate to replace liquid fuels particularly those used for baseload power generation because its infrastructure costs are low (much of the infrastructure is reusable), and unlike hydrogen, LNG is readily available.

Delivering LNG to these many tiny markets is more complicated than it is for diesel. The carriers are more expensive, the product has unique handling needs, and consuming locations can vary considerably in their demand profiles, storage capacity, and port restrictions.

Optimizing against all of these variables to minimise the capital cost for LNG and the operating cost for fuel is an ideal application for artificial intelligence. Engie, a French energy concern, has adapted a solution originally developed for optimizing fuel delivery to the EU’s growing LNG fuel stations for heavy haulers to this task in Indonesia.

Drones have matured from geeky plaything to serious business tool across many industries, LNG included. The use of drones in the industry fall into a couple of broad use cases—capital project execution, and plant operations.

Capital projects are challenging to manage. The construction context is highly dynamic, construction sites (particularly for LNG) are huge, the interrelationships between equipment, crews, materials, and site are complex to manage, and the consequences of error can be high. Drones can be used to collect construction site data from the air and provide that data to construction managers so that they have a better grasp of cost and schedule. Check out Cyberhawk to learn more.

Woodside’s Pluto LNG project is presently using mobile quadruped drones from Boston Dynamics (they look like robot dogs) to prowl about the plant collecting photos and video about the facility. That visual data provides operators with context, particularly when it is linked to specific tags, maintenance history, and live operating performance.

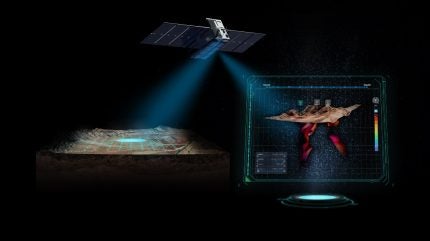

From DragonFly UAS comes aerial drone data integrated with live operations data and 3D models of facilities. This is Star Trek at its best, but now available more or less off the shelf.

For an industry that prides itself on its safety and performance track record, you would think that any core function that is dependent on human labour would have long ago been automated. But you’d be incorrect. I was surprised to learn that LNG loading arms are still, for the most part, million dollar mechanical contraptions requiring a skilled human operator.

The state of the market loading arm uses hydraulics to handle arm extension, manoeuvring in place, connect, and emergency and normal disconnect. Arms need to operate in a range of conditions (Yamal LNG is above the Arctic Circle, and Darwin LNG is close to the equator), a variety of settings (fixed in place on jetties, or on floating platforms), and a full set of exposures (cyclones, typhoons, hurricanes).

Hydraulics are an environmental problem because the hydraulic fluid can leak and contaminate the waters around the loading arm. The growth in the industry is straining the ability to find and train up adequate numbers of operators.

One supplier to the industry, Technip, has developed the first electric loading arm. This arm eliminates the need for hydraulics, and with its sensors and cameras feeding its algorithms, can operate in a fully automated mode, without an operator. The data collected by the sensors on the arm is transmitted to a cloud database where the data is analysed and used to strengthen the algorithms. LNG port operations are headed in the same direction as container ports with their lights-out operations.

Woodside has been one of the global leaders in driving digital innovation across its LNG businesses. Their YouTube channel has some great footage of their digital work, and I’ve written about their use of IBM Watson as a means to transform engineering work.

The Pluto LNG project has always been one of Woodside’s more progressive plants. In addition to building a second train, Pluto is moving to a fully autonomous control room operation staffed from Perth. The challenge the project needed to address is maintaining full situational awareness when there are no eyes on site. For this, they developed a digital twin and virtual replica of the facility, integrating formerly siloed data from SAP, engineering systems, and SCADA.

Making machines work harder to automate low value and boring work meant that there was more time and capacity for the workers to carry out more valuable cognitive tasks. An example was to aim a camera at a pump oil level gauge to capture the reading in a photo, and use a machine algorithm to interpret the data from the photo. This saved having an operator on site to do rounds to manually inspect oil level gauges.

To collect data as efficiently as possible, Pluto uses drones, robots and internet of things (IOT) sensors feeding data into its now-commercial Fuse application. To help its few people from being overwhelmed by all the data, Fuse leverages AI and machine learning tools to distill the data into useful decision-oriented content.

At events like LNG 2023, multiple panels feature CEOs discussing relatively lofty subjects, but sometimes they can be very practical. Meg O’Neill, CEO for Woodside, was particularly bullish on the role of digital in the industry, claiming that digital would have profound and transformational impact on the sector. Hopefully the other CEOs take note.

I drew the artwork for this week, using an iPad and Paper 53.

Share This: