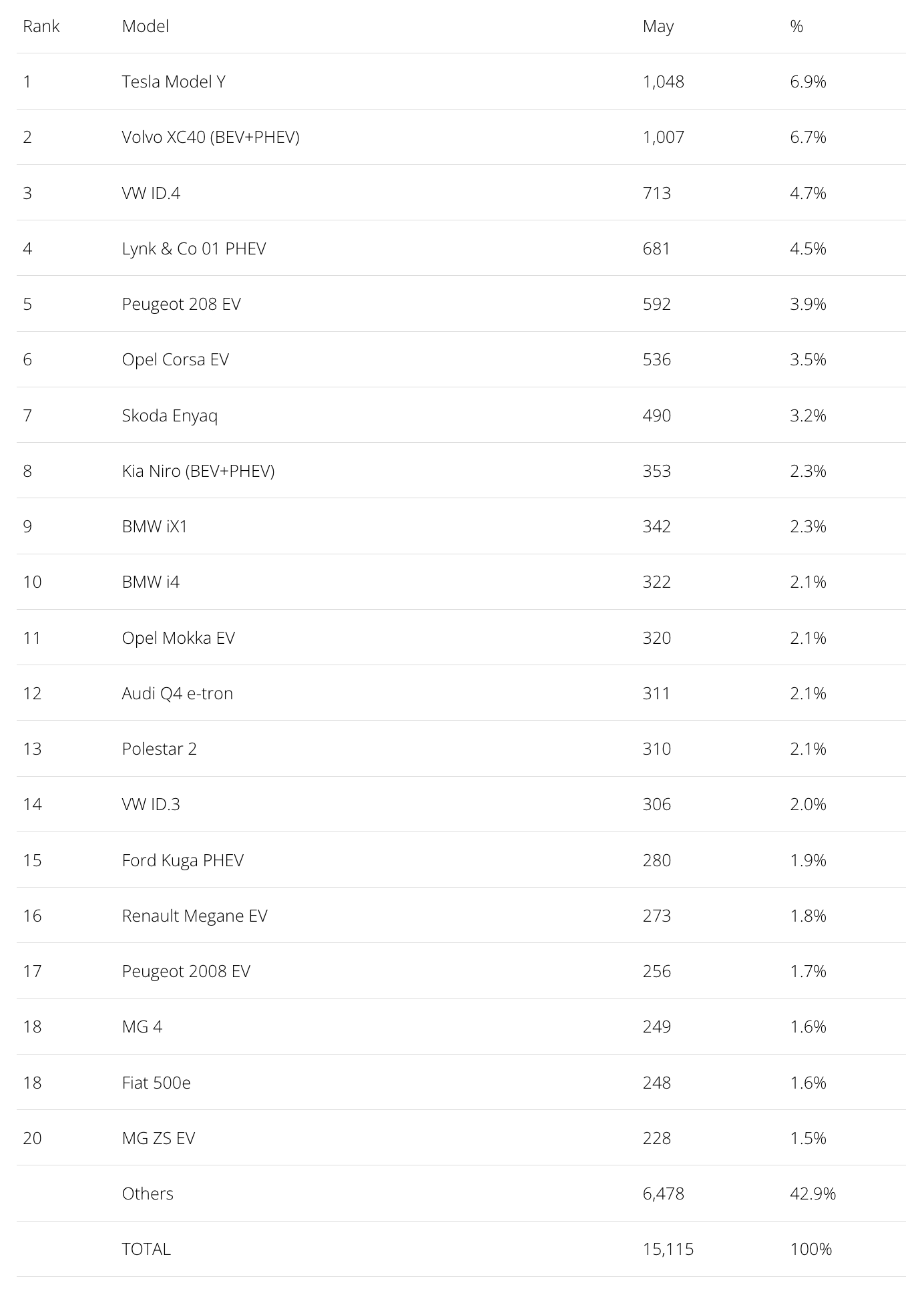

May saw an increase in plugin registrations to 15,115 units in the Netherlands, with the Dutch plugin vehicle (PEV) market reaching 46% last month. That’s mostly thanks to pure electrics (33% of new vehicle sales), which jumped 119% year over year (YoY). The overall market is also rising. It got up to 33,135 units, although at a slower rate (+42% YoY).

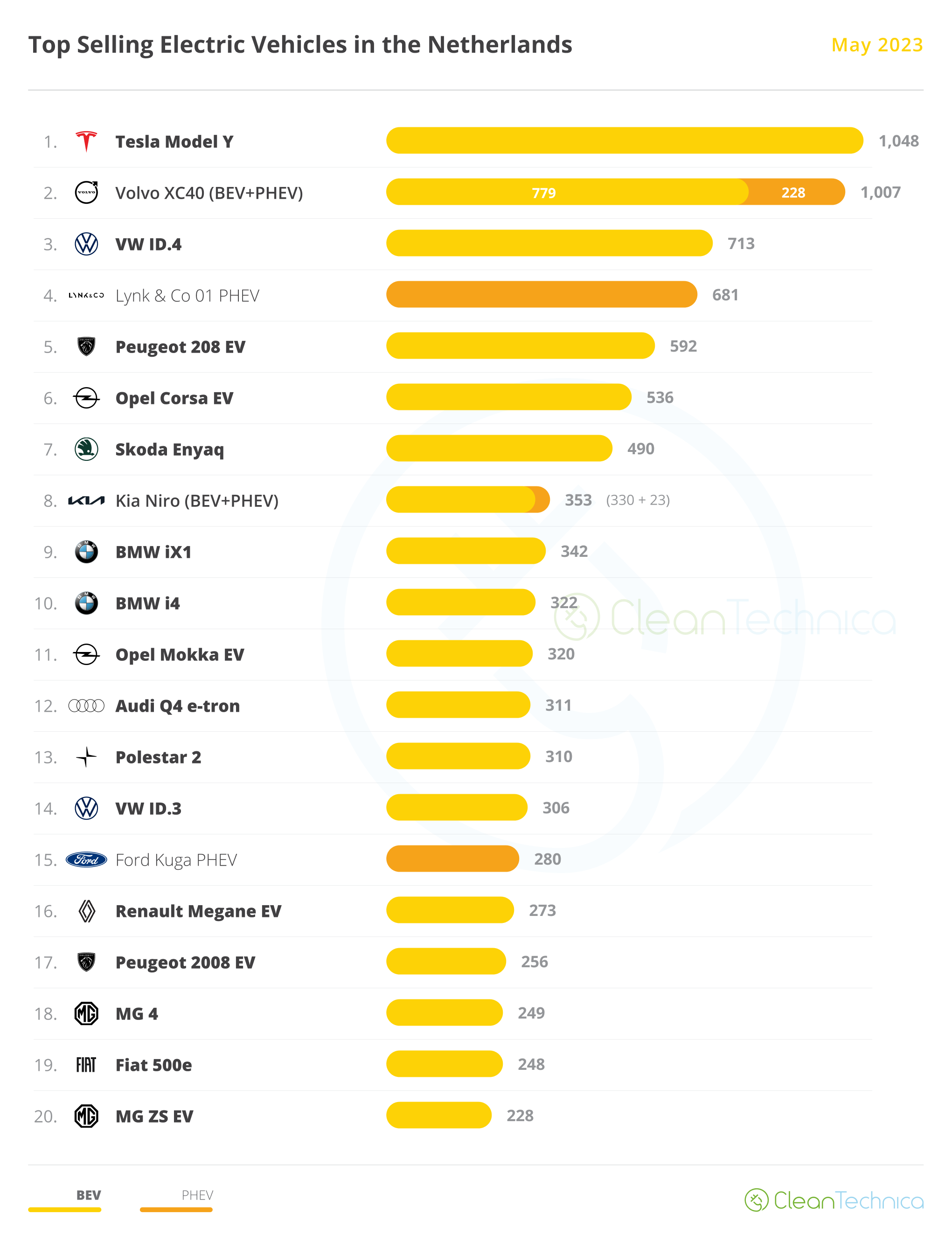

In May, the Tesla Model Y was #1 in the EV race with 1,048 registrations, allowing it to be #3 in the overall auto market ranking.

It was followed by the #2 Volvo XC40, which had 1,007 registrations, 779 of them belonging to the BEV version. That allowed the Swede to be 4th in the overall market. The VW ID.4 closed out the podium (and was 6th in the overall auto market) with 713 registrations.

In 6th we have the Opel Corsa EV. The Stellantis EV scored a record 536 units. The model was #5 overall in the May auto market. Highlighting a great month for Opel, Corsa’s crossover sibling, the Mokka EV, also scored a record performance, 320 registrations. That allowed it to be #11 in the PEV table.

Another model on the way up is the BMW iX1, which ended the month in 9th with a record 342 units. Will BMW’s new crossover be able to become the best seller that the brand expects it to be?

In the second half of the table, the highlights show up in the last positions in the table. Those include the Fiat 500e reaching #19 with 248 registrations, its best performance of the past 14 months, and especially SAIC’s MG brand placing two models in the top 20, a first for the Sino-British brand. The 4 hatchback was 18th with a record 249 registrations, while the crossover ZS EV ended the month in 20th with 228 registrations, its best score since June 2021.

While the other value-for-money-champ in the market, Tesla, gets most of the attention, the never-ending rise of MG in European markets is nothing less than astonishing. While Tesla is jumping 79% this year in Europe, in the same period the MG growth rate is 110%….

Finally, the Polestar 2 ended the month in #13, compensating for another slow month for the Volvo XC60 PHEV. With BEVs representing 73% of all plugin sales in May, versus 67% YTD, the trend towards BEVs continues, meaning that plugin hybrids are slowly going extinct on the table. (Hear that, Ford Kuga PHEV? The Explorer EV is coming to get you….)

With this in mind, expect that by next year, all models in the top 20 will be BEV.

Outside the top 20, May witnessed the ramp-up of the Hyundai Ioniq 6 streamliner, now up to 173 units delivered. Meanwhile, another much-debated EV (although not for the same reasons) is also starting to reach significant volumes — the Toyota BZ4X registered a record 111 units last month.

A model that was very close to reaching the table was the Volvo C40. It ended the month just five units behind the #20 MG ZS EV, with the sporty Belgian-made Swede reaching 223 registrations.

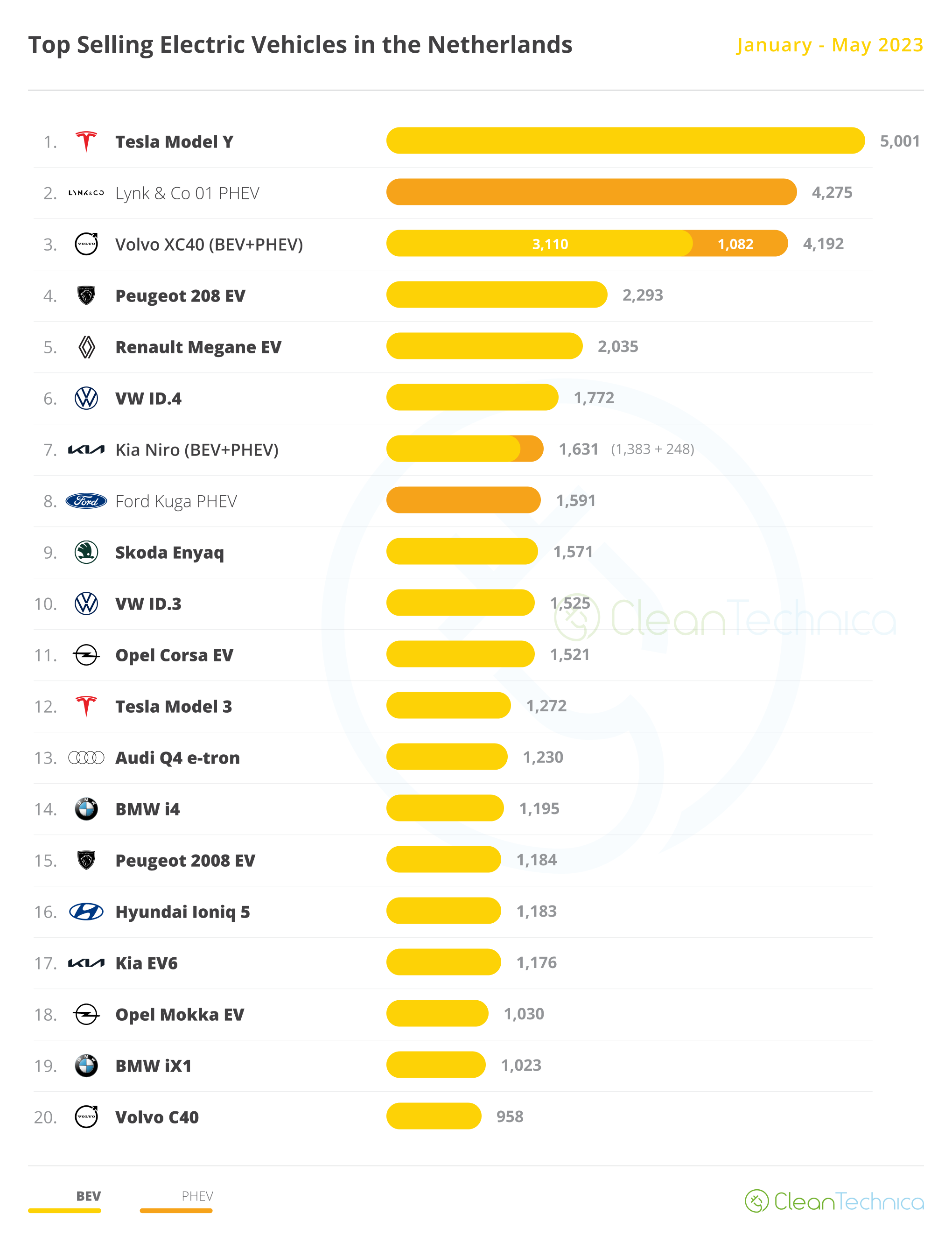

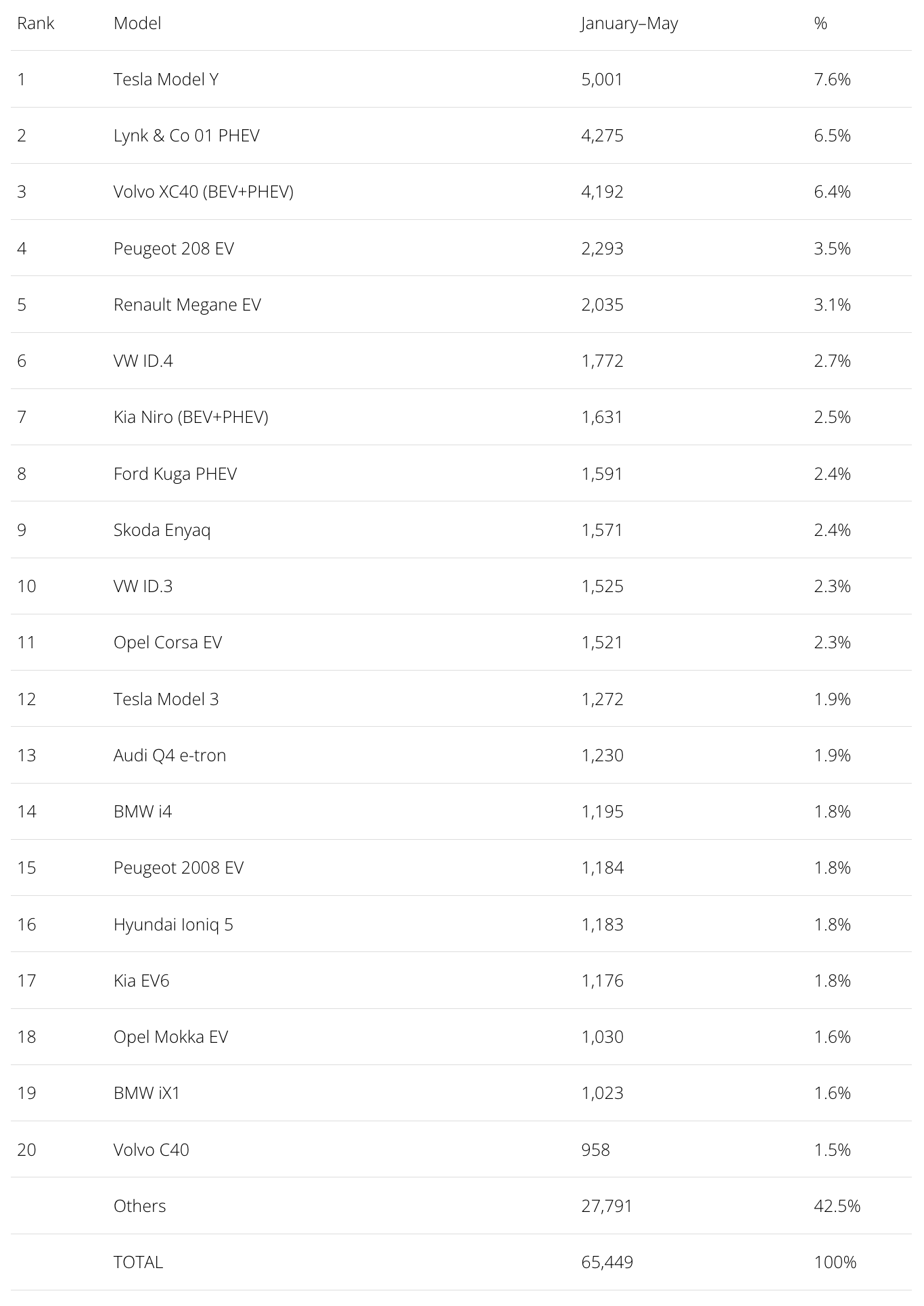

Looking at the 2023 ranking, the Tesla Model Y has enough distance over the runner-up Lynk & Co 01 PHEV to remain comfortable in the lead. The compact Chinese SUV now has to worry about keeping the silver medal from its cousin, the Volvo XC40, which gained significant ground on it. With both models effectively set to be replaced next year (by the EX30 in the Volvo stable and an unnamed new L&K model set to land next year), there could be some opportunities for the competition to compete with these two, but …

… With the podium bearers some 2,000 units above the rest of the competition, those other EVs shouldn’t bother Geely’s cousins. The question now is how they will be aligned by year end.

Off the podium, the Peugeot 208 EV surpassed the Renault Megane EV, with the Pug now the new #4. That says more about the Megane EV’s current issues, being stuck between a rock (MG 4) and a hard place (Tesla’s models) than Peugeot’s strong points.

Speaking of Megane’s issues, it doesn’t help that VW’s MEB-based models are also on the rise, as proven by the 5-spot jump of the VW ID.4, now in 6th (and 5th in June?), the rise of the Skoda Enyaq to #9, and the poshest of them, the Audi Q4 e-tron, jumping from #16 to #13 in May. With headwinds coming from all sides, there seems to be no other solution for Renault than to cut prices of its compact EV.

This says a lot about the current dilemma with Europe’s mainstream brands: While one way of surviving the EV transition would be to go upmarket, thus compensating the smaller scale with higher profit margins, the truth is that buyers do not seem willing to pay a premium to have an EV coming from a mainstream brand, no matter how good the model is (which in the case of the Megane EV, is pretty darn good).

In the second half of the table, the highlights come from the Opel and BMW stables, with the Opel Corsa EV jumping to #11 while the stylish Opel Mokka EV joined the table at #18. As for the Beemers, the i4 jumped three positions, to 14th, while the new iX1 crossover joined the table at #19. Expect the iX1 to continue climbing in the table, most likely becoming the brand’s new best selling model.

Finally, there are now 16 BEVs on the table, two more than in the previous month, as the Opel Mokka EV and BMW iX1 replaced the Volvo XC60 PHEV and Hyundai Tucson PHEV in the top 20. So, the BEV takeover continues to evolve.

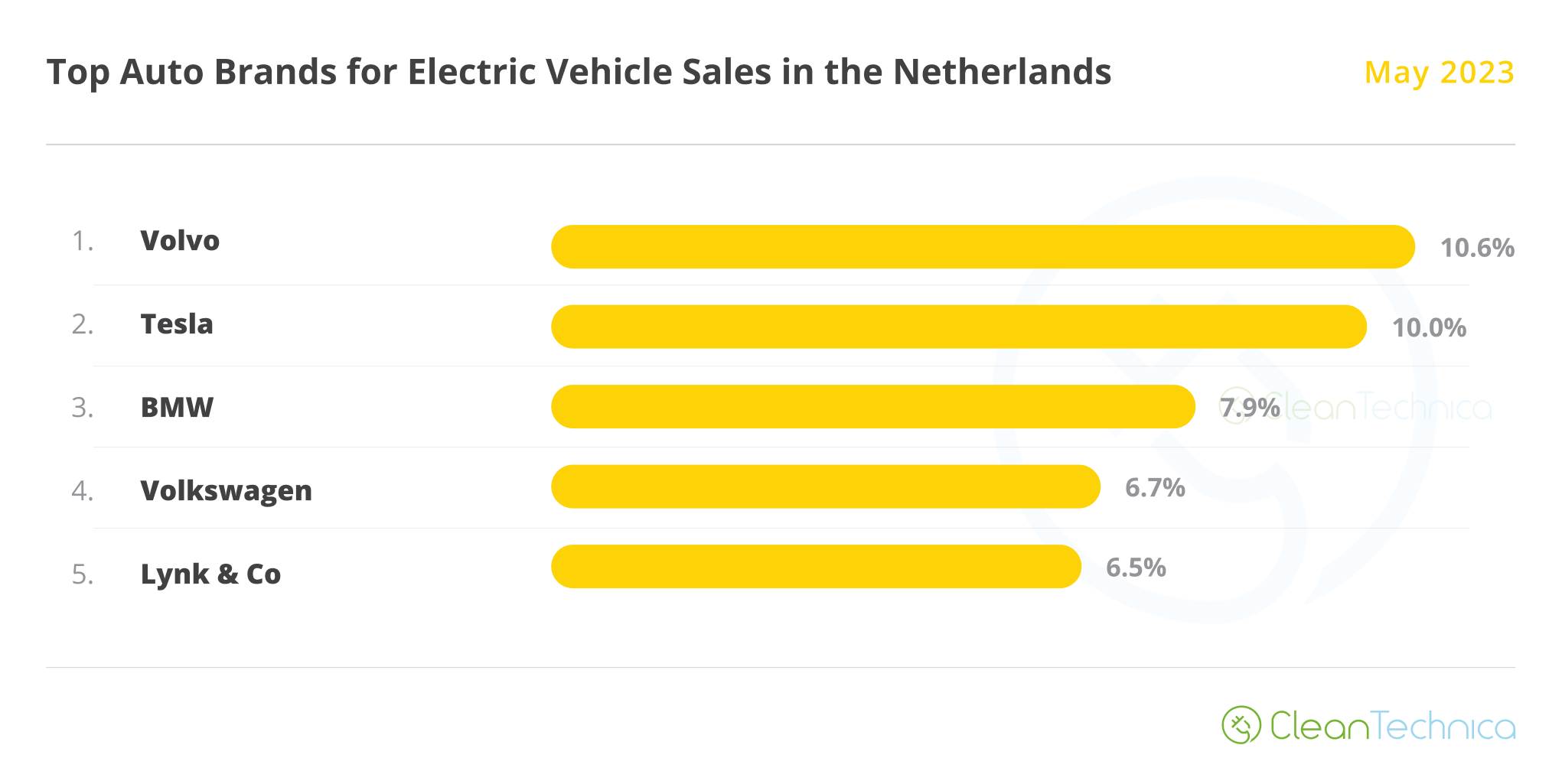

In the manufacturer ranking, Volvo (10.6%) retained the leadership position, keeping #2 Tesla (10%) at bay. Meanwhile, BMW (7.9%, up from 7.5%) remained in 3rd, while Lynk & Co (6.5%, down from 7.1%) lost the #4 spot to a rising Volkswagen (6.7%, up from 6.1%). Volkswagen jumped two positions last month, from 6th to 4th, mostly thanks to the strong result of the VW ID.4. On the other hand, Kia (5.9% share, down by 0.3%) took a beating, falling from 5th in April to its current #7 spot — having been surpassed by the previously mentioned VW but also by a rising Peugeot (6.2%, up from 6%).

As for OEMs, the leader, Geely–Volvo, lost share, going from 18.6% down to 18.3%. That was mostly due to Lynk & Co having a slow month. #2 Stellantis is rising (15.2%, up from 14.2%) thanks to positive performances from Peugeot and especially Opel, thus securing the runner-up status. #3 Volkswagen Group was also up (14.5%, compared to 13.8% in April), thus gaining ground on #4 Hyundai–Kia (10.9%, down from 11.1% in April) and #5 Tesla.

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Have a tip for CleanTechnica, want to advertise, or want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Former Tesla Battery Expert Leading Lyten Into New Lithium-Sulfur Battery Era — Podcast:

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …