Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Plugin vehicles are all the rage in the Chinese auto market, with plugins scoring a new record, a little more than 1.1 million sales (in a 2.1-million-unit overall market). That’s up 51% year over year (YoY), compared to the overall market being up 5%.

Looking deeper at the numbers, growth came from both sides — BEVs were up by 29% in September, to 644,000 units, while PHEVs jumped 97% in the same period, to 479,000 units, which is a record month for the third fourth straight time. Breaking down plugin sales by powertrain, BEVs had 57% of sales, inline with the YTD numbers, while EREVs had 11% of plugin sales in September and regular PHEVs were responsible for the remaining 32%.

The year-to-date (YTD) tally is around 7.3 million units, a significant rise over the 5.4 million units in the same period of 2023.

Share-wise, September saw plugin vehicles hit 53% market share! Full electrics (BEVs) alone accounted for 31% of the country’s auto sales. This pulled the 2024 share to 47% (27% BEV), and with the market still with plenty of room for growth, the year should end at around 50%.

Comparing this result with what was happening twelve months ago, at the time, the 2023 plugin share was 37% (25% BEV), which means that, while BEVs are experiencing moderate growth (27% vs 25%), the PHEV share is growing faster (20% vs 12%). At this pace, we should have the Chinese market fully electrified around 2030.

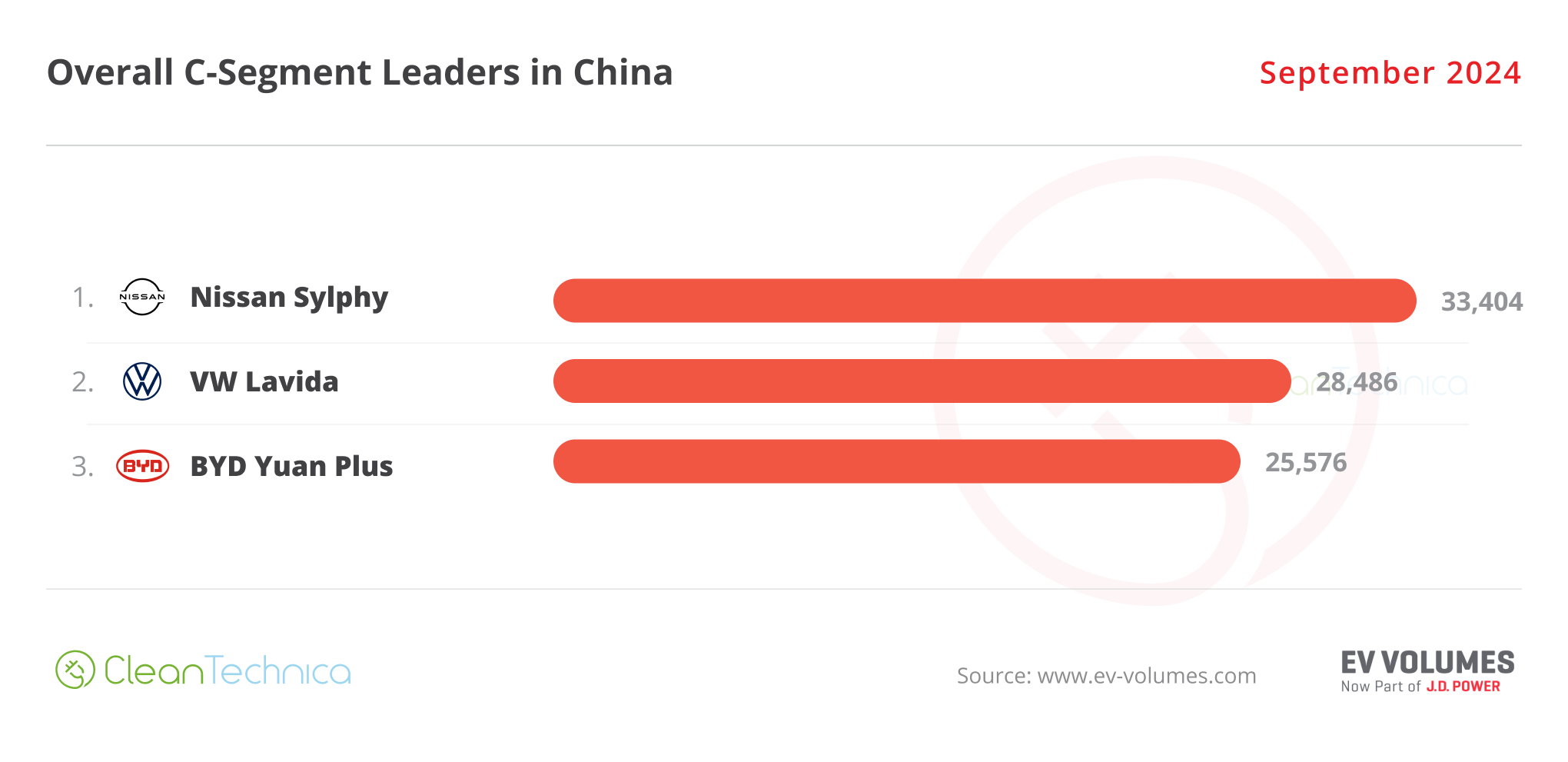

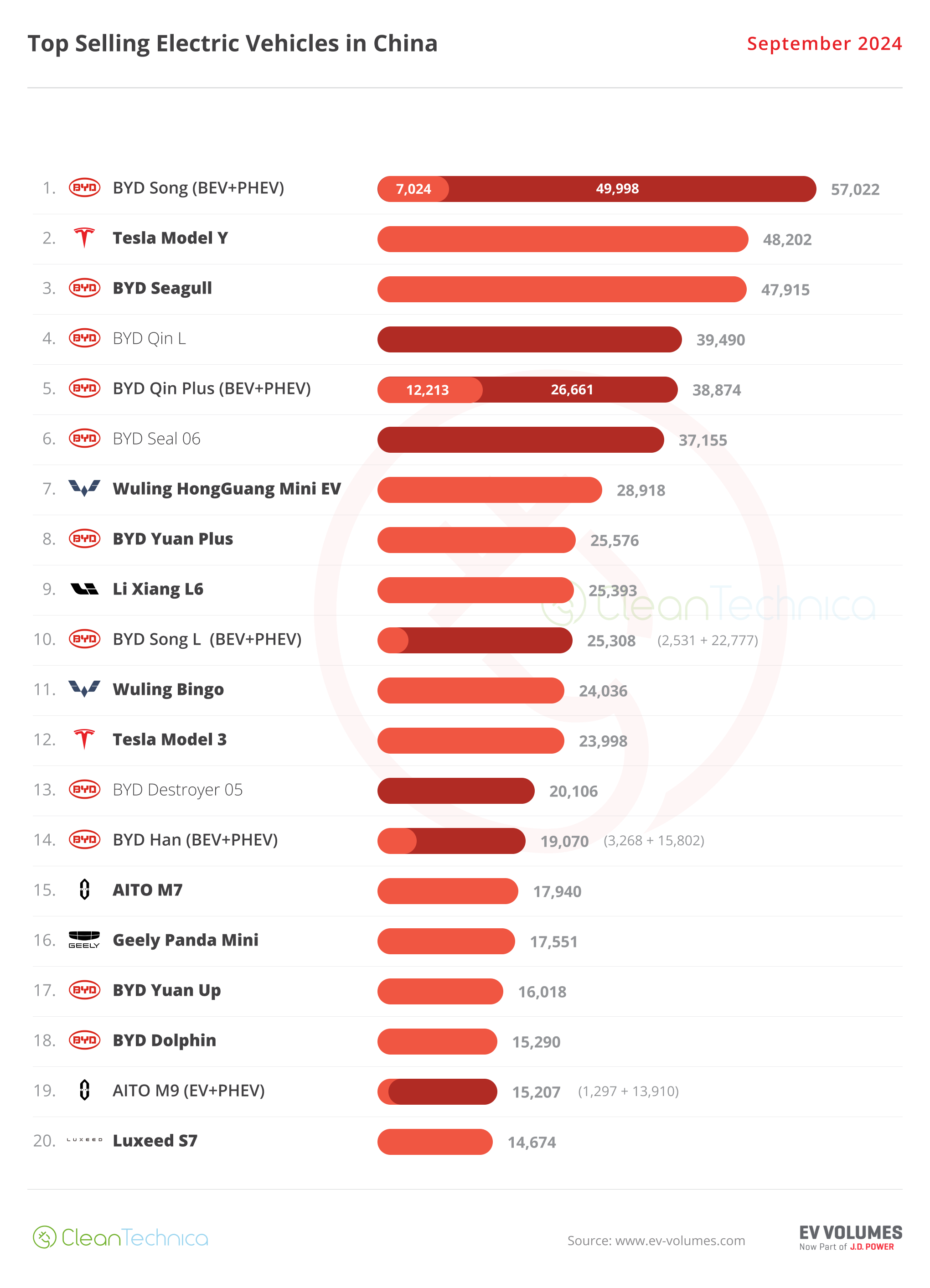

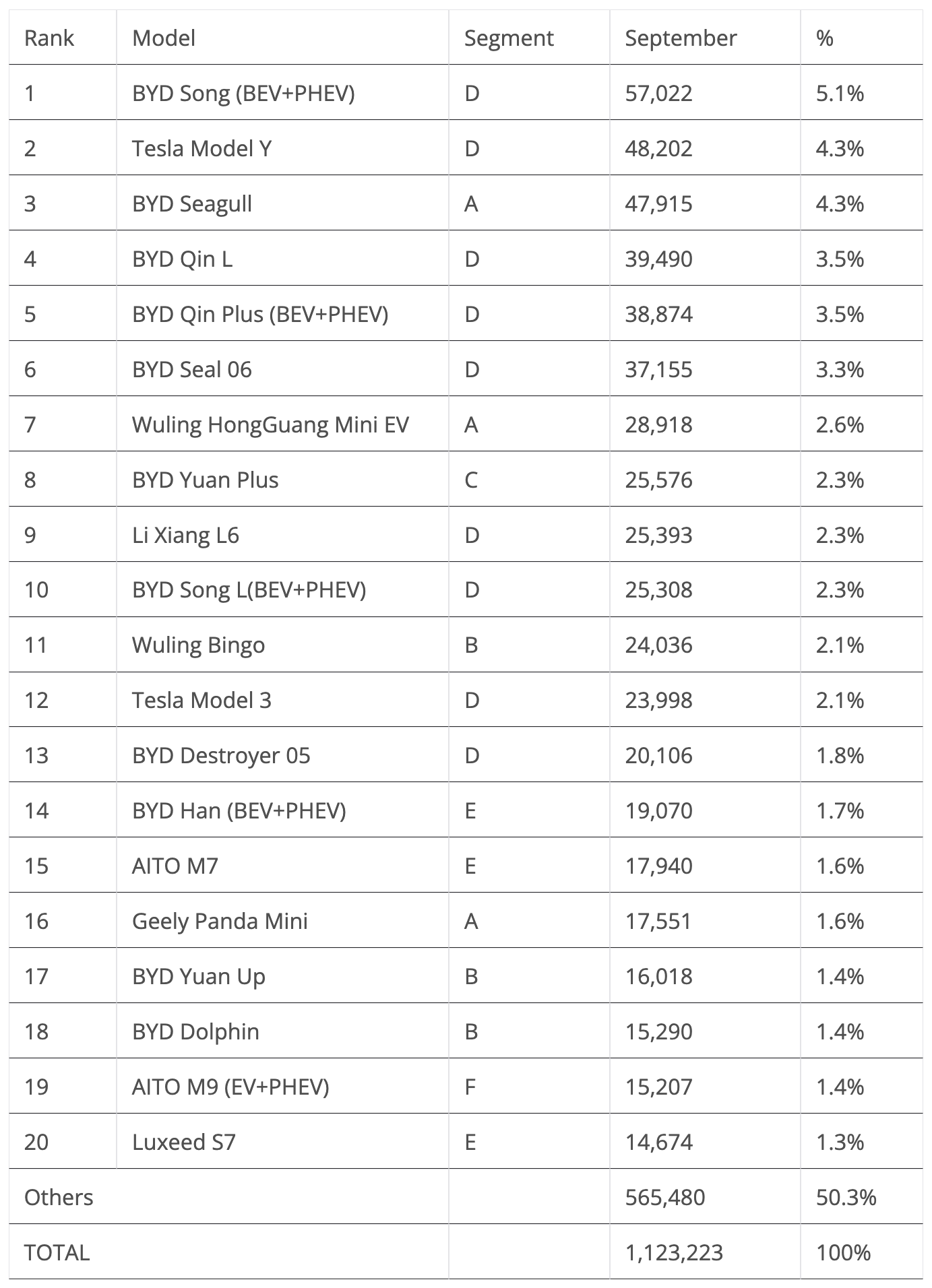

The overall top six was 100% plugins, with the Tesla Model Y being the best-selling non-BYD model, in 2nd. The best selling ICE model was the Nissan Sylphy, in 7th, with some 33,000 units sold.

In September, out of the eight plugin models in the overall top 10, a remarkable six belong to BYD. The price cuts from the Shenzhen OEM are pressuring not only the ICE competition, which might be completely kicked out of the top 10 sometime soon, but also its plugin adversaries.

Looking at several categories, all the vehicle segments have plugins on top, with the exception of the C (compact) segment, which is the only category where ICE vehicles are still relevant. BYD’s Yuan Plus is representing the EV team in that category, while the upcoming (not so) compact hatchback, the Seal 06 GT, will surely help things for the EV side. And don’t forget the recently introduced Geely Galaxy E5….

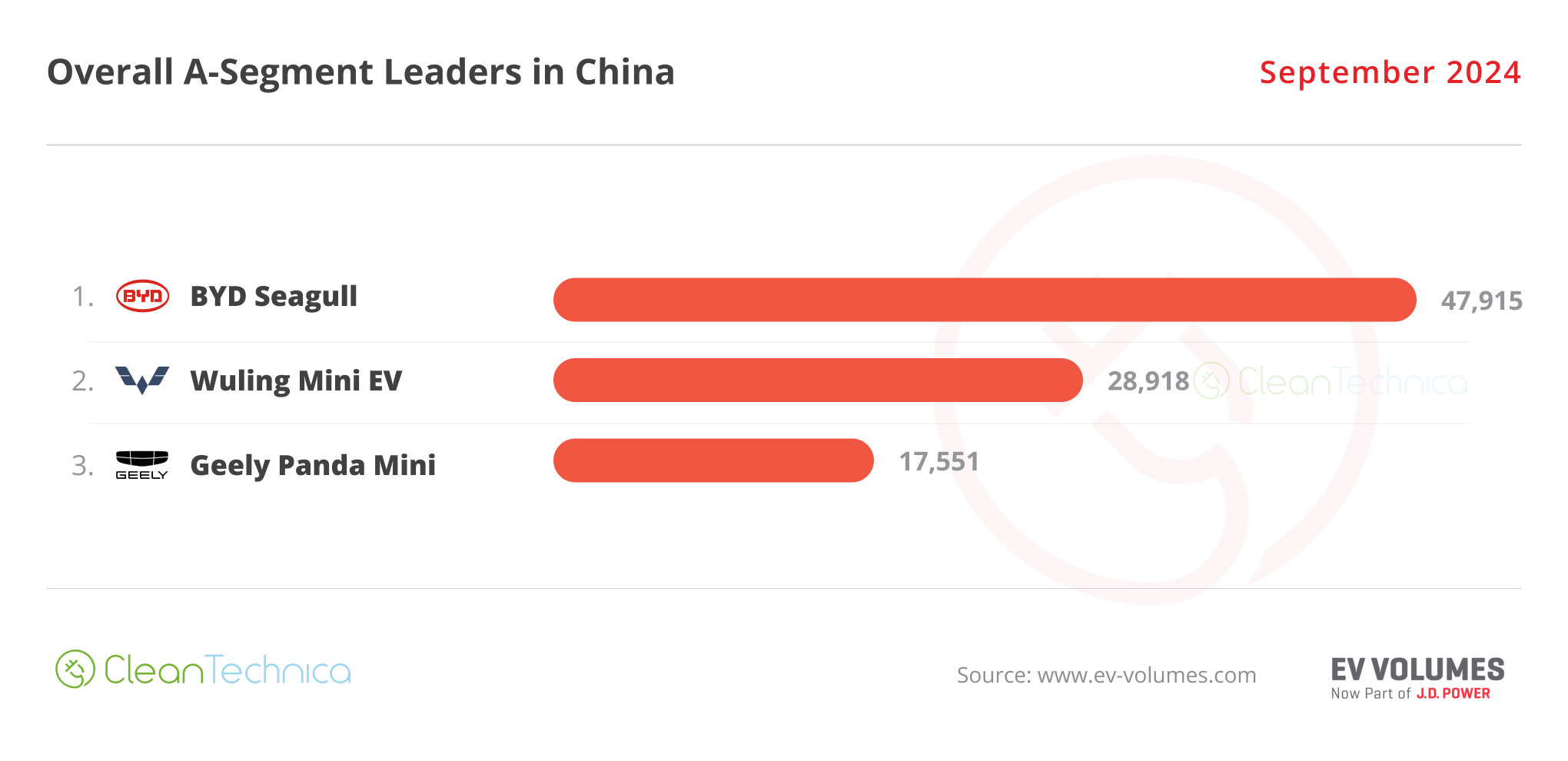

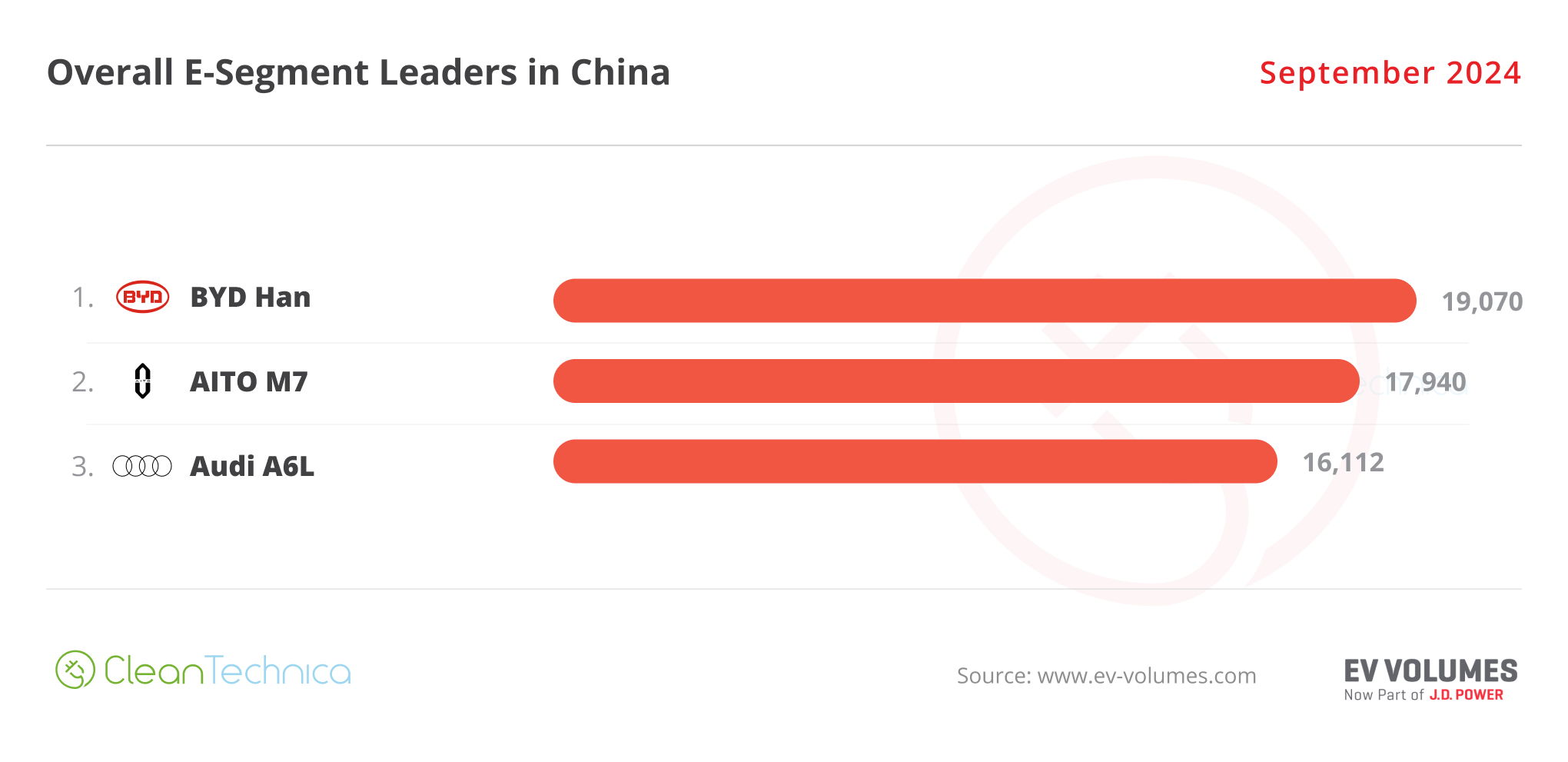

BYD currently dominates the market, with the Shenzhen make leading the tables in three categories — the midzise category, the full-size category, where the recent refresh allowed the Han to return to the top, and the A segment (city car) category.

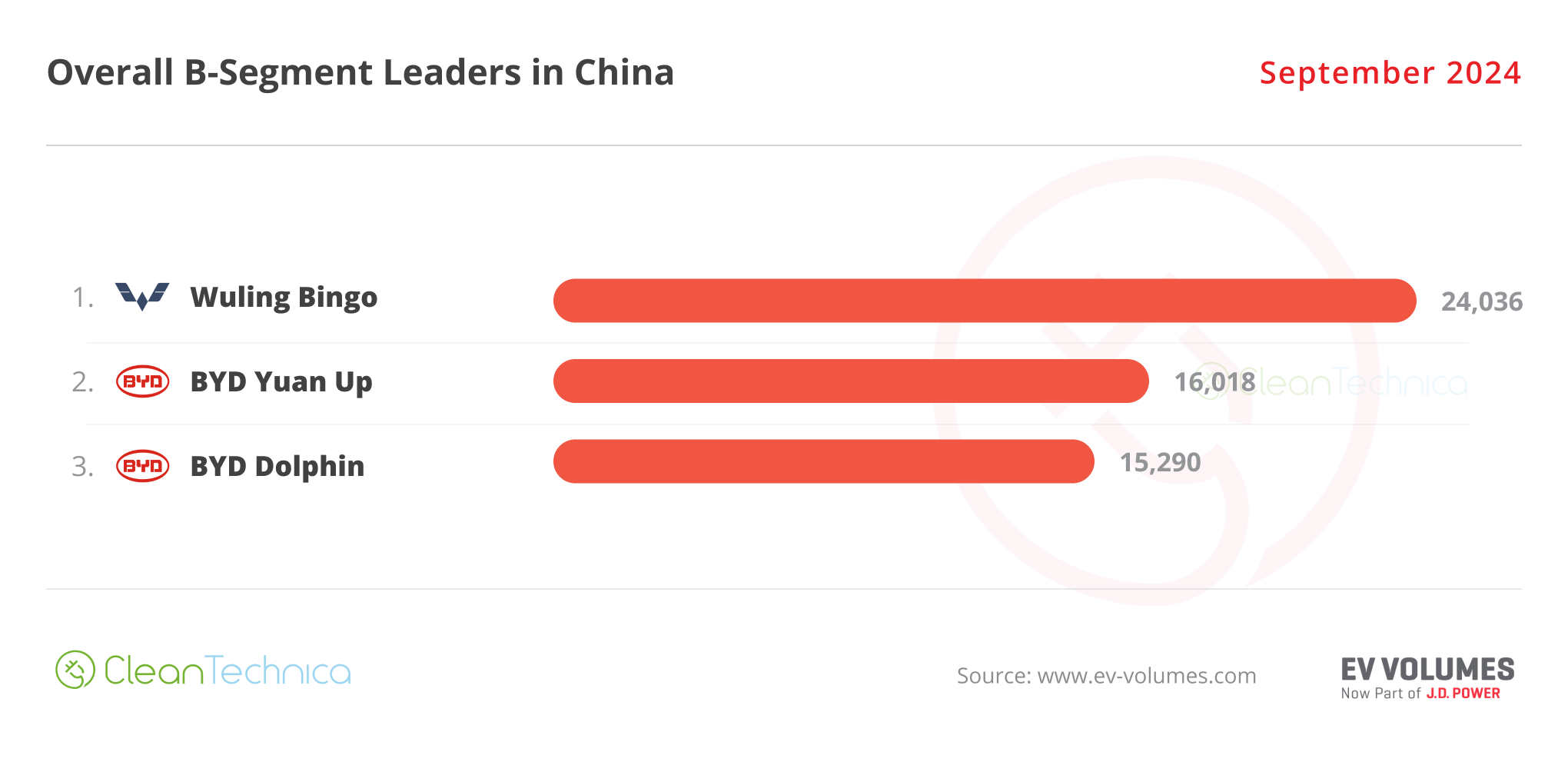

In subcompacts (the B segment), the Wuling Bingo is profiting from split sales in the BYD field — between the established Dolphin (15,290 units) and the new Yuan Up (16,018 units).

A final reference is due for the return of the Audi A6L to the podium, in 3rd with 16,000 units. Now that the German make is about to launch the new A6 e-tron, it will be interesting to see if the full-size model will transition successfully into the BEV market or if A6 buyers will remain faithful to the ICE model.

Best Selling EVs — One by One

Regarding last month’s best-sellers table, the top 5 best selling models in the overall table exactly mirrored the ones in the EV table — proving the merging process that we are witnessing between the two tables. Here’s more info and commentary on September’s top selling electric models:

#1 — BYD Song (BEV+PHEV)

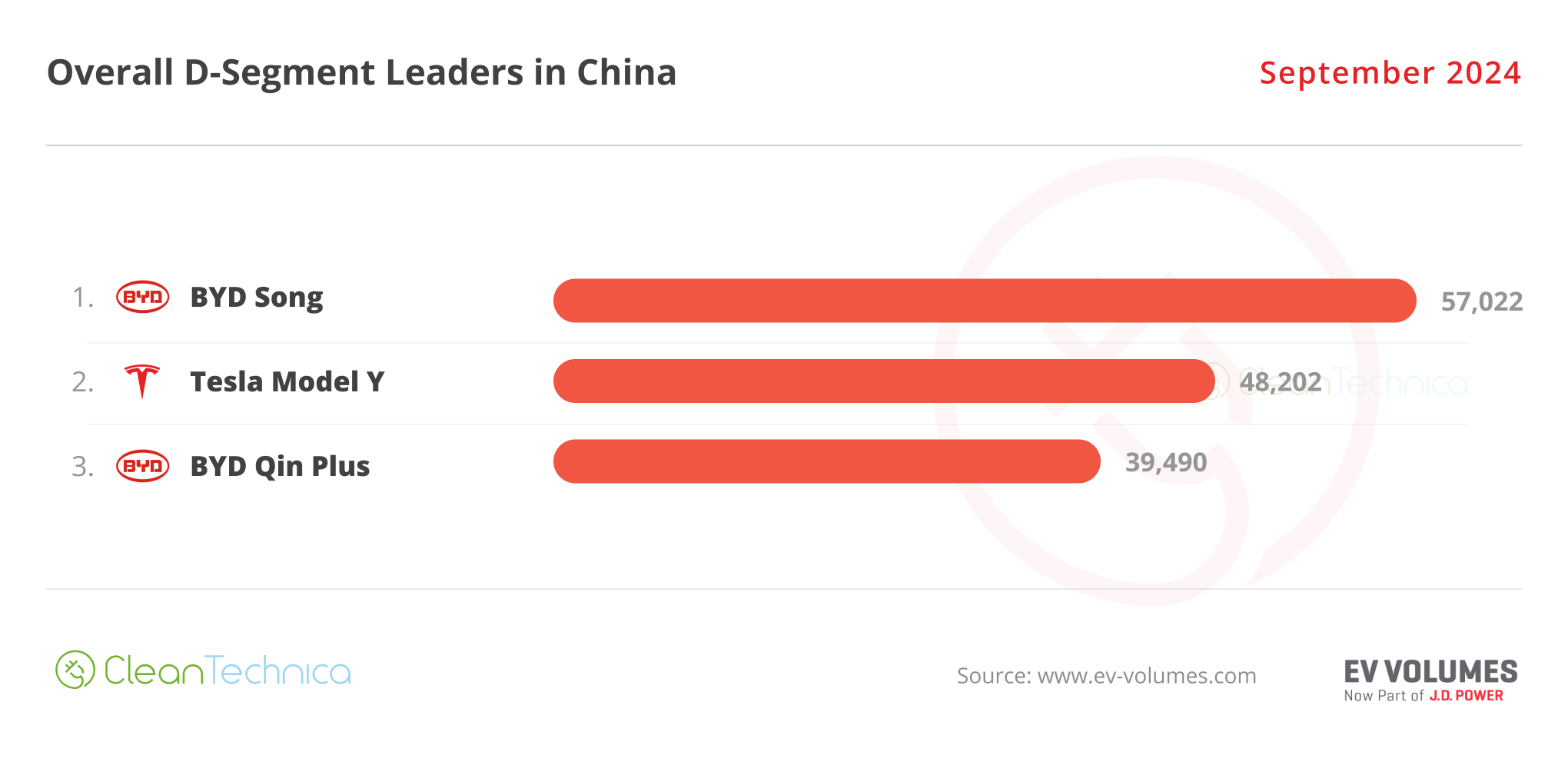

BYD’s midsize SUV is the uncontested leader in the Chinese automotive market, and the star player retained its leadership position in September, keeping its rival, the Tesla Model Y, at a good distance. The midsize SUV scored 57,022 registrations, with 7,024 units belonging to the BEV version. Will the Song continue to rule in the Chinese automotive market? Well, it will depend on the competition, including the internal competition. Will it be too much? Despite being down 7% YoY in September, the Song continues clocking over 50,000 sales/month, a necessary threshold to continue leading the cutthroat Chinese auto market. But thanks to its competitive pricing, the Song is continuing its success story.

#2 — Tesla Model Y

Tesla’s star model got 48,202 registrations, up 16% YoY. This allowed it to land in 2nd in the overall ranking. It was a good month for the US crossover, as it was its best month so far this year. The Model Y is keeping Tesla relevant in the Chinese market — no small feat considering current market trends (the Tesla Model Y, together with its sibling Tesla Model 3, were the only foreign models in September’s top 20). Looking into the future, it will be interesting to see how both Tesla models will be affected (or not) by the upcoming two self-declared anti-Tesla models, NIO’s Onvo L60 and Xpeng’s Mona M03.

#3 — BYD Seagull

Things continue to go well for the hatchback model, with the small EV ending September in the 3rd spot thanks to 47,915 registrations. Even with part of production now being diverted to export markets, it seems demand for the little Lambo is still growing in China. And with greater export potential than the regular Song, the perky EV could become the best selling BYD globally soon. With its attention now spread into other geographies, like Latin America and Asia-Pacific (and Europe?), we could see the little hatchback ascend to the second position in the EV ranking in 2025, both globally and at home.

#4 — BYD Qin L

This new sedan is basically the 3rd generation of the BYD Qin, but because the second generation is still running strongly, BYD added the suffix “L” to the new one to separate the two. In September it climbed to 4th, with a record 39,490 sales. So, it seems its production ramp-up still hasn’t ended. And it has done this without hurting the sales of the regular Qin Plus too much! At this moment, BYD has a sort of Midas touch, transforming into gold almost everything it launches into the market, and it has launched a lot of metal recently…. Just to have an idea, if we were to add the September sales of the Qin Plus with the sales of the Qin L, the sales of the #6 Seal 06 (which is a sort of left-field trim line of the Qin L), and the sales of the #13 Destroyer 05 (the left-field trim line of the Qin Plus), we would get more than 135,000 registrations! That’s more than what the Tesla Model Y does globally!

#5 — BYD Qin Plus (BEV+PHEV)

Along with the Song, the BYD Qin has been a bread & butter model for the Chinese automaker for a long time. The midsize sedan reached 38,474 registrations in September (with 12,213 units belonging to the BEV version). This meant it was only fifth in the overall market, having dropped only 3% YoY. Prices start at 80,000 CNY ($12,000) and demand still seems high.

BYD’s Domination in the Top 20

Looking at the rest of the top 10 list, there were five BYDs in total in the top 6 positions. And that’s not all. …

… Looking at the rest of the table, we have five more BYDs, with the Yuan Plus in 8th, the Song L in 10th with a record 25,308 units, the Destroyer 05 in 13th, the Han in 14th, the Dolphin in 18th, and the Yuan Plus in 17th, thus making it eleven BYD representatives in the top 20!

It feels like, to beat the Dragon Kings (Tesla Model 3 & Model Y), BYD raised a pack of smaller dragons which on their own might not be enough to beat the kings but when fighting together sure can leave them in the dust. (E Pluribus Unum and all that.)

This kind of domination is happening at a time when BYD still has several potential best selling models either ramping up (the Qin L, Seal 06, and Song L all had record months, just like the Sea Lion 07, which registered 11,764 units in September) or landing. Sure, at this point these models will likely cannibalize existing BYD models, but they will also steal sales from the competition.

One does start to wonder at what point BYD’s new model fever will start to get counterproductive…. Do you really need six different nameplates in the midsize car category?

More Top 20 Notes

Outside the BYD Galaxy, the big surprise is the tiny Wuling Mini EV, which jumped to 7th with 28,918 registrations, the EV’s best result since February 2023. Highlighting Wuling’s good month, the bigger Bingo also had a year-best result, ending at #11 with 24,036 registrations.

The Tesla Model 3 ended the month at #12 with 23,998 registrations, which is the sedan’s best performance in two years. Are Chinese buyers finally warming up to the refreshed Tesla?

Another model on the rise is the Li Auto L6, which was 9th with a record 25,393 deliveries. The smaller of Li Auto’s lineup is the make’s newest model, and probably the best from the make so far, so expect the midsize SUV to become a frequent presence in the top 10.

A surprising result was the 16th spot of the Geely Panda Mini, which had a record 17,551 sales last month. That added to the good results of the Wuling Mini EV and Changan Lumin (12,284 units) and ramp-up of FAW’s Bestune Xiaoma (9,615 units in its 4th month on the market), meaning that tiny city cars had a great month in September.

The last position in the table also brought a surprise, with the Luxeed S7 making its debut on the table in #20 with a record 14,674 registrations, in what is the first good result from the EV that came out of Chery’s association with Huawei.

The Chinese technology giant now has two brands in the top 20. Besides the now familiar AITO (M7 in #15 and M9 in #19), it now has the Luxeed S7 peaking in #20. How high will the full size sedan go? Hard to say. For now let’s just celebrate its debut on the table….

Beyond the Top 20

Outside the top 20, as usual, there was a lot to talk about, like Chery’s Fengyun T9 PHEV crossover, which delivered 11,156 sales in August, an impressive result for a model that is just in its 5th month on the market.

Geely also saw its new Galaxy E5 crossover reach an impressive 14,250 units in only its second month, ending the month at #22. The compact EV could be the long awaited star player in the Geely conglomerate, being able not only to secure a table presence, but also beating the category’s BYD competition!

On the startup field, the highlight was Xpeng’s Mona M03, which hit an amazing 10,023 units in its landing month — has Xpeng finally found its star player? The Aion brand hasn’t managed to place any model on the table, but the Y crossover ended mighty close (#21, with 14,612 sales).

Looking at foreign OEMs, the only highlight comes from the Volkswagen ID.3, which had a year-best score of 9,650 registrations.

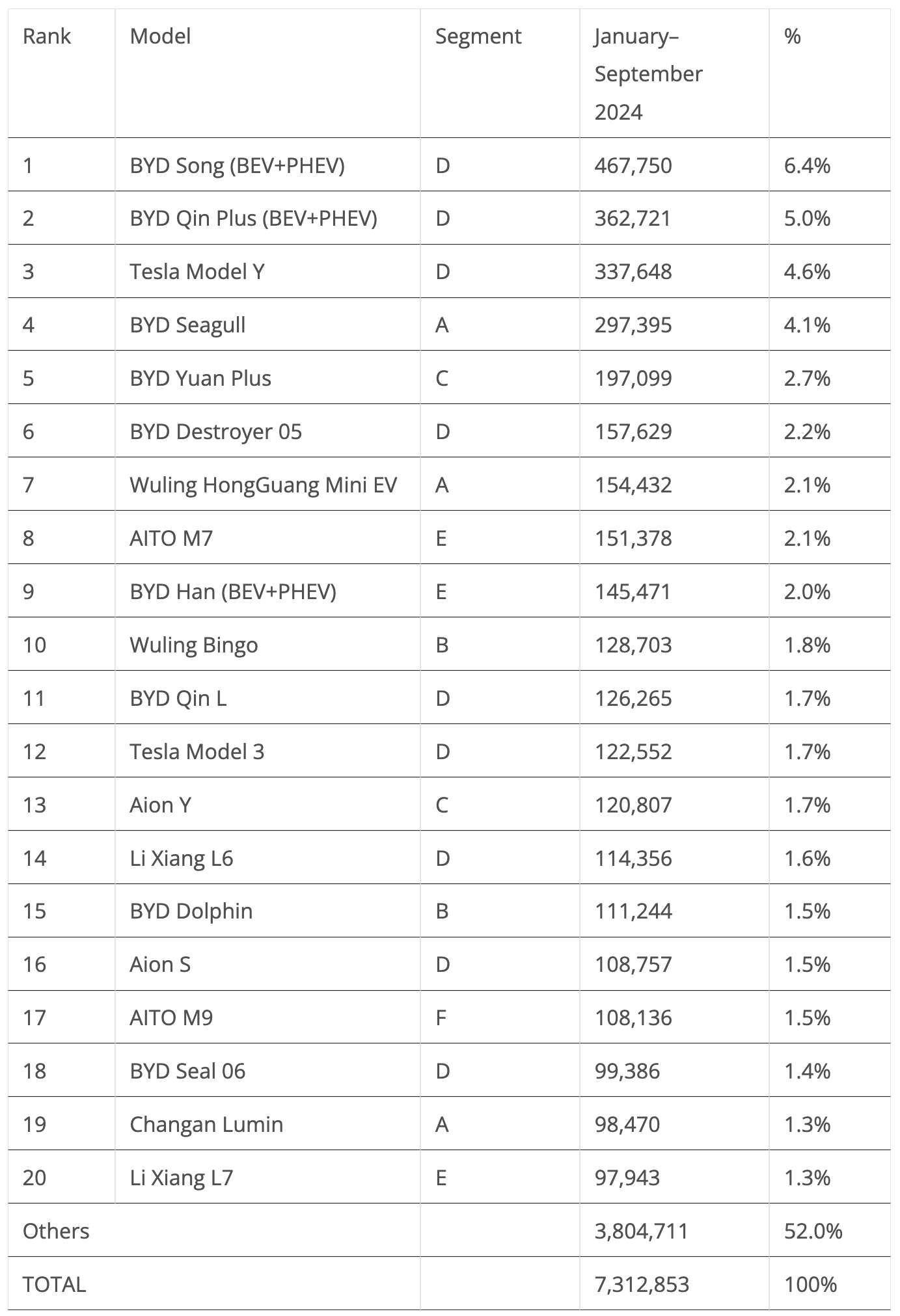

The 20 Best Selling Electric Vehicles in China — January–September 2024

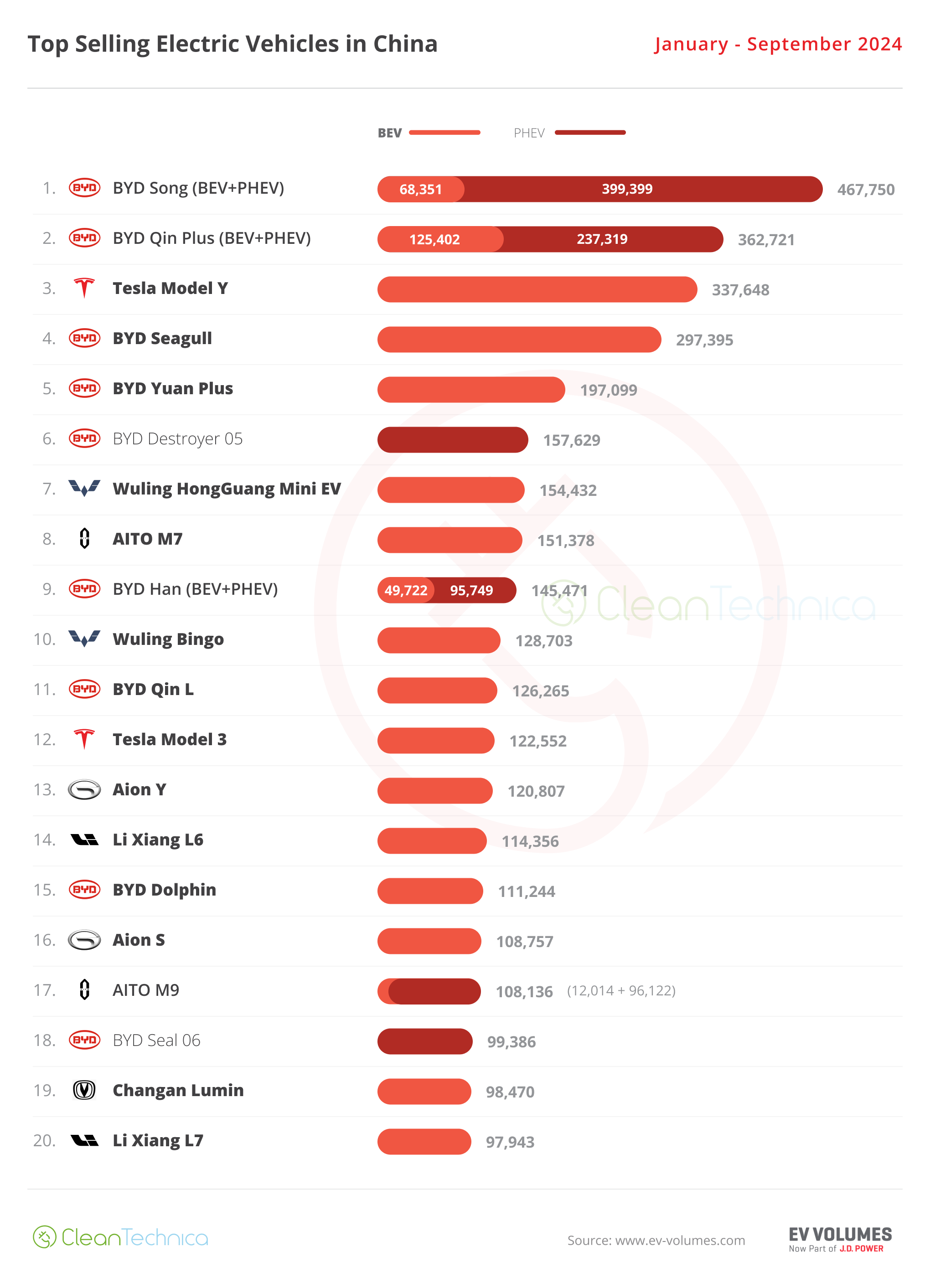

Looking at the 2024 ranking, there’s nothing new in the top positions, with the podium bearers BYD Song, BYD Qin Plus, and Tesla Model Y safely in their positions.

We have to go down to the 7th position to see some action. There, the Wuling Mini EV benefitted from another good result and jumped two spots, surpassing the AITO M7 and the BYD Han on the way.

The Wuling Bingo was also on the way up, climbing to #10, but the Climber of the Month was the #11 BYD Qin L, which jumped six positions, to #11. Expect the new sedan to continue climbing positions, with a top 10 position likely in October.

The rising Li Xiang L6 has jumped two positions and is now 14th, with the midsize SUV likely jumping even more spots in October and probably ending the month in 12th — and maybe finishing the year in the top half of the table.

Finally, we signal another BYD on the table (because there weren’t enough of them…). The Seal 06 joined the table at #19, and that makes it nine BYDs in the top 20.

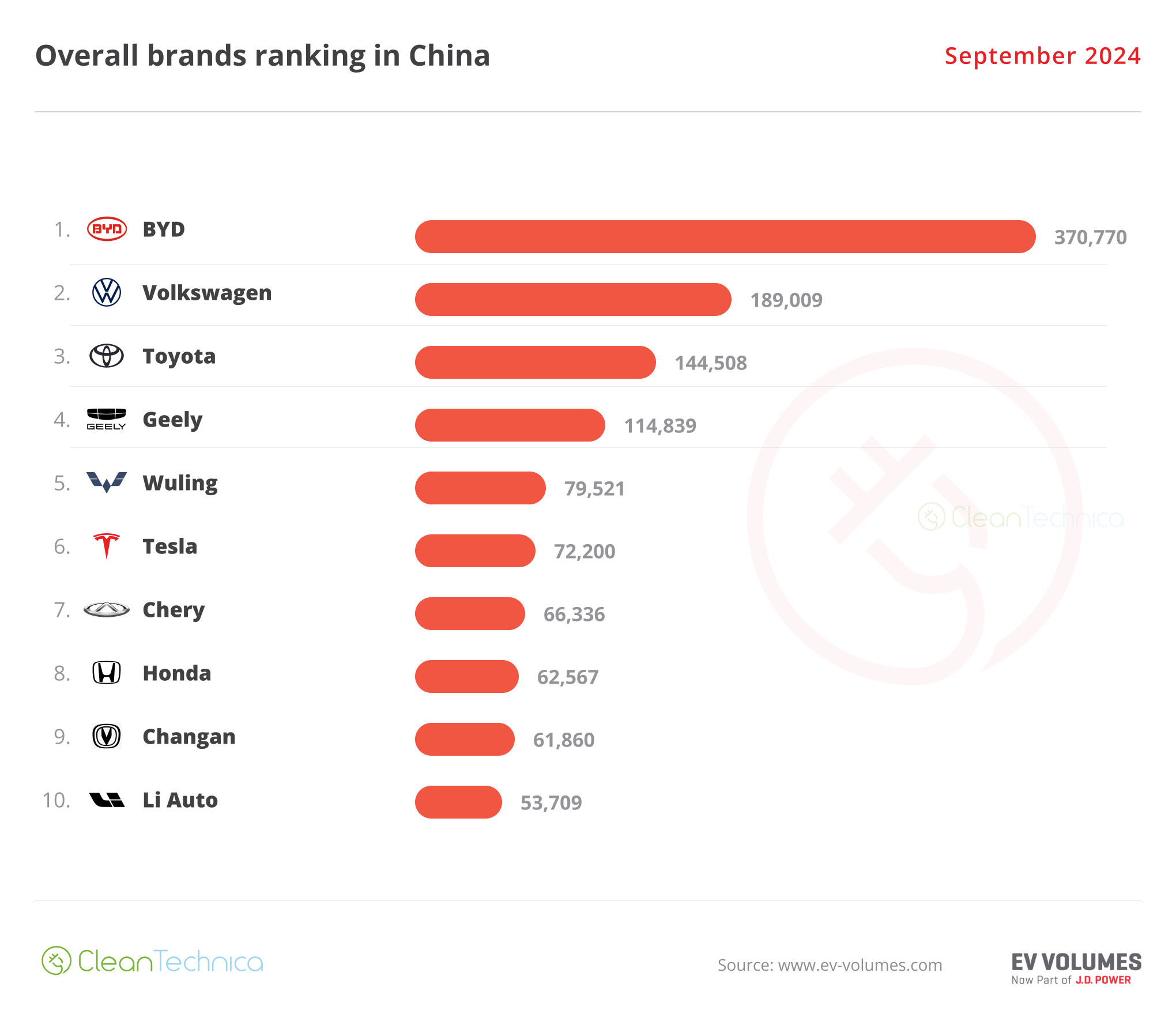

Changes in the Overall Brand Ranking

In September, the top three positions mirrored the 2023 full year ranking, with BYD on top followed by Volkswagen and Toyota. The dynamics are quite different, though. BYD (370,770 sales) grew 52% YoY (will they ever find a demand ceiling?), almost doubling the sales of #2 Volkswagen (189,000 sales), which was down by 8%, and #3 Toyota (144,000 sales), which fell by 10%. So, while the first place automaker is still rising fast (to infinity and beyond?), the other two are losing significant ground in a fast changing market.

Confirming the domestic takeover, #4 Geely (114,000 sales) is firm in its position, while below it, Wuling (79,000 sales) stayed in the 5th position.

Honda, 4th in the full year of 2023, was only 8th in September, with a steep sales drop of 43% YoY. It’s like the ground is vanishing from beneath the Japanese carmaker.

Still, there are others worse than Honda, like #24 Buick being down 59% in September and #67 Chevrolet doing even worse, cratering a worrying 85%! Basically, it looks like GM is being wiped out of China….

On the other hand, others are on the way up, like #17 AITO, which jumped 434% YoY, and #19 Leapmotor, which jumped 105% — with the 30,000 units of September representing its 4th consecutive record performance. Now that was perfect timing from Stellantis….

There is a seismic shift happening in China, which promises to expand beyond its borders in the following years.

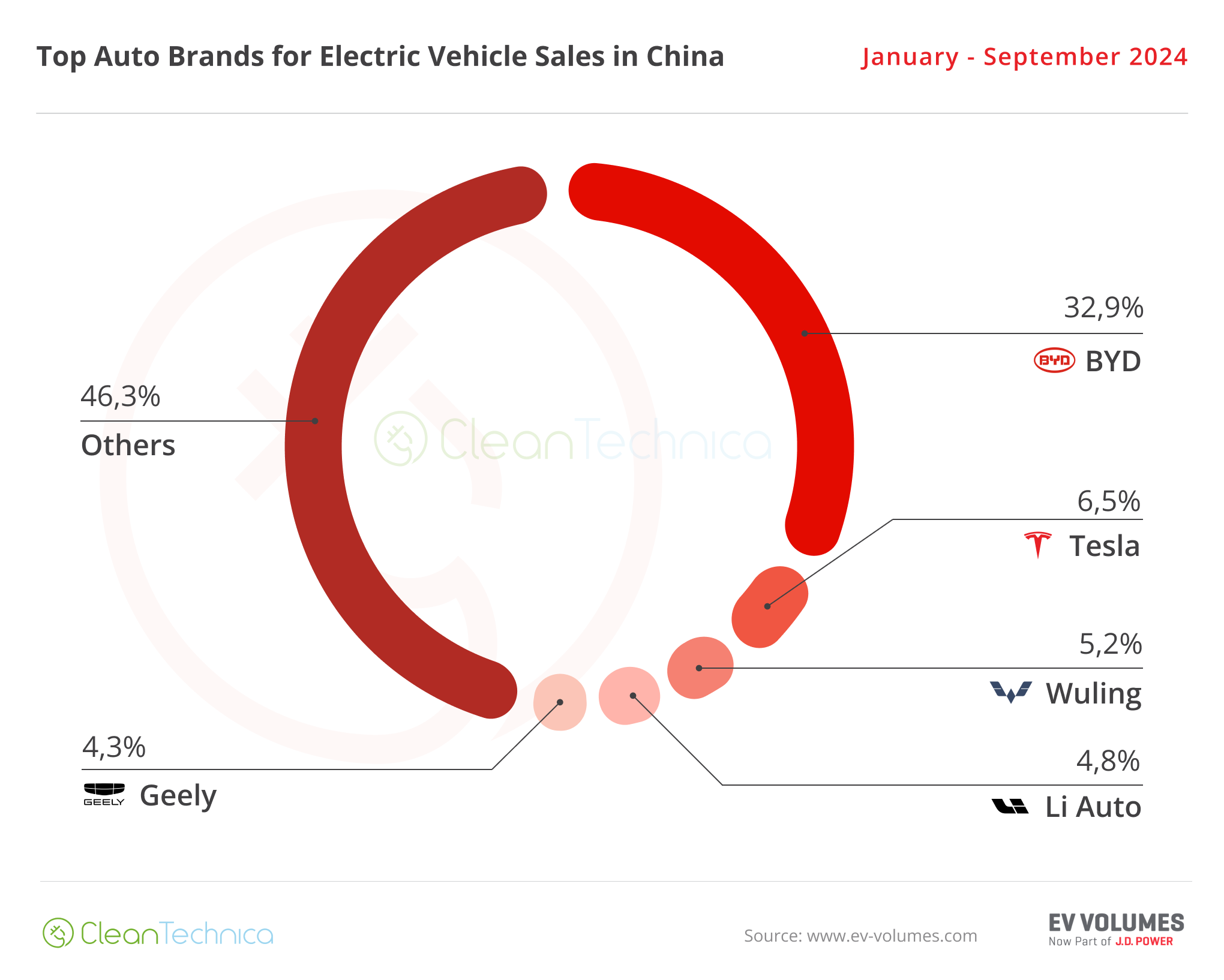

Auto Brands Selling the Most Electric Vehicles in China

Looking at the auto brand ranking, there’s no major news. BYD (32.9%, up 0.6% from August) is firm in its leadership position, and there’s really no way to see this domination ending anytime soon.

Things get more interesting below, though. Tesla (6.5%, up from 6.4%) is comfortable in the runner-up spot, while Wuling profited from good results from its dynamic duo (Bingo and Mini EV) to slightly increase its share (5.2% in September vs. 5.1% in August), all while Li Auto (4.8%) kept a safe distance over #5 Geely (4.3%).

#6 AITO (4.1%) profited from a poor month from #7 Aion (3.6%, down 0.1%) and consolidated its position just outside the top 5.

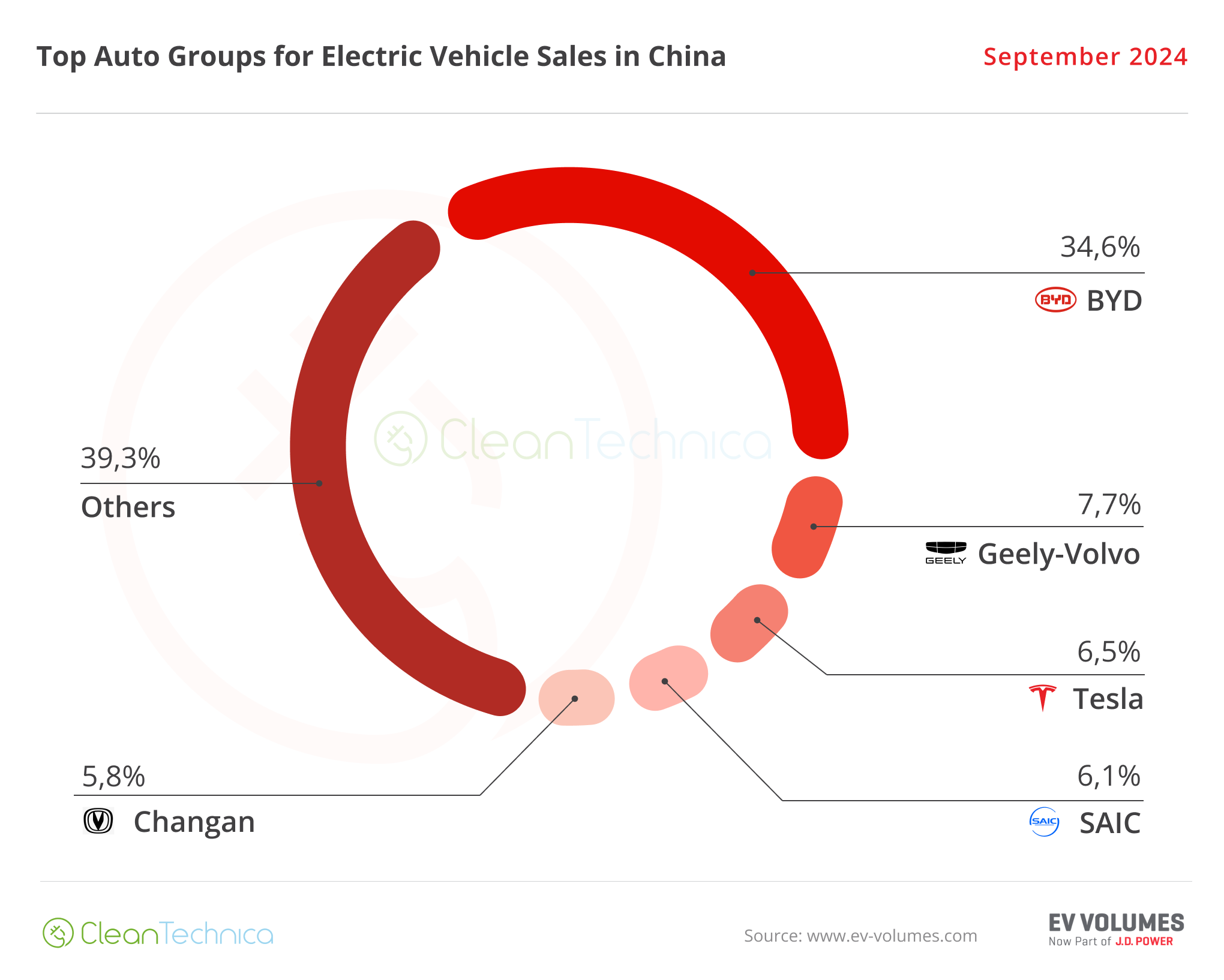

Auto Groups Selling the Most Electric Vehicles in China

Looking at OEMs/automotive groups/auto alliances, BYD Group is comfortably leading, with 34.6% share of the market. That increase in share is mostly thanks to the strong results of its namesake brand, as its daughter brands are not exactly in top form…. So, while the main brand goes from strength to strength, Denza, Fang Cheng Bao, and Yangwang are not doing their part when it comes to increasing the OEM’s profit margins. Hey, one can’t have everything, right?

At this moment, it seems BYD has its domestic market domination well assured, replicating what Tesla is doing in the USA.

Geely–Volvo is a distant runner-up, with 7.7% share. The namesake’s good result in September was dragged down by sister brands having a slow month (like, ahem, Zeekr, ahem).

Tesla (6.5%) is firm in 3rd, while #4 SAIC (6.1%) hasn’t profited from Wuling’s good moment due to weak results elsewhere.

#5 Changan remained stable (5.8%), but with a falling SAIC just 0.3% away now. #6 GAC (4.6%, down from 4.7% in August) is surely too far away from a top 5 finish.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy