+28.1%, +27.2%, +28.3% – this is the impressive performance of gold in the first 9 months of the year in US dollars, Euros and Swiss Francs, respectively.

+42.3%, +35.0%, +31.1% – this is the even more impressive year-on-year performance as of the end of September. Given these figures, the question automatically arises: has the gold price reached its ceiling, or is it even in a bubble, as it was in the early 1980s, and is a significant correction imminent? However, there are strong reasons to believe that the gold price is not yet in a region of extreme overvaluation.

Adjusted for inflation, gold is not yet at its all-time high

Since December 2023 in US dollars and October 2023 in euros, the gold price has been chasing one all-time high after another. It is hard to imagine now that the gold price failed several times to break through the USD 2,000 mark for almost four years, given that it subsequently rose by more than 30% to over USD 2,600 in less than six months.

However, adjusted for inflation, the month-end gold price is still below its record level of USD 2,646 set in January 1980, albeit only slightly. Therefore, concerns that the air may already be thin in the current sphere are unfounded.

Another positive aspect is that the rise in the gold price since 2000 has been much more moderate than the second part of the gold bull market in the 1970s.

It should also be noted that the method of calculating inflation has changed significantly over more than four decades. Based on the calculation method used in the 1970s, the inflation in the subsequent 40+ years would be significantly higher than it is now reported, and so would gold’s inflation-adjusted all-time high. The US Bureau of Labor Statistics, responsible for calculating the CPI, lists three major inflation revisions since 1980 and countless smaller adjustments. Calculations by Shadow Government Statistics now show a difference of around 8 (!) percentage points compared to 1980.

Demand for gold remains high

Among central banks, while China noticeably slowed down its pace of accumulation in Q2/2024, India accelerated it just as noticeably. In Q2/2024, India increased its gold reserves by 18.7 tonnes, only slightly less than Poland did. In Q1/2024, India bought only marginally less. The Bank of India thus increased its gold reserves by 4.6% in just half a year.

It is striking that after the severe slump in 2022, OTC gold transactions increased almost eightfold in 2023. This trend has continued so far in 2024. Compared to the first half of 2023, OTC transactions rose by nearly 60% in the first half of 2024. This more than compensated for the other 6% decline in gold demand in Q2/2024, resulting in the highest value for a Q2 since the WGC began recording data in 2000. It is also the highest value for the first half-year in this quarter-century.

However, a central bank’s gold reserves are also an expression of a country’s economic importance. The Polish central bank, NBP, for example, now has a total of 420 tonnes of gold reserves, more than the UK. In Europe, the economic (power) balance is increasingly shifting from West to East.

Poland is one of the fastest-growing economies in Europe. Adam Glapinski, President of the NBP, emphasized that Poland aims to hold 20% of its currency reserves in gold. The current figure is 14.9 %, while at the end of 2020, it was not even 10%. The reason given by Glapinski for the substantial gold purchases speaks for itself: “None of our trading partners and investors can doubt our credibility and solvency, even when a dramatic situation is unfolding around us.”

In other words, in times of severe crisis, i.e. when it matters most, gold is a more credible guarantor of solvency than even the leading fiat currencies, the US dollar and the euro.

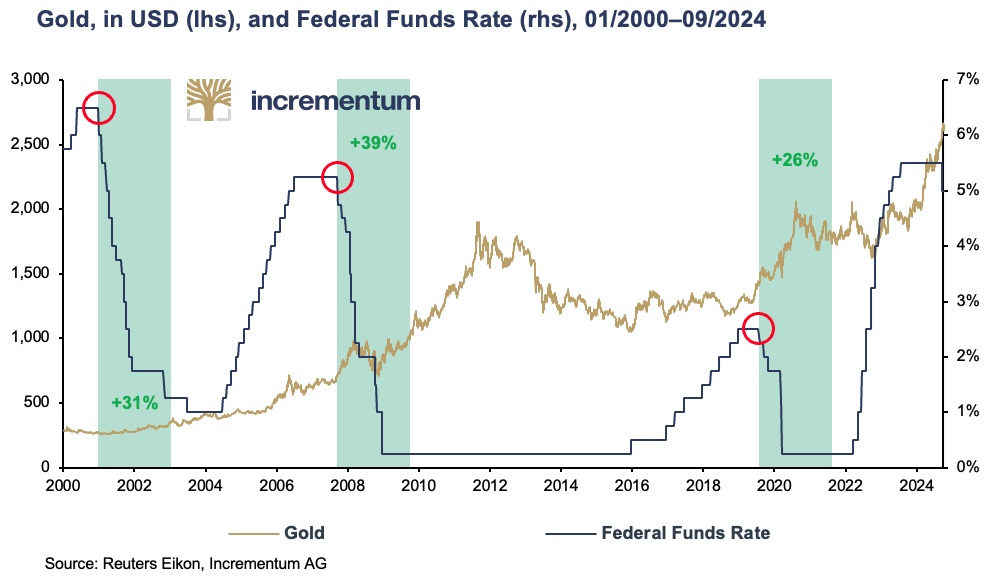

Interest rate cuts boost the gold price

Wednesday, September 18, was the day. Amid intense speculation, the Federal Reserve cut interest rates for the first time since the end of July 2019, and ultimately by a surprising 0.50 percentage points. After all, the last times the Federal Reserve cut interest rates by 0.50 percentage points were in January 2001 and September 2007 amid economic turmoil. The phase of falling interest rates that began with this bombshell should certainly boost the gold price. That has been the case in each of the three phases of interest rate cuts since the turn of the millennium.

At the beginning of the 2000s, the price of gold rose from USD 270 to around USD 420, or by almost 60%, during the cycle of interest rate cuts following the bursting of the dot-com bubble. In the years of interest rate cuts following the global financial crisis of 2007/2008, the gold price soared from around USD 660 to around USD 1,600, or by more than 140%.

During the interest rate cut phase in 2019/2020, the slowdown in the US economy, the trade dispute between the US and China, and the coronavirus pandemic that immediately followed resulted in gold climbing by more than a third, from USD 1,400 to around USD 1,900.

Demand from private and professional investors remains very low

Demand for gold remains very subdued among private and professional investors, particularly in North America and Europe. A Bank of America survey of investment advisors in 2023 found that 71% had invested no more than 1% of their portfolio in gold. A further 27% held between 1% and 5%. The significant underweighting of gold is also reflected in the development of global ETF holdings, especially in North America and Europe.

Global ETF stocks have only been increasing again for a few months and, at a total of 3,200 tonnes, are roughly at the same level as before the outbreak of the Covid-19 pandemic but well below the peaks of just under 4,000 tonnes in October 2020 during the pandemic and in March 2022, immediately after the war in Ukraine began.

While ETF demand from Asia has been slightly positive every month in recent quarters, European ETF holdings were only able to turn their long-lasting losses back into positive territory in May. In September, however, outflows predominated again. In the USA, ETF holdings increased for the third month in a row in September, following a rollercoaster ride in the previous quarters in which months with net outflows dominated. ETF holdings, therefore, have a huge amount of catching up to do.

Given the gold price trend in recent quarters, an increase in ETF holdings in North America and Europe from just over 3,200 tonnes to almost 6,000 tonnes would have been expected if one were to base this calculation on the historical correlation since 2005. There is, therefore, still a lot of room for improvement in this demand segment, especially as Western European investors tend to be pro-cyclical.

Thus, it seems that Western investors initially turned down the invitation to the gold party. Now that the party is gaining momentum, they do not want to admit they were party poopers. Therefore, they could only come to this party when it is already in full swing, and then at a much higher “entrance fee”.

Geopolitical tensions remain high

The war in Ukraine has now been raging for more than 2½ years, and the situation in the Middle East also intensified further at the end of September as a result of Israel’s massive attacks on leading Hezbollah cadres and the invasion of Lebanon by ground troops. The danger of a major conflagration continues to hang like the sword of Damocles over these two conflict regions.

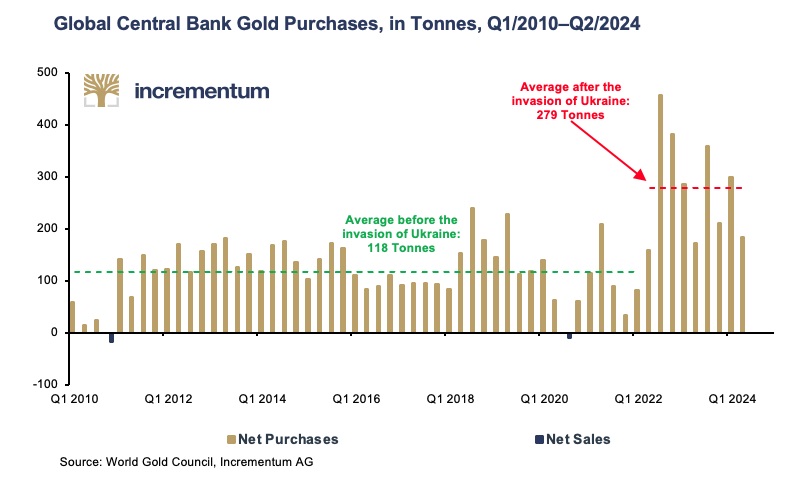

The increasingly fragile geopolitical situation is becoming ever more apparent in central banks’ balance sheets. The massive gold purchases by central banks since 2009 and the rising gold price have led to the precious metal’s share of global international reserves increasing to the detriment of fiat currencies. By the end of 2023, gold will have overtaken the euro. This means that gold now ranks second among central banks’ reserve assets. The US dollar remains undisputed in the first place, although the proportion of US dollars among FX reserves has now fallen well below the 60% mark. In 2015, two-thirds of currency reserves were still accounted for by the world’s reserve currency. The BRICS summit in Kazan (Russia) from October 22-24 will show whether the move away from the US dollar will gain further momentum and whether gold, as a neutral reserve asset, will receive an additional, geopolitically motivated boost in demand.

This development comes as no surprise when you consider the results of the 2024 Central Bank Gold Reserves Survey published by the World Gold Council in June. 66% of the central banks surveyed stated they expect a slightly higher share of gold in total currency reserves in five years. In 2022, the figure was just 46%. The proportion of central banks that expect gold to play a slightly or significantly smaller role has fallen from 24% to 13%. Not a single central bank now expects central bank gold holdings to fall in the coming year. 81% expect them to increase. In 2021, this figure was only 52%.

Remarkably, geopolitical considerations – at least according to this survey – are almost entirely insignificant with regard to the importance of gold as a reserve asset for central banks. Concerns about sanctions are nearly as insignificant. Instead, hedging against inflation, the performance of gold in times of crisis, the lack of default risk, and the high liquidity of gold are among the most critical reasons in favour of gold.

However, according to the Central Bank Gold Reserves Survey, a look at the central banks’ demand for gold in recent quarters does not confirm the relative insignificance of geopolitical considerations and hedging against sanctions. The discrepancy between quarterly gold purchases before the outbreak of the war in Ukraine, at an average of 118 tonnes, and the 279 tonnes afterwards is simply too large. In the end, actions count more than words.

Conclusion

With a value of 61 as of October 10, the Fear and Greed Index for gold is just outside the greed range. In view of the enormous price rally over the past 12 months, a noticeable correction cannot, therefore, be ruled out. However, there are numerous fundamental reasons to believe that gold will continue to rise even after a setback.

After all, at the beginning of 2024, gold successfully broke out of the cup-and-handle formation that had formed since 2011. With a gold price of just over USD 2,600 at the end of September, the gold price has reached the year-end forecast of our Incrementum Gold Price Forecast Model for 2024. We presented this model for the first time in the In Gold We Trust Report 2020 and have since updated it in every subsequent In Gold We Trust report.

Given the further deterioration in economic and (geo)political conditions, the model’s price target of just over USD 4,800 by the end of 2030 will be considered a conservative projection. Against this background, even gold, which became significantly more expensive last year, is still cheap.

As Michael Kosares once said so aptly: “In a bull market, the sideline is the worst place to be!”

Courtesy of VonGreyerz.gold

********