Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Also: Geely is Rising

Plugin vehicles are all the rage in the Chinese auto market, with plugins scoring yet another new record, a little more than 1.27 million sales (in a 2.42-million-unit overall market). That’s up 51% year over year (YoY), and it’s the 4th month above one million units.

Looking deeper at the numbers, it’s clear that we are on the peak end (Q4) of EV seasonality in China, with growth coming from all electric powertrains. BEVs were up by 37% in November, to a record 758,000 units, while PHEVs jumped 92% in the same period, to 393,000 units, and EREVs were also up, reaching 114,000 units from 42% growth YoY.

Breaking down plugin sales by powertrain, BEVs had 60% of sales, a significant improvement over the YTD numbers (51%), while EREVs had 9% of plugin sales in November and regular PHEVs were responsible for the remaining 31%.

The year-to-date (YTD) tally is around 9.7 million units, while share-wise, November saw plugin vehicles hit 52% market share! Full electrics (BEVs) alone accounted for 31% of the country’s auto sales. This pulled the 2024 share to 48% (24% BEV), and with the market still having one more month to grow, the year should end at 49% share, or really close to it.

If the 2024 market share ends at 49%, that is a significant improvement over the 37% share of 2023, which in turn was a big advance over 2022 (30%), let alone 2021 (15%) and 2020 (6.3%). At this pace, we should have the Chinese market fully electrified before 2030!

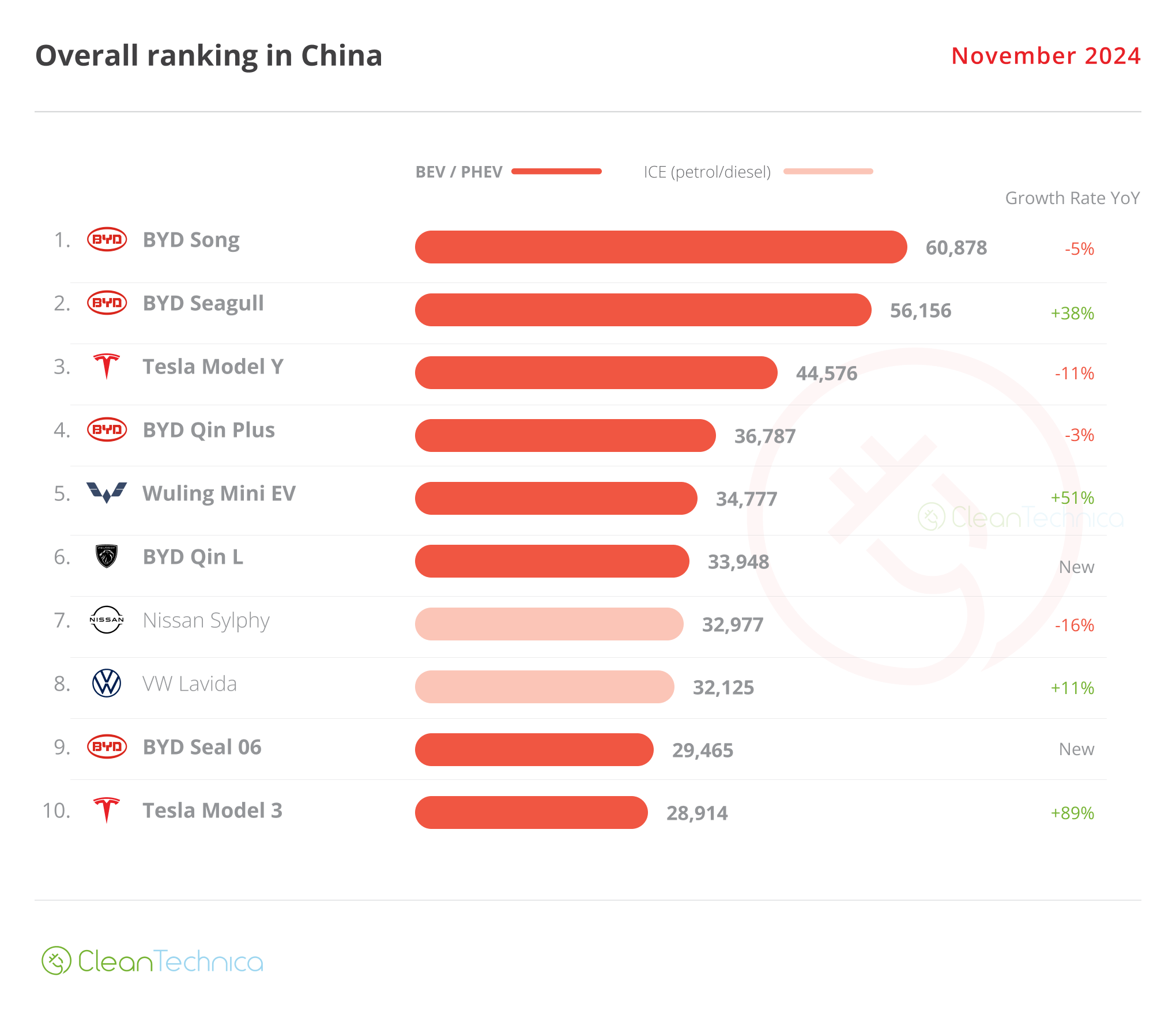

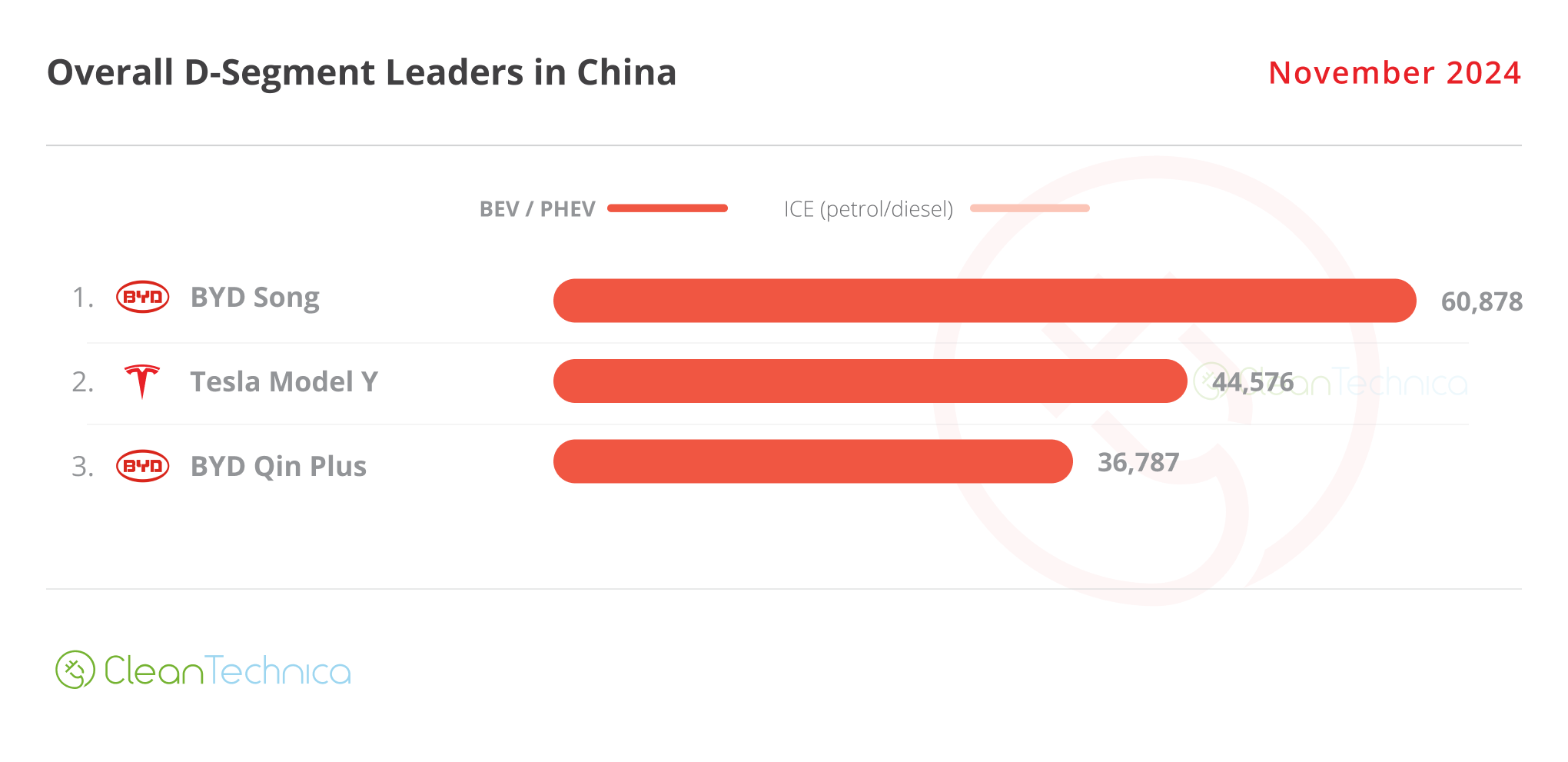

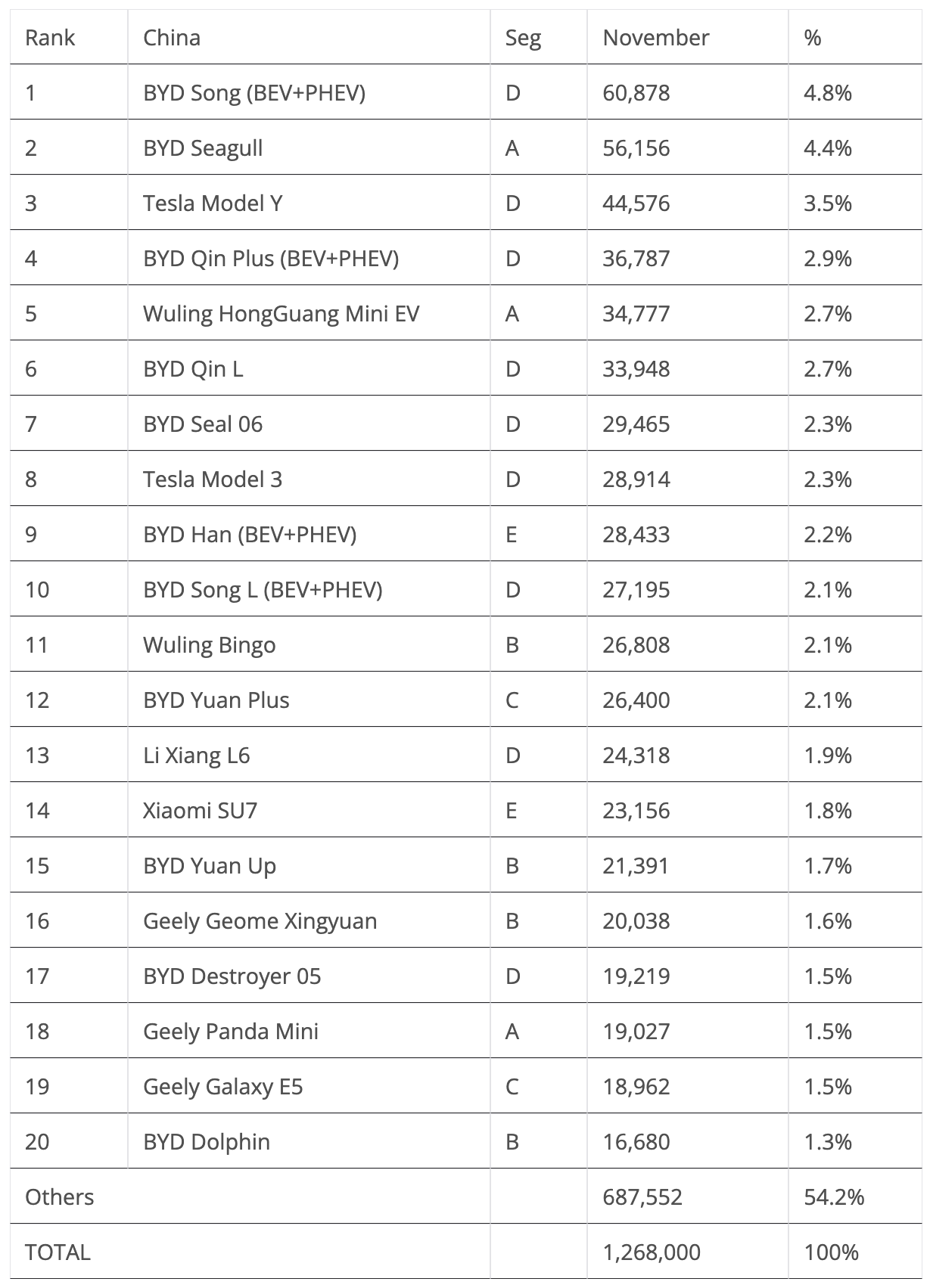

The overall top six was 100% plugins, with the Tesla Model Y being the best-selling non-BYD model, in 3rd. The best selling ICE model was the Nissan Sylphy, in 7th, with some 33,000 units sold.

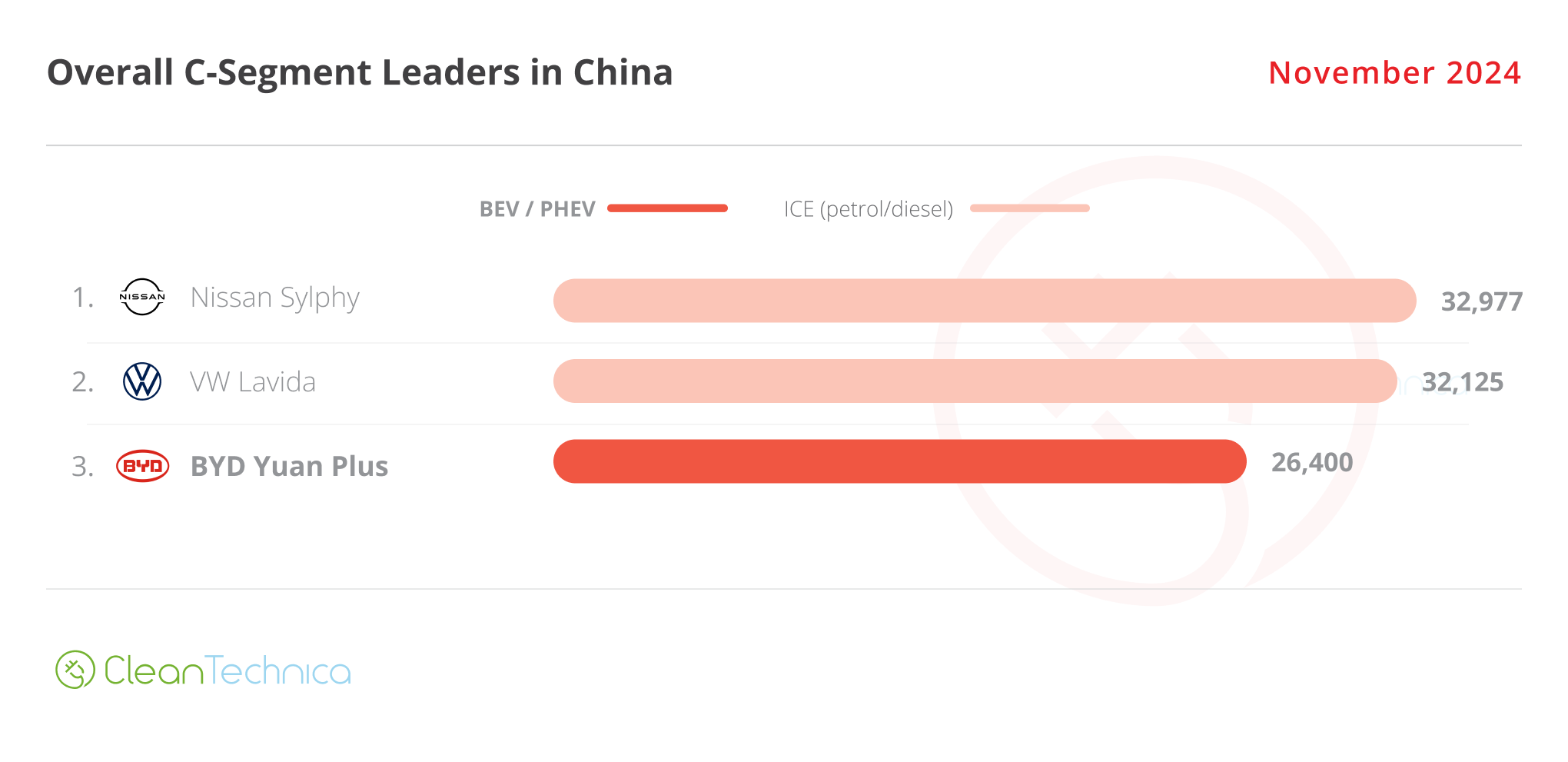

In November, only two pure fossil fuel models were present in the top 10, with the aforementioned Nissan model in 7th and the VW Lavida in 8th. Considering that both models are compact sedans, this is the last bastion of resistance for ICE vehicles in China.

Speaking of ICE sedans, looking at several categories, all but the C segment (compact cars) have plugins dominating the podium. In the C segment, the top two positions are ICE models.

Still, I believe this is temporary. BYD’s Yuan Plus continues going strong, the promising Geely Galaxy E5 is still ramping up, like the BYD Seal 06 GT, while the upcoming BYD Sealion 05 EV (aka anti-Geely Galaxy E5) is surely going to make a splash. And don’t forget the recently introduced Xpeng Mona M03….

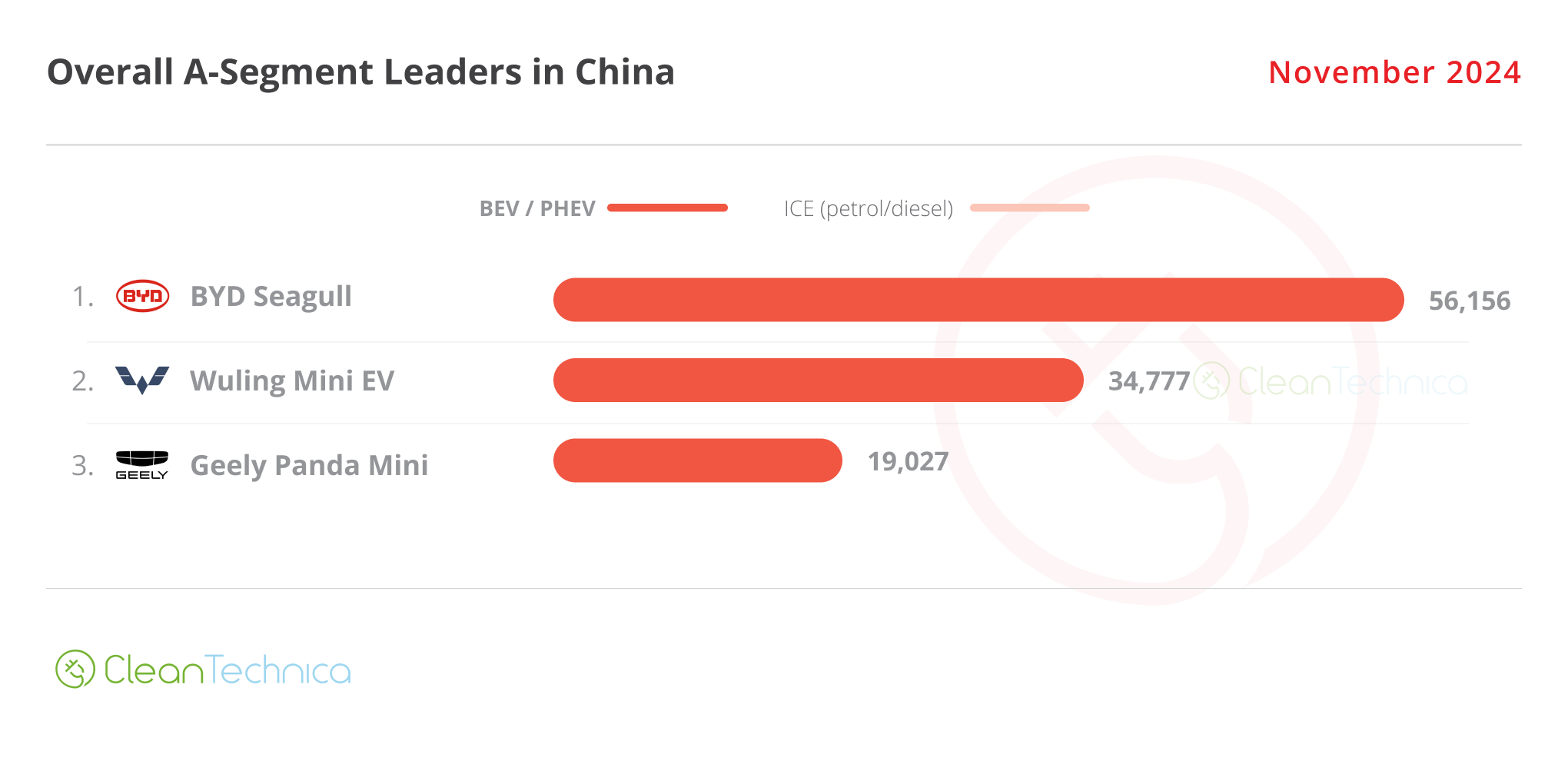

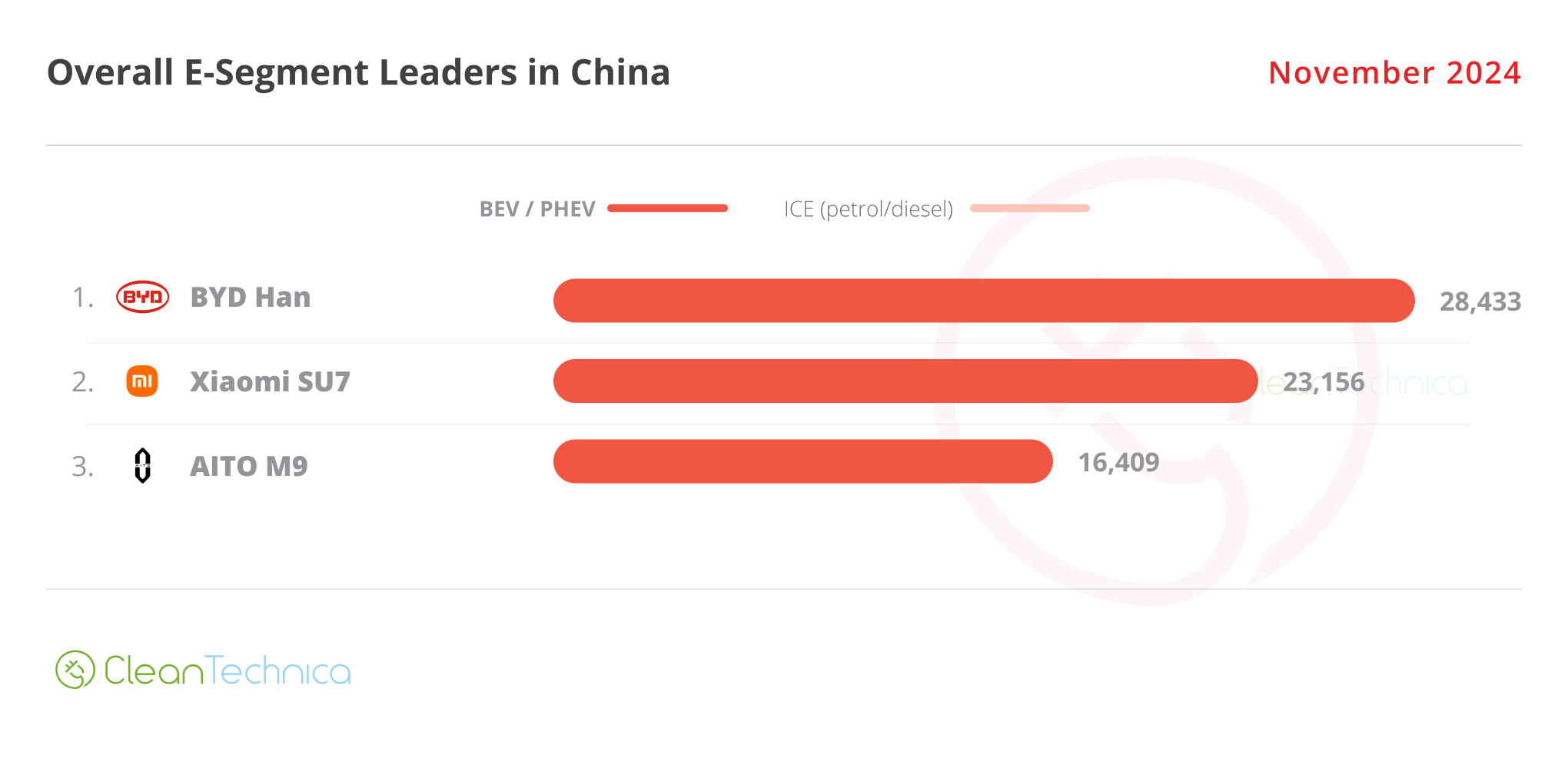

BYD dominates the market, with the Shenzhen make leading the tables in three categories — the midsize category; the full-size category, where the recent refresh allowed the Han to return to the top; and the A segment (city car) category, where the Seagull rules.

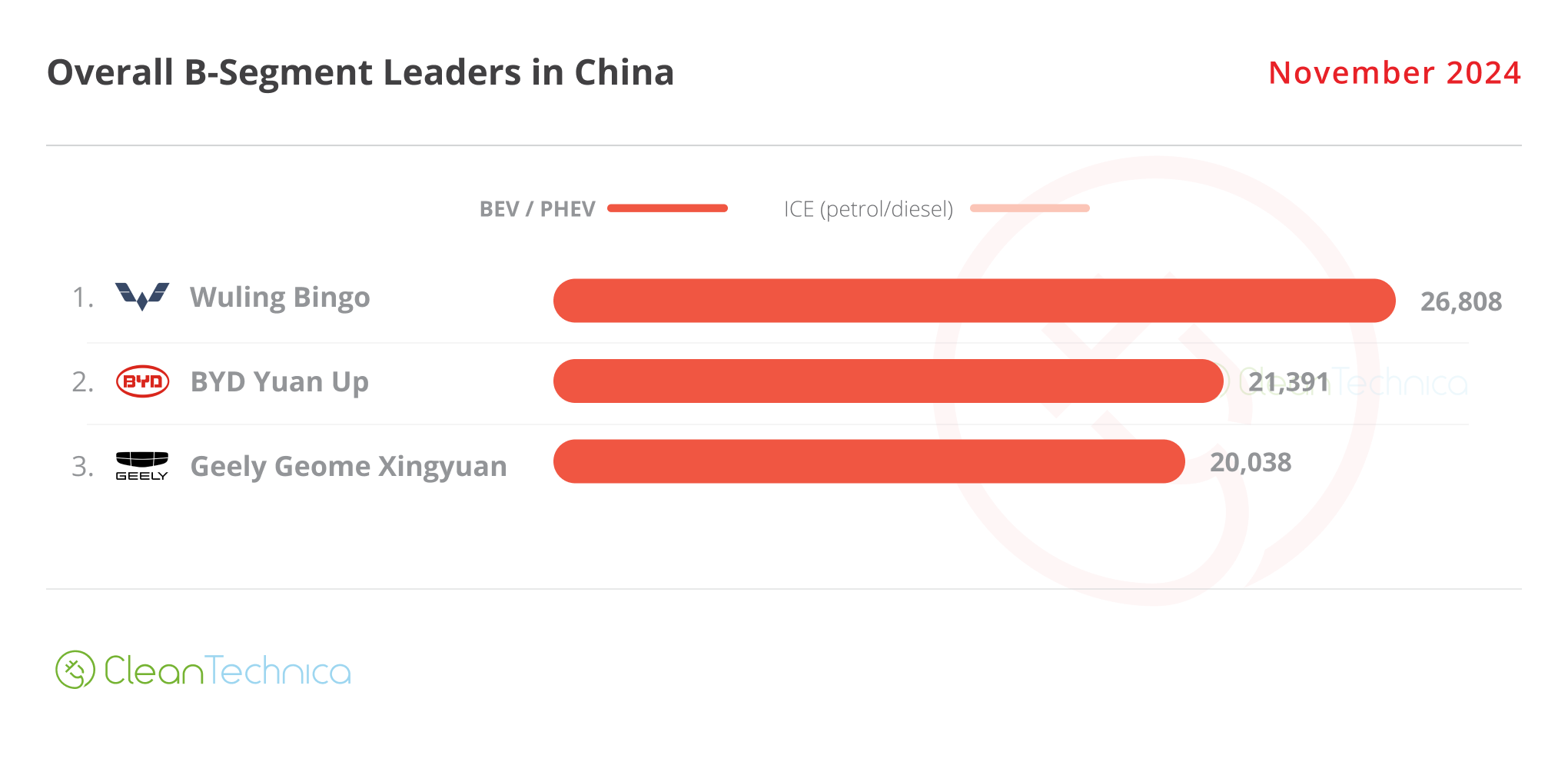

In subcompacts (the B segment), the Wuling Bingo is profiting from split sales in the BYD field — between the Dolphin (16,680 units) and the Yuan Up (21,391 units).

But with the Geely Geome Xingyuan already on the podium (20,038 units!) in only its second month on the market, expect the small hatchback to disrupt the category status quo soon.

Geely is rising…

Best Selling EVs — One by One

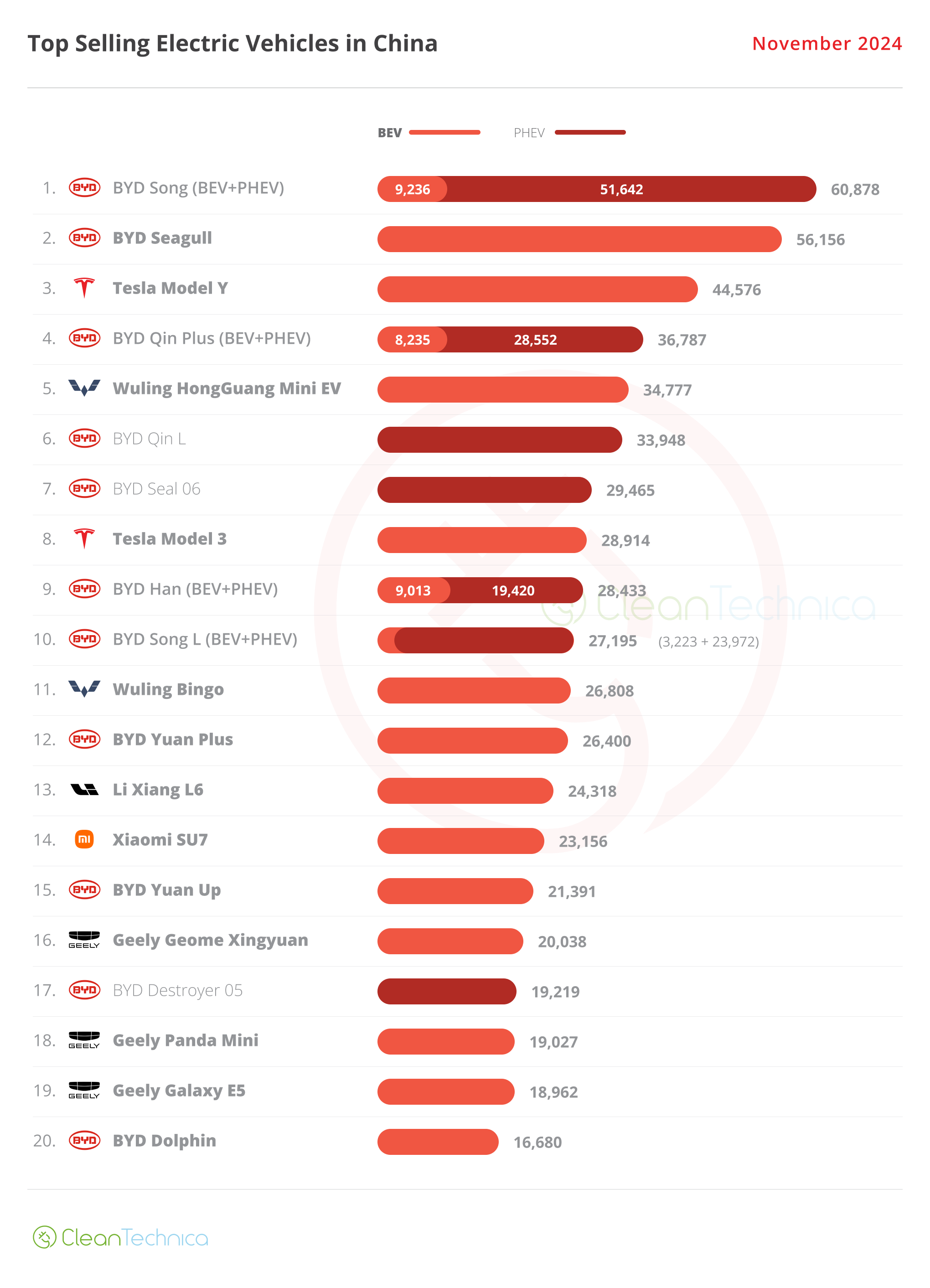

Regarding last month’s best-sellers table, the top 5 best selling models have two non-BYDs, the usual Tesla Model Y, and the refreshed Wuling Mini EV. Here’s more info and commentary on November’s top selling electric models:

#1 — BYD Song (BEV+PHEV)

BYD’s midsize SUV is the uncontested leader in the Chinese automotive market, and the star player retained its leadership position in November. The midsize SUV scored 60,878 registrations. Will the Song continue to rule in the Chinese automotive market? Well, it depends on the competition, including the internal competition. Despite an increasing number of competitors, the Song continues clocking over 50,000 sales/month, a necessary threshold to continue leading the cutthroat Chinese auto market. But thanks to its competitive pricing (and an upcoming refresh?), the Song is set to continue its success story.

#2 — BYD Seagull

Things continue to go well for the hatchback model, with the small EV ending November in the 2nd spot thanks to 56,156 registrations, it’s second record performance in a row. Will it reach 60,000 units in December? Even with part of production now being diverted to export markets, it seems demand for the little Lambo is still strong in China. And with greater export potential than the regular Song, the perky EV could become the best selling BYD globally soon. With the company’s attention now spread into other geographies, like Latin America and Asia-Pacific (and Europe in 2026?), we could see the little hatchback ascend to second position in the EV ranking in 2025 globally as well as at home.

#3 — Tesla Model Y

The midsize crossover has been the bread & butter model for the US automaker ever since it landed in China. The midsize EV reached 44,576 registrations in November, which is down 11% YoY, but it is an expected drop, as the refreshed version is just a couple of months away from landing. Having been on the model podium since 2021, the US model is expected to repeat the feat this year, and with the help of the upcoming refresh, it hopes to do the same next year, which would be its 5th consecutive podium presence in China, something that no other EV has ever managed to do in China. Why does it continue to sell so well? A good balance between specs, pricing, and space are part of the explanation, but another strong factor is sheer brand strength, as Tesla is probably the only foreign brand (still) escaping old hat infamy among local buyers….

#4 — BYD Qin Plus (BEV+PHEV)

Along with the Song, the BYD Qin has been a bread & butter model for the Chinese automaker for a long time. The midsize sedan reached 36,787 registrations in November. This meant it was 4th in the overall market, having dropped by 3% YoY, which is not bad considering it was launched in 2018 — which is ancient history in the Chinese EV market. Just to have an idea, that year’s best selling EV in this market was BAIC’s EC-Series. … Who?!?

#5 — Wuling Mini EV

The tiny car with a long name (Wuling Hongguang Mini EV is its full name) is back to its former glory. Thanks to a recent refresh, it returned to the top 5. In November, it climbed to 5th with 34,777 sales, its best result in over two years. And with a 5-door version landing soon, expect its sales to continue climbing. Will it be able to go after the City Car Master BYD Seagull? Hmm … hard to believe, as it has a more limited appeal. But it will be interesting to see nevertheless….

BYD’s Domination in the Top 20

Looking at the rest of the top 10 list, there were seven BYDs in total in the top 10 positions. And that’s not all. …

… Looking at the rest of the table, we have four more BYDs, with the Yuan Plus in 12th, the Destroyer 05 in 17th, the Yuan Up in 15th (with a record 21,391 units), and the Dolphin in 20th. Therefore, there were eleven BYD representatives in the top 20!

Geely is Rising

But, fortunately, it seems that the Shenzhen make will have a worthy competitor in the future, as Geely placed three models on the table, for the first time, and all of them are either new and ramping up (#16 Geome Xingyuan and #19 Galaxy E5) or hitting record results, like the tiny #18 Panda Mini, which scored a best ever 19,027 units. Expect both the Geome Xingyuan and Galaxy E5 to continue climbing positions in the upcoming months, and with more reinforcements coming, like the Galaxy Starship 7 SUV, Geely seems to be the only OEM able to match BYD’s feverish launch schedule. Expect more models coming from it, and/or its subsidiaries, to join the table in the coming months.

More Top 20 Notes

Outside the upcoming BYD vs. Geely race, the Tesla Model 3 is back on track, ending the month in 8th with 28,914 registrations, the EV’s best result since September 2021. Highlighting Wuling’s good month, the bigger Bingo also had a year-best result, ending at #11 with 26,808 registrations.

Another model on the rise is the Xiaomi SU7, thanks to a record 23,156 registrations. And with demand more than assured, the hot sedan is only dependent on scaling up production in order to become an even greater disruptive force in China. (And the world?)

Beyond the Top 20

Outside the top 20, as usual, there was a lot to talk about, like Xpeng’s Mona M03 ramp-up, scoring 11,960 deliveries in its third month on the market. This is a model that will surely feature in the top 20 soon (and provide the startup a way forward to profitability). Interestingly, this month, Xpeng has dropped another model with best seller potential: the P7+ full size fastback landed with an impressive 6,950 units. It’s now or never, Xpeng….

But the most impressive landing this month was the Luxeed R7. This Tesla Model X-sized SUV-coupé, selling at Model Y prices, has landed with an amazing 11,086 deliveries, which is one of the best landings ever in China. So, the model made out of the Chery–Huawei cooperation seems poised to follow in the footsteps of AITO’s success story.

Leapmotor continues to expand, and this time the star was the C11 SUV, hitting 11,260 sales, a new year best. The recently introduced Zeekr 7X got 11,112 deliveries in its 4th month, meaning Geely’s premium brand has a new star player.

Changan’s Deepal S7 SUV hit a record 12,021 registrations, while FAW’s Bestune Xiaoma continues to rise, with 13,890 registrations, giving the Chinese OEM a much needed foot in the door in the EV market. I mean, it’s not only foreign OEMs that are being disrupted in the switch to EVs….

Speaking of foreign OEMs, the only highlight comes from the Volkswagen ID.3, which had a year-best score of 10,572 registrations, its first five-digit score this year.

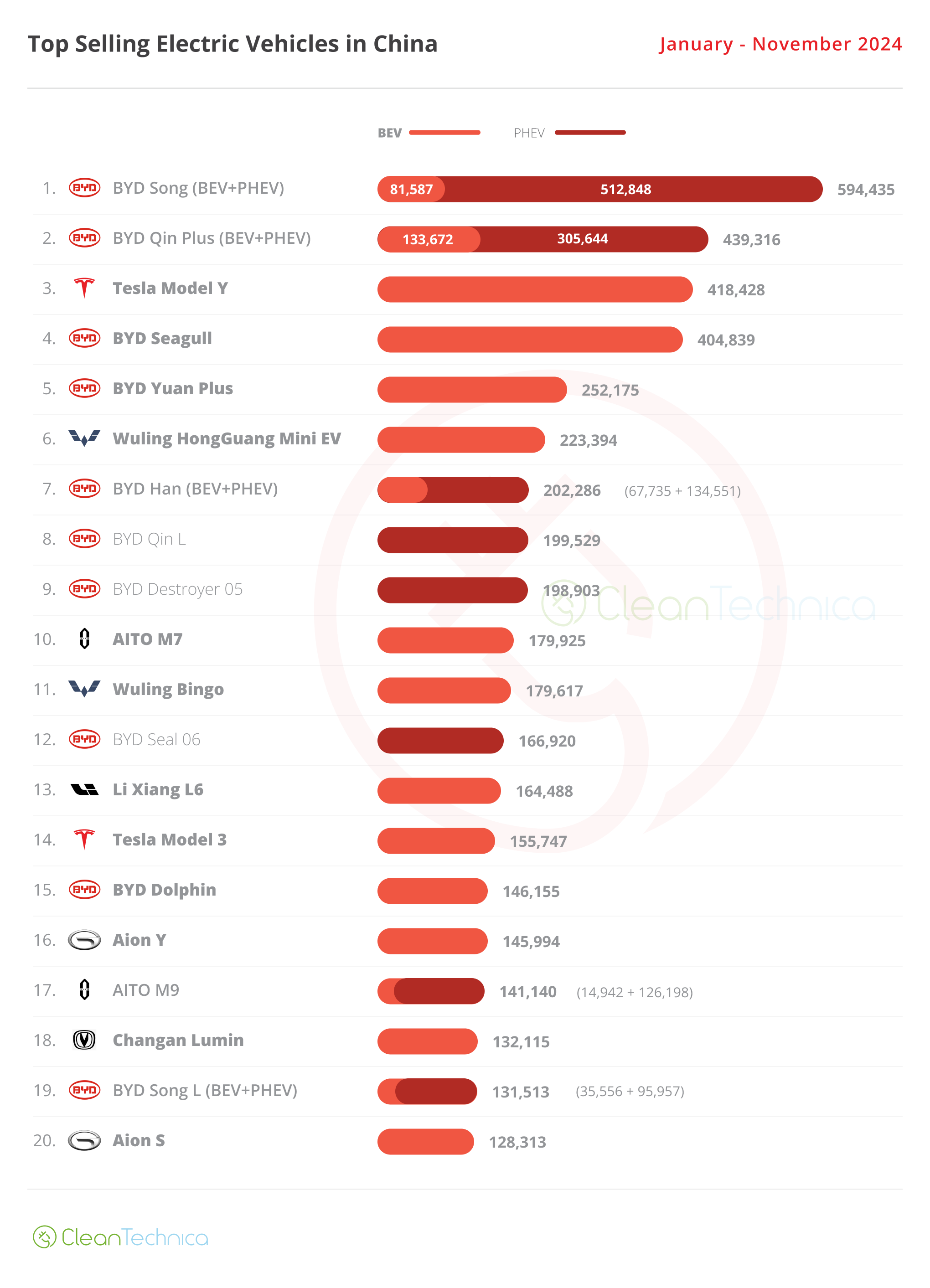

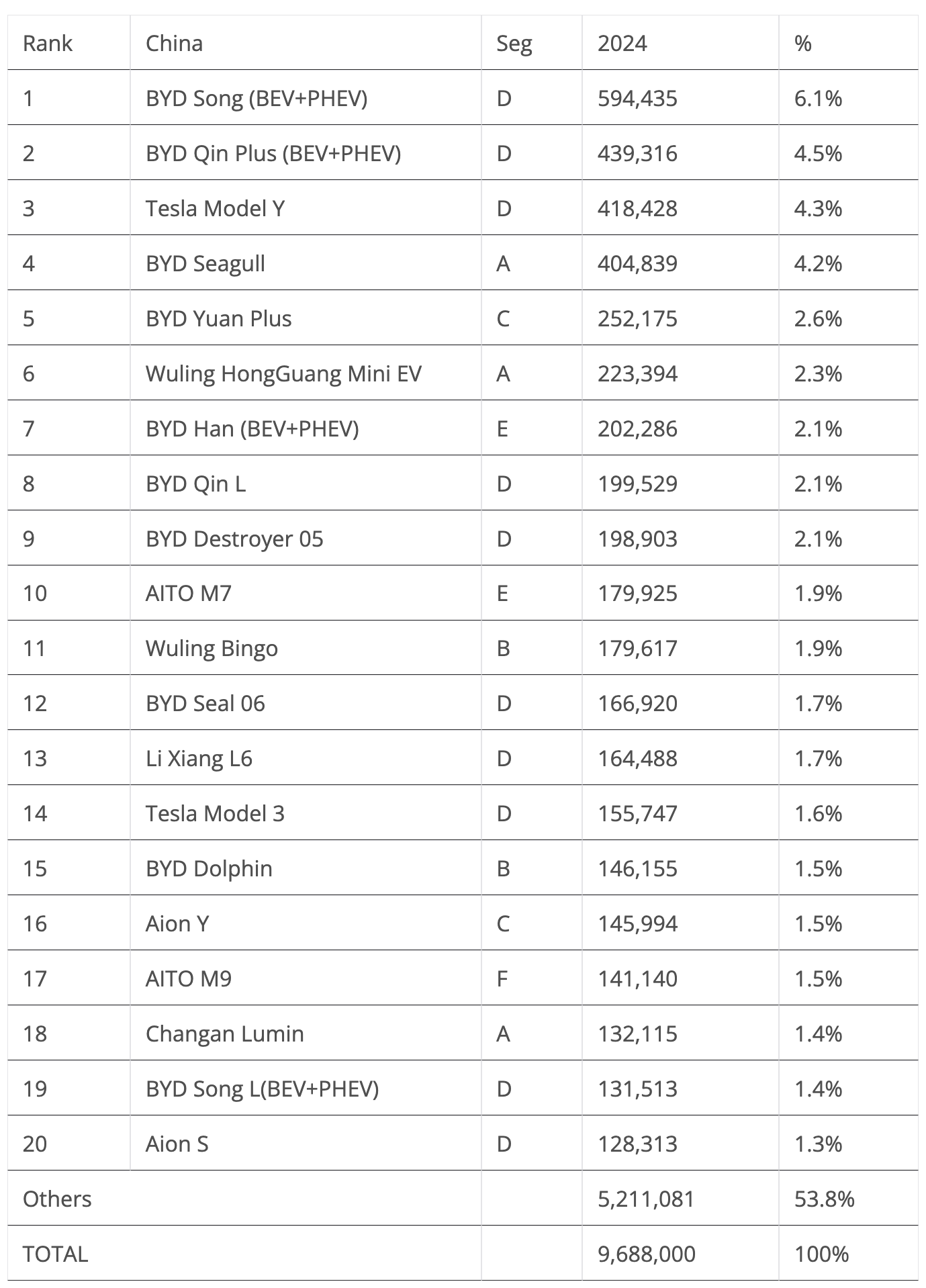

The 20 Best Selling Electric Vehicles in China — January–November 2024

Looking at the 2024 ranking, there’s nothing new in the top positions, with the podium bearers — the BYD Song, BYD Qin Plus, and Tesla Model Y — retaining their positions.

The #3 Tesla Model Y can still dream to remove the #2 BYD Qin Plus from the runner-up spot, but a difference of 21,000 units seems too big to overcome. On top of that, the US model should also look over its shoulder, because the #4 BYD Seagull is expected to have a strong end of the year, so it might have a chance to catch the Model 3 in December…. It could even be the case that the little EV could jump into the silver medal position. Not likely, but it is entertaining to imagine it possible….

We have to go down to the 7th position to see some action. There, the BYD Han benefitted from the phaseout stage of the BYD Destroyer 05, climbing one spot, while the BYD Qin L is also on the rise, having jumped two positions to #8.

Still on the BYD stable, the Seal 06 continues to rise up the table, in this case to #12, while the BYD Song L joined the top 20 in #19.

Finally, the Tesla Model 3 has jumped two positions and is now 14th, while the Changan Lumin climbed one position to #18.

Changes in the Overall Brand Ranking

In November, the podium has seen a significant change. The rise and rise of leader BYD continues, Volkswagen is hanging on in the runner-up spot, but Toyota has now been surpassed by Geely in the race for the last place on the podium. So, here too, Geely is rising….

Honda, 4th in the full year of 2023, was only 8th in November, with a sales drop of 28% YoY — by far the steepest of the top 10.

Still, there are others worse than Honda, like #46 Hyundai being down 52% in November (Kia was also down a harsh 24%), #42 Cadillac cratering 35% YoY, and #55 Chevrolet also falling 57%! Basically, it looks like Hyundai–Kia and GM will soon be out of China….

On the other hand, others are on the way up, like #20 Leapmotor, which jumped 110%, and #25 Zeekr, up 106%. There is a seismic shift happening in China, with legacy OEM sales being replaced by new startups, and this trend promises to expand beyond China’s borders in the coming years….

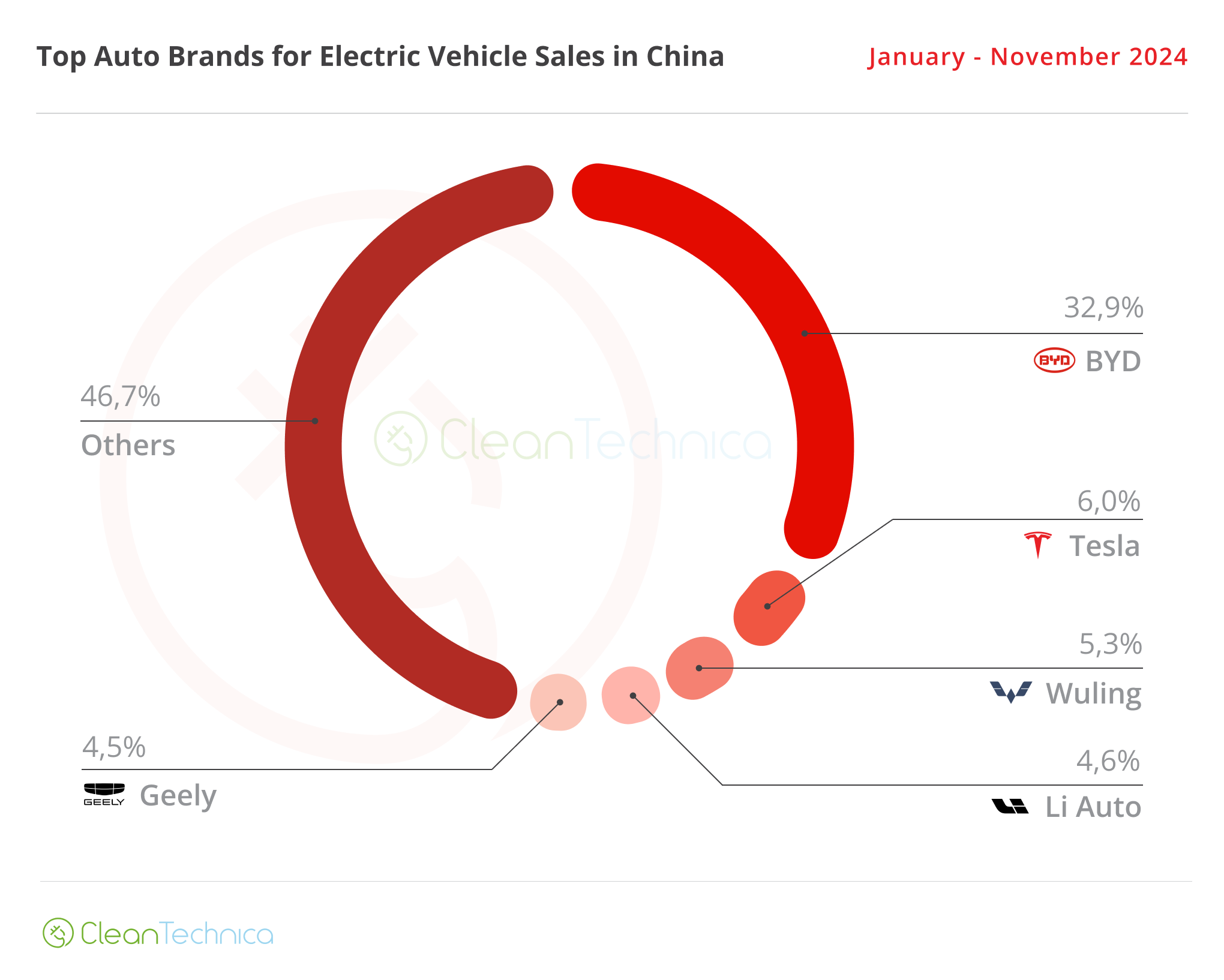

Looking at the auto brand plugin vehicle (PEV) ranking, there’s no major news. BYD (32.9%, down 0.2% from October) is firm in its leadership position, and there’s really no way to see this domination ending soon.

Things get more interesting below, though. #2 Tesla remained stable, at 6% share. Wuling profited from good results from its dynamic duo (Bingo and Mini EV) to increase its share to 5.3%. So, it all looks likely that Wuling will end 2024 in the last place on the podium, displacing last year’s bearer, GAC’s Aion.

#4 Li Auto (4.6%, down from 4.7% in October) lost some ground over rising #5 Geely (4.5%, up from 4.4%), so we might see a position change here in the last stage of the race.

#6 AITO had a slow month and lost share (3.7%, down from 3.9%), but because #7 Aion was also down (3.4%, down 0.1%), it remained comfortable in its position just outside the top 5.

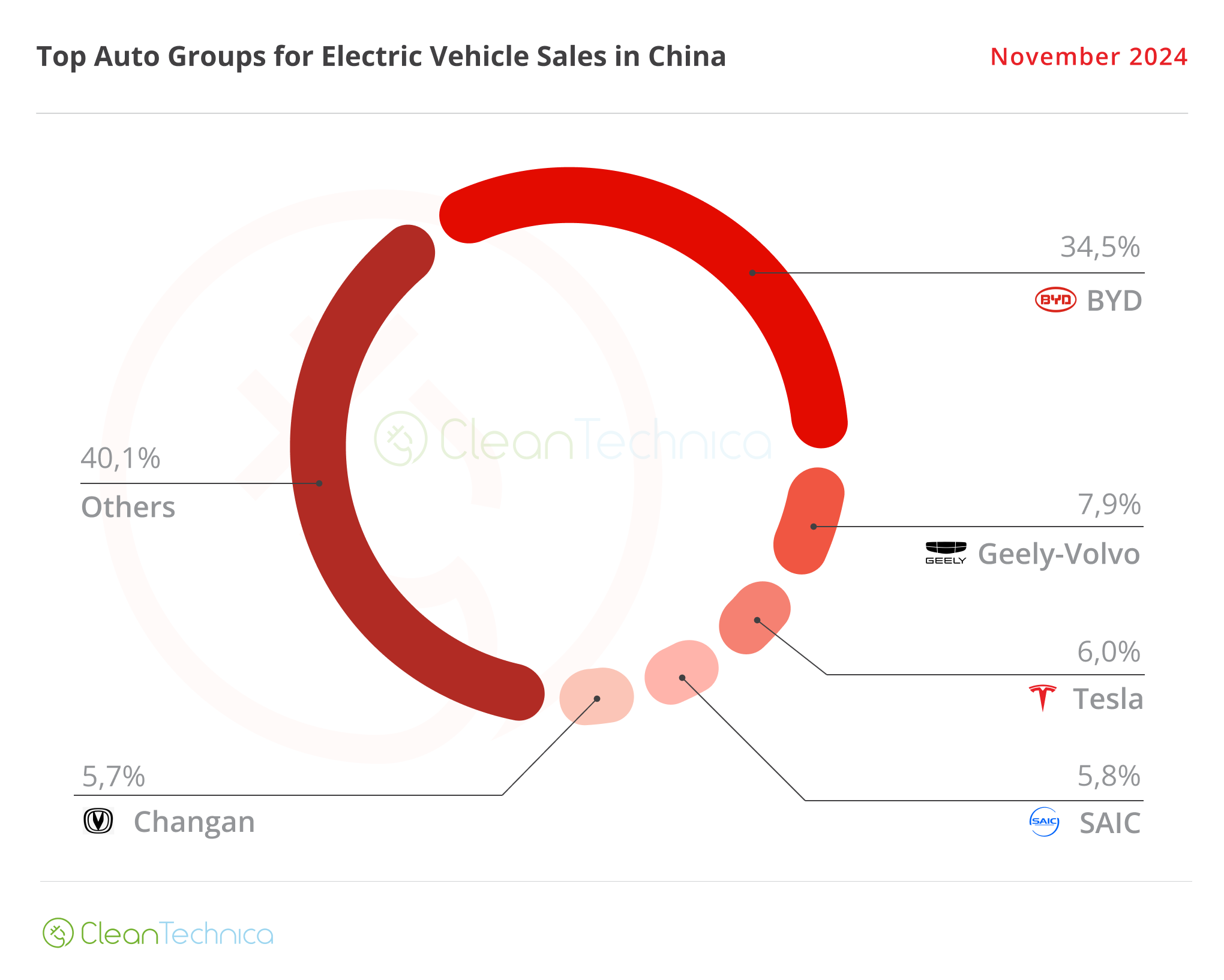

Looking at OEMs/automotive groups/auto alliances, BYD Group is comfortably leading, with 34.5% share of the market.

Geely–Volvo is a distant runner-up, but has seen its market share increase, from 7.7% in October to its current 7.9%. The namesake’s good result in November was helped by sister brand Zeekr. Looking back to where the OEM was a year ago, the progress is visible. In November 2023, Geely was 5th, with 6.3% share. So, in 12 months, the Chinese OEM gained 1.6% market share, making it the fastest growing automotive group in China share-wise. Have I mentioned that Geely is Rising?...

Tesla (6%) is firmly in 3rd, but it has lost 1.5% share compared to a year ago, while #4 SAIC (5.8%, up 0.1%) has profited from Wuling’s good moment and gained precious ground over #5 Changan (5.7%).

This will be an interesting race to look at in December, with both SAIC and Changan racing for #4.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy