Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

In the Netherlands, 46% of new car sales were plugin car sales in November. Furthermore, 34% were full electrics!

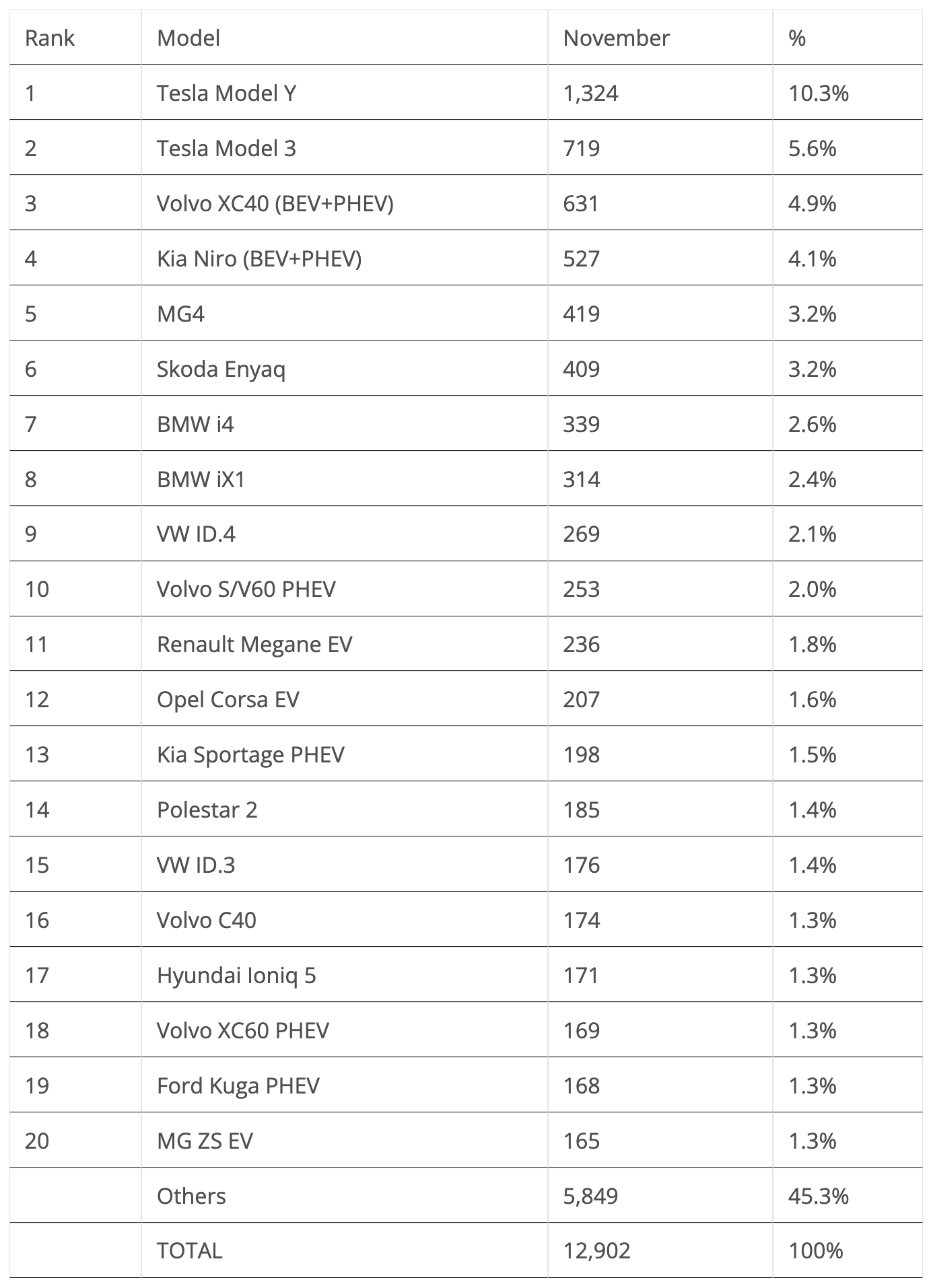

The Dutch market saw an increase in plugin registrations to 12,902 units in November, up 34% YoY, thanks to the close to 10,000 BEVs registered (+41% YoY), with the plugin vehicle (PEV) market thus reaching 46% of the overall auto market last month. That kept the year-to-date (YTD) score at 43% (30% BEV). That’s mostly thanks to pure electrics (30% of new vehicle sales), which represented 74% of all plugin sales, pulling the yearly average to 70%. There were 28,256 registrations on the overall market.

Expect the December plugin share to end around the 50% mark, and then expect the full year to end around 44%, which could mean that the Dutch market could have its EV transition finished before the end of the decade!

Looking at the overall top 6, only two models (#2 Kia Picanto & #5 VW Polo) don’t have plugin versions. Interestingly, they are either city cars (Picanto) or belong to the B-segment/subcompact category (Polo). The remaining models in the top 5 (#1 Tesla Model Y, #3 Tesla Model 3, #4 Volvo XC40, #6 Kia Niro) are either fully electric, like the Tesla models, or are heavily electrified, like the XC40 (96% of all the Swede’s registrations were EV) and Kia Niro (86% plugin rate, with the remaining 14% belonging to the HEV version).

This shows once again that while the EV transition in the upper half of the market is well advanced, the lower half still has a long way to go. Those promised €20,000-ish small EVs are badly needed….

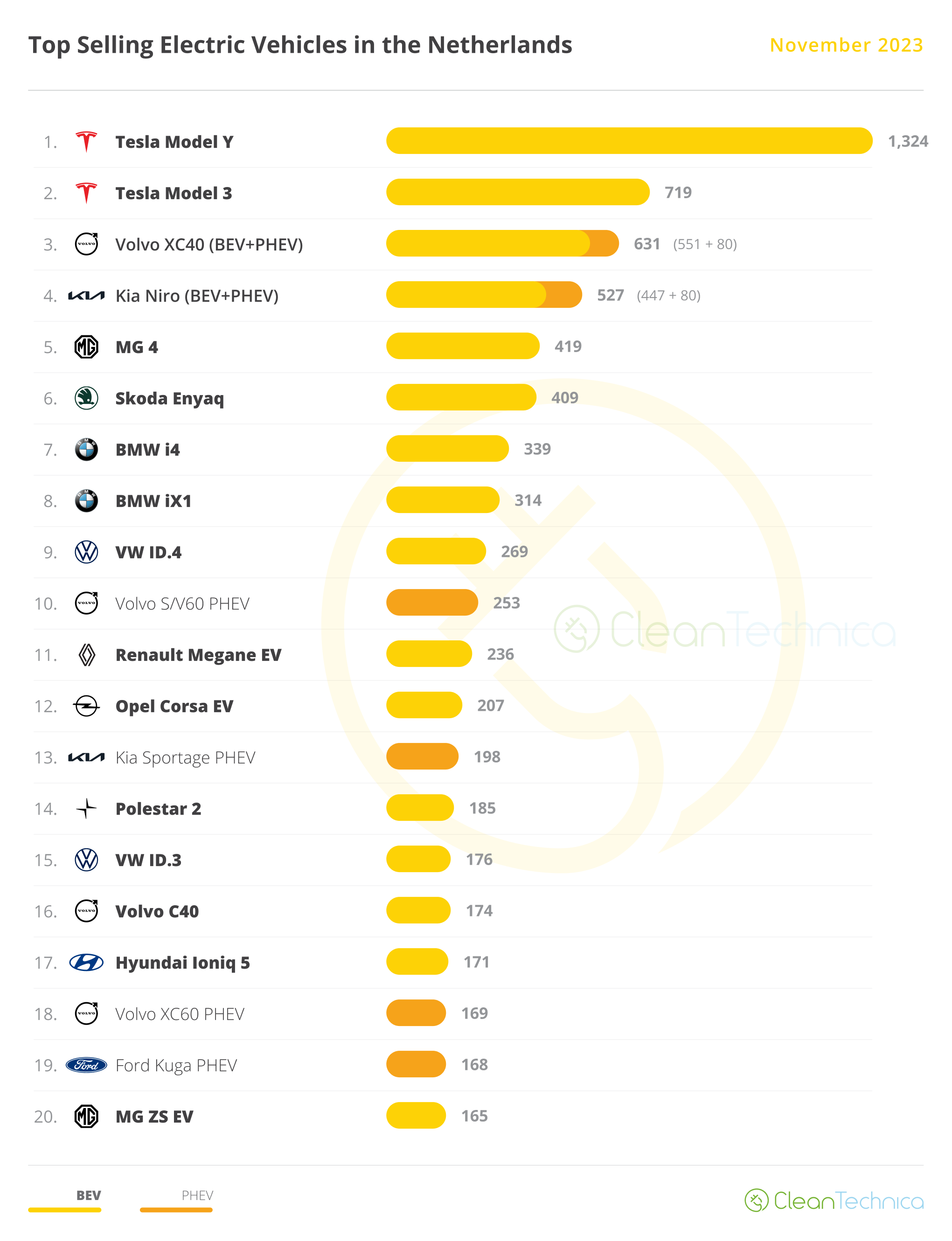

In November, the big plugin vehicle news was the #1 plus #2 win from Tesla, with the Model Y recovering its usual leadership role and the Model 3 benefitting from the refresh to win silver.

The Volvo XC40 took the last place on the podium, keeping the Kia Niro in 4th, with 527 registrations.

In the first half of the table, there were several highlights. The MG4 ended the month in 5th, which added to the #20 spot of the MG ZS EV, underlining another positive month for the Sino-British make. The #6 Skoda Enyaq confirmed its popularity in the Dutch market and its best seller status in Volkswagen Group. BMW also had a positive month, with its new dynamic duo, the i4 fastback and the iX1 crossover, ending in 7th and 8th, respectively.

In the PHEV category, the surprise is coming from Volvo, with the S/V60 PHEV twins winning the category title with 253 registrations, their best result in over three years!

In 13th we have another surprising plugin hybrid model, the Kia Sportage PHEV, scoring 198 registrations. Volvo placed two additional representatives in the top 20 — the XC60 PHEV in #18 and the XC40’s sportier looking sibling, the C40, joining the table in #16 thanks to the refreshed specs. Also benefitting from revised specs, Volvo’s more extroverted younger sibling, Polestar, placed its second model in history, the “2” fastback, in #14.

Outside the top 20, a couple of models had good results. The refreshed Hyundai Kona EV reached 145 registrations. MG had its “5” station wagon reach 116 registrations, proving that its lineup is more than just the MG 4. Meanwhile, Mercedes saw its two compact EVs reach three-digit scores, with the EQA registering 140 units, its best result in 23 months, and the family-friendly EQB 7-seater reaching 102 units.

In the full size segment, things are brewing with activity. The segment has long been dominated by Audi, thanks to the success of the Audi e-tron/Q8 e-tron, but things could change soon.

This month saw XPeng’s G9 scoring 72 registrations. With the startup’s appealing SUV starting at €58,000, just €13,000 more than the smaller Tesla Model Y Standard Range and €44,000 less than the similarly sized Tesla Model X, it is quite competitive! With a fully specced G9 AWD Performance version sold at €72,000, or €30,000 less than the Model X, this model is one of the most competitive options in the category. So, expect value-for-money Dutch buyers to welcome it with open arms, and let’s see if it can challenge Audi’s leadership.

But maybe more concerning for the Audi Q8 e-tron, which scored 125 registrations in November, were the 116 registrations of the Kia EV9, in only its second month on the market. Slightly over 5 meters, and a real 7-seater, this XL-sized Kia Soul also has a lot going for it. Hiding in its crossover exterior design is an MPV-like interior. Starting at €68,000, this vehicle is good value for money for those families that do not suffer from badge snobbery. Kia is on a roll, and its biggest bet (literally) could also threaten Audi’s leadership.

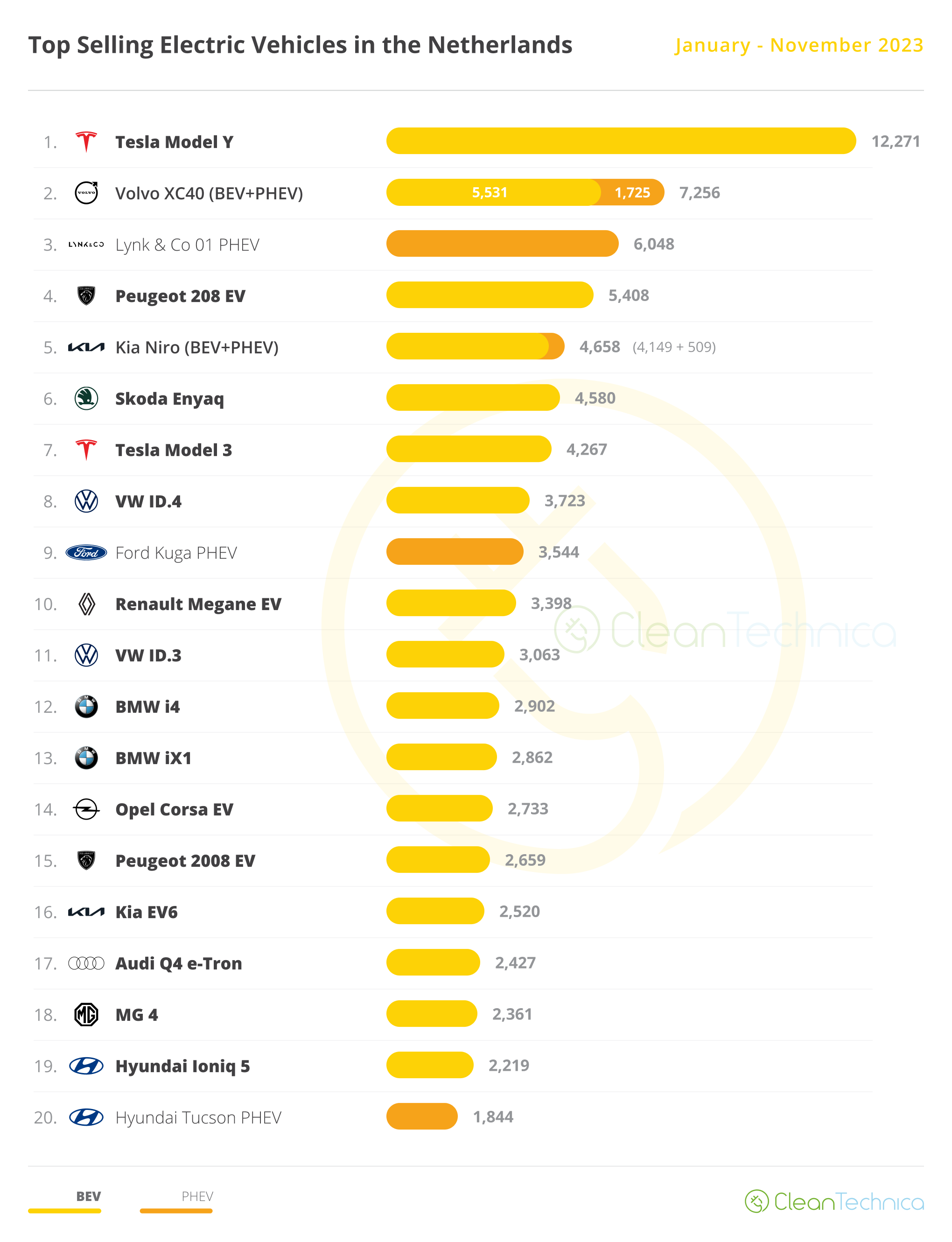

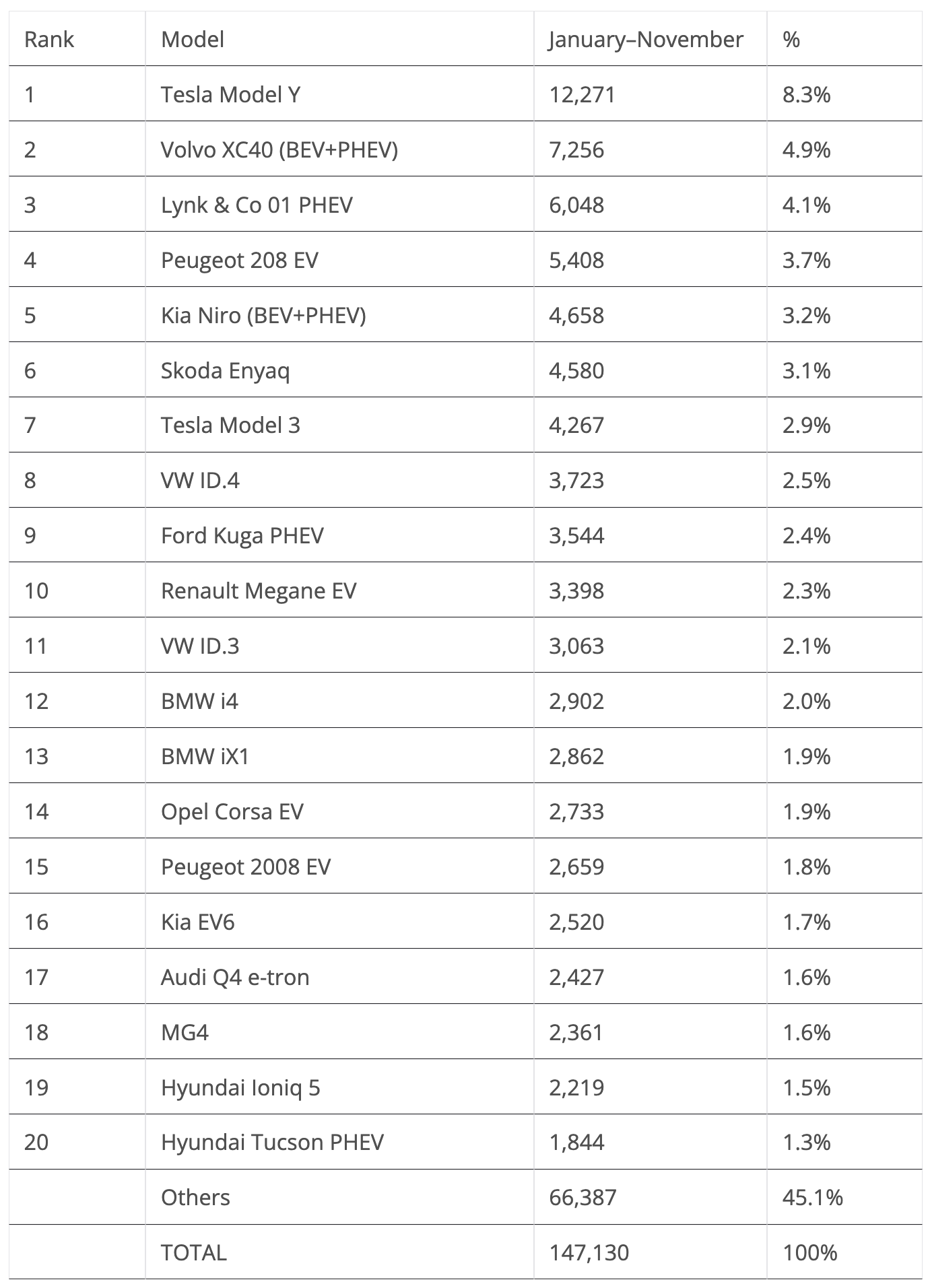

Looking at the 2023 ranking, the Tesla Model Y has this year’s title in the bag, with almost double the registrations of the runner-up model. It will be the Model Y’s first best seller title in Dutch lands, and Tesla’s first win since 2019, when the Tesla Model 3 took the title.

Interestingly, since 2018, there has always been new best seller every year. In 2018, the title went to the Tesla Model S; the following year, it was for the then new Tesla Model 3; 2020 saw the VW ID.3 take the gold medal; the 2021 trophy went to the Skoda Enyaq; last year’s title went to the Lynk & Co 01 PHEV; and now we have the Tesla Model Y on top. Will Tesla’s crossover be the first to repeat the title since Tesla’s Model S double (2017 & ’18)?

Regarding the next position on the podium, the Volvo XC40 is most likely to become the silver medalist, which will be the first medal going to the Swedish make ever since the XC90 PHEV took bronze back in … 2016! It has been a while, Volvo!

As for the bronze medal, while the #4 Peugeot e-208 and #7 Tesla Model 3 could in theory benefit from the runnout-mode of the #3 Lynk & Co 01 PHEV, as well as renewed strength from their recent refreshes, the Chinese SUV should remain ahead.

Looking at position changes, the Kia Niro climbed one position, to 5th, surpassing the Skoda Enyaq. Two interesting discussion points for the last stage of the race will be how high the #7 Tesla Model 3 will reach — if the 5th and 6th positions are achievable, and whether it will deliver enough units to bother the #4 Peugeot e-208 EV. Also, will the #10 Renault Megane EV be able to surpass the #9 Ford Kuga PHEV?

In the second half of the table, four models were up. Following a bad month for the Peugeot e-2008, which is seeing the transition to the refreshed version delayed, BMW’s i4 and iX1 rose one position each, to #12 and #13. The Opel Corsa EV followed the Bavarians up the ladder and surpassed the French crossover, with the Opel EV ending November in #14.

Finally, the Hyundai Tucson PHEV kept the last position on the table, but with the #21 Polestar 2 just 61 units behind, we might yet have a surprise here.

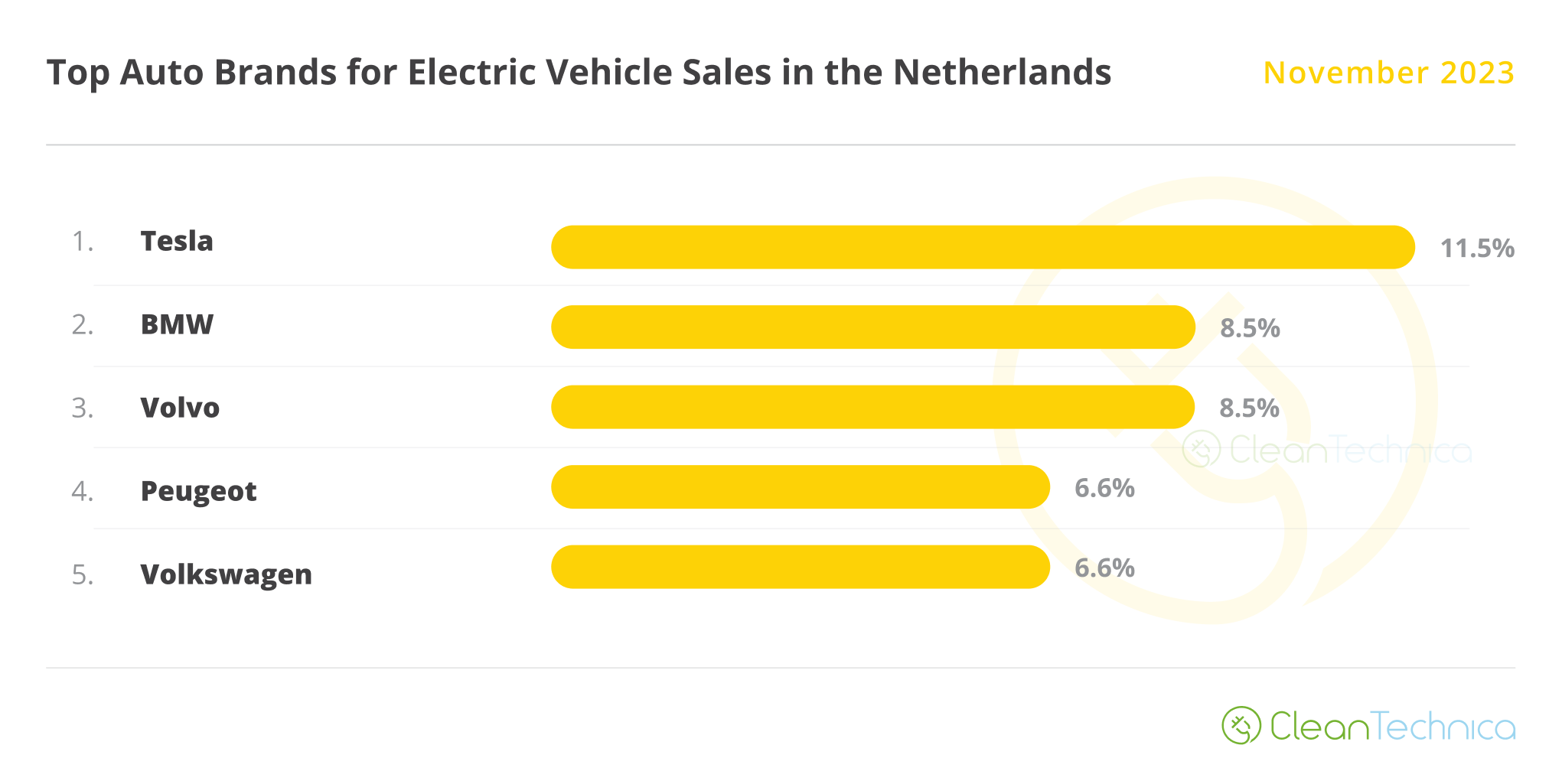

In the brand ranking, leader Tesla (11.5%, up from 11.1%) is the virtual winner, gathering its 4th best seller title in the manufacturer race and its first in the last four years — the last one was achieved in 2019.

Interestingly, and proving how diverse and fragmented this market is, we have had four different winners in the last four years, with Tesla taking the title in 2019, followed by Volkswagen in 2020, then by Kia in 2021, and finally by Volvo last year.

Back to 2023, the race for silver is quite heated, as we see #2 BMW (8.5%, up from 8.4%) and #3 Volvo (also 8.5%, also up from 8.4%) racing neck and neck for silver. Expect a close race between these two in the last stage of the race!

Meanwhile, Peugeot (6.6%, down from 6.9%) is continuing to suffer from delays in the launch of its refreshed EVs. It now has #5 Volkswagen (6.6%, down 0.2%) closing in. This duel is another point of interest for December.

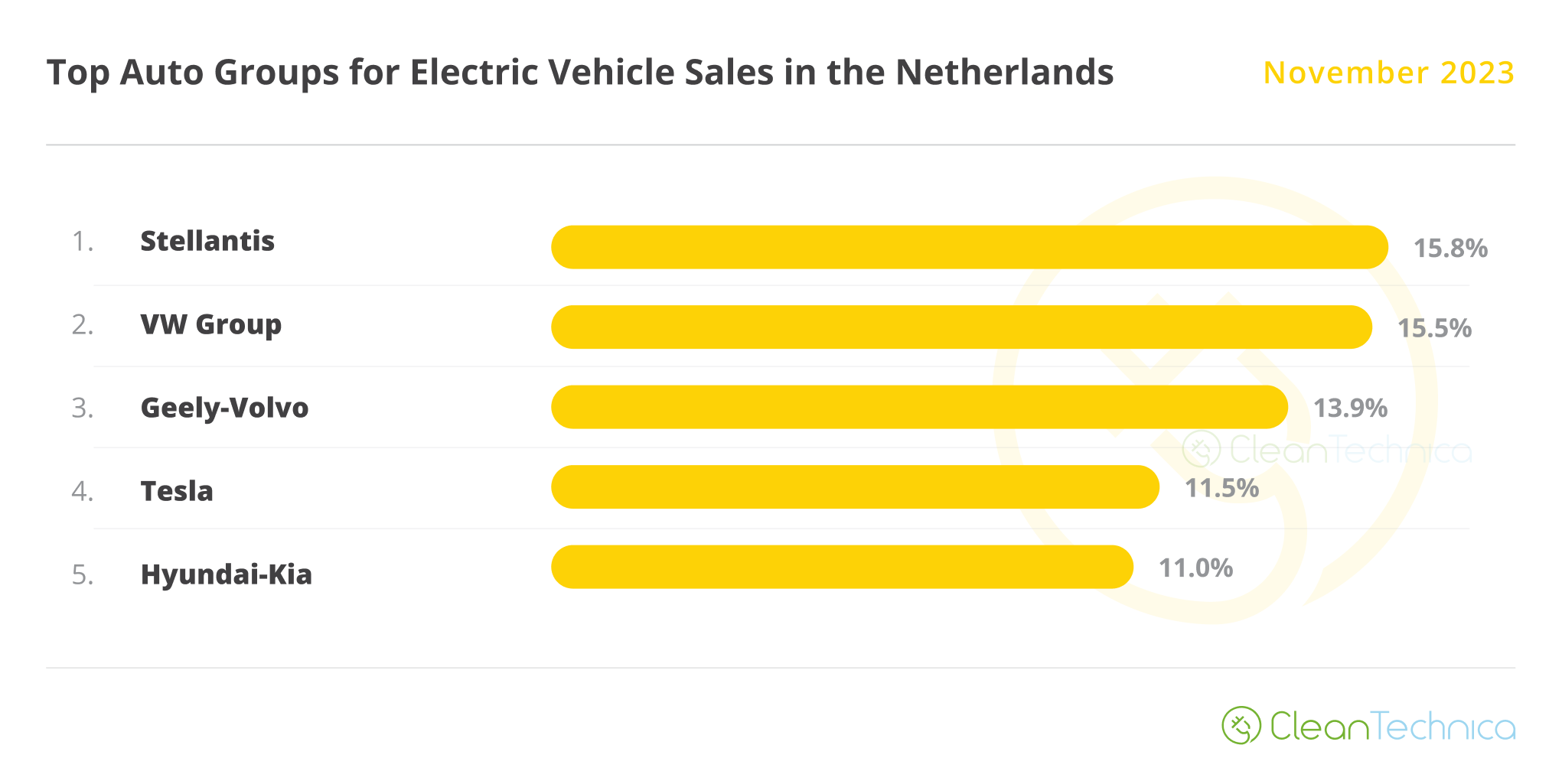

As for OEMs, leader Stellantis (15.8%, down from 16.1%) is slowly sliding, but luckily for it, so is #2 Volkswagen Group (15.5%, down 0.1%). With 0.3% share separating the two, the German OEM still has a chance to win this year’s title, which would be its 4th in a row!

On the other hand, if Stellantis wins, it will be the conglomerate’s first win in the Netherlands, ending a three-year rule by Volkswagen Group (which won all three previous titles, every time with around 22% share).

Back to the 2023 race, Geely–Volvo continued its steep descent, having dropped from 14.1% in October to its current 13.9%, but this time it wasn’t Volvo’s, or Polestar’s, fault — that responsibility fell solely on the shoulders of Lynk & Co, which is in runout mode.

Finally, #4 Tesla (11.5%, up from 11.1%) gained ground on the Koreans, Hyundai–Kia (11%), while #6 BMW Group is stable with 9.6% share.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.