Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Coal will move further into decline as an energy producer in Australia, after several superannuation companies announced that they will no longer support investing in companies that derive 10% or more of their income from thermal coal production. As a former government employee, my superannuation is invested with QSuper. Over a decade ago, I raised the issue of investing in industries that exacerbated climate change. Now, it looks like enough clients have registered concern and they have taken action. Well done. Australian super funds hold A$3.7 trillion in assets.

QSuper has placed companies that receive over 10% of their revenue from the mining of thermal coal on an investment blacklist. Look closely at the list below and you will find that coal is listed alongside tobacco producers, the makers of cluster munitions and land mines. Who would have thought that coal had such deadly friends?

Some superannuation funds are still backing fossil fuels believing that there is still some money to be made for their members. According to MarketForces.org, “… investments by the top 30 super funds in clean energy companies have declined by half a billion dollars over that same period, totalling just A$7.7 billion as at 31 December 2023.” Whereas Australia’s top 30 superfunds have more than A$39 billion invested in the global fossil fuel companies with the largest expansion plans. This group has been dubbed the “Climate Wreckers Index.” The A$39 billion needs to be seen in the context of the almost A$4 trillion held by Australian superfunds.

Want to know if your superfund is investing in Climate Wreckers? Check the Climate Wreckers Index here.

Brett Morgan, of Superannuation Funds Campaigner Market Forces, said: “Investments in the world’s biggest climate wreckers are skyrocketing as Australia’s biggest super funds are failing to rein in dangerous coal, oil and gas growth. Tens of thousands of members are demanding immediate and decisive climate action from their super funds, by forcing coal, gas and oil companies to end their fossil fuel expansion plans and divesting where this fails.”

Obviously, more super companies need to follow the example set by QSuper and heed the warnings of such think tanks as Carbon Tracker. Carbon Tracker has been warning for years about stranded assets in the fossil fuel industry and the threat to retirees’ super. They will be pleased by QSuper’s decision.

The Australian government’s recent federal budget adds more fuel to the fire: no new funding for fossil fuels was announced – not even for gas. Climate Council CEO Amanda McKenzie said: “Gas and coal are not part of the budget’s vision for a Future Made in Australia, underlining that our next era of prosperity can be built on cleaner foundations. This is an essential signal across our entire economy.”

The Climate Council continues: “By earmarking billions of investments in coming years to grow clean industries like critical minerals, renewable hydrogen and clean energy manufacturing, the Federal Government is charting a course to power past the end of fossil fuels.” The Climate Council calls for bipartisan support. However, that is highly unlikely, as the Conservation Federal Opposition is doubling down on its call for modular nuclear reactors and running a scare campaign about renewables causing blackouts. As if the transition wasn’t hard enough, we have to fight Luddites riding dinosaurs! On a side note — none of their followers want a nuke in their backyard!

The last ten years have been dominated by a debate about whether there was such a thing as climate change. Now that the Conservatives have accepted that climate change is an issue, the next 10 years might be taken up with a debate about how to fix it — nuclear or renewables! One only hopes sense will prevail and votes will go to those who can do the maths. Australia’s premier scientific research body, the CSIRO, has come down decisively on the side of renewables as cheaper than nuclear, and the better option for power generation.

The use of gas peakers during the evening hours when solar is low and people are demanding greater power loads from the grid continues to put upward pressure on power prices and add to the “cost of living crisis.” There are multitudinous big battery and wind powered projects in the pipeline. Until they are built, connected, and commissioned, Australia remains reliant on fossil fuel gas. Meanwhile, the greenwashing continues with advertising on free-to-air TV trying to sell methane gas as a renewable!

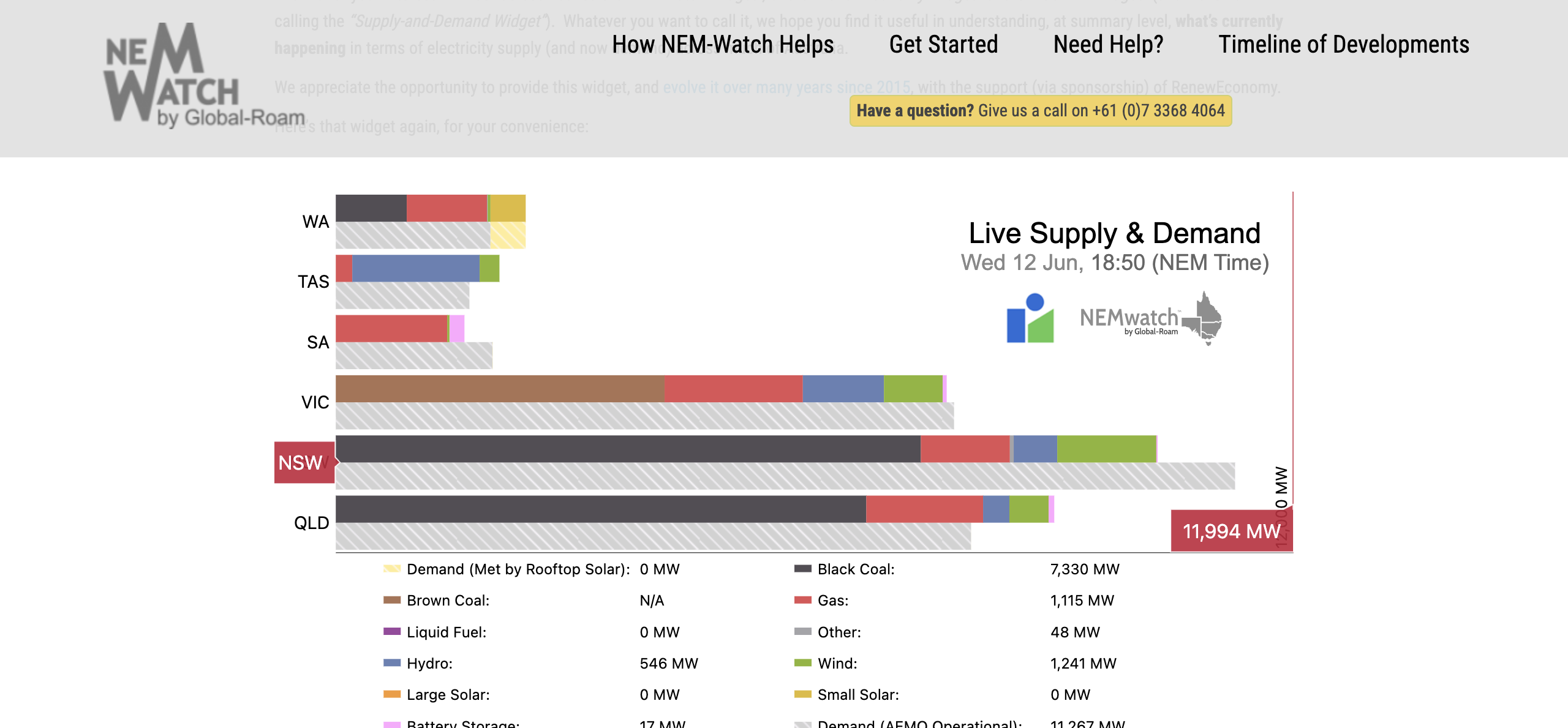

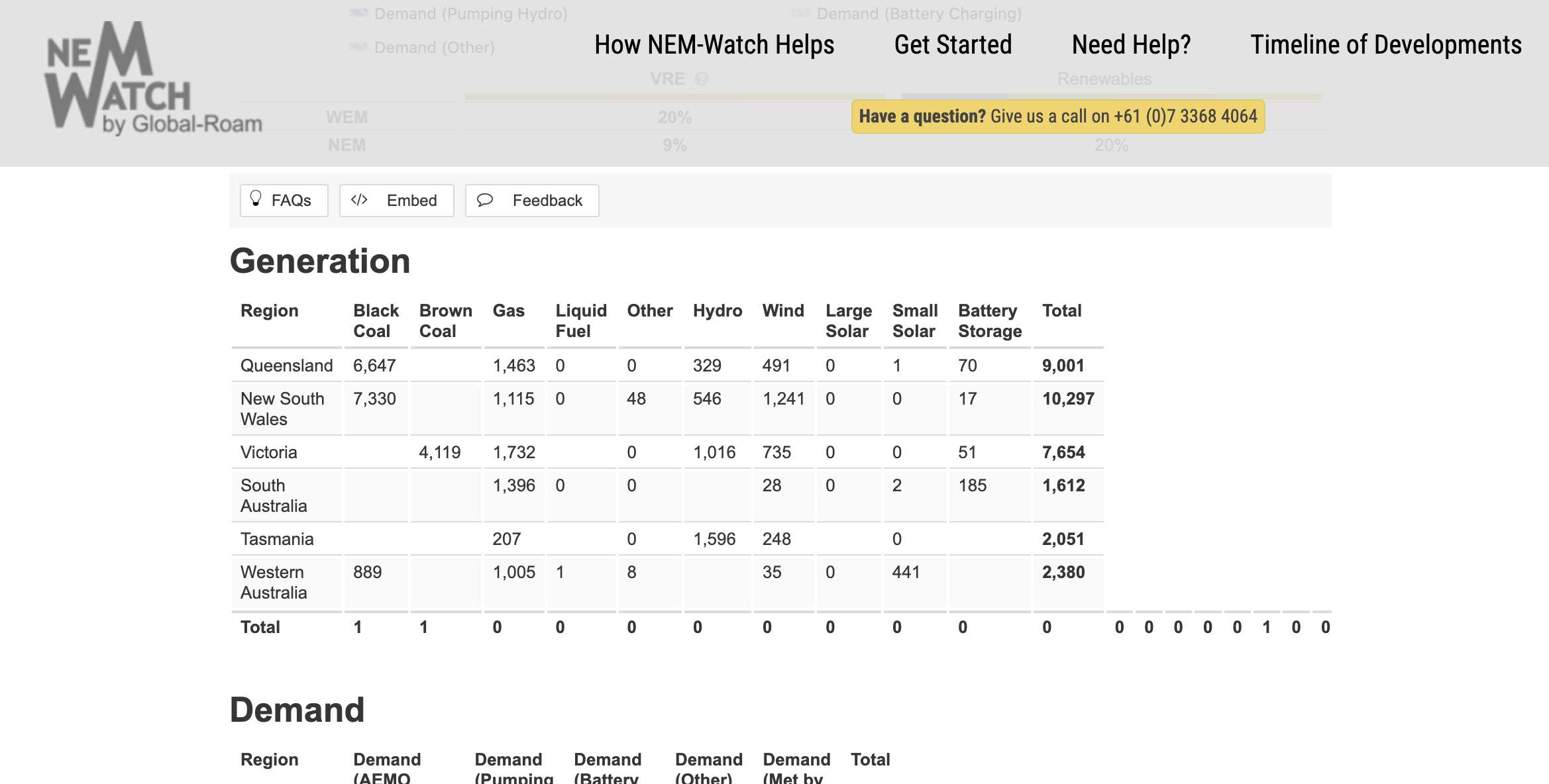

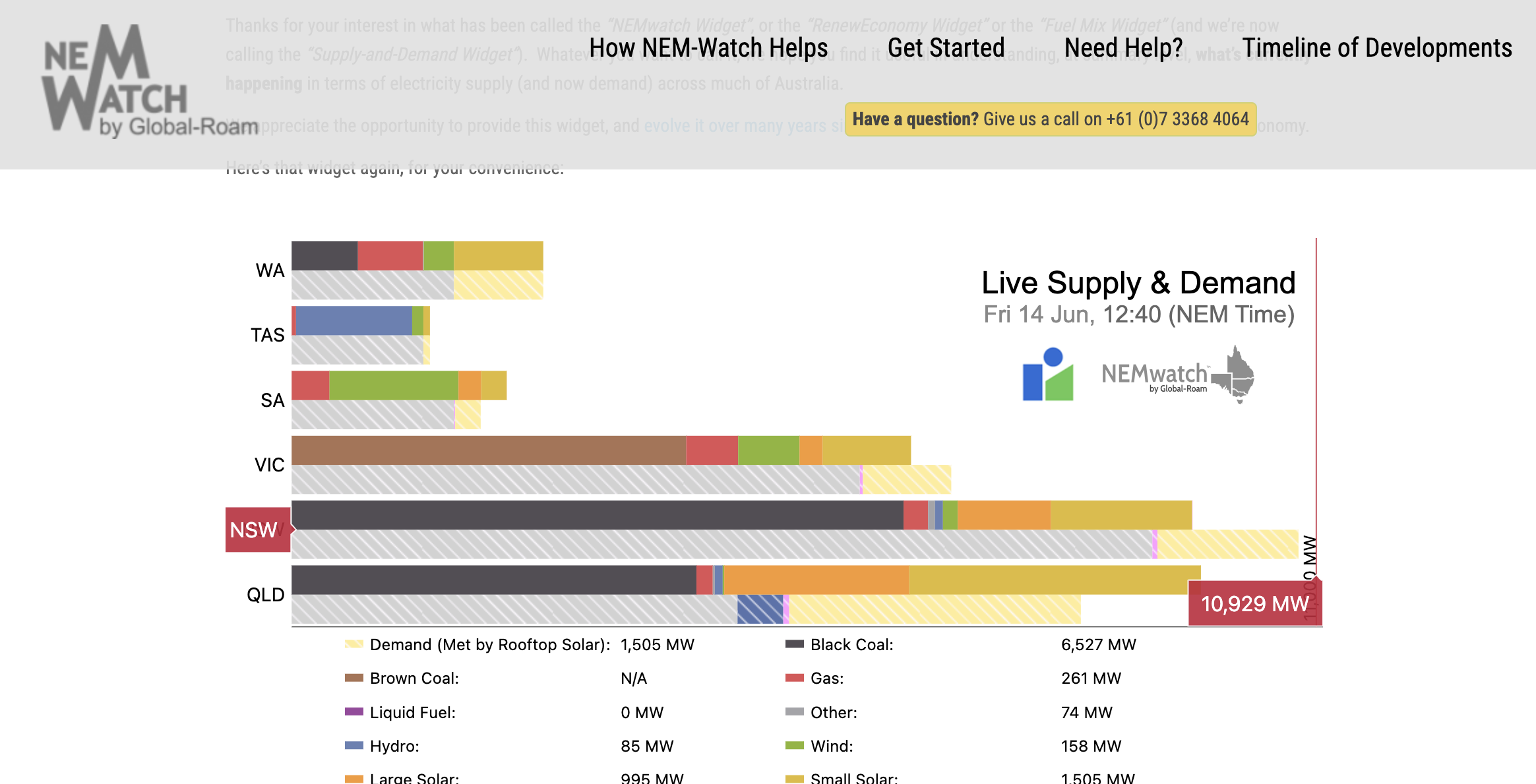

A check of the National Energy Market during the evening peak (5–7 pm) makes it obvious that gas is essential as Australia transitions to clean energy from wind and solar, backed by big batteries and virtual power plants. Please note that this is a live site and values will vary during the course of 24 hours. The screenshots below were taken in Australia’s winter, as the weather was cooling and people were arriving home from work and cooking dinner. At 6:50 pm about 6 GW of power was coming from gas. There were only about 300 MW of battery storage available.

Only a little over 2 GW of electricity is being produced by gas in the middle of day.

In a sign of a maturation, mainstream financiers are entering Australia’s big battery market. According to Allens Insights, “market financiers, are developing a greater understanding of technology risks and split construction contracting, which are typical features of battery energy storage systems (BESS) projects.” They are seeing more “bankability” leading to confidence that big batteries can be commercially viable in Australia even without government support. The government in turn is simplifying the rules for bidirectional flows which make for easier connections and the ability to provide a greater range of services.

“Momentum for new investment in battery projects is rapidly building. Revenue opportunities continue to grow and diversify as owners and off takers look at novel ways of sharing risk and reward, and developers grapple with integrating revenue underwriting schemes into their offtake offerings. Critical mineral prices have fallen as growth in mineral production has outstripped growth in battery production. The oversupply of critical minerals is expected to continue at least in the short-term, which should keep prices competitive for battery supply through 2024.”

Thermal coal may be hearing its death knell for domestic electricity production in Australia, but it will still be some time before gas can be squeezed out of the market by renewables firmed by grid-scale batteries.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.