Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

My feeds have been somewhat overflowing with hot takes on China’s recent approval of another 11 nuclear reactors. While coal approvals get a lot of attention — but not the 775 GW of shelved plants — and renewables just keep accelerating their deployments, dwarfing nuclear, China has approved 10 reactors in 2022, another 10 in 2023, and now 11 in 2024. That seems like a lot, but is it?

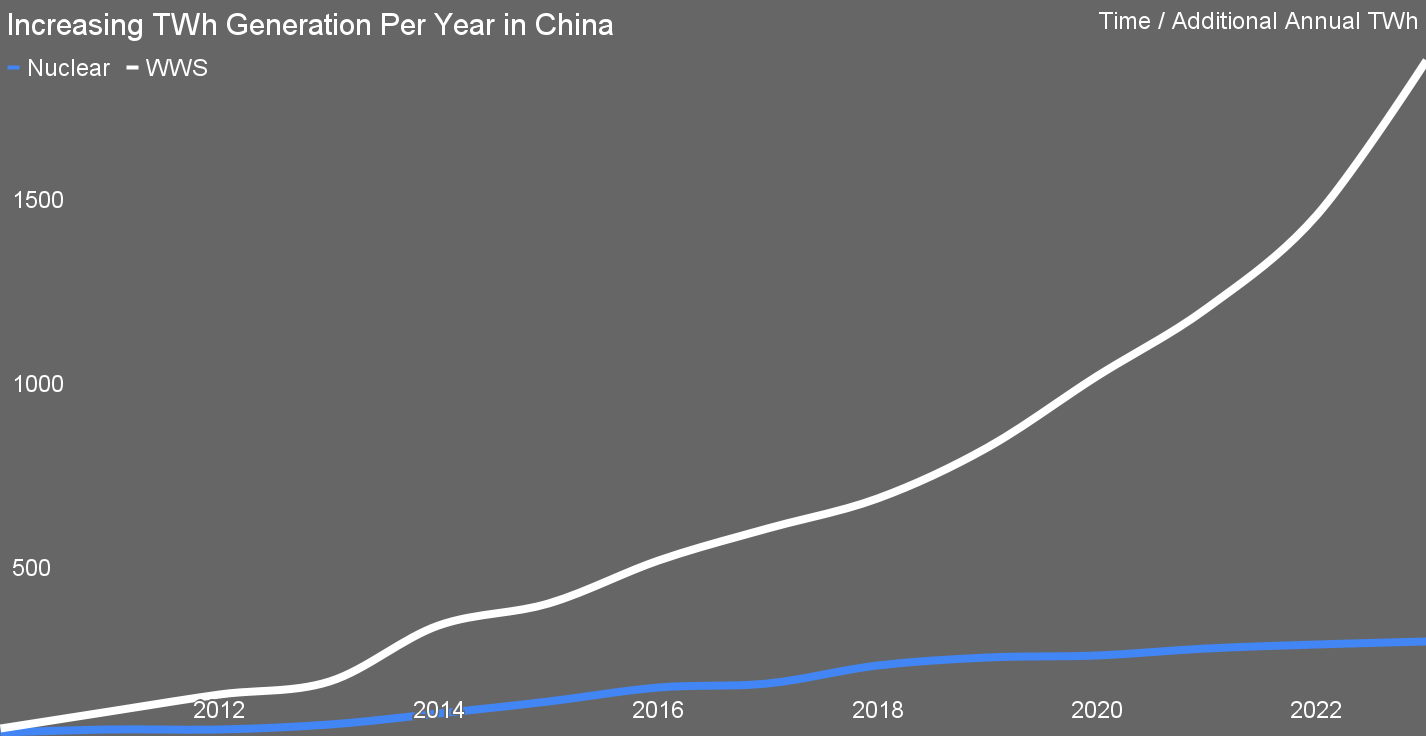

As a reminder, for a decade I’ve been tracking the natural experiment of renewables vs nuclear in China. The chart above is the latest I’ve built. It shows the actual additional TWh of generation, adjusted for capacity factors, for wind, water and solar on the one hand, and nuclear on the other. The biggest chunk by far is from wind and water, of course, so the chart doesn’t look much different with water excluded.

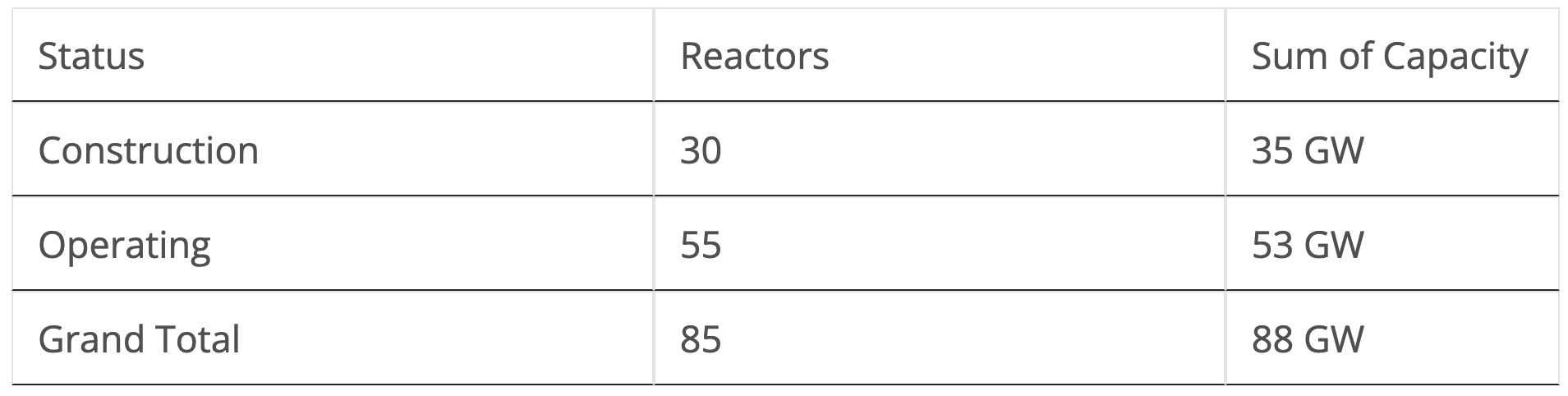

China has 55 reactors in operation and 30 in construction, so it’s understandable that the global nuclear community considers this a nuclear renaissance, after the failed 2000s renaissance, the failed 2010s renaissance and the dwindling hopes for the small modular reactor renaissance. And to be clear, China is actually building nuclear generation and is doing it in a moderately accelerated way. As David Fishman of The Lantau Group notes, the projects are moving from approvals to pouring of concrete in 18 months, and sometimes faster.

So what’s a natural experiment, and why have I been tracking this one in China?

A natural experiment is a research method in which researchers study the effects of a naturally occurring event or situation that closely resembles a controlled experiment, even though the subjects were not randomly assigned by the researchers. Instead, the environment or conditions create the groups being studied.

For example, consider a scenario where a government unexpectedly raises the minimum wage in one state but not in neighboring states. Economists can compare employment rates before and after the wage increase in the affected state with those in the neighboring states. The wage hike acts as the “natural experiment,” and by analyzing the differences in employment trends between the states, researchers can infer the impact of the wage policy on employment without having to conduct a traditional experiment.

This method is valuable in situations where controlled experiments are impractical or unethical, allowing researchers to draw conclusions from real-world events.

China is a natural experiment for the scalability of renewables and nuclear because so many of the variables that western nuclear advocates point to in an attempt to explain away the lengthening timelines and budgets of nuclear projects in the developed world don’t apply in China. For example, China does enormous numbers of megaprojects, so there’s no lack of skill and experience in doing them. Witness all the cities, rail, highways, ports and industrial facilities they’ve built from scratch in the past 40 years. If nuclear were just another megaproject, then China wouldn’t have any problem building them at the same rate.

China has built 500 cities from scratch since 1980. 45,000 kilometers of high speed rail. 177,000 kilometers of highways. 30,000 to 40,000 hydroelectric dams. About 440 GW of wind. About 720 GW of solar.

Yet only 55 nuclear reactors. What gives?

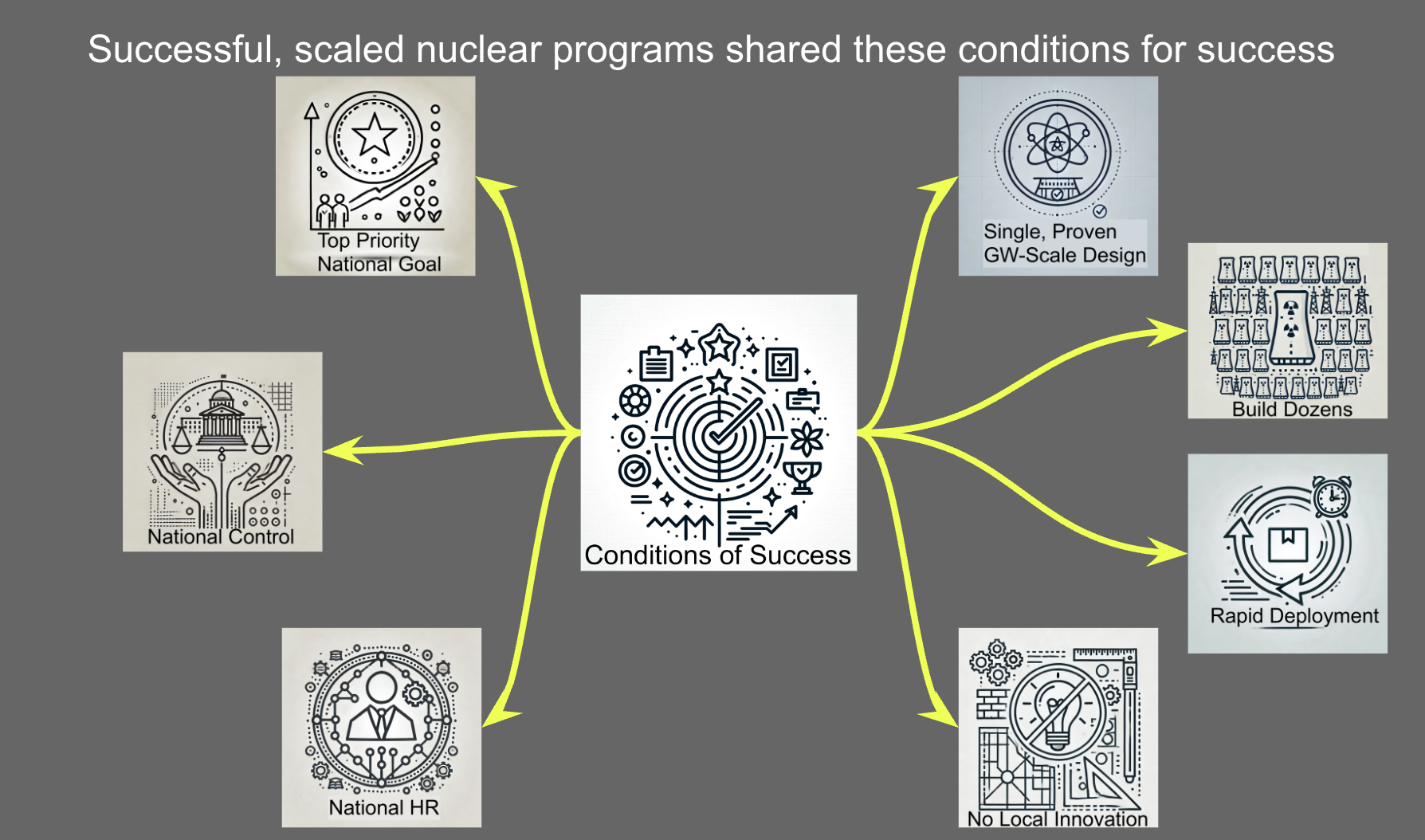

I created this graphic for my next seminar to India’s utility professionals. It provides a visual shorthand for what it has taken in the past to build a lot of nuclear generation in a reasonable period of time for a not terribly excessive cost of energy. Looking at the list, there’s nothing there that China shouldn’t be able to achieve, yet their nuclear program has been languishing. It peaked with seven reactors commissioned in each of 2016 and 2018 and has actually slowed since then, with only one big reactor and an SMR commissioned in 2023 for 1.2 GW of capacity.

Look up that the conditions for success. Note the requirement for a single, GW scale design, or possibly two. That’s how the USA, France and Britain succeeded with their programs, and South Korea has only a handful of designs. China has commissioned or has in construction 23 unique designs with varying capacities of different models. And that’s only the coarse variances. That little bit about no local innovation is key as well, as local engineers love to put their fingers on the design as it’s built, ‘improving’ it, leading to more variations that show up and even more challenges.

Why the focus on big reactors? Because the absurd number of connections, pipes and fittings isn’t reduced on smaller reactors, so all of the labor is multiplied. With reactors, go big or go home, which is one of the many major problems with small modular reactors.

Why single design? So that human resources and lessons learned can be shared across dozens of reactor builds, instead of new designs effectively being first of a kind.

Why tight control? Same thing. Keeping innovative engineers’ fingers off of designs means that lessons learned can be shared and no new problems are introduced.

If China gets so many things right with the rest of the megaprojects it builds, why didn’t it figure this one out? My assertion, backed up by public statements by Chinese nuclear organizations and firms, is that they are building as much for the export market as for the local power market. As a result, they have to build at least one of everything any customer might want them to build in other countries.

That’s why China’s nuclear program hasn’t remotely met its targets in the 30 years it’s been in operation, consistently deploying fewer than planned or projected and hitting delays and cost overruns.

Has China learned this lesson with the 30 reactors under construction and recently approved?

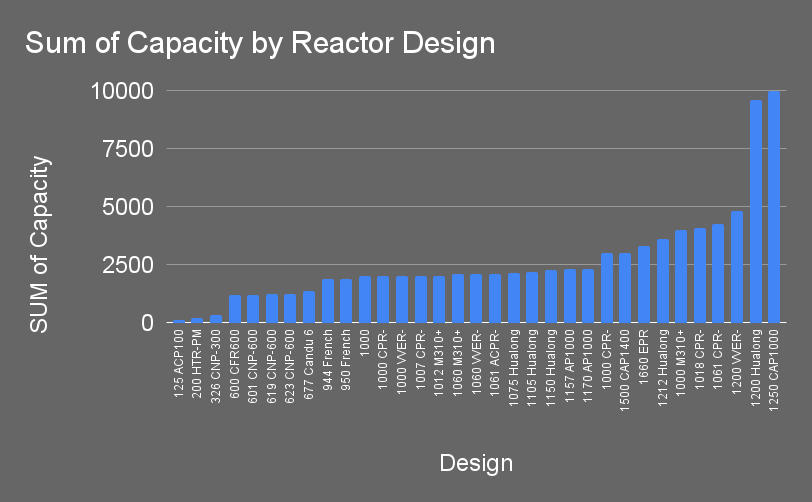

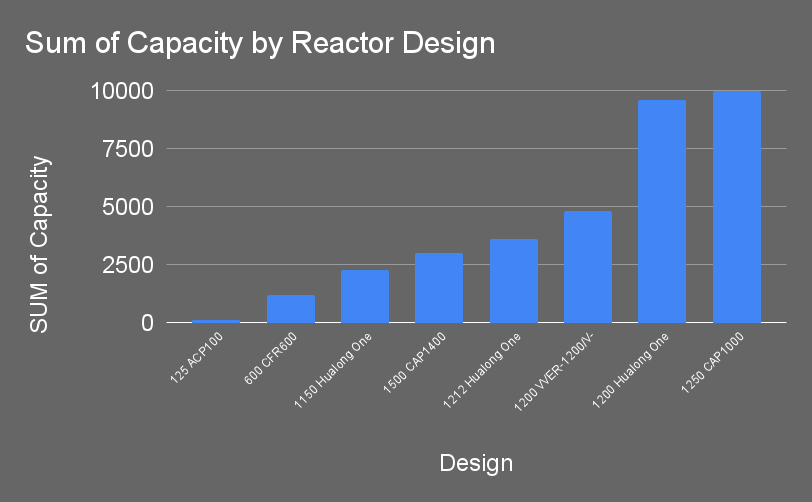

This chart is just of the reactors under construction. Does this look like a country that’s only building a couple of reactor types with proven designs? No, in fact the reactors it’s building the most of are a design that they haven’t commissioned before and they have another six designs, including a uselessly tiny one, in construction.

While the data I have is for reactors under construction, which includes most of the 2022 and some of the 2023 approved reactors, reports indicate that the recently approved tranche includes yet another new reactor design. There is some indication that more Hualong One reactors are in the approved set, but not if they are the same nameplate capacity or not, something which would constitute another design.

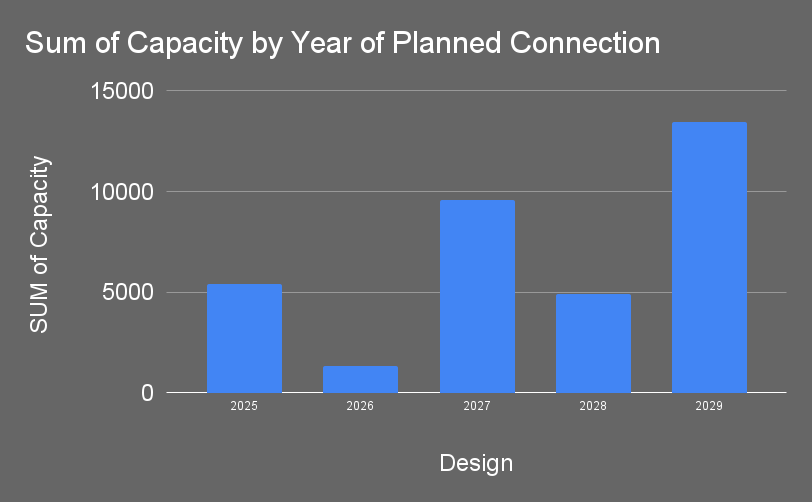

Do I believe this construction schedule? No, no I don’t. This has all of the hallmarks of a failing nuclear program that is far behind targets claiming that it will make up all of the lost ground in the next handful of years. It’s building a bunch of reactors it’s never built before, it’s coming off of years of managing one to three reactors a year, and its claiming that in both 2027 and 2029 it will connect more reactors to the grid than it has managed in 30 years of their nuclear program. To be fair to them, the average construction time in the publicly available plans is 6.6 years, which might be reasonable. Unfortunately, the data I have available to me excludes the start of construction for reactors in operation, so it’s impossible for me to tell if this is optimistic given China’s track record. The multitude of designs and the most common designs in construction being new ones does not give me comfort. China does surprise me constantly, however.

Of course, while I’m pleased with each new nuclear reactor that gets commissioned in stable countries as it is a low-carbon, low-pollution, safe form of electrical generation, it’s also going to be dwarfed by China’s build out of wind and solar.

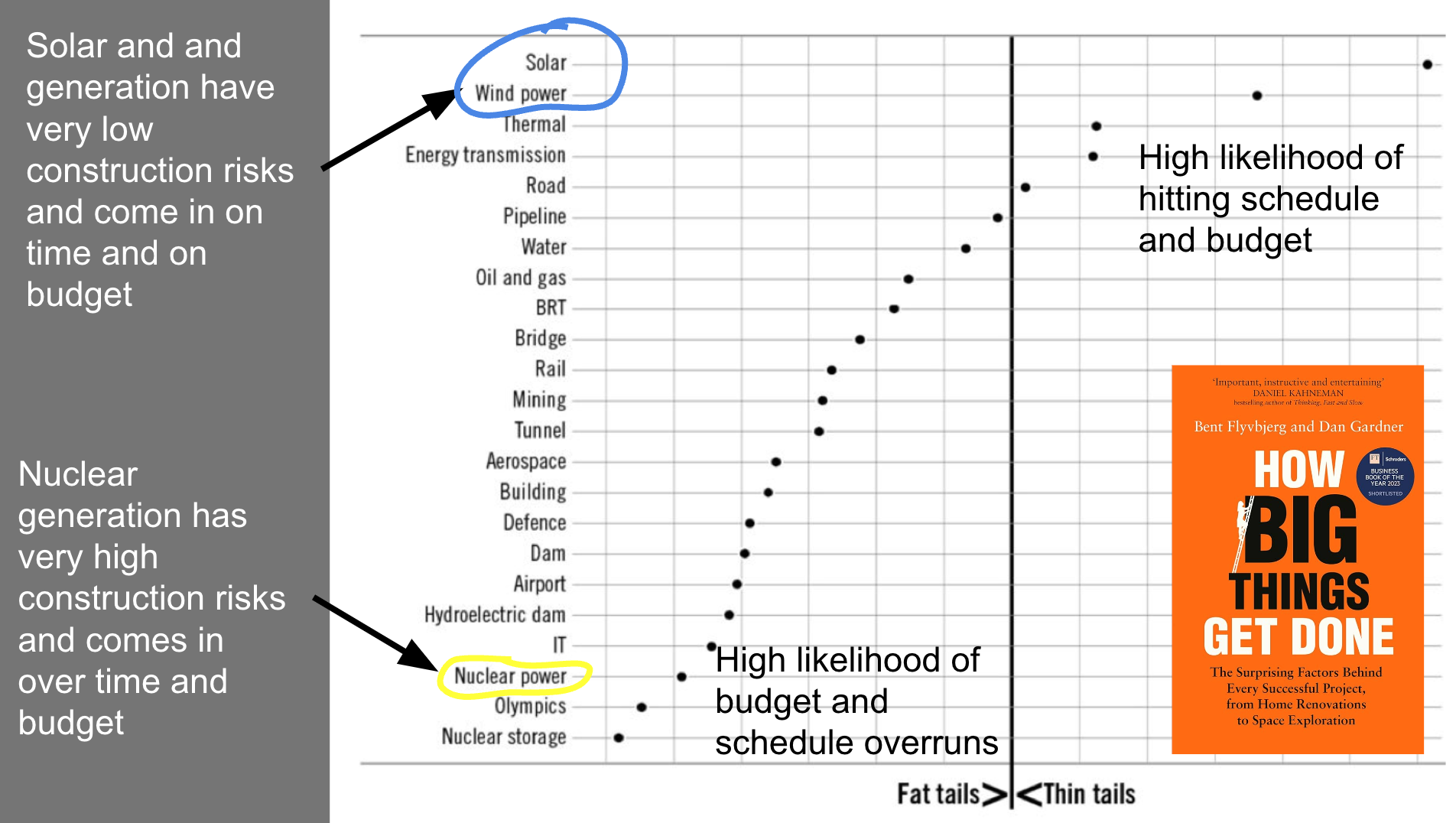

The likelihood of the enormous capacities of wind and solar successfully getting built on time, on budget and hitting benefits targets is immensely higher than that of this nuclear build out. That’s a key learning of Professor Bent Flyvbjerg and team from their global dataset of megaprojects, something that Flyvbjerg has been building since the late 1990s and is now over 16,000 strong, with over 150 nuclear generation projects.

Nuclear reactors have lots of risks that, if they trigger, cause very significant time and budget overruns. Wind and solar have very few risks that cause significant time and budget overruns if they occur. The results are clear in the data. If you want to hit targets and achieve benefits, build wind and solar. China is doing that incredibly well.

China added 274 GW of wind and solar capacity to their grid in 2023. They are on track to build a lot more than that for each of the next seven years. The chart at the top of this article is just going to get worse and worse for nuclear as its line gets flatter and flatter to allow wind, solar and water generation additions to fit into it vertically.

While China has a lot of nuclear in construction and a bunch more approved, that’s not the takeaway that other jurisdictions should learn from its energy efforts. If anything, there are three lessons. One, that wind and solar are the right choice for the vast majority of jurisdictions. Two, that China’s failures to stick to a single proven design for nuclear and build lots of it are a warning related to national and regional nuclear programs. Three, that unless a country is big enough and rich enough to build dozens of identical reactors as well as to achieve the rest of the conditions of success, or is able to join a bunch of other countries to achieve critical mass with a guarantee of singularity of design and the rest of the success criteria, nuclear shouldn’t be on the energy policy agenda.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy