US stock market crash season is underway. Every year I urge equity investors to sell out of the stock market on Aug 1… to avoid what can be life-changing carnage.

The season ends 90 days later, on Oct 31. If there’s no crash by then, investors can return to the market.

The upside action is generally minimal during this period, so investors aren’t missing much.

This year, the carnage began right on schedule!

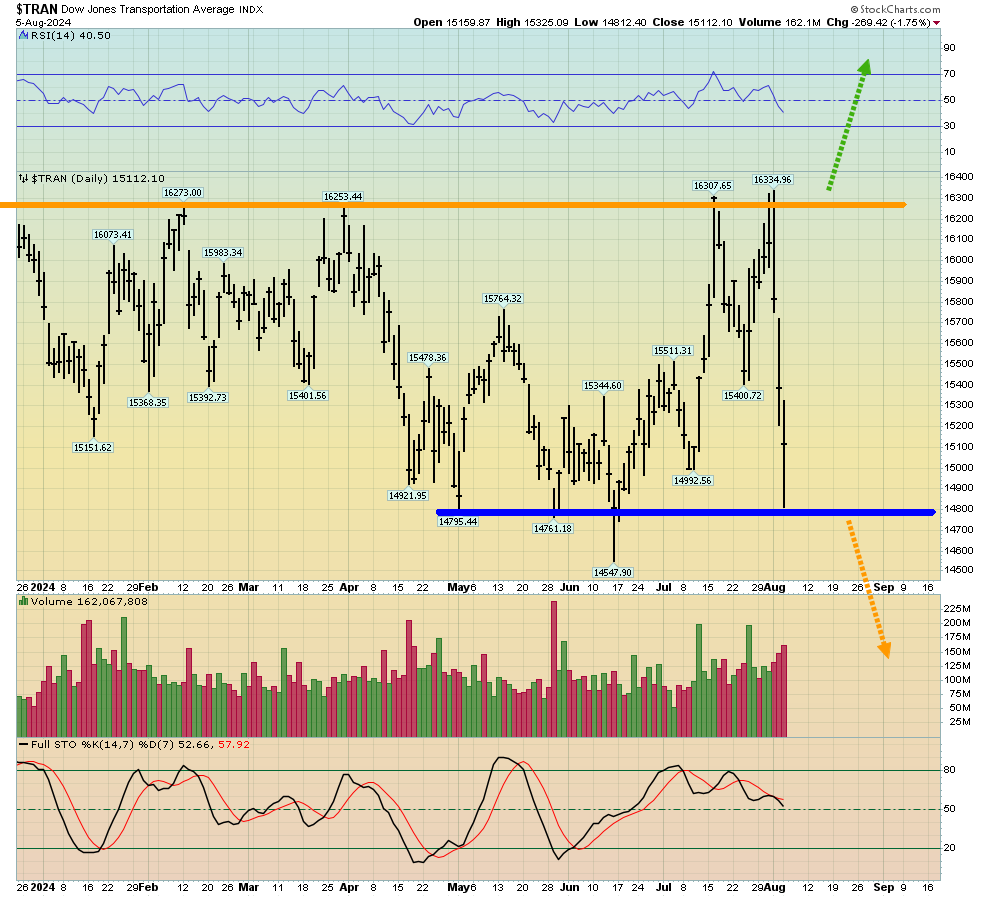

For a look at the Dow Transports:

If the Industrials close under 37,600 and the Transports confirm that with a close under 14,800…

The US stock market could be entering a bear market.

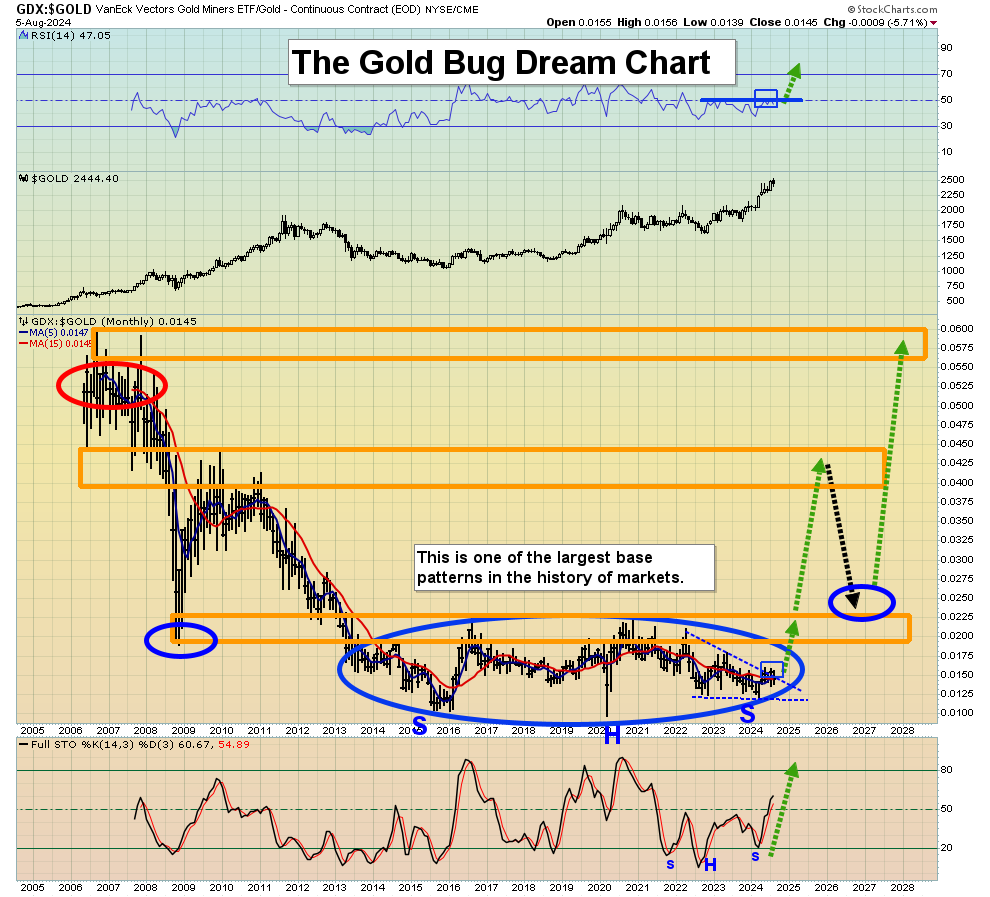

I’ve suggested that whether that bear market begins in this year’s crash season or not, when it does start, it’s likely to last for as long as 40 years.

It’s likely to end with US rates at 20%+, inflation rampant, and gold stocks functioning as the undisputed asset class of investing champions.

This bear market will also define the biggest stage of empire transition… from debt, fiat, and war-obsessed America to gold-oriented China… and soon after that to gold-obsessed India.

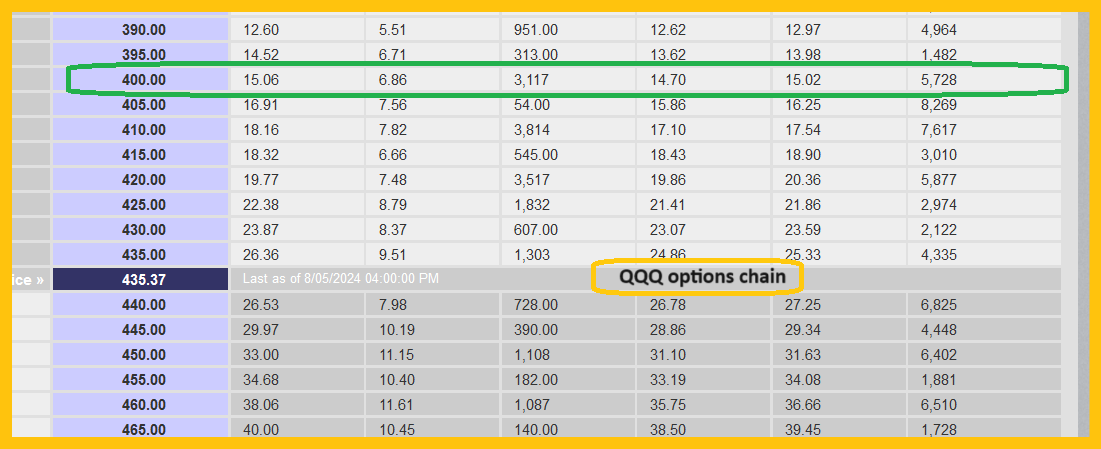

At my GU Swinger trading newsletter we were prepared for the mayhem. To profit from it, we bought put options on the over-valued Nasdaq. We just booked close to 100% profits in about 48 hours! More downside action lies ahead after this pathetic “relief rally” fails. My swing trade newsletter offers great value at $269/3mths and I have a special $249/4mths special offer this week. Click this link or send me an email if you want the offer, and I’ll get you onboard! Thank-you.

While debt is the big global theme, what were the specific catalysts for the mayhem in August so far?

This is the weekly yen vs USD “carry trade” chart.

For a closer look at the action, via the daily chart:

The yen looks like a financial geyser!

It’s surreal that money managers took on so much leverage that a tiny (microscopic really) hike from the BOJ has incinerated their silly carry trade.

The carry trade is of course the action of borrowing massive amounts of low-interest money in Japan and using it to buy the US stock market. It’s an action of outrageous greed, and it’s an action that’s now on fire.

The big question, the big unknown, is how much of the carry trade has been destroyed with the BOJ’s tiny hike, and how much is still out there.

Some pundits in America are calling for an “emergency cut” from Fed chief Jay. If most of the carry trade is already unwound, that might restore some confidence, although it would likely be short-lived.

If a big portion of the carry trade is still out there, any cut, even one at the next Sep 18 FOMC meet… that could create another yen vs USD geyser!

If 70% or more of the carry trade is still out there, I’ll dare to suggest that an emergency cut could usher in a 10,000 point down day for the Dow.

What lies ahead for America is likely a macabre hybrid of 1929 and 1966 and debt is of course the catalyst.

This is day six of the 2024 stock market crash season and gold looks fantastic on this short-term chart.

There’s a broadening pattern in play. These patterns suggest a situation that is out of control. Flaming carry trade gamblers certainly fit that bill. There’s also now some symmetrical triangle action, which indicates another big move up lies ahead.

This is the daily gold chart. It also looks good (as does our latest buy), and the price action suggests that $2600 may be coming soon.

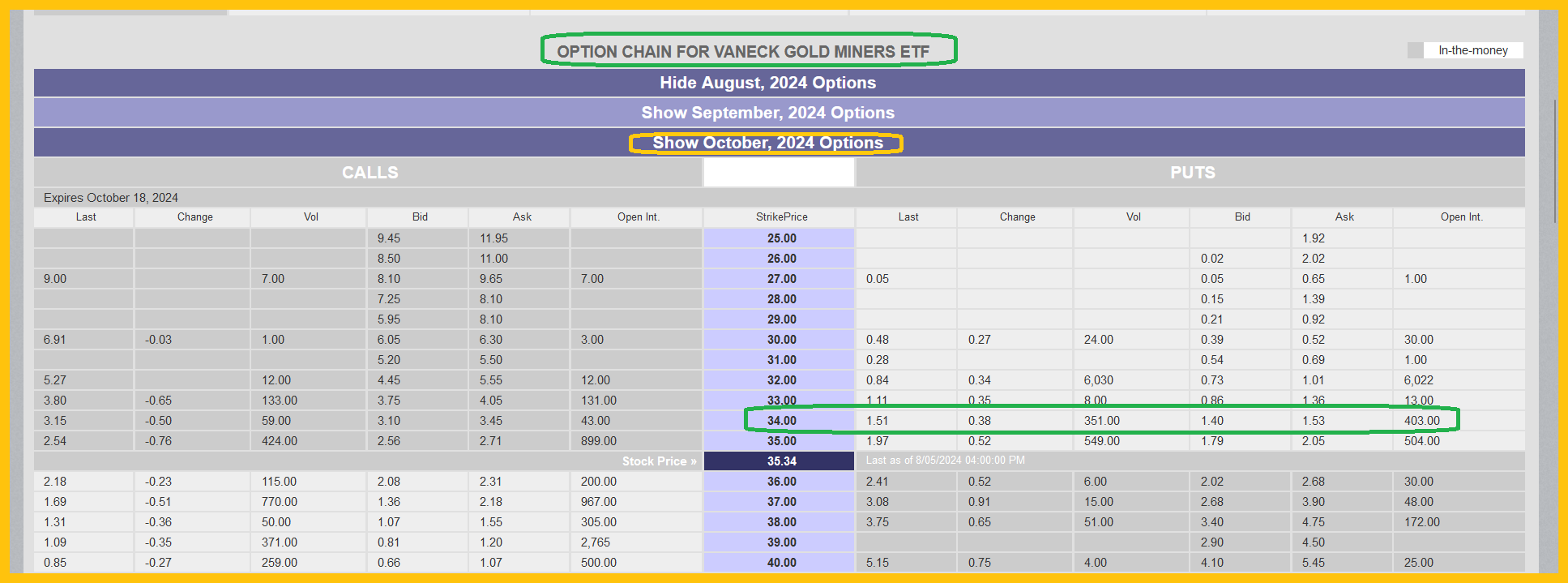

The miners generally don’t fare as well as gold when the stock market gets hit.

Nervous mine stock investors (particularly those with too many miners in relation to the amount of gold they hold) could consider allocating 2%-5% of their portfolio to October put options on GDX. I like the $34 strike price… it’s basically fire insurance to help investors have a good night’s sleep.

While enormous investor patience is required, in the big empire transition picture, gold stocks are set to become the world’s premier investment. The bottom crash season line: With put option insurance and the right amount of gold, investors are in the driver’s seat and will never feel cold!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********