The gold bull era… what exactly is it?

Well, for some insight into this exciting matter:

While silly Westerners worship government fiat and debt-funded bully wars, billions of citizens in China and India focus on “going big” with saving…

And going big with gold!

Whether it’s the citizens making enormous purchases of jewellery or central banks adding aggressively to their reserves, the gold-oriented action in the East is set to continue, and intensify, for the next 200 years.

As the East saves more and puts the proceeds into gold, citizens of the West will eventually catch that vibe.

It’s already happening! As their fiat collapses, many Western citizens are making weekly and monthly purchases of gold at retail giant Costco (now estimated at $200million/month by Wells Fargo), and that’s fuelling interest in purchasing gold from the highest quality gold and silver dealers like Kitco.

In the short term, events like this Friday’s US jobs report will cause minor changes in the gold price (likely a dip), but that won’t stop the growing trend of citizens around the world becoming obsessed with getting more gold.

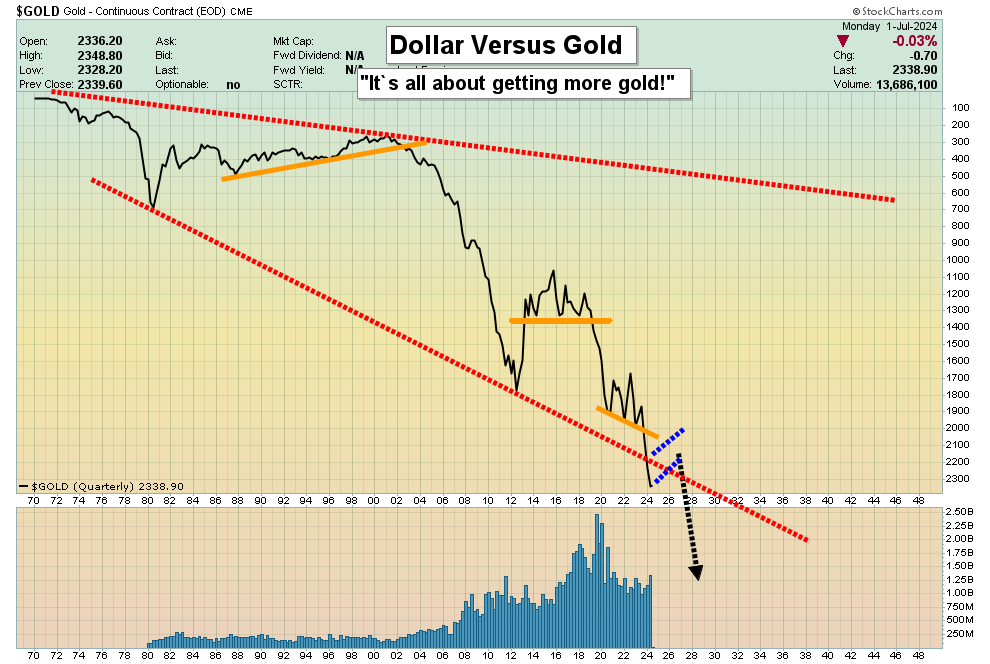

On this weekly gold chart, a bull flag scenario exists. Interestingly, gold could dip to $2200 or even lower… and the flag would still be intact.

On the daily chart, gold is trading sideways in its traditional “summer doldrums” pattern.

The price is underpinned with several massive floors of support. I’ve outlined $2265 as a solid zone to buy silver/mining stocks and $2220-$2000 to buy more gold.

Without a ramp-up in Lebanon-Israel-Iran tensions, gold is likely to continue its ooze sideways with a slight downside bias until October.

That’s when the US election will take the short-term spotlight and a big move higher for gold should occur.

The Iranian presidential election is also underway, and the battle is between a professional soldier (hardliner) and a surgeon (reformist). The reformist has the edge so far, but barely.

If the hardliner wins and takes Iran into the Israel-Lebanon fray, the bull flag on the weekly chart could activate, sending gold to $2600-$2800… before this month ends. If the reformist wins, the sideways ooze into October is the most likely scenario for the price.

A daily focus on the big picture (fundamental, cyclical, and technical) is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

What about rates?

Several months ago, I suggested an upwards move was likely, to complete the right shoulder zone on this US rates chart.

That’s played out as suggested. With US rates significantly higher than Euro zone rates, money managers are buying the dollar… but at the same time Asian governments are curtailing their US government bond buy programs.

The money managers appear to be buying dollars, but with a focus on bank deposits and the US stock market rather than government bonds.

The current dollar and rates situation is essentially neutral for gold, and in Asia few investors care whether gold pays interest or not. All they care about is getting more of it on dips in the price.

The H&S top pattern on rates hints that there could be a big stock market swoon in the Aug-Oct time frame. Rates would fall and bond prices rise as panicked investors sell stocks and buy supposed safe-haven bonds.

Oil?

Oil has been moving in sync with the dollar and rates, rather than with gold. A lot of traditional relationships have fallen apart as the “Get more gold and get it regardless of what else is happening!” theme intensifies globally.

Investors should own a modest amount of oil, but if there’s a stock market tumble, oil could fall too. Oil will become a sideshow as the gold bull era intensifies and copper could become as big a holding in the major commodity indexes as oil is now.

The miners?

This is the GDX chart. Why buy miners at a gold price of $2265? Well, that’s almost a $200/oz drop in the price from the $2448 high. Significant sales in the price need to be bought. That drop would likely put technical oscillators into some interesting buy zones too.

Most importantly, many futures market gamblers will have their long position stoplosses placed just below the $2280 low. They will likely go short there and be quickly overwhelmed by thunderous commercial trader short covering… and some very golden long position buys!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********