Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Plugin vehicles are all the rage in the Chinese auto market, with plugins scoring 816,000 sales (in a 1.7-million-unit overall market). That’s up 33% year over year (YoY).

Looking deeper at the numbers, BEVs were up 22% while PHEVs did even better, jumping 55% in May. Breaking down plugin sales by powertrain, BEVs had 63% of sales, below this year’s average of 64%, proving the rising popularity of plugin hybrids in this market.

The year-to-date (YTD) tally is around 3.3 million units, a significant rise over the 2.5 million units in the same period of 2023.

Share-wise, May saw plugin vehicles hit a record 47% market share! Full electrics (BEVs) alone accounted for 29% of the country’s auto sales. This pulled the 2024 share also to 41% (26% BEV), and with the market still with plenty of room for growth, the first half of the year should end at around 42%. (And maybe above 50% by year end?)

Comparing this result with May 2023, at the time, the plugin share was 35% (24% BEV), which means that, while BEVs are experiencing moderate growth (24% vs. 29%), the PHEV share is growing faster (11% vs. 18%). At this pace, we should have the Chinese market fully electrified by 2035, if not sooner.

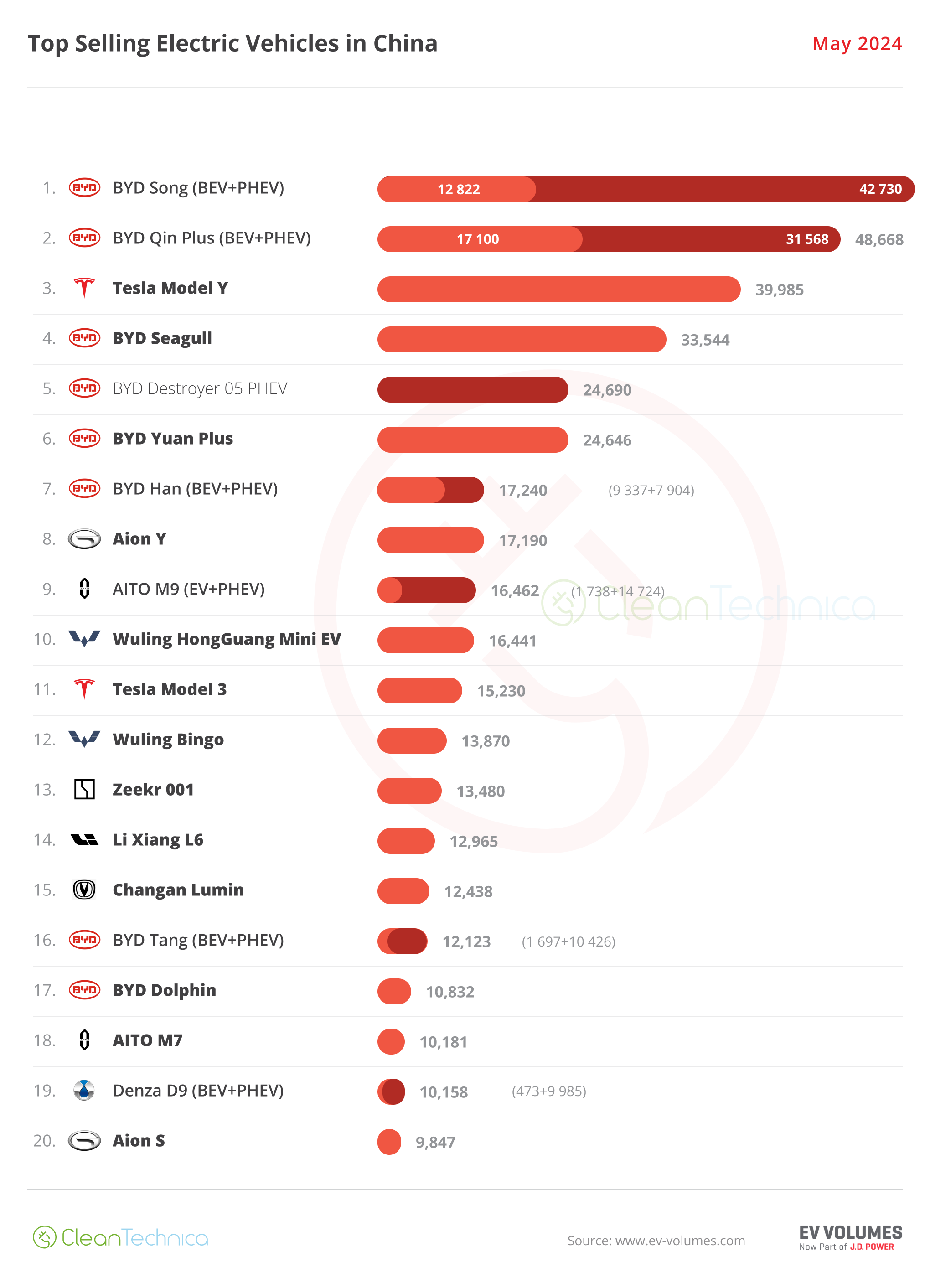

The podium was 100% plugins, with the Tesla Model Y being the best selling non-BYD model, in 3rd. The best selling ICE model was the Nissan Sylphy, in 5th, with some to 31,000 units sold. The Japanese model was the first of four ICE models in the top 10.

Benefitting from its recent War on ICE, BYD placed five models in the overall top 10! Price cuts from the Shenzhen make are pressuring not only the ICE competition, but also its plugin adversaries….

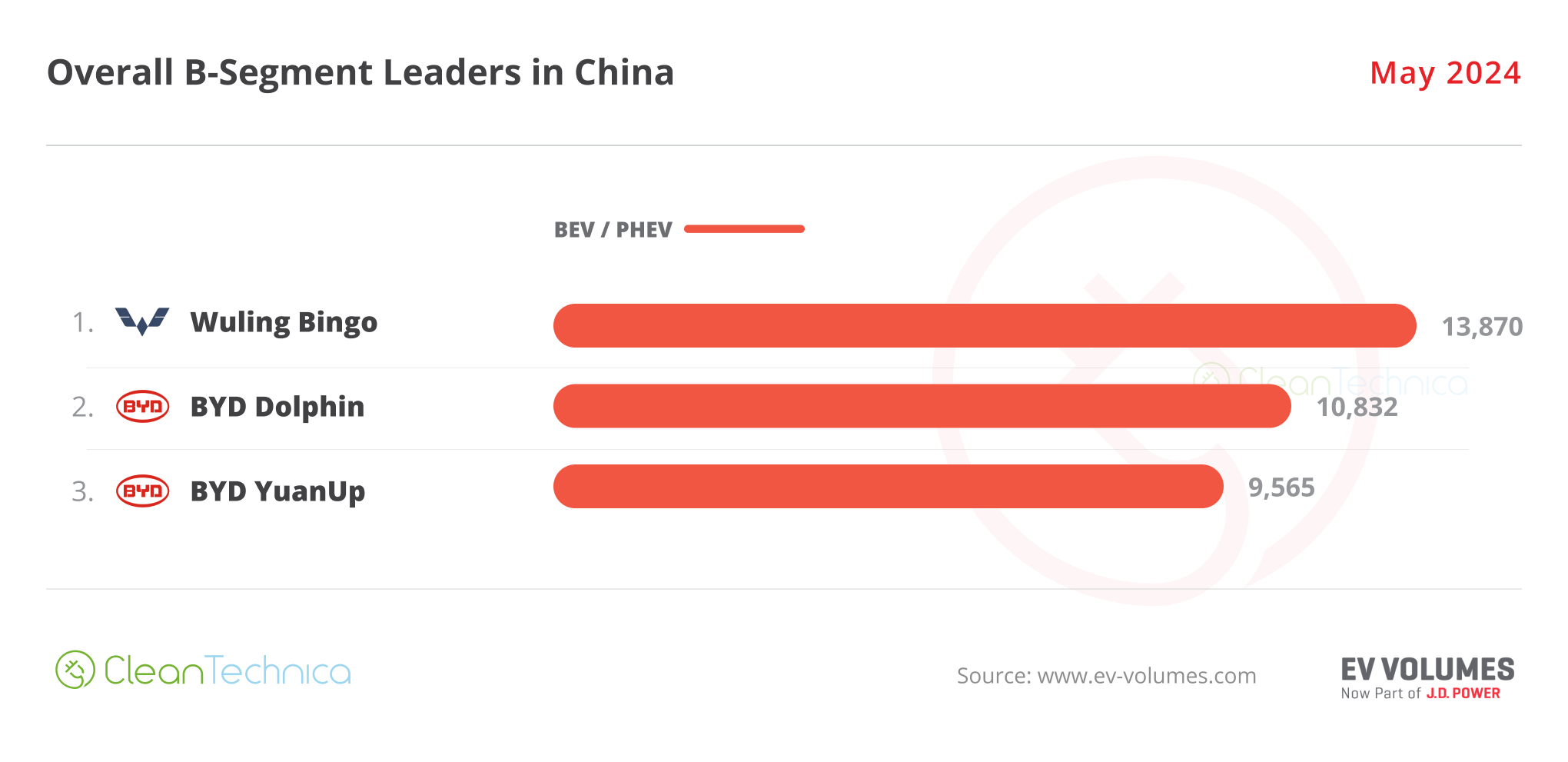

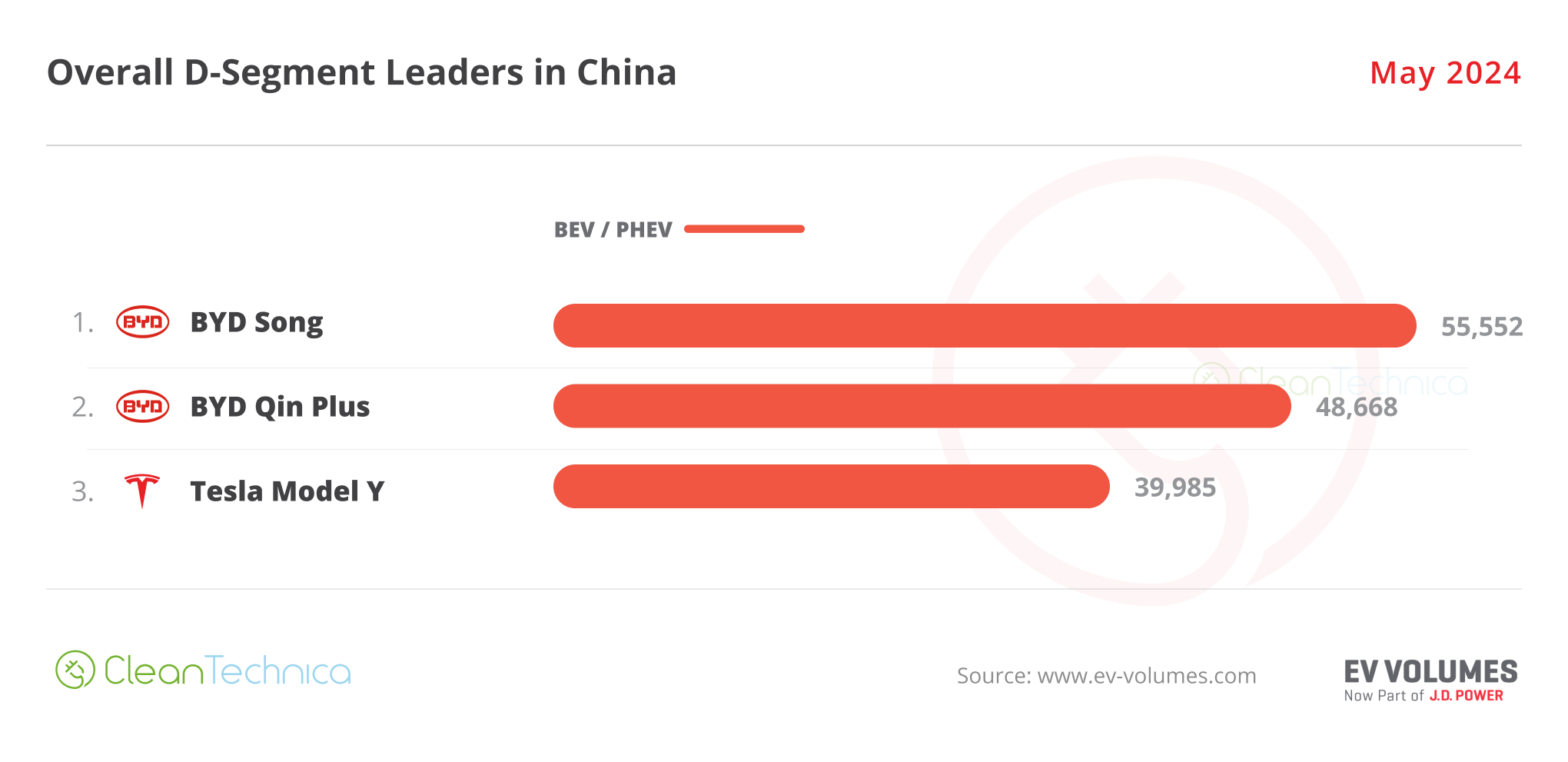

Looking at several categories, all the vehicle segments have 100% PEV podiums with the exception of the C (compact) segment, which is the only category where ICE vehicles are still present. BYD’s upcoming (not so) compact hatchback is surely needed here.

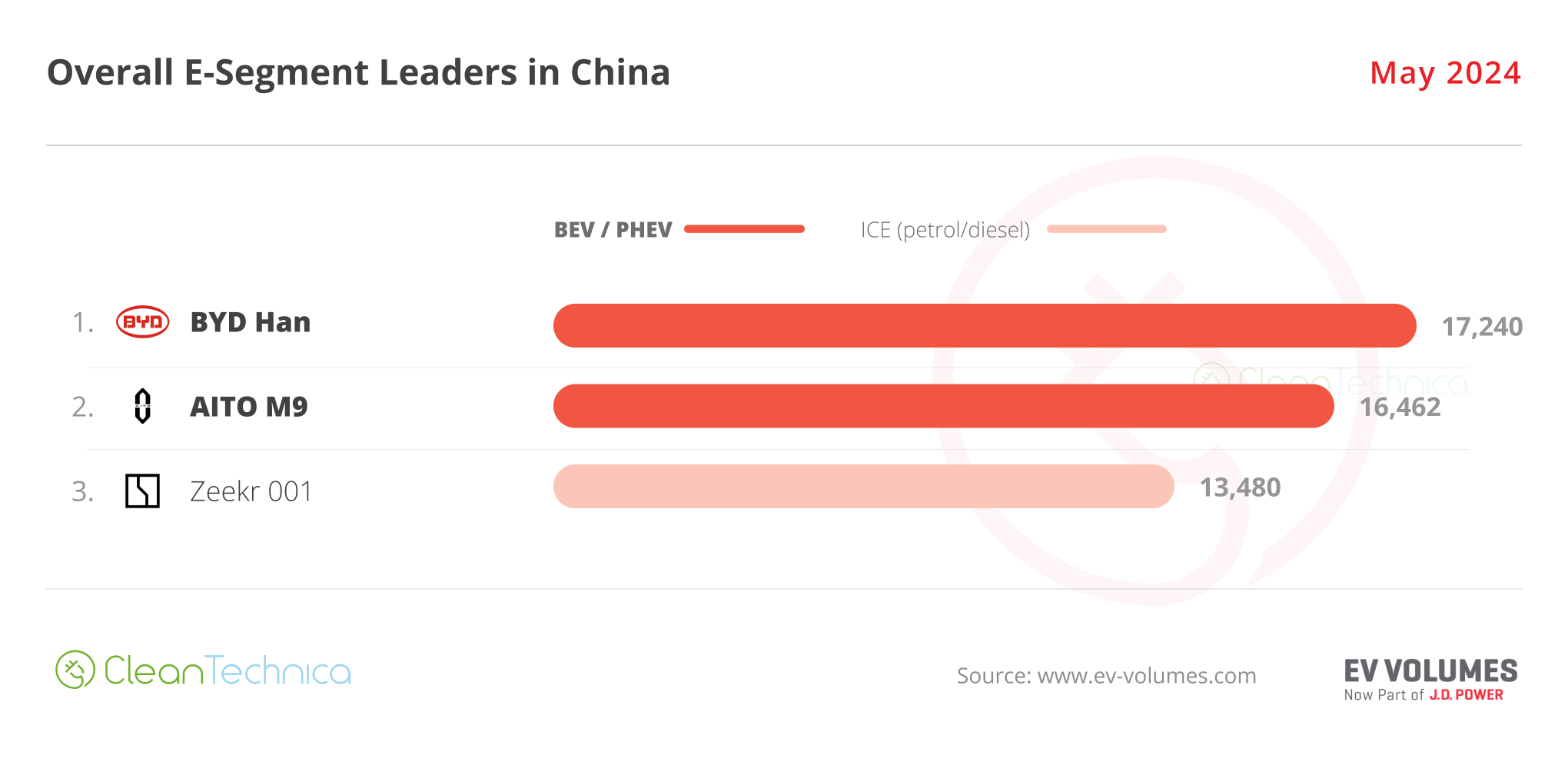

Anyhow, with the exception of the C segment, where the Nissan Sylphy still soldiers on as the sole ICE category leader, BYD is ahead of ICE vehicles in every other category, and only otherwise lost the top spot to the Wuling Bingo in the B segment. The big surprises this month are coming from the full size category, with the recent AITO M9 ending fewer than 1,000 units below the leader BYD Han, so we might have a close race between these two in the following months. The other, more significant surprise in the full size category is that the Zeekr 001 has replaced the Audi A6 in the 3rd position, allowing this category to be 100% plugin for the first time — and it’s also now a 100% domestic podium. So, this is another category that legacy OEMs can say bye bye to.

Best Selling EVs — One by One

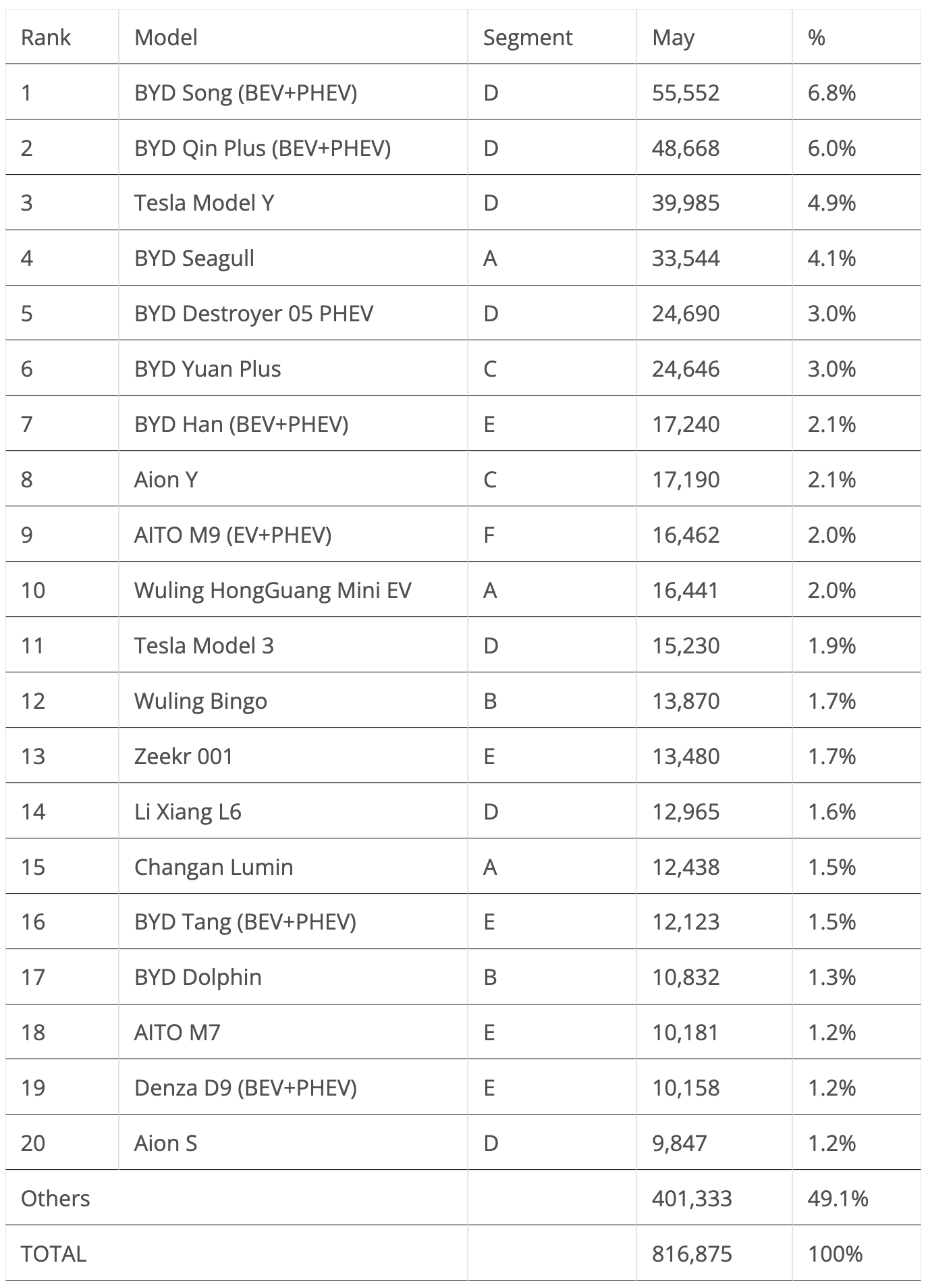

Regarding last month’s best sellers table, the top 4 best selling models in the overall table exactly mirrored the ones in the EV table — which once again proves the merging process that we are witnessing between the two tables. Here’s more info and commentary on May’s top selling electric models:

#1 — BYD Song (BEV+PHEV)

BYD’s midsize SUV is the uncontested leader in the Chinese automotive market, and the star player retained the leadership position in May, keeping its Qin Plus sibling in the runner-up spot. The midsize SUV scored 55,552 registrations, with 12,822 units belonging to the BEV version. Will the Song continue to rule in the Chinese automotive market? Well, it depends on the competition, especially the internal competition. In the near future, the Song will have to race against tough internal competition, like the recently introduced Song L and the upcoming Sea Lion 07, as well as the premium car-on-stilts Denza N7 (a car that sits somewhere between the Tesla Model Y and the Zeekr 001). All of these models also want a piece of the pie. This is probably too much competition inside BYD’s midsize SUV portfolio for the Song to continue clocking 50,000 sales/month, a necessary threshold to continue leading the cutthroat Chinese auto market, but thanks to its recent price cuts, the Song is continuing its success story.

#2 — BYD Qin Plus (BEV+PHEV)

Along with the Song, the BYD Qin has been a bread and butter model for the Chinese automaker for a long time. The midsize sedan reached 48,668 registrations in May (17,100 units belonged to the BEV version). This allowed it to be second in the overall market, with the sedan benefitting from being the first pawn launched by BYD in its recent “War on ICE” campaign (aka price cuts). Prices now start at 80,000 CNY ($12,000), and demand is bound to stay high. Despite the strong internal competition — a new, fancier Qin L and a Seal 06 PHEV had their first units registered in May — expect BYD’s lower priced midsize sedan to continue posting strong results at the cost of the competition, EV or ICE, all while keeping its external direct competitors — the Tesla Model 3, Wuling Starlight, and GAC Aion S — at a safe distance.

#3 — Tesla Model Y

Tesla’s star model got 39,985 registrations, which allowed it to land in 3rd in the overall ranking. The US crossover had a positive month, having grown 29% YoY in May. Expect the Tesla EV to peak at about 45,000–50,000 units in June. While that doesn’t make it the best seller in the market, it allows the Model Y to stay Tesla relevant in the Chinese market — no small feat, considering current market trends (the Tesla models were the only foreign models in May’s top 20). Interestingly, its lower-to-the-ground sibling, the Model 3, also had a good month in May, with 15,230 sales, up 33% YoY and breaking a series of months in the red.

#4 — BYD Seagull

Things continue to go well for the hatchback model, with the small EV securing another top 5 presence thanks to 33,544 registrations. With part of production now being diverted to export markets, it seems demand for the little Lambo is now at cruising speed in China. The perky EV is now a regular in the top 5. Even with its attention now diverted to other geographies, like Latin America and Asia-Pacific, expect the little BYD to continue being part of the BYD pack that populates the Chinese top 10. What about export prospects to Europe? There are talks that the model will be launched in Europe in the second half of the year. Of course, do not expect the low prices in Europe that the Seagull has in China. When the city EV lands, as the Dolphin Mini, European prices will be significantly higher for a number of reasons (tariffs, VAT, etc.), but I wouldn’t be surprised if it started at 17,999€ … which would still be a killer price considering the direct competition is north of 20,000€.

#5 — BYD Destroyer 05

A big beneficiary of the recent price cuts, the Qin Plus evil sibling joined the top 5 thanks to 24,690 sales, a new record. That provided BYD with a gold and silver medal in the midsize sedan category. With the launch of the BYD Seal 06 PHEV, sales of the Destroyer 05 could suffer. The new sedan is not that much bigger (4.83 mt vs. 4.78 mt), and it has a more attractive design, especially inside, which might steal sales from the Destroyer 05. One thing is certain: it took time, but the Destroyer 05 became another sales success for BYD. Now, about that Seal hatchback….

BYD’s Domination in the Top 20

Looking at the rest of the best seller table, there were six BYDs in the top 7 positions. And that’s not all….

… Looking at the rest of the table, we have an amazing eight BYDs (nine, if we count the #19 Denza D9) in the top 20!

And this kind of domination is happening in a time where BYD has several potential best selling models getting ready to land (the Qin L, Seal 07, Seal 06, Seal hatchback …). Sure, at this point, these models will likely cannibalize existing BYD models, but they will likely also steal sales from the competition.

Although, one starts to wonder at what point BYD’s new model launch fever will start to get counterproductive…. How much is too much?

This is also starting to suffocate a lot of its competitors, especially those that are coming from foreign OEMs, but more on that later….

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

More Top 20 Notes

Outside the BYD Galaxy, I have a few more notes on the April top 20. The AITO M9 joined the table, jumping to #8, with a record 16,462 sales, 1,738 of them belonging to the BEV version. The flagship AITO is the make’s most recent model, and probably the best of the make so far, so expect the 5.2-meter (205-inch) land yacht to become a frequent presence in the table and a serious contender to the XXL SUV category title, with top 5 presences also a possibility.

The Zeekr 001 was 13th, thanks to 13,480 sales, its best result ever, with the flagship model taking full profit from the recent refresh. You know, a 3-year-old model, like is the case of the Zeekr EV, can already be considered a veteran under Chinese standards.

A final note on Li Auto’s new L6 model. It is the “smallest” model of the brand, but nevertheless measures a significant 4,925 mm (194 in) in length. It had its first full month on the market in May, immediately reaching top 20 status by joining the table at #14 with 12,965 sales. With the L6 set to join the top 10 soon, the question now is: Will it be able to break through the BYD–Tesla domination and secure a top 5 presence?

We are counting on you to make this top 5 more diverse and interesting, Li Xiang L6 and AITO M9….

Outside the top 20, as usual there was a lot to talk about, like Changan’s new EV brand, called Qiyuan, which had its A07 sedan reach a record 5,774 sales. There’s also NIO’s ET5, which reached 7,282 sales in May, its best score in the last 17 months.

One of Huawei’s other brands, Luxeed, made in cooperation with Chery, is continuing to expand sales. Its S7 full size sedan reached 5,021 sales in May, a new personal best. With AITO models going after Li Auto’s full size SUVs, will Huawei’s Luxeed brand also be successful in beating the BYD Han and Zeekr 001?

Speaking of AITO, the M5, the make’s midsize offering, was the last model of the brand to be graced with Huawei’s magic fairy dust, spiking its sales upwards to 5,583 units in May. That was the SUV’s best result since December 2022! Will we see it in the top 20 soon?

Also ramping up is Leap Motor’s C10 compact crossover, with the startup’s most recent model scoring 5,411 sales in May. This is Leap Motor’s most important model so far, because not only is it the one set to be the brand’s best seller in China, but also because it is the first one developed from the beginning with overseas markets in mind, and with the recent association with Stellantis now coming to fruition, we can expect this crossover to land on European shores this year — and in other markets soon after.

Last, but surely not least, a mention goes out to the Xiaomi SU7 in May (in only its second month on the market). It is a car with unbeatable value for money. It is the size of a Tesla Model S, has air suspension, has a 0.195 drag coefficient, has 800-volt architecture, has a 74 kWh LFP battery or a 101 kWh NMC battery, with a promise of a 150 kWh version coming later on, and all of this for Tesla Model 3 prices! That is … quite an offer.

No wonder they have already locked in some 100,000 orders. Not reservations, actual orders. As such, the SU7 delivered a significant 8,646 registrations in May, and aims to achieve some 100,000 deliveries this year alone!

Will it reach the top 20 already by June?

With the electronics giant preparing the SUV version of the SU7 for 2025, and a smaller, lower-cost model set to land in 2026, Xiaomi could be a disruptive force on the market.

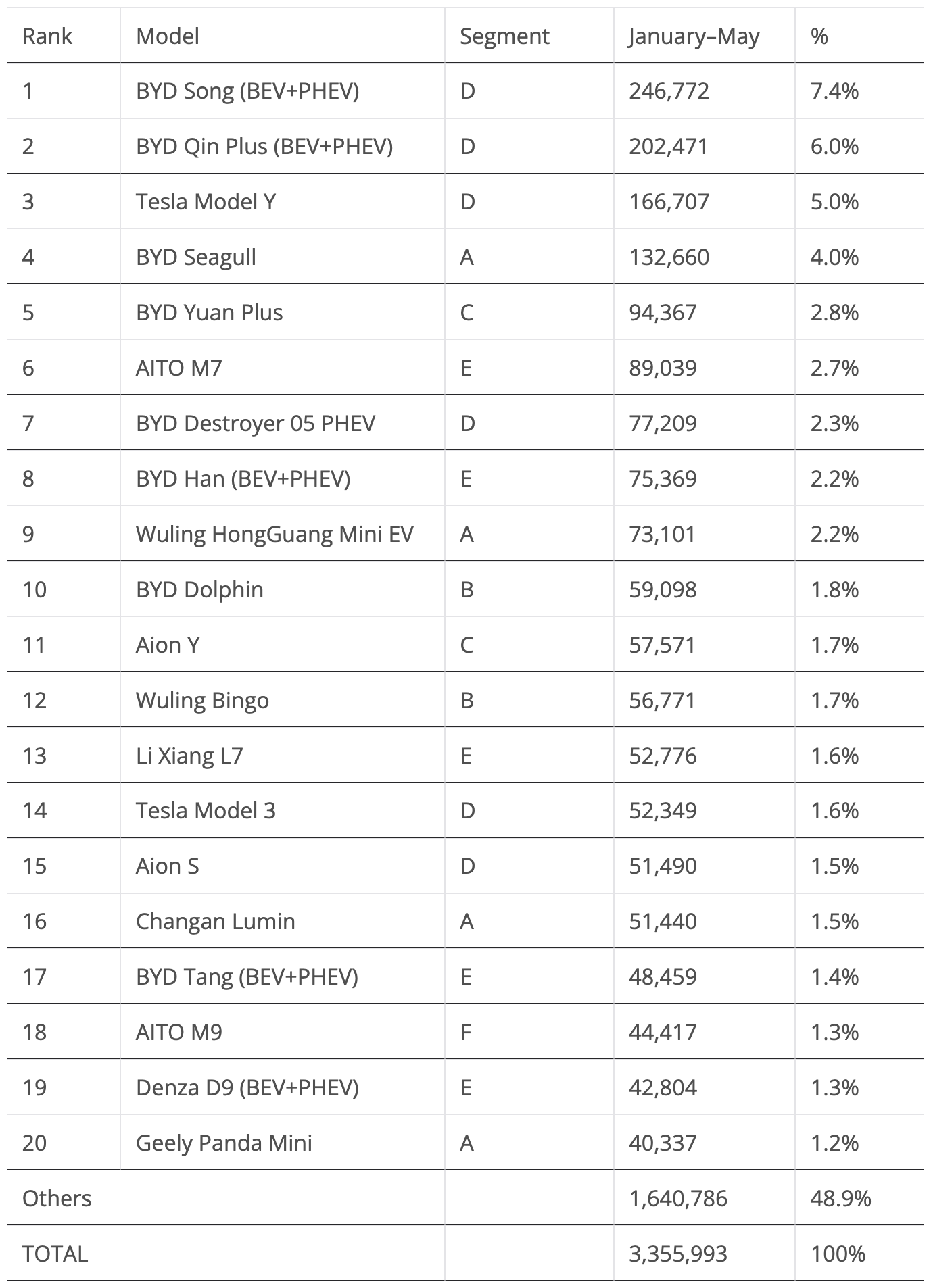

The 20 Best Selling Electric Vehicles in China — January–May 2024

Looking at the 2024 ranking, there’s nothing new in the podium positions, with the podium bearers BYD Song, BYD Qin Plus, and Tesla Model Y safely in their positions.

The same can be said about the 4th placed BYD Seagull, which has distanced itself from the competition — more than 30,000 units separating the little Lambo from the #5 BYD Yuan Plus or the #3 Tesla Model Y.

With the top 4 positions already secured, we have to go down to the 5th position to see some action. Due to a bad month for the AITO M7 (#18 in May), the BYD Yuan Plus surpassed it in May to become the new #5. And this should not be the end of AITO’s troubles, because a rising Destroyer 05, which jumped two positions in May to 7th, is now some 12,000 units behind the big SUV from AITO. So, we might see the hot selling BYD surpass it in June already.

In the second half of the table, the Aion Y jumped three positions, to #11, with the crossover-MPV mashup looking to join the top half of the table next month.

Good news for the Tesla Model 3: thanks to a positive performance in May, the US sedan was up two positions, now 14th. With Tesla’s usual quarterly peak happening in June, Tesla probably hopes that its sedan can reach the #10 position then. Realistically, it is the best that the Model 3 can expect from this market.

Regarding the lower positions on the table, the big news is the AITO M9 land yacht joining the top 20, in #18, and with the #17 BYD Tang just 2,000 units ahead, expect AITO’s flagship model to surpass it in June, along with a few other models on the way.

Finally, in #21, we have another full size model looking to join the table, as the Zeekr 001 is benefitting from its recent refresh to jump several positions. We might see the flagship model on the table soon.

Changes in the Overall Brand Ranking

In May, the top three positions mirrored the 2023 full year ranking, with BYD on top followed by Volkswagen and Toyota. The dynamics are quite different, though. BYD (248,000 sales) grew 18% YoY, while #2 Volkswagen (151,000 sales) was down by 13% and Toyota (124,000 sales) fell by 16%. So, while the first place automaker is still rising fast, the other two are losing significant ground in a fast changing market.

Confirming the domestic takeover, #4 Geely (81,000 sales) had a 20% growth rate, mirroring BYD’s growth rate. On the other hand, #5 Honda, the 4th best selling brand in 2023, had 66,000 sales, crashing 35% YoY. At this rate, Honda’s future looks bleak in China…

#9 Tesla was the exception to the downward trend among foreign OEMs, growing 30% YoY in May, with the best selling US brand in China selling 55,000 units. That’s a stark contrast to the 41% drop of the 2nd highest selling US automaker in China, Buick, which ended the month at #18 with 27,000 sales.

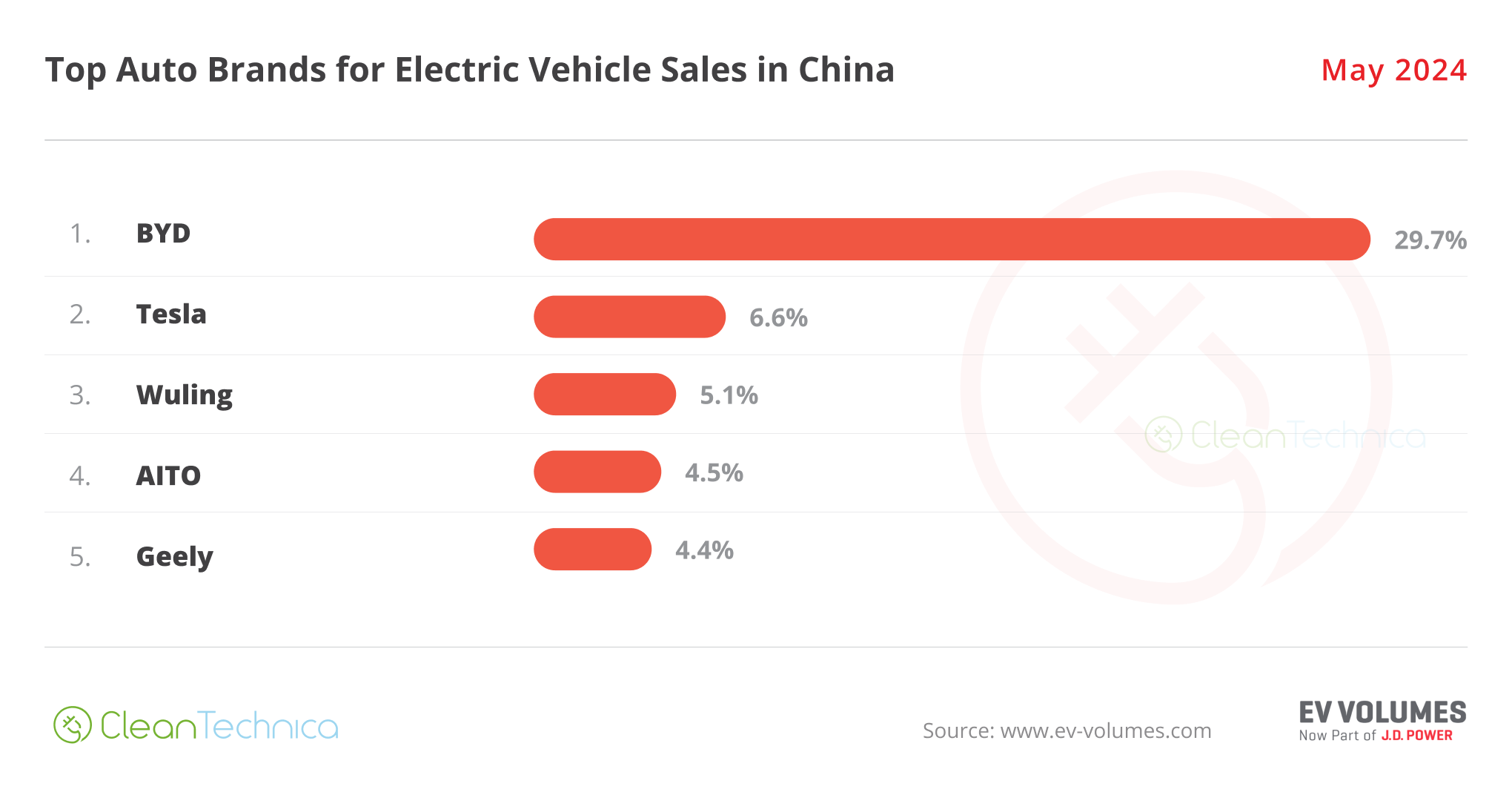

Auto Brands Selling the Most Electric Vehicles in China

Looking at the auto brand ranking, there’s no major news. BYD (29.7%) is firm in its leadership position, and there’s really no way to see this domination ending anytime soon.

Things get more interesting below, though. Tesla (6.6%, up from 6.5%) is hanging onto the runner-up spot, while #3 Wuling has seen the competition getting closer (now at 5.1%, down from 5.3% — SAIC’s low-cost brand is one of BYD’s War on ICE victims).

Geely also suffered from the recent BYD price cuts, and it has seen its share drop, from 4.6% in April to 4.4% at the end of May, losing the 4th position on the way.

Due to the good result of the M9, AITO (4.5%) resisted the black hole effect in the Chinese market, BYD. And with Geely’s drop, the Huawei-backed startup climbed to the 4th position. Still, the startup brand’s lineup is still too small. One bad month from one of the models and things could go south quite fast.

Finally, Li Auto, despite staying outside the top 5, has gained share in May (4.3% now vs. 4.2% in April). With the recent launch of the L6 midsize SUV, its cheapest to date, we could see it surpass AITO soon and aim for the last place on podium.

Auto Groups Selling the Most Electric Vehicles in China

Looking at OEMs/automotive groups/auto alliances, BYD Group is comfortably leading, with 31.9% share of the market. That increase in share is thanks to the strong results of the namesake brand, but also thanks to good results from its premium branches — Denza, Fang Cheng Bao, and Yangwang. At this moment, it seems BYD has its domestic market domination assured, replicating what Tesla is doing in the USA.

Geely–Volvo is a distant runner-up, with 8.3% share, having gained a little bit of ground over #3 SAIC (7.7%). Although, one should highlight that both lost share last month, with both OEMs being hit by BYD’s recent price war.

#4 Tesla (6.6%, up from 6.5%) has gained a precious advantage over #5 Changan (6.5%) in the race for the 4th position.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.