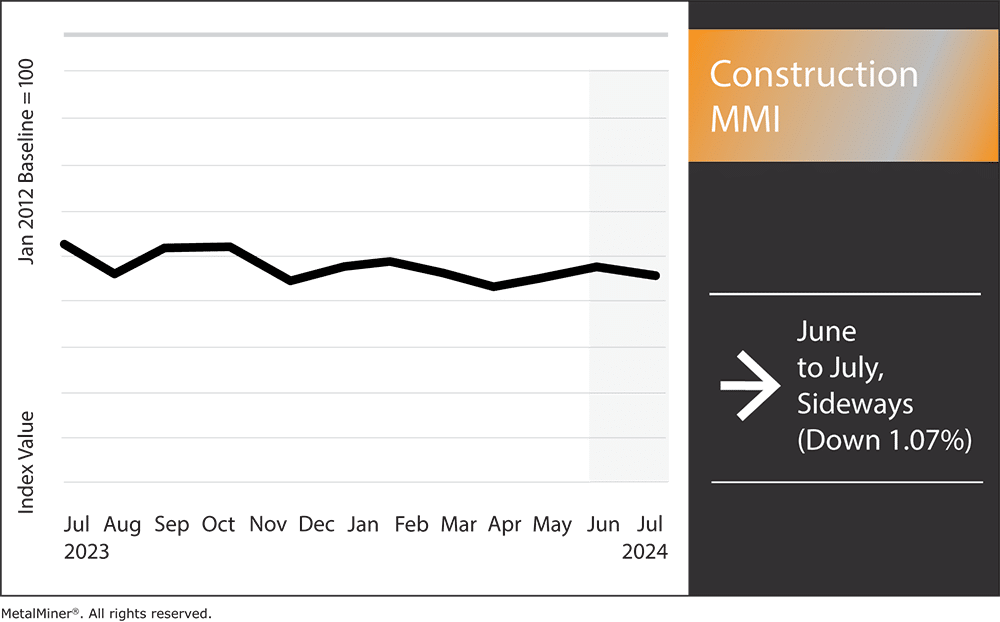

The Construction MMI (Monthly Metals Index) held true to its year-long sideways trend, only budging down 1.07%. While base metals prices in the construction market remain fairly stable, construction projects overall still continue to battle with elevated rates. This is especially true in the private sector. However, the market continues to push through more than a year of elevated interest rates and remains resilient, despite ongoing labor shortages.

Get a competitive edge in challenging metal market conditions. Learn game-changing metal industry insights by opting into MetalMiner’s free weekly newsletter.

Metals Prices Stable, but Construction Costs Remain High

The U.S. construction sector is going through a phase of elevated prices. The primary reasons for this include a rise in the demand for building supplies as well as general economic factors like higher interest rates. As of mid-2024, the price of building materials in the U.S. is much higher than it was earlier in the year. COVID-19 disrupted global supply networks badly enough to cause ongoing shortages of necessities like timber, steel and concrete, even years later.

Many experts also attribute the total rise in construction cost prices to rising labor and fuel costs. Meanwhile, construction material production and transportation costs continue to rise in tandem with energy prices.

Construction News: Insight on Cost Stabilization

There are conflicting signs regarding whether building costs will stabilize anytime soon. According to some industry analysts, prices may stay high because of continuous issues with the supply chain and ongoing demand. Others predict that prices may stabilize or even fall when supply chains eventually adjust and output catches up with demand.

For this reason, it remains important to keep an eye on the state of the world. If inflation keeps rising globally, material prices could remain high. On the other hand, building prices could decrease if central banks are effective in controlling inflation and the rate of economic growth stabilizes.

Innovations in technology and changes in supply chain tactics are further factors to watch. In an effort to lessen potential disruptions and support pricing stability, businesses are increasingly considering diversifying their supply sources and making investments in more substantial supply chain infrastructure.

Opt into to MetalMiner’s Monthly Metals Index report and leverage it as a valuable resource for tracking and predicting steel, aluminum, copper and nickel price trends.

Relief for Builders: Metals Prices Showing Stability

Steel and aluminum, two essential building components, witnessed noticeable price stability in recent months. The sector is receiving much needed relief from this stabilization in metals prices. Meanwhile, this will also contribute to a more stable and predictable economic climate by reducing the continued high cost of building.

In the past, the price volatility of steel and aluminum dramatically influenced the construction industry. For example, tariffs and trade conflicts like the ones imposed under Section 232 previously caused these commodities’ costs to rise sharply. Such increases have the potential to blow project budgets, cause delays, and eventually drive up expenses for both businesses and consumers.

Stabilization Brings Predictability

The stabilization of steel and aluminum prices in June marks a pivotal shift – one that allows contractors and developers to plan and budget more precisely. This is because steady material costs lower the chance of unanticipated budget overruns, thus facilitating better financial planning and resource allocation.

Project time frames are also less likely to be thrown off when expenditures are predictable. In the past, unexpected cost increases often resulted in delays as parties renegotiated contracts and procurement methods, but a stable project guarantees far more seamless development.

Construction MMI: Noteworthy Shifts in Metals Prices

Decode and understand steel, aluminum, copper and nickel market trends and stay ahead of the competition. The MetalMiner Monthly Metals Outlook equips you with the insights needed to understand and respond to market shifts effectively. View a free sample and subscribe today.

- European aluminum commercial 1050 sheet prices dropped by 5.04% to $3281.80 per metric ton.

- Steel rebar moved sideways, falling 2.88% to $540.48 per metric ton.

- Lastly, h-beam steel prices also moved sideways, dropping 2.56% to $471.09 per metric ton.