Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Tesla #1 and #2 Lead in PHEV-Heavy Market

After previously checking out Spain, we turn west, to its Iberian neighbor, Portugal, for a new EV sales report. As a Southern European market with low purchase power, one would think that this would be another market lingering in the back of the peloton, struggling to reach double digits.

Well, think again, as this is the leading EV market in Southern Europe, market share wise, with plugins representing 28% of all passenger cars in 2024!

Putting that into context, that value is higher than Austria (23%), the UK (24%), or even France (26%)! (I am not mentioning Germany, because due to the current end-of-subsidies sales blues, the EV market share there is now at 18%….)

So, what is the secret for this success? I believe there are three main reasons, all connected to each other: Generous company-car benefits, namely VAT deductability, to BEV and PHEV models; the importance of the company car market in the overall passenger car market; and the local automotive culture, which regards cars as a fashion statement and EVs being regarded as the next big thing.

There are other fiscal incentives (annual road tax reductions, free parking, etc.), but the ones mentioned above are the ones that move the needle and truly shape the plugin market.

Compared to Spain, whose plugin vehicle (PEV) market is currently at around 11% share of the overall market, and especially compared to Italy, which is still lingering at around 6% share(!), Portugal is indeed one step ahead. Although, looking closer at the numbers, there is a more nuanced picture….

Due to those company car incentives also being available to plugin hybrids, looking closer at the numbers, we realise that a little less than half of the plugin market is in the hands of PHEVs, while Tesla owns more than 25% of the BEV market, which is not a positive sign of a healthy market.

Still, it could be worse. Let’s look at the performance by powertrain, and with the backdrop of the overall market growing 9% YoY in 2024, to 96,223 units. Plugless hybrids are booming, currently representing 16% of the overall market. BEVs grew 12% YoY this year, to 16% share as well. PHEVs surged 23% in the same period, to 12% share, having reached its third best result ever in May with 2,601 registrations, just 122 units below the record of November 2023 (2,723 units). One can say that the market’s electrification process is continuing at a steady pace, reaching 29% PEV share in May and 28% in 2024 so far. And if we include plugless hybrids, this market reached 44% share of electrification.

May saw a small peak from PHEVs, which reached 13% that month, pulling their YTD share to 12%. By 2035, expect this market to be mostly electrified, with the question being if they will be able to make the full transition just using BEVs or if some share of PHEVs will be needed to be added to the mix in order to reach the EU’s ban on ICEVs.

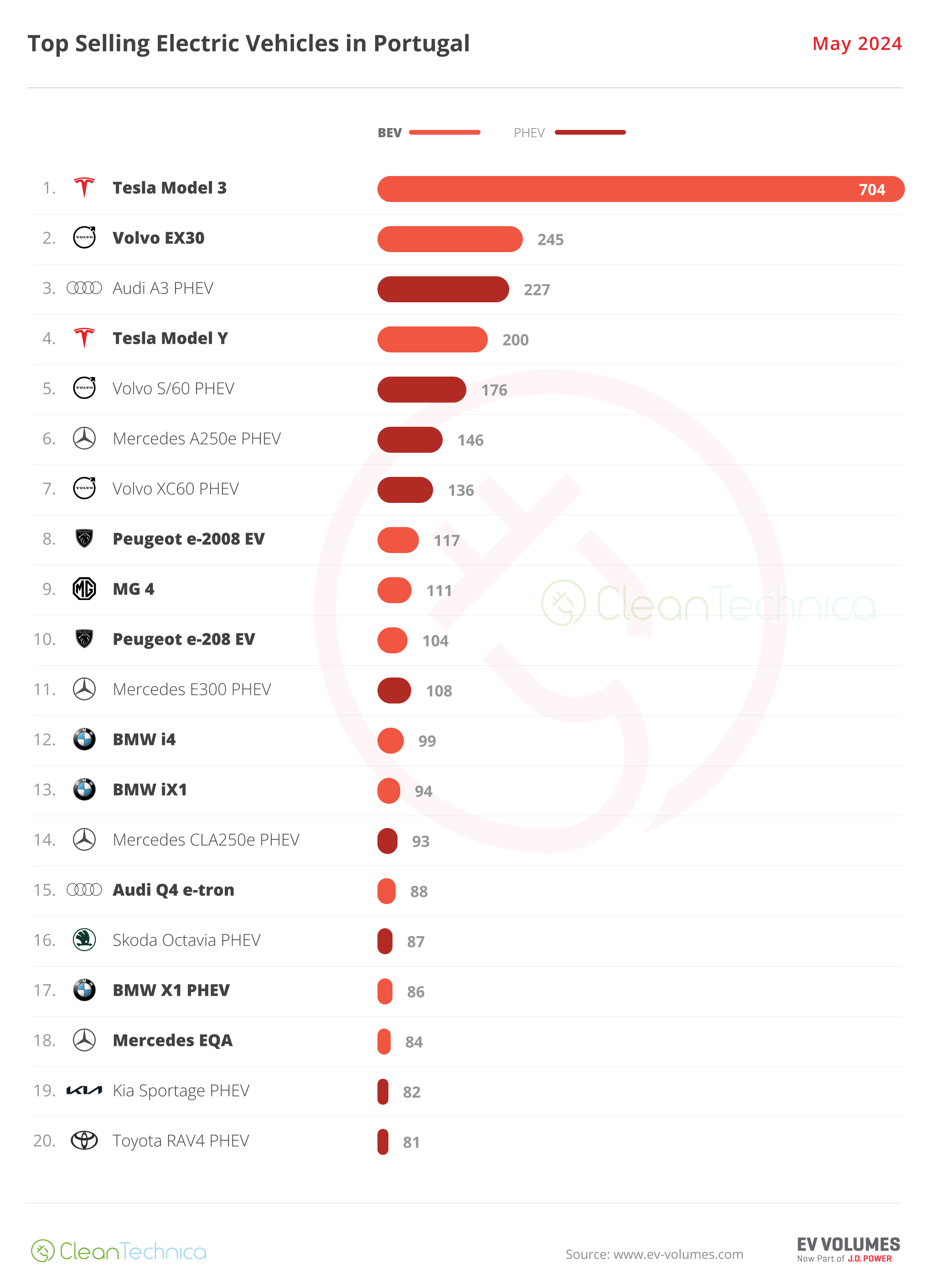

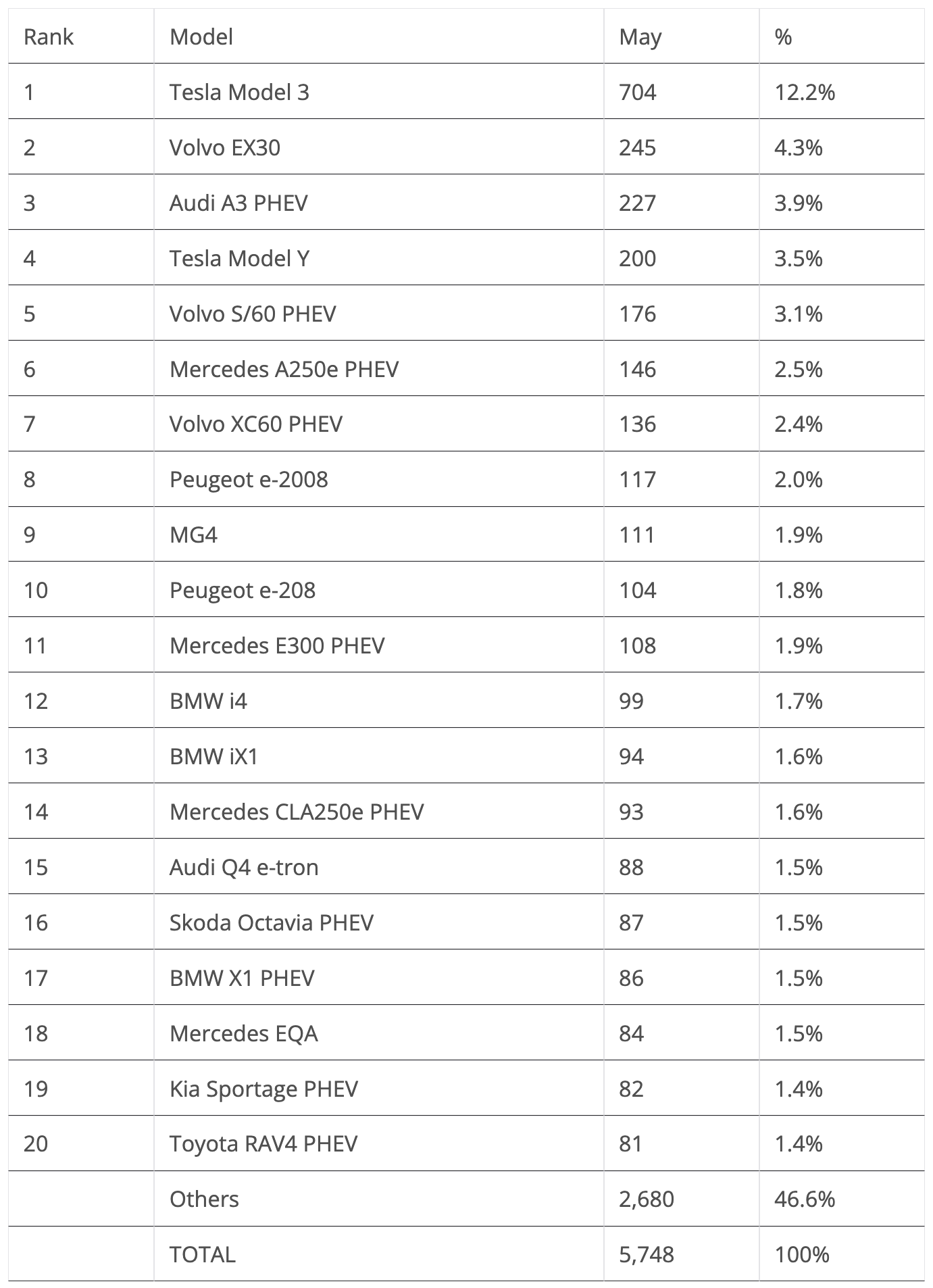

Looking at the best selling models, the situation is that Tesla is at the top, followed by a sea of plugin hybrids and a few compact BEVs.

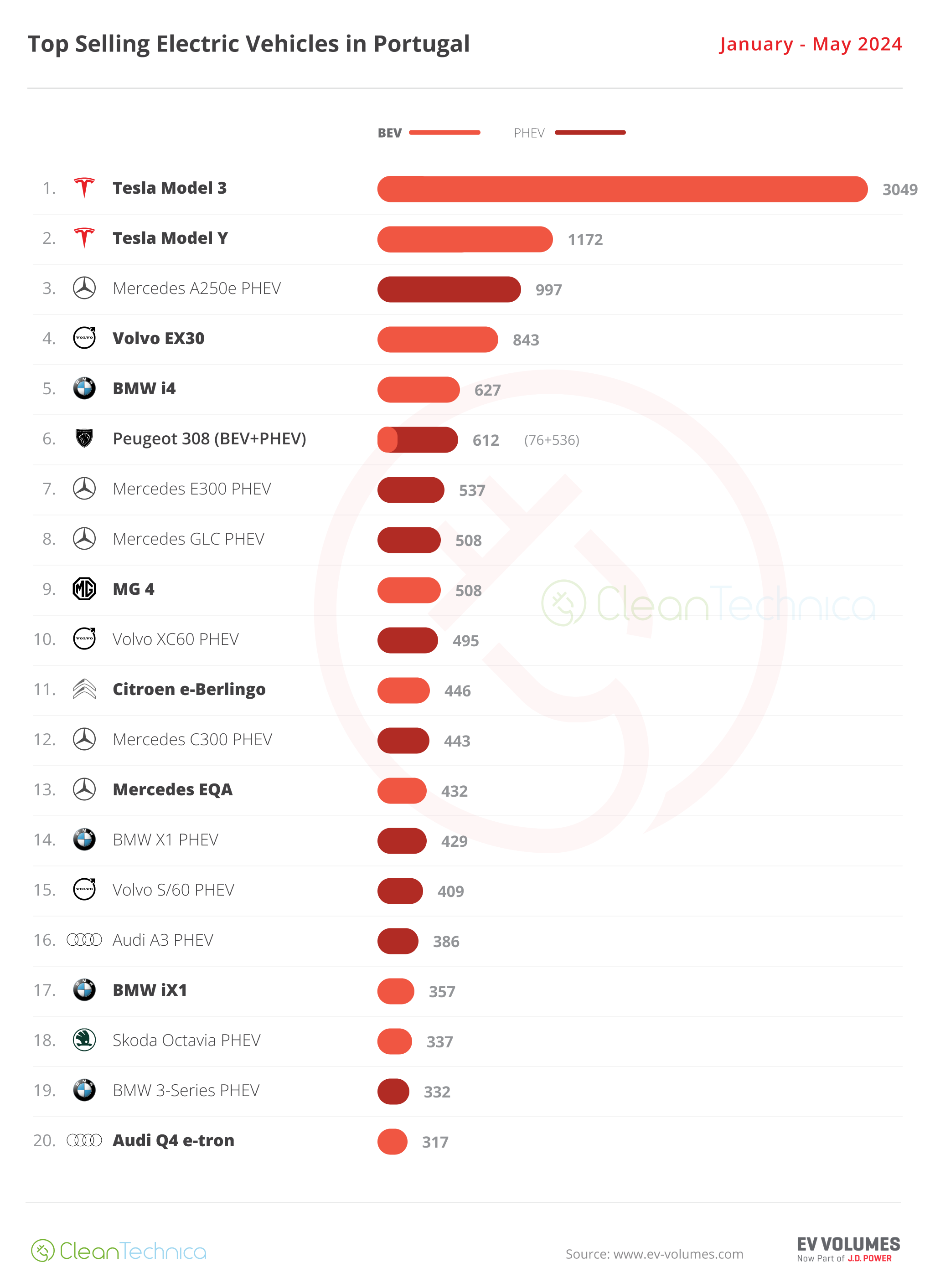

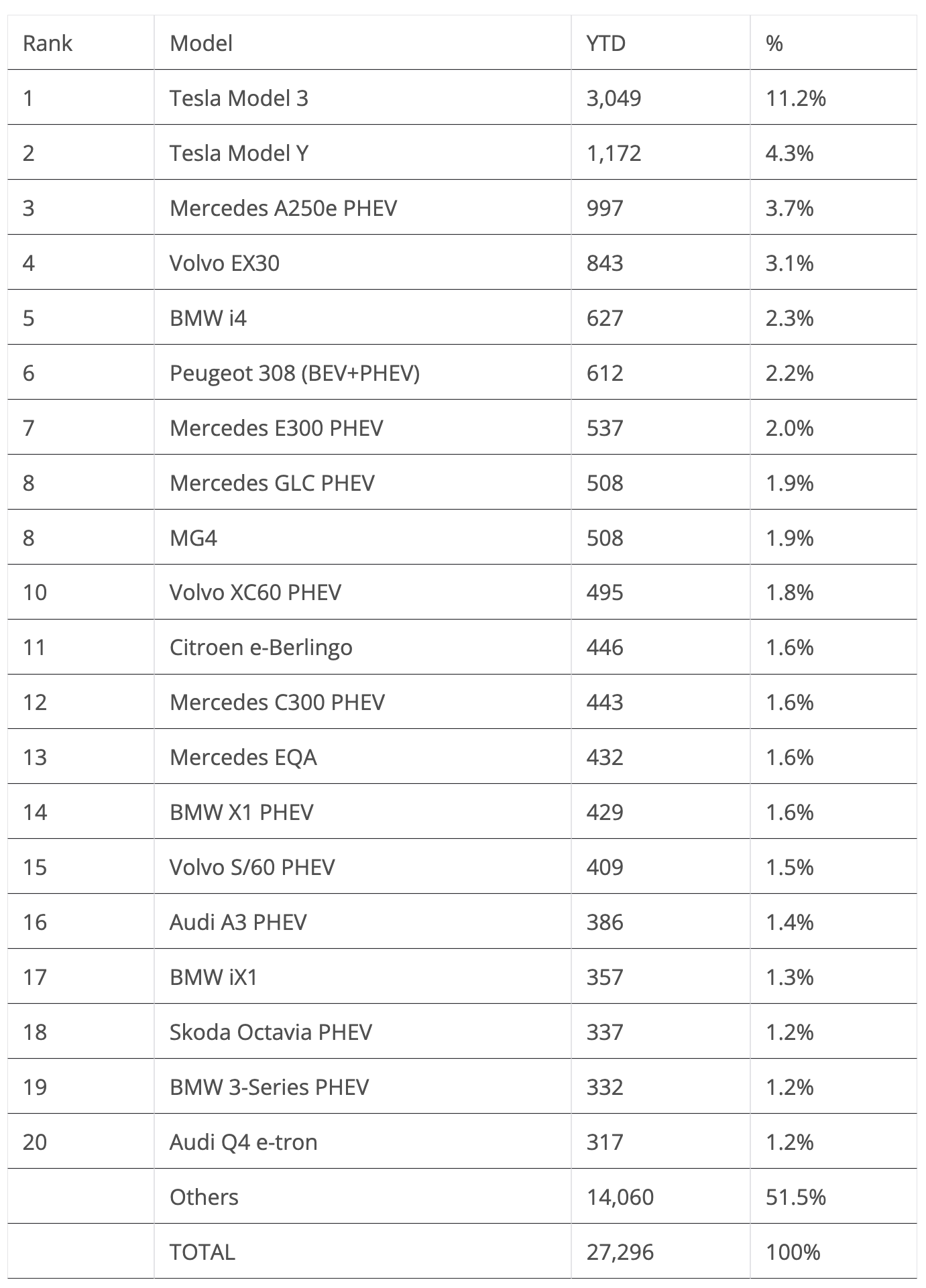

As such, the Tesla Model 3 is in the lead in both the May and YTD rankings, almost tripling the sales of the Tesla Model Y, with this being one of the interesting quirks of the Portuguese market — as it is one of the only markets in Western Europe less affected by the SUV craze. Add that to the fact that the Model 3 recently had a refresh and you have the recipe for the Model 3 beating the Model Y. In fact, the sedan reached the #1 position in the overall ranking for just the second time ever, after its first triumph in November 2023.

The 704 deliveries of the Model 3 represented a 96% increase YoY, while on the other hand, the Model Y (200 units in May), sank an astonishing 56%(!) in the same period.

Outside of TeslaWorld, the silver medal in May went to the Volvo EX30, with 245 registrations, once again confirming its popularity in Europe. The last place on the podium went to a surprising Audi A3 PHEV, which delivered a record 227 units!

This is another quirk of this market, and others like it, because it is not a market with large volumes — like say, Spain — and it also sits on the periphery of mainland Europe. Portugal, along with other markets like Ireland and Iceland, suffers from regular units starvation, which means, instead of a steady flow of deliveries, when it comes to some models and brands, deliveries are made in batches. So, during several months, a given model gets symbolic registrations, say single digits or low double digits, and then a boatload of units land in dealerships, shooting the model to the top of the tables in a given month while actually satisfying demand that had been on hold for several months.

The Audi A3 PHEV is just the most extreme example, as there are more cases in May’s ranking of the same logic: The #19 Kia Sportage PHEV and #20 Toyota RAV4 PHEV broke their personal records in May, with 82 and 81 registrations respectively, after rather discreet careers this year. The Audi Q4 e-tron, #15 with 88 deliveries, had its best result in a year. (This model’s deliveries probably came in the same batch as the Audi A3 PHEV.)

Other models shining in May were the Volvos S/V & XC60 PHEV midsizers, with both the SUV (136 registrations) and the sedan/wagon (176 registrations) scoring record results, something that can only be explained by the EX30’s current success (a high tide lifts all boats and all that) as these models already have six to seven years on their backs.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

The BMW iX1 continues to expand its deliveries, having reached a record 94 units in May, thus confirming the crossover’s popularity, while Peugeot finally got time to allocate decent volumes of the new e-208 EV and e-2008 EV to Portugal, allowing both models to reach new year best scores, 104 units and 117 units, respectively.

A popular model in Portugal, the Mercedes CLA250e PHEV scored a record 93 registrations in May, helping the German make to place four models on the top 20 and allowing it to be the most represented brand on the table.

Speaking of Mercedes, the three-pointed-star’s models are quite popular in Portugal, and the aforementioned performance wasn’t a one-time thing but a regular feature. The German make has even more representatives in the YTD top 20 — the entry A-class in 3rd, E-Series in 7th, GLC in 8th, C-Class in 12th, and EQA compact model in 13th.

Outside the top 20, and still on Mercedes, the EQB had 59 registrations, its best result in almost two years, while a mention also goes out to the good result of the VW ID.3 (50 units), its best result since last August. And here’s another peculiarity of the Portuguese market: In May, the best selling BYD model was the Seal(!), with 57 registrations, with the good looking sedan cementing its position as the brand’s best seller here — not only in May, but also YTD, with 271 registrations.

Interestingly, it looks like even BYD was caught off guard with this one. Having recently visited a BYD dealership in Portugal, all available models (the Dolphin, Atto 3, Tang, Han…) were available for immediate delivery except for the Seal, which had a waiting list….

The reason for this is likely the addition of generous company car subsidies as well as the popularity of sedans (and station wagons) in Portugal.

Looking at the YTD data, in the light of the recent developments regarding tariffs, the current advance of the Tesla Model 3 should be enough to keep it in the lead, but the second position could be up for grabs if the Tesla Model Y continues on its downwards spiral. The main candidate to replace the US crossover is the 3rd placed Mercedes A-Class, as the #4 Volvo EX30 should see its delivery surge drop in the second half of the year.

The only other top 20 model to be affected by the new Chinese tariffs is the #8 MG4, which should drop several positions by the end of the year.

Another highlight in the ranking is the 6th position of the Peugeot 308, with the compact hatchback being the best selling Stellantis model, ahead of the surprising #11 Citroen e-Berlingo van-with-windows MPV.

One more surprise appearance in the top 20 is the Skoda Octavia PHEV, in #18, with the Czech model securing an unexpected presence among the best sellers.

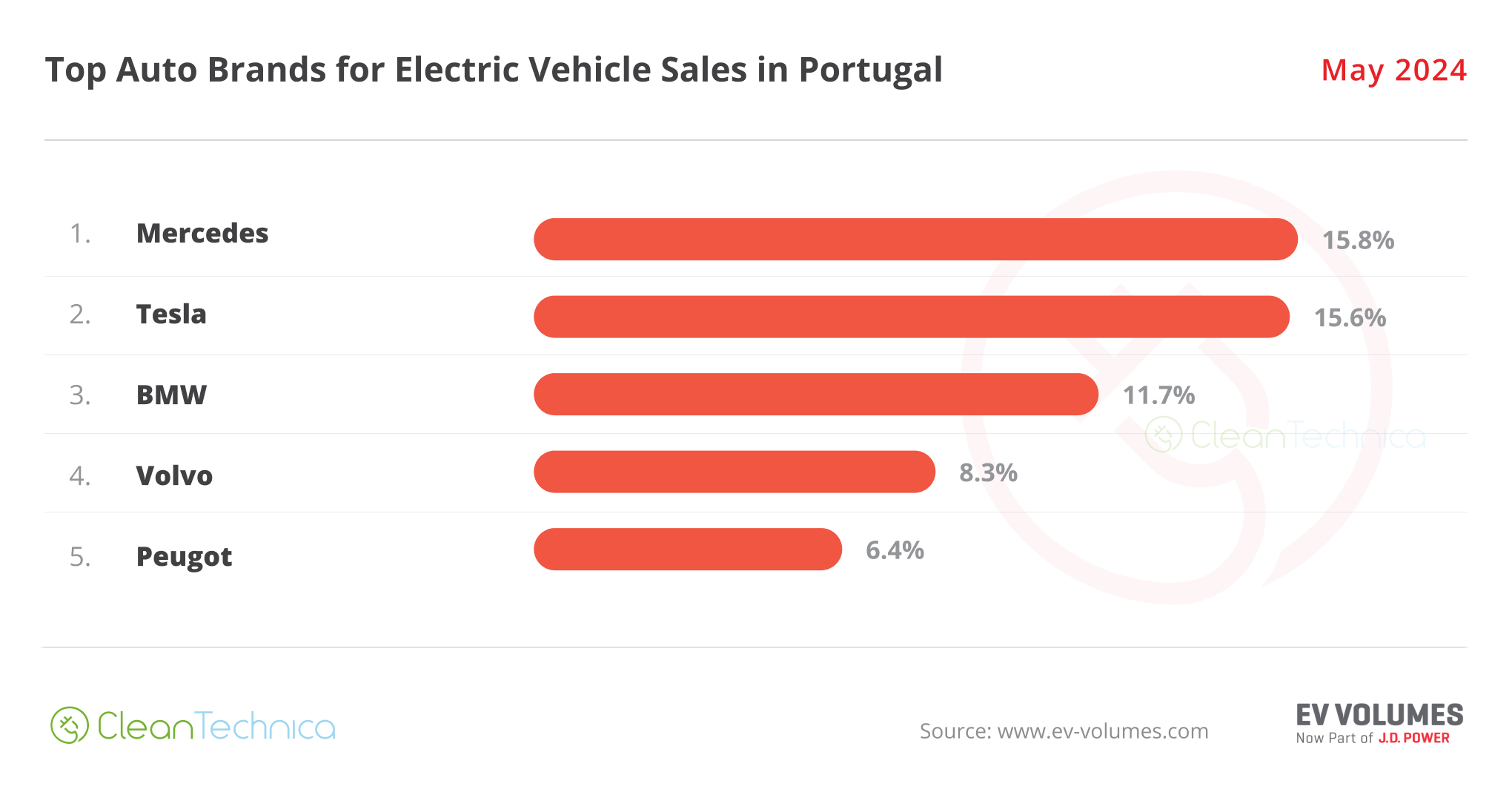

Looking at the brand ranking, Mercedes benefits from the popularity of its lineup, even beating Tesla (15.8% vs. 15.6%). The German make is also comfortably ahead of its arch rival, BMW, which is 3rd with 11.7% share. This is one of those markets where the investment that Mercedes made in its plugin hybrid models (bigger batteries, CCS availability…) is paying off, allowing it to distance itself from its German rivals.

In 4th we have Volvo, with 8.3% share, with much of it based on the EX30’s sales. Peugeot is in 5th, with 6.4% share, with the French brand comfortably ahead of #6 Audi (4.7%), but also distant from #4 Volvo.

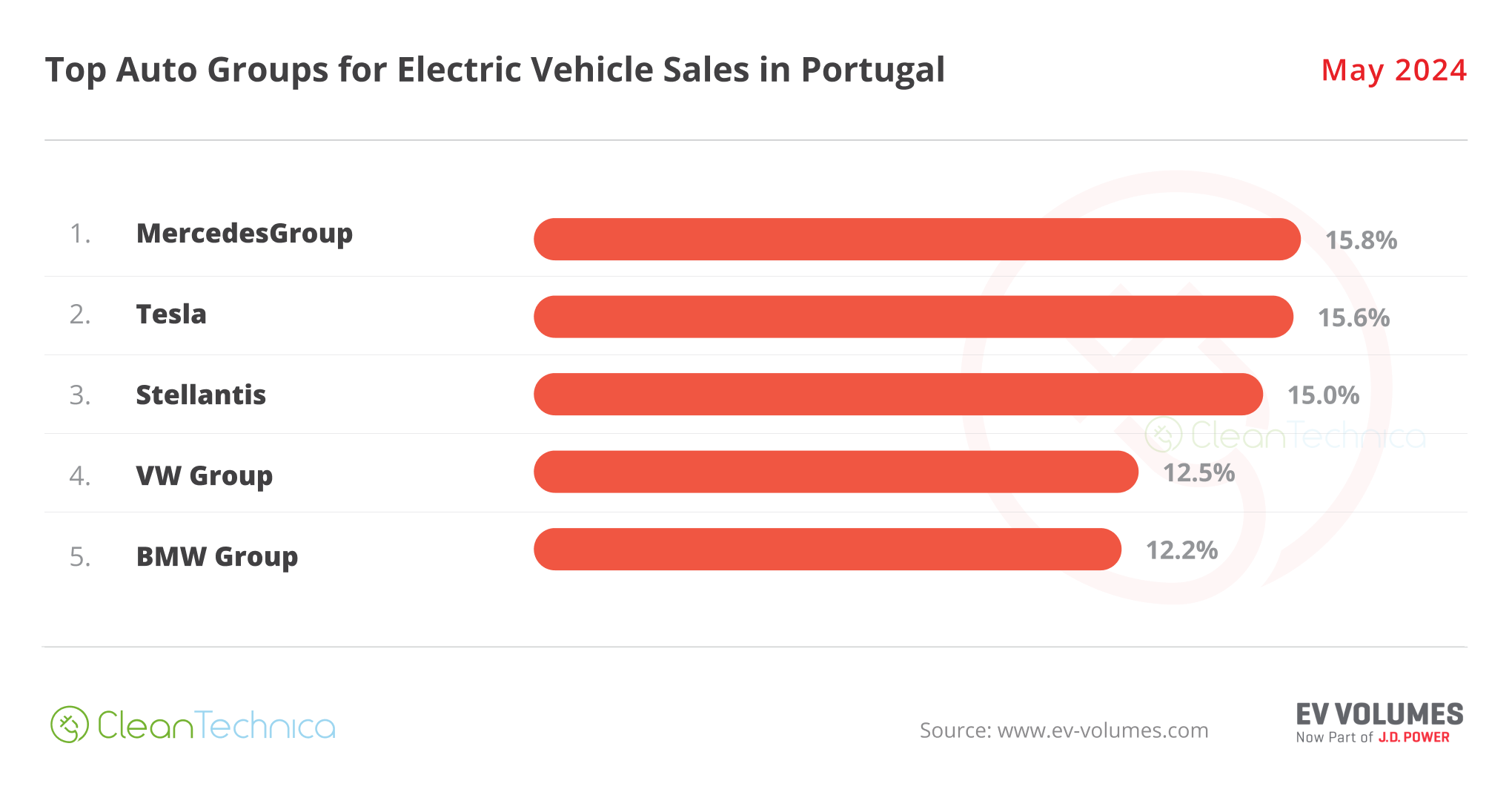

Arranging things by OEM, we have a close race for #1, with Mercedes Group (15.8%), Tesla (15.6%). and Stellantis (15%) competing for the top spot, but with #4 Volkswagen Group (12.5%) and #5 BMW Group (12.2%) not that far behind. This is probably one of the more open races for gold in the OEM category anywhere in the world.

With Tesla probably suffering from smaller volumes coming from the Model 3, Mercedes Group seems the favorite at this moment, but with Stellantis probably benefitting from increased volumes coming from its new, lower-cost models (Citroen e-C3, Citroen e-C3 Aircross, Opel Frontera, Fiat Grande Panda…), we could see it surpass the German OEM by the end of the year. We shall see.

Finally, Geely–Volvo is 6th, with 9% share, and with the Chinese conglomerate likely suffering from the new tariffs (the Volvo EX30, Polestar 2, and Smart #x’s are all made in China), not only will these developments prevent it from trying to reach a top 5 spot, but they will have to watch their back and keep an eye on the competition.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.