The climate finance community should be watching Sweden. Swedish steelmaker H2 Green Steel (H2GS), founded in 2020 to produce (using renewable hydrogen), is completing a landmark €5 billion+ fundraise for its first plant in Boden, near the Arctic Circle in northern Sweden, an industrial project finance template is taking shape and it’s important: heavy industry produces 30 percent of global carbon emissions and steelmaking is 7 percent alone.

Industrial project financiers can reflect on five key lessons from the ongoing H2GS deal: 1) Diverse seed equity rounds can work, 2) entice offtakers with equity upside, 3) use export credit agencies (ECAs) and government support, 4) build flexibility throughout the deal, and 5) hire banks with relevant climate expertise.

Deal summary & status

- In February 2021, H2GS — launched by Swedish Vargas Holding — announced itself with a Series A equity raise targeting €50 million for the (then €2.5 billion) Boden project.

- In May 2021, H2GS closed its Series A equity round at US$105 million.

- In October 2022, it announced final close of a €260 million Series B equity raise, bringing total equity raised to around $400 million.

- That same month, it announced a ground-breaking €3.5 billion in conditional debt commitments.

- As of April 2023, Morgan Stanley is reportedly running the final part of H2GS’ fund-raise: a €1.5+ billion equity round.

- In June 2023, the project received a full environmental permit for construction and operations.

- The plant is expected online by the end of 2025 with a ramp-up to commercial volumes in 2026.

Large, diverse equity investor groups can work

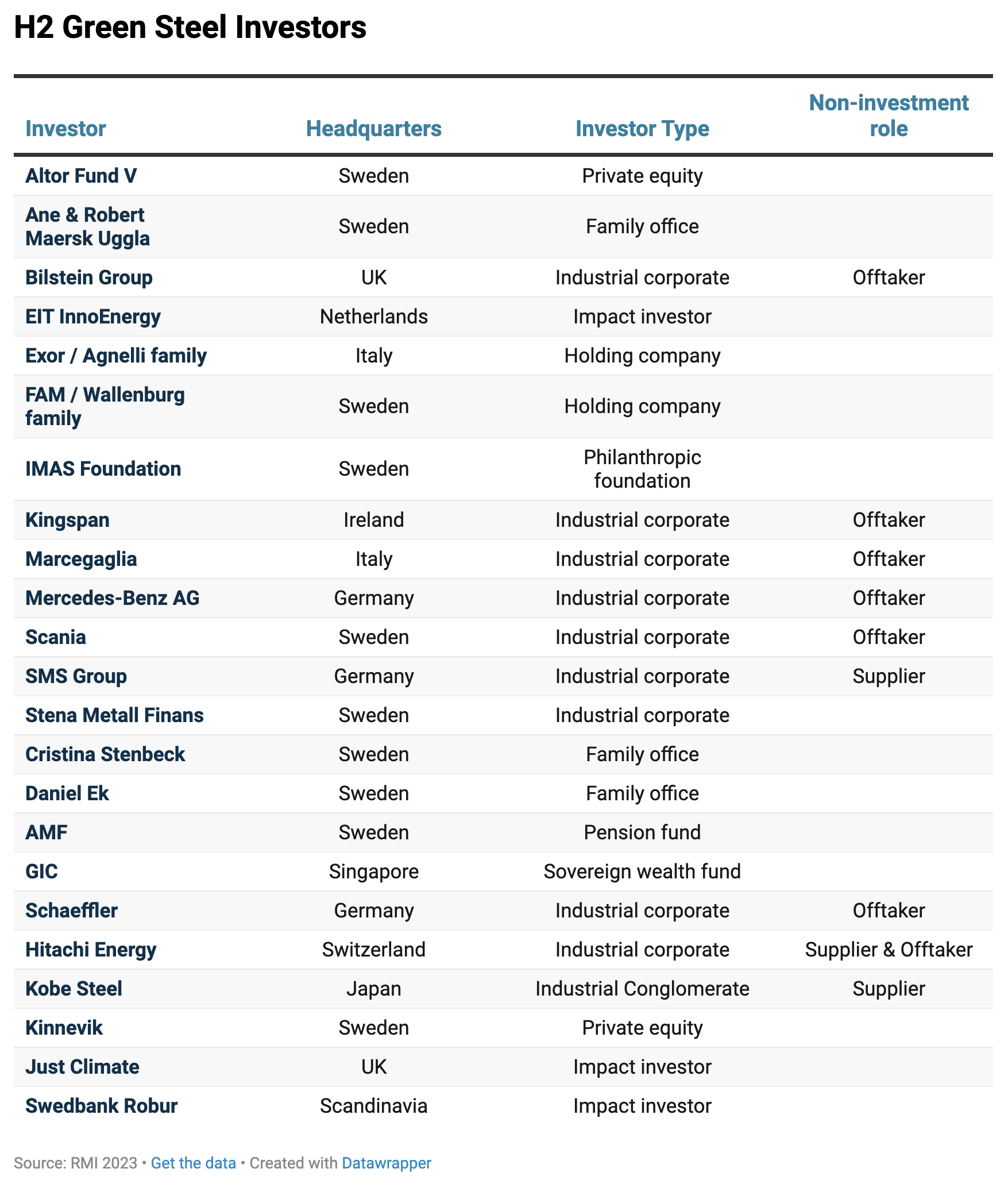

Infrastructure project developers usually warn against having too many fellow equity co-investors, since joint decision-making can become cumbersome. For example, the landmark $3 billion Vineyard offshore wind project off the US east coast has just two equity investors — a private equity group and an electric utility. H2GS, however, counts over 20 different equity investors (see table below). The types of equity investors range to Asian sovereign wealth funds and industrial corporates, which is also uncommon in large infrastructure projects. Given the H2GS announces every few weeks, the formula seems to be working.

Some equity investors may well sell their stakes in the current equity raise or as commercial operations begin, but the lesson for other industrial developers remains: sourcing equity for these first-of-a-kind projects will be even harder than for proven technologies, potentially requiring large, diverse, equity investor pools.

Consider selling equity stakes to offtakers

It’s little surprise to see H2GS’s component suppliers come on board as equity partners — this is common practice in large infrastructure project financings. It’s the offtakers that are interesting. H2GS’s equity stack diversity is in part because many of the investors will also buy the end product (see table above). When both sponsors and offtakers have equity, they can share in the upside as the project increases in value. Where offtakers would traditionally only see downside risk (e.g., in case the first-of-a-kind project does not reach commercial operations), offtakers with an equity share would now also be compensated for that risk, over and above the nominal deposits that suppliers usually have to put down for long-term contracts anyway. This is a crucial way sponsors can secure bankable offtake contracts for emerging commodities like green steel.

“The key to success for us has been to involve stakeholders early,” says Otto Gernandt, Chief Financial Officer, H2 Green Steel. “Together we have shaped and built a project that caters to the specific requirements of customers, project finance lenders, and equity. It has been challenging but, in the end, the requirements and the thorough process of a project financing of this magnitude made us a better company and a better project. Hopefully, we will be able to make a meaningful contribution towards developing a precedent that others may use to unlock more capital for the transition.”

H2GS reportedly secured its mammoth €3.5 billion debt commitments with 60 percent of initial volumes pre-sold via 5-to-7-year offtake contracts. Aside from the debt guarantees, these robust offtake contracts from blue-chip customers like BMW and Mercedes-Benz would have helped banks compensate for any perceived technology risks with this new green hydrogen-based steelmaking. Italy’s Marcegaglia, for instance, will pay H2GS around €1.79 billion over seven years. Marcegaglia has an investment grade credit rating of A2.2 from Cerved Rating Agency, showing the importance of well-rated anchor customers for emerging technologies.

Use ECAs & government support

Export credit agencies may be less nimble than private lenders, due to the government oversight and political constraints they must operate within. But for these first-of-a-kind deals, they are proving to be powerful allies in , both as debt guarantors and direct lenders. In the H2GS deal, Swedish ECA Svensk Exportkredit participated in the €3.3 billion senior debt tranche alongside commercial banks. Meanwhile, the core ECA, Allianz-owned Euler Hermes, committed to guaranteeing €1.5 billion of the senior debt. Sweden’s National Debt Office would guarantee another €1 billion in senior debt. The European Investment Bank is providing a further €750 million of senior debt.

A significant portion of the senior debt tranche is either guaranteed or provided by an ECA or public lenders, helping de-risk commercial capital. Developers financing clean industrial hubs in the United States are similarly navigating a tapestry of government funding programs to de-risk their projects. If project developers partner with foreign corporates and original equipment manufacturers, they may attract funding from foreign ECAs and development finance institutions. The Development Bank of Japan, for example, has previously bought equity in US power plants alongside Japanese corporates;

Price in the cost of flexibility

Green steelmaking is complex and hasn’t been commercially executed. It involves financing renewables (and potentially electric transmission/storage), hydrogen electrolyzer and midstream infrastructure, as well as the steel plant. Prices for power, hydrogen, steel, and carbon move constantly. With so many variables and interdependent elements, making long-term assumptions in financial models can be difficult and it’s important the financing structure remains flexible to accommodate unforeseen volatility. Project finance attorneys help to share this volatility fairly between stakeholders in the financing agreements. While we do not know specific financing covenants — and the financing has not yet closed — we can observe two ways the sponsor has built-in flexibility.

First, procuring the clean electricity — i.e., the “green” in “green steel”. Rather than building and financing new renewable electric generation itself, H2GS is buying hydropower from Statkraft (2 TWh/year) and Fortum (2.3 TWh/year) to power its 700+ MW thyssenkrupp nucera electrolyzer. The Fortum agreement highlights H2GS’s input cost flexibility because 1.3 TWh will be priced based on a floating index while 1 TWh will be fixed price. This “bifurcated” power purchase agreement with a combination of floating and fixed prices helps protect investors from power price spikes eating away at revenues.

Secondly, H2GS has sourced “mezzanine” capital to sit between the senior debt and the equity. A Nordic infrastructure fund has committed to roughly €500 million in junior debt. Whether it’s junior/subordinated debt or preferred equity, mezzanine funding typically takes more risk than senior debt for a higher interest rate, but without the return expectations and voting rights of equity. There is a $475 million mezzanine debt tranche in the $8.5 billion NEOM Green Hydrogen project in Saudi Arabia. Often used in riskier oil & gas deals, mezzanine capital provides sponsors with flexibility — at a cost.

Building flexibility into a deal usually costs more than going with standard, fixed options — it’s the same reason why fully-refundable flight tickets are more expensive than non-refundable ones! But for these ambitious industrial projects, it seems to be worth the price.

Bank on climate expertise

Three of the five senior commercial lenders announced — Société Générale, ING, and UniCredit — are founding signatories of the Sustainable STEEL Principles (SSP), a climate-aligned finance agreement for lenders to the steel sector. Annual SSP alignment reporting will incentivize lenders to support the low-carbon transition of existing clients and bank with new companies with a lower emissions profile. In the shipping sector, Poseidon Principles signatory banks have led on sustainable ship debt. Sector expertise goes a long way on first-of-a-kind transactions, and participation in climate agreements can signal to industry the leading lenders willing to support the transition; Societe Generale was H2GS’s lead debt advisor as well as a lender.

“As a founding member of the SSP and the NZBA (Net Zero Banking Alliance), Société Générale is committed to the decarbonization of the steel industry and H2GS is the emblematic example of how we support innovative emerging leaders to achieve this purpose,” says Christophe Hadjal, managing director and regional head for Europe in Société Générale’s Mining, Metals & Industries Finance division. “The work we have done together to structure the debt package over the past years is a good illustration of how we collaborate with our clients to deliver the ambition of the SSP.”

Meanwhile, the two other commercial senior lenders (BNP Paribas and KfW IPEX-Bank) not only have deep steel expertise but also bring valuable experience from similar pioneering industrial financings like Northvolt’s $1.6 billion battery factory debt raise in July 2020 and the aforementioned NEOM hydrogen deal.

To financial close and beyond

As we await H2GS’s final equity raise and financial close, observers can look to the Northvolt deal for clues on what lies ahead. The two deals are similar in many ways: both have Vargas Holding as the sponsor, both tapped similar banks, both signed offtake & equity deals with European automotive giants, both leveraged government support from ECAs, etc. After raising debt & equity, Northvolt has since issued $1.1 billion in convertible notes, begun a fresh $5 billion fundraise, and is reportedly exploring an IPO.

H2GS has given pioneering industrial project developers around the world an off-balance sheet financing template: secure seed equity and offtake; then conditional debt and government support; then a full equity round and financial close; then begin construction and potentially refinance after commercial operations. RMI’s industrial finance team will share more innovative financing templates as they emerge. We are beginning to see private finance flow to decarbonize “hard-to-abate” sectors. It can’t happen fast enough.

© Rocky Mountain Institute. Published with permission. Originally posted on RMI. By Shravan Bhat, Asia Salazar.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …