The New York Fed’s September Empire Manufacturing Survey trends back to positive.

My economic thesis is for contraction and a counter-cyclical environment. So the September Empire Manufacturing Survey flies in the face of that for this snapshot in time. The national ISM data have been recessionary, however. I wonder if Empire is leading ISM to a bounce. We’ll know on October 1.

Regardless, within the bigger picture view of an economic slowdown, we have had a “to or through the election” theme for the stock market bull and the intact economy. So this data, whether somehow gerrymandered by fiscal policy or otherwise, fits into that theme.

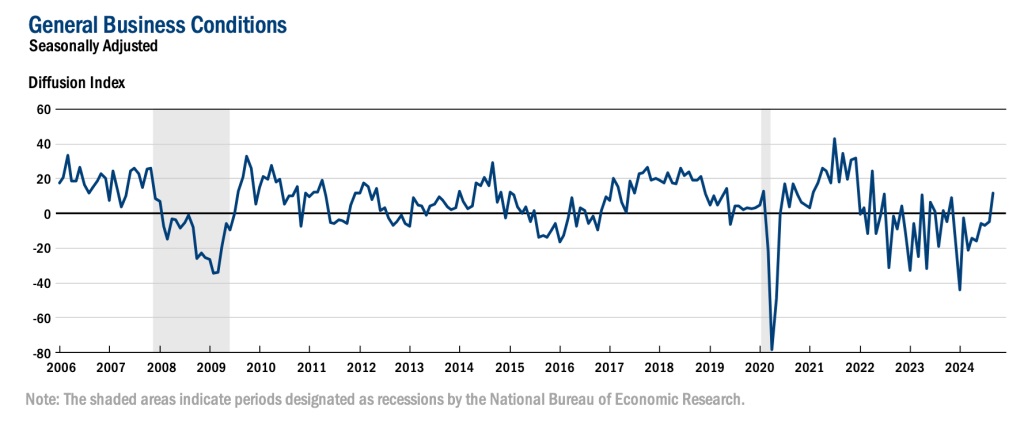

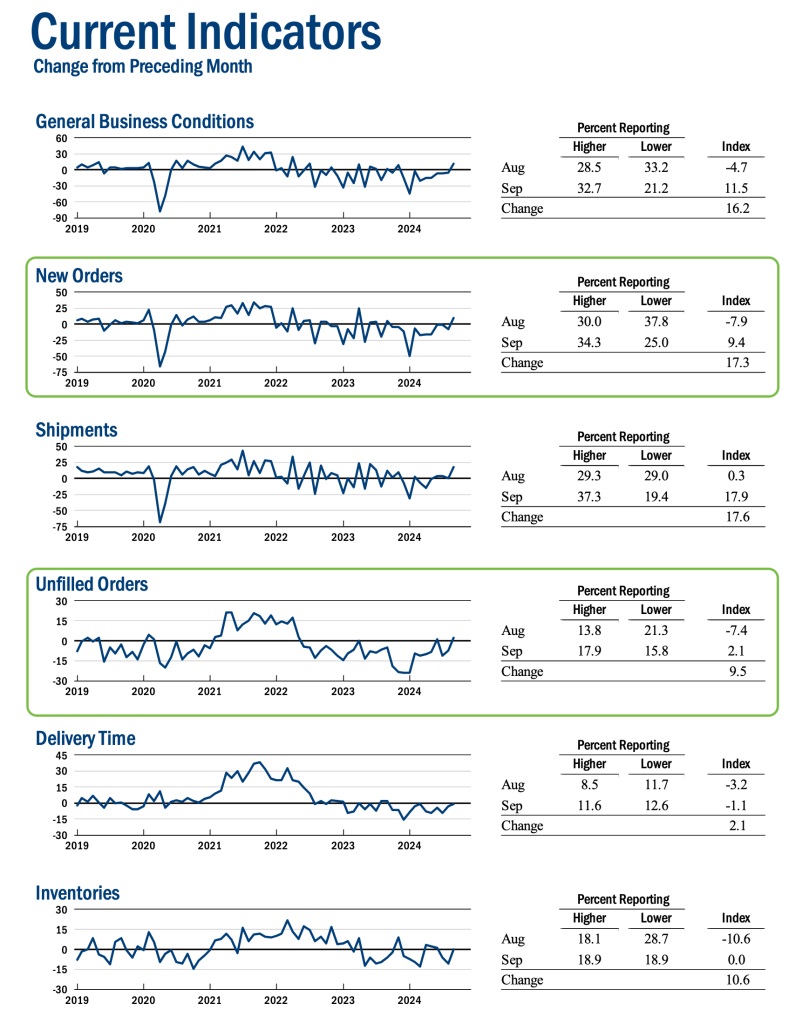

Here are some of the key readings. The diffusion index is spiking…

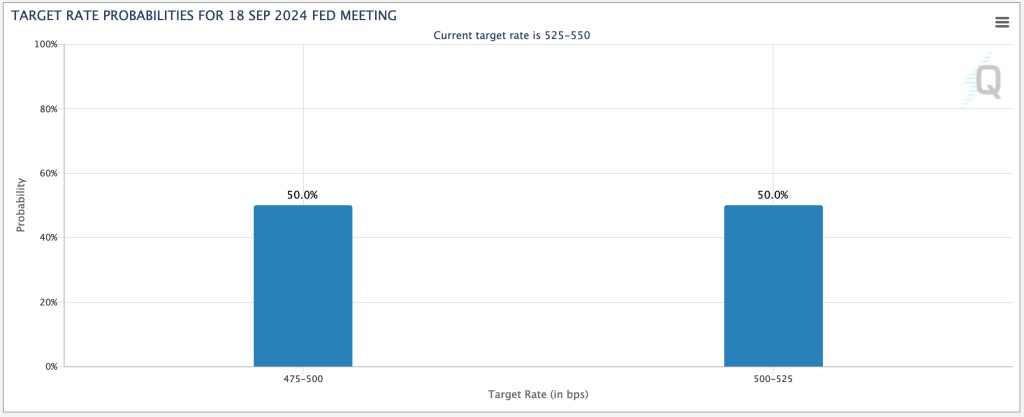

…and notably, this comes at a time when CME traders are completely split between a 25 or a 50 basis point cut by the Fed this week. On the face of it, the Empire data tilts the scale toward the smaller 25bp cut.

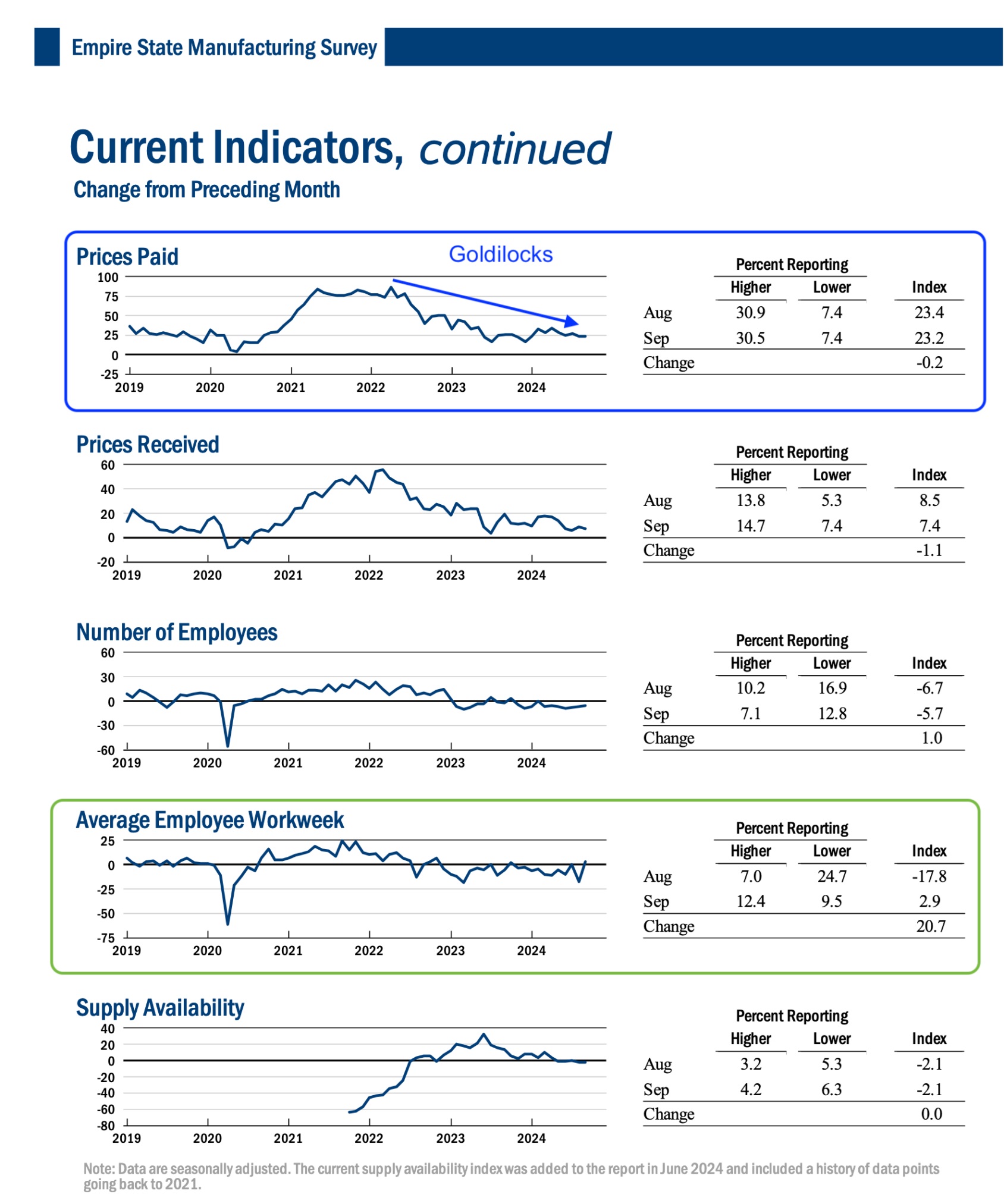

I’ve highlighted the more notable positive readings, including a Goldilocks type situation in prices paid.

The Goldilocks aspect implies disinflation, which could actually be an incentive for the Fed to do 50 bp, should it have an agenda to do so. But the balance of the report, if it were to be extrapolated economy-wide, seems to give FOMC a backbone by which it can present itself as not too dovish too soon, should that be its agenda.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

********