Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Through the last days of July, a new arrival has been quietly transforming the EV landscape in Latin America: the BYD Yuan Up. Its silent appearance has happened so far in Chile and Colombia (that I could verify), and it has the potential to revolutionize the market of either country because, as several news outlets have already pointed out, it’s been presented at a lower price than its direct ICEV competitors.

The BYD Yuan Up would be considered a small car in the US, but in Latin America, it’s actually seen as a decent-sized SUV. For the following analysis, I will focus on Colombia, as these small SUV-like vehicles are all the rage in the Colombian market, whereas Chile, being wealthier, has a preference for larger SUVs and pickup trucks.

BYD Yuan Up heats the competition in Colombia

At 4.31 meters (169 inches) long and 1.83 meters (72 inches) wide, this car presents direct competition to some of the most sold models in Colombia, including the top three year to date: Mazda CX-30, Toyota Corolla Cross, and Renault Duster. The catch? Of course, that this would be the only EV in that list.

The BYD Yuan Up arrived in Latin America only in its most expensive trim. It comes with a relatively small 45 kWh battery (the main sacrifice it makes to achieve a good price), but otherwise brings a good design and a luxury feel to its interior, as well as a 130 kW motor capable of reaching 100 km/h (~60 mph) in 7.9 seconds. As most BYDs in the market, it claims the capacity to reach 80% battery charge in 30 minutes (in this case thanks to 65 kW peak charge). The official range estimate is 380 km under the optimistic NEDC cycle: make of that information what you wish.

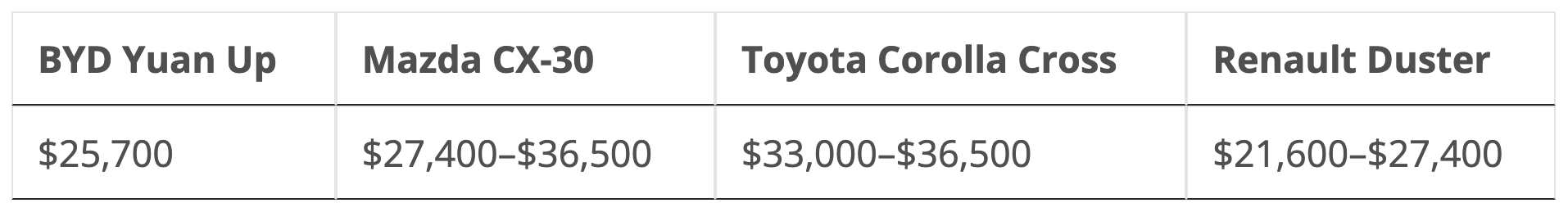

But let’s get to what everyone here is probably waiting for: its price, and how it compares to the ICEV competition.

These three models lead the Colombian market so far in 2024, with the Mazda CX-30 and Toyota Corolla Cross remaining ahead of the Renault Duster despite their higher cost, mainly because they offer HEV variants (MHEV in the case of Mazda), which are exempt from traffic restrictions in large cities.

I guess most of you already see where I’m going with this.

The BYD Yuan Up may be more expensive than the Renault Duster entry-level trim, but it also enters the competition with a significant advantage: exemption from the above-mentioned ICEV traffic restrictions (which in Bogota are every second day). Another factor is that the entry-level Duster has a manual transmission, $26,600 being needed to get an automatic one … enough to place it above the Yuan Up cost-wise.

As for its Japanese competition, the Yuan Up is cheaper than any of the alternatives, and more so if we consider that the entry-level Mazda and Toyota are pure ICEVs and a little more needs to be paid to get oneself a hybrid.

BYD seems to have found a sweet spot where it can play to its strengths while still maintaining a lower price than its direct competition, making it so that the downsides (which are basically the relatively low range and a smaller trunk) can be overlooked.

Final thoughts

The Latin American EV market is heating up thanks to the arrival of more competitive EV offerings that are starting to threaten the ICEV best-sellers. The BYD Yuan Up is only the most recent arrival on a growing list of champions that should sow fear into the hearts of Legacy Auto, which also includes: the Geometry E, the Tesla siblings, and the BYD Seagull. And more are coming.

The Yuan Up is being touted as a success already, but my main question is whether it will have enough to gain a place in the top 3 most sold vehicles in Colombia. What do you think?

By the way, according to some comments, 18 hours after its presentation, the first shipment of this car (due to arrive in September) is already sold out. People will now have to wait until December for the second shipment.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy