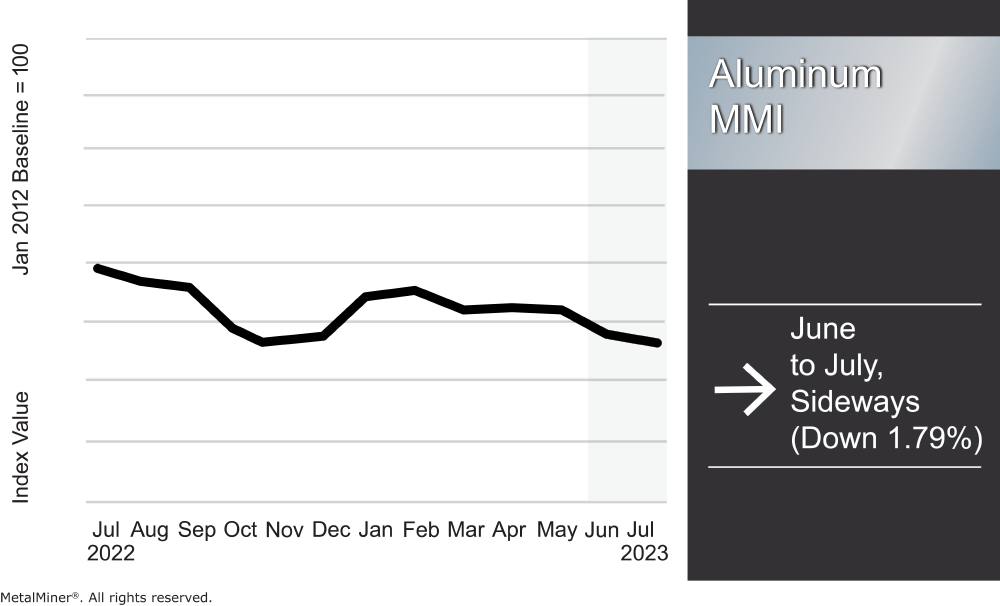

Aluminum prices continued to slide throughout June but appeared to find a bottom in early July. Prices started to form relief patterns in the short term, rising following bearish price action over recent months. Meanwhile, cooling inflation data saw market sentiment improve. The U.S. dollar index, which has an inverse correlation to metal prices, dropped below the 100 mark for the first time since April 2022 amid expectations of no further rate hikes from the Fed. Although prices have yet to form any bullish structures at this time, it is important to note that aluminum markets remain uncertain. Indeed, at this point, the downtrend could potentially continue or reverse. Until aluminum markets show clear signals, the market remains consolidated. Overall, the Aluminum Monthly Metals Index (MMI) moved sideways, falling a modest 1.79% from June to July.

Is your aluminum buy large enough to impact earnings? See how others report that data to their executive teams

Russian Aluminum in LME Warehouses at 80%

Russian-origin aluminum now represents over 80% of LME warehouse inventories. However, news of rising Russian stocks amid government and self-imposed sanctions has become redundant at this point. June’s Country of Origin (COO) data from the LME marked only the second consecutive proportional increase in Russian material. Still, it was the fourth month-over-month increase in the last five months, aside from a less than 1% dip in April.

India: January 53%, February 51%, March 45%, April 47%, May 30%, June 18%

The LME continues to accept Russian-origin material despite the risk to its position as a global aluminum benchmark. The concern is that a dominance of Russian-origin material within LME warehouses could weigh on the overall price of aluminum as buyers compete for a smaller supply of material produced elsewhere. In its own defense, the LME stated that ongoing demand for Russian-origin aluminum from several countries amid a slowdown in the West would regulate the price. Thus far, LME and CME aluminum prices continue to trade similarly, with LME prices currently sitting at a roughly $55/mt premium over CME prices. Meanwhile, the Midwest aluminum premium, a proxy for domestic demand, remains bearish, sitting at its lowest point since December 2022. (MetalMiner publishes both LME and CME prices, as well as the Midwest premium within Insights).

Does your company have an aluminum buying strategy based on current aluminum price trends?

U.S. Lifts Indian Aluminum Tariffs

Meanwhile, the U.S. lifted most of its tariffs on Indian steel and aluminum imports. The new agreement will see the U.S. Department of Commerce approve 80% of aluminum applications for projects in India.

The move came as a surprise to markets, particularly after a source told Reuters that “U.S. officials have been very clear with India in meetings that they are not considering an exemption for India on Section 232 tariffs.”

Related article: The 5 Golden Rules for Sourcing Aluminum

Indian Aluminum Remains an Important Counterweight to Russia

Indian supply appears to be an increasingly important counterweight to the rising presence of Russian material in LME warehouses and aluminum prices. According to the International Aluminum Institute, the proportion of Russian stock in LME inventories has increased considerably since the start of the year. However, production levels in Russia and Eastern Europe during H1 slid by 1.62% year over year.

Meanwhile, Asian production levels (including India but excluding China) rose by 1.27% during the same period. While it may put additional pressure on domestic producers, the removal of the U.S. tariffs will add support to India’s aluminum sector.

MetalMiner’s monthly free MMI report gives monthly price trends for ten different metal areas, including copper, stainless, aluminum, and precious metals. Sign up here!

Biggest Aluminum Price Moves

- Korean commercial 1050 aluminum sheet prices saw the largest increase of the index, rising 4.6% to $4.03 per kilogram as of July 1.

- The Korean 3003 coil premium over 1050 increased by 4.58% to $4.07 per kilogram.

- The Korean 5052 coil premium over 1050 rose 4.51% to $4.18 per kilogram.

- Meanwhile, European commercial 1050 sheet prices fell 2.94% to $3,830 per metric ton.

- LME primary three-month aluminum prices fell 3.28% to $2,152 per metric ton.