Are investors taking “All the news is in” events seriously?

This week’s CPI and PPI inflation reports are likely dovish, and the only real debate now amongst stock and gold market analysts is whether next week’s key Fed meet brings a 25bp or 50bp cut.

It’s possible that the market’s heavy hitters feel, as I do, that the good rate cutting news is mostly priced into both gold and mainstream stocks.

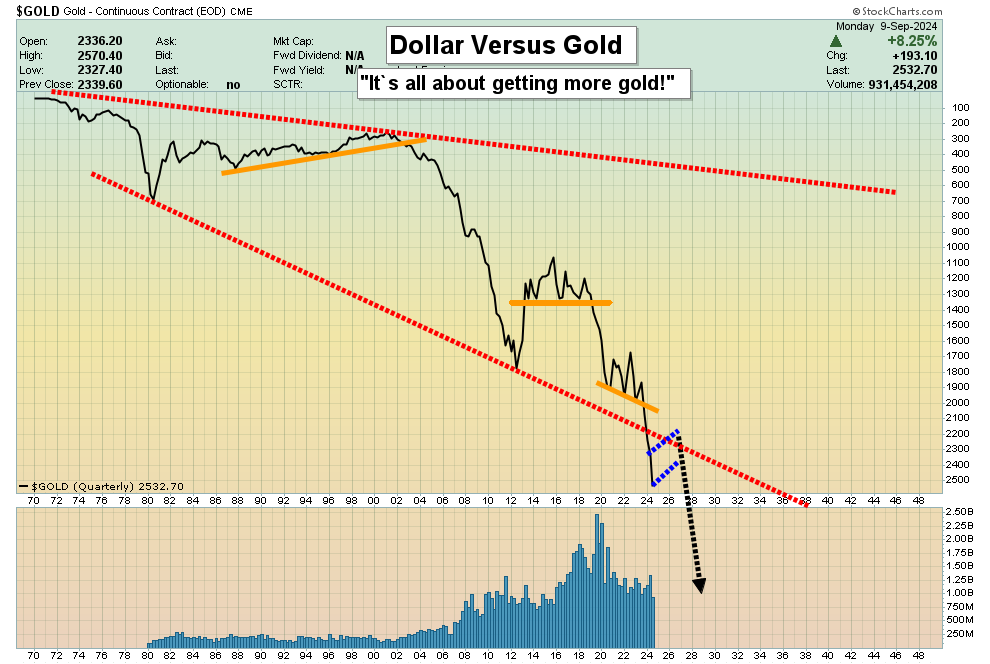

On the one hand, many investors have been on a silly mission to make “big fiat profits”, instead of a mission to get more superior money gold. Many are beginning to realize the folly of their scheme.

On the other hand, gold doesn’t move in a straight line. If most of the good news is already priced in, a correction of significance becomes more likely each day.

This is the important weekly gold chart. A large non-confirmation of RSI with the price is now in play.

Stochastics is also significantly overbought. The rally can continue into the Fed meet, but after that many gold bugs may find their favourite miners are running on all the news is in fumes.

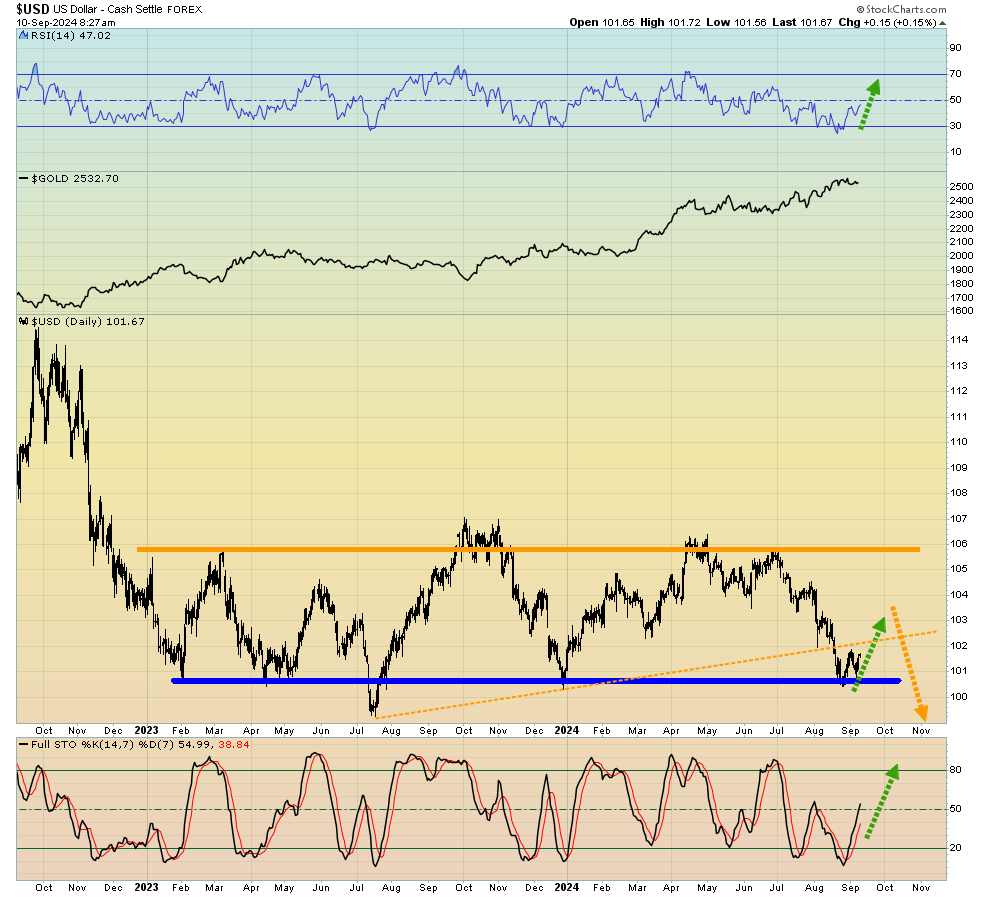

This is the yen versus dollar chart. There could be a final burst above 70.50 (and maybe not), but the dollar looks ready to show some strength.

For a look at the DXY dollar index chart:

This chart is incredibly bearish… but a rally for the dollar is likely before the next big leg down begins.

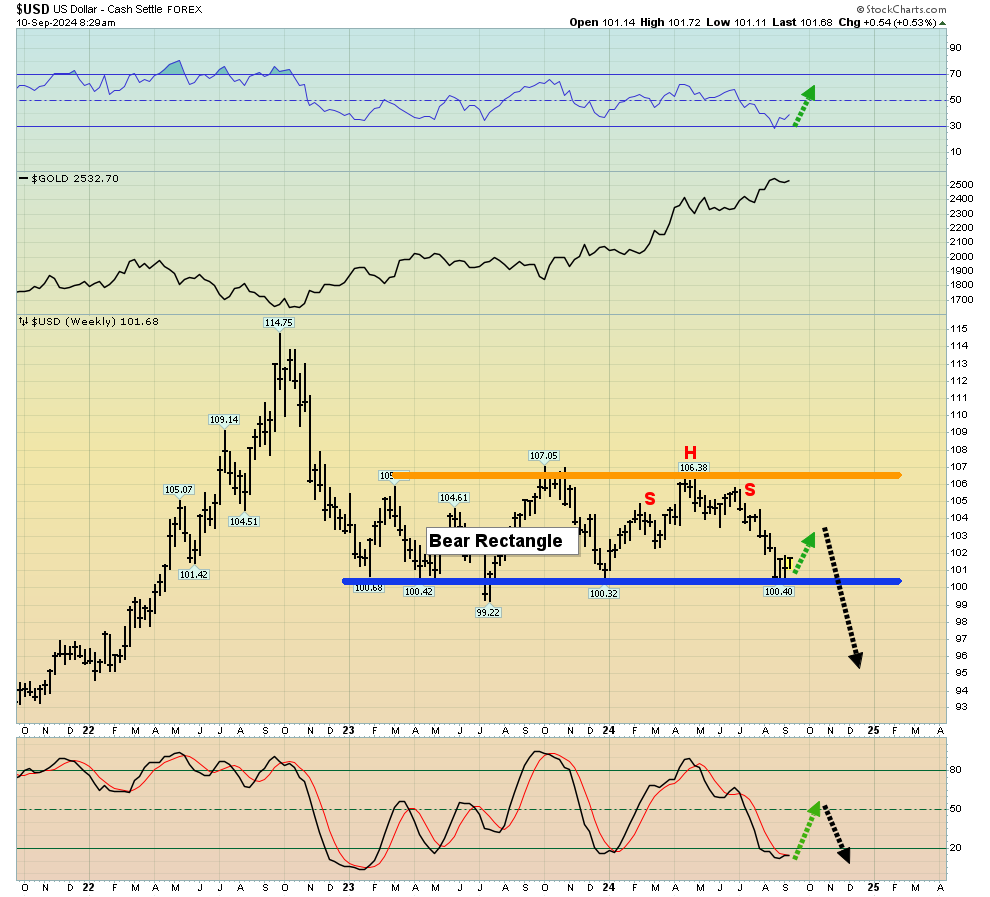

To view the weekly chart:

Note the dramatically oversold state of the key 14,5,5 series Stochastics oscillator. A flatline event could occur, but a rise is much more likely.

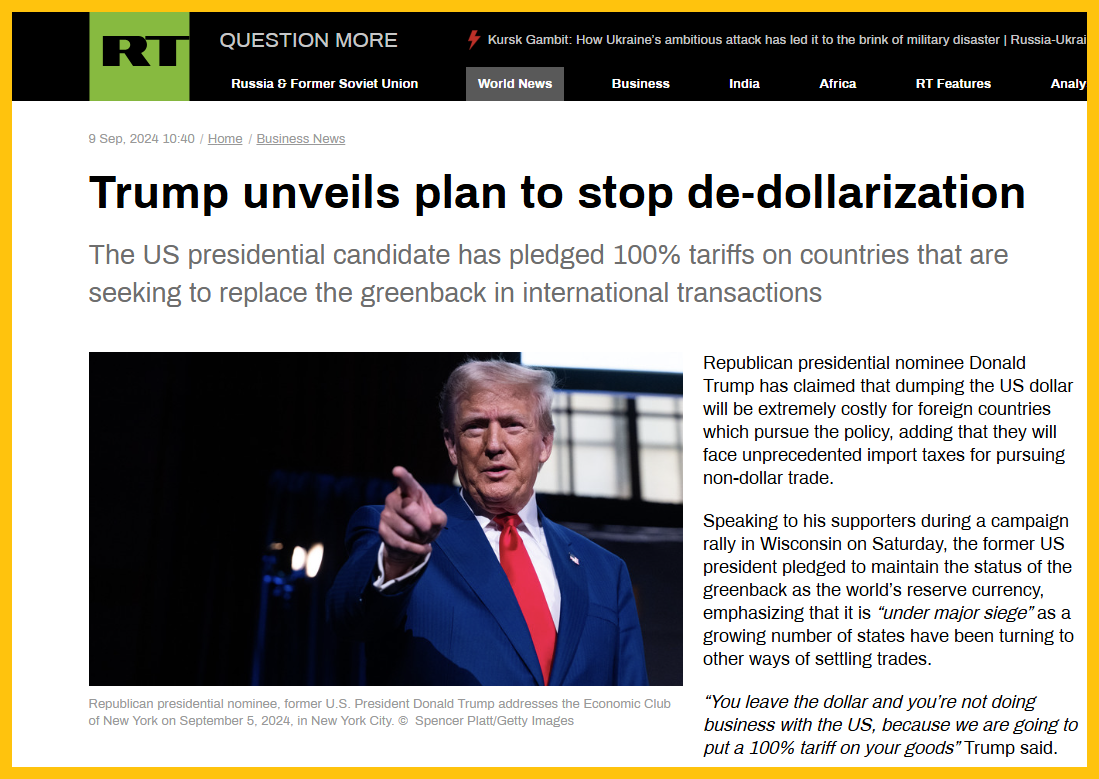

Tariff taxes will increase de-dollarization in the long term, and they could help crash the stock market.

In the short-term though, just the threat of these hideous taxes can create some “re-dollarization”.

In the past, US “Gmen” (politicians) were happy to see US corporations use Asian workers as de facto slaves. Some of the workers killed themselves and most became miserable because of the barbaric working conditions they were forced to endure.

Now their wages are rising. Asian companies are multiplying like rabbits and producing many more goods at much lower cost than their US counterparts.

The Asian population is about ten times that of the United States. It’s not a case of Asia being better. It’s just bigger. US Gmen (both democrats and republicans) refuse to face the reality of this situation and are trying to force re-dollarization with goon squad tactics…

Tactics that ultimately will help create a global rush into gold. Tariff taxes as a scheme to fix fundamentally flawed fiat are like a band trying out a new song on the Titanic’s deck… after the ship crashes into an iceberg.

In the big picture, these tariff taxes are less worrying than a fly for gold and…

The good news is that I expect the coming “correction of significance” for gold to be very short lived.

It likely ends in a matter of weeks, not months or years, and from the low a surge towards $3000 should be the next order of gold bull era business!

Tariff taxes are just one small part of the big markets picture I cover 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

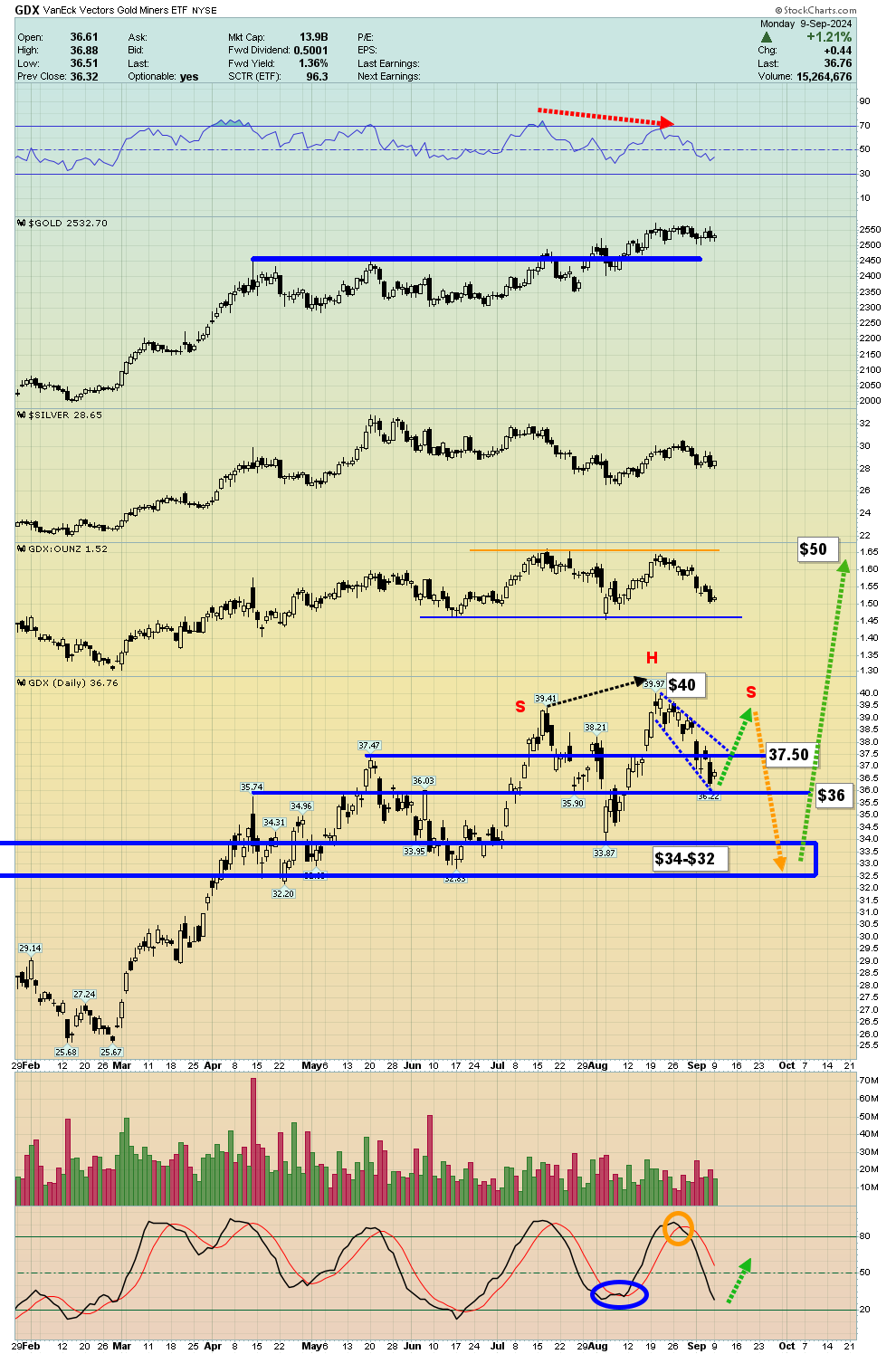

This is the GDX daily chart. As with gold, a negative RSI divergence with price is in play.

A head and shoulders top pattern may be forming and could “bear fruit” around the September 18 Fed meet. For a look at the weekly chart:

From the recent highs, GDX has pulled back about 10% while gold eased about 2%

A dip to the $32 area would be a rough 20% price sale for GDX and a lot of senior and intermediate producers.

This is the daily futures chart for gold. A pullback to $32 for GDX that is accompanied with a dip to $2450 for gold could become one of the greatest buying opportunities in the history of gold stocks!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********