Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

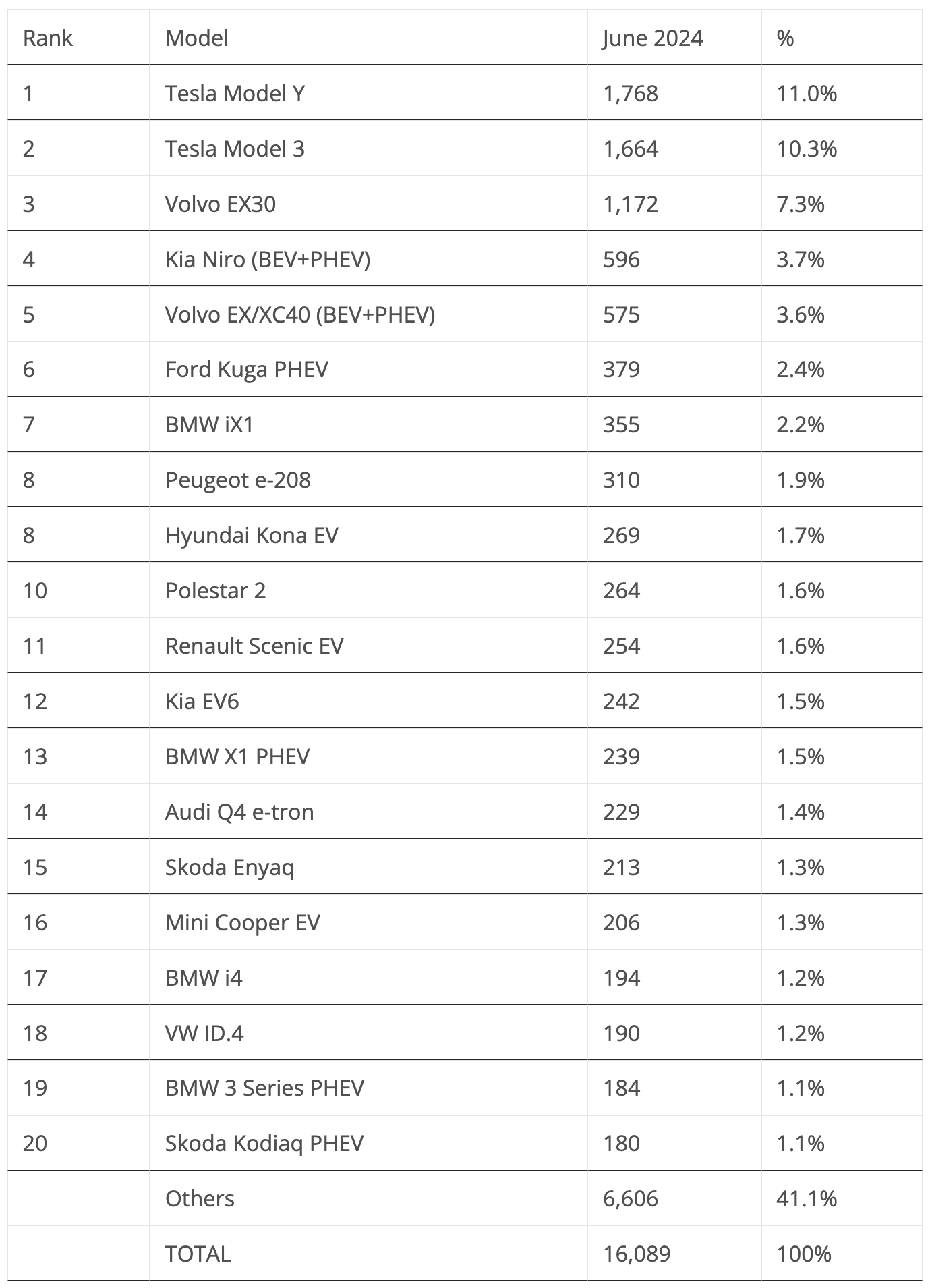

In a negative month in the overall market (down 12% to 35,386 sales), June saw plugin registrations also drop by 15% YoY, to 16,089 units. As a result, the Dutch plugin vehicle (PEV) market reached 45% market share last month, in line with the year-to-date average. That’s mostly thanks to pure electrics (33% of new vehicle sales). With 11,816 registrations, pure electrics (BEVs) represented 73% of all plugin sales last month, above the YTD average of 70%.

Comparing the current results with 2023, we are above the full year score (44% PEV, 31% BEV), and more importantly, 3% above the results presented 12 months ago. With the help of new models landing soon, it points to the possibility that the Dutch EV market could reach the 50% mark already this year, with BEVs at 36%! That would be some good news!

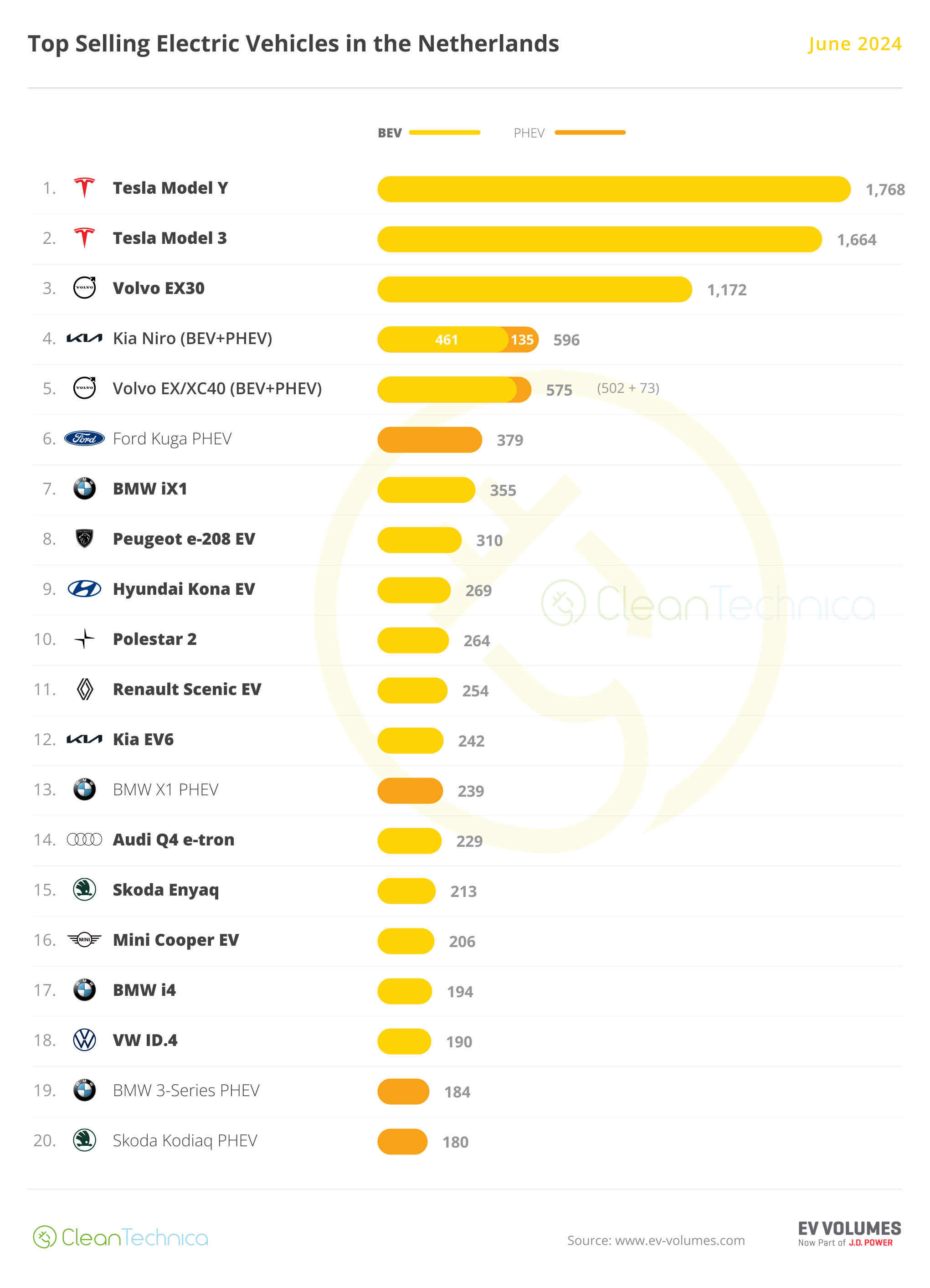

Looking at the overall auto sales table, Tesla profited from a high tide in the Dutch market, scoring a #1 and #2 win in June, with the Model Y leading thanks to 1,768 units while the Model 3 had its best result in years by scoring 1,664 sales, no doubt influenced by the pre-tariff increase sales rush.

The also Made-in-China Volvo EX30 was 3rd, with 1,172 sales, thus making a 100% BEV podium in the overall market. The Kia Niro (52% plugin sales) took profit from the additional units coming from the HEV version to take 4th place with 1,142 registrations, leaving the 5th position to the Volvo EX40/XC40 (82% of units were plugins). It was thus a full 100% plugin podium in the Netherlands. This is another sign of the merging of the plugin and overall markets continues.

We should highlight that the #4 Kia Niro had a significant change in the powertrain mix. Until recently, the BEV version usually represented the majority of sales of the crossover, but in June, the BEV share dropped to 40%, while the HEV share of sales rose to 48%. Is the upcoming Kia EV3 already making a dent in the Niro EV orders? That is a strong possibility, as the EV3 is said to start at 37,000 euros, some 2,000 euros below the current Kia Niro EV’s price. For buyers, it’s really a no brainer — if they wait a few more months, they get a better, cheaper, and more modern model.

As such, we might see the same cannibalization process among the Kia EVs that we are currently witnessing between the Volvo EX30 and its slightly bigger, older, and more expensive XC40/EX40 sibling.

The best selling pure ICE model in the overall ranking was only 8th, with the little Toyota Aygo X winning that title. (We really need small, cheap EVs….)

The plugin table repeated the overall top 5, while below them, the Ford Kuga PHEV was 6th, with 379 registrations, the crossover’s best score in 10 months. Just below it, we have the BMW iX1, which continues to impress. It registered 355 units, its best result in 2024.

Still on the top half of the table, the Polestar 2 was 10th, with 264 registrations, its best result in over a year, giving much needed good news to the struggling startup brand.

But the real news is in the second half of the table, with three new models already making themselves noticed. The Renault Scenic EV jumped to #11 in only its 2nd month on the market. The compact Renault, which went from being an MPV to a crossover in this latest generation (I guess we have to change with the times…) has already become Renault’s best selling EV by far. The 2nd best selling Renault, the Megane EV, had only 117 registrations. How high will the French EV go? With prices starting at 42,500 euros for the 430 km WTLP range and 48,000 euros for the 625 km WLTP range version, this is a competitive model in the category, so a top 10 position should be relatively easy for it to achieve.

And Renault really needs a successful model in the coming months, as the hot new Renault 5 is only set to land late this year.

Another model landing with strong results is the new Mini Cooper EV, which had 206 sales in June, the nameplate’s best result in a year. It will be interesting to see how the new Made-in-China model behaves in the next few months, considering the recent tariffs increase for BEVs made in that country.

Finally, the biggest surprise of the month was the Skoda Kodiaq PHEV landing straight in the table, in #20, with 180 registrations. The Czech midsize 7-seat SUV packs a big(ish) 26 kWh battery and CCS charging, and it seems poised to become a regular presence in the top 20.

Outside the best sellers table, the rise and rise of the BMW i5 (169 registrations) continues. The big sedan has beaten the remaining full size competition, and the good news for BMW Group does not stop there, as the Mini Countryman EV scored 129 units in only its second month on the market, which means that the ramp-up of the crossover is in full motion. We could see the German-made Brit reach the table soon.

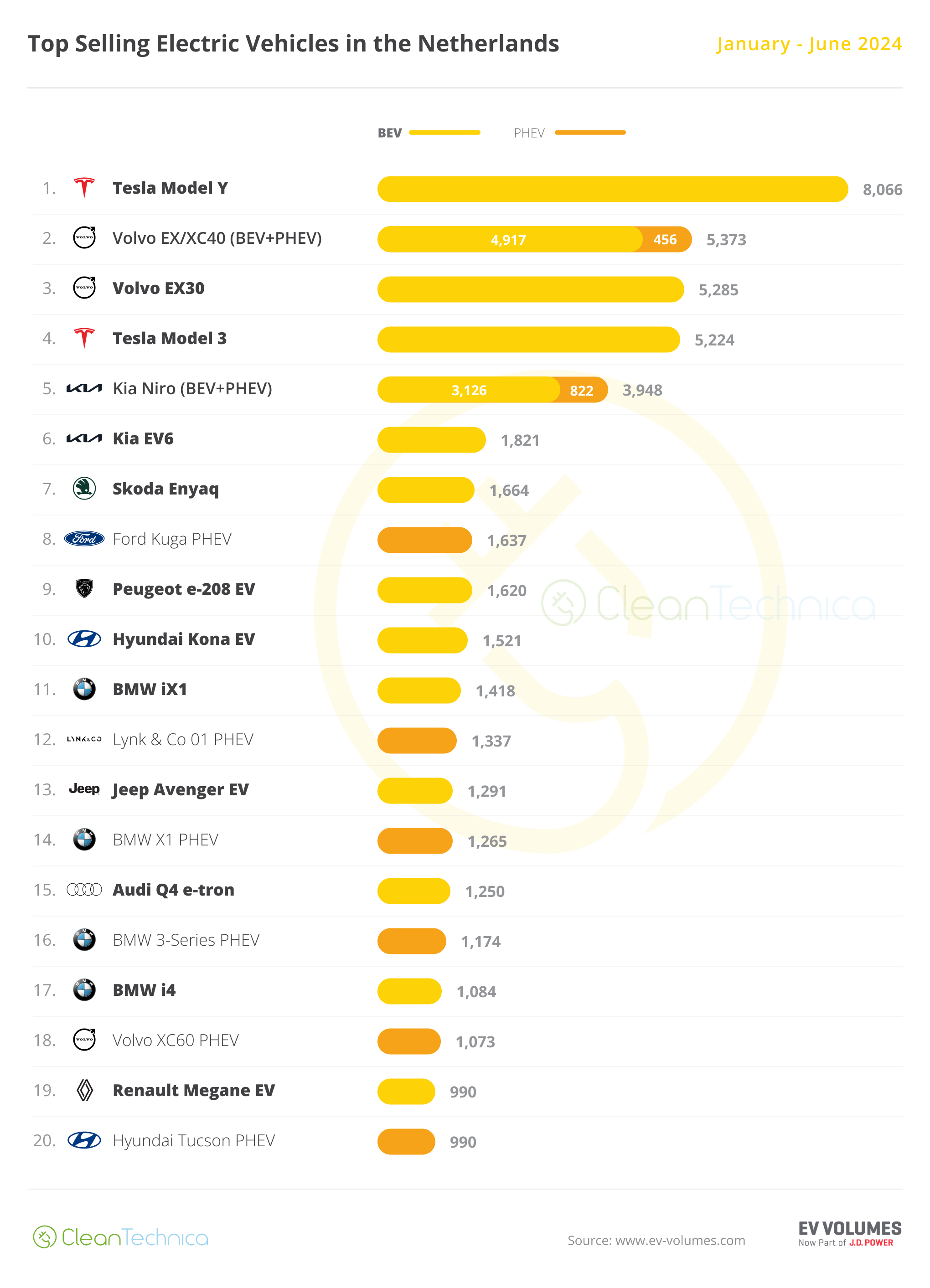

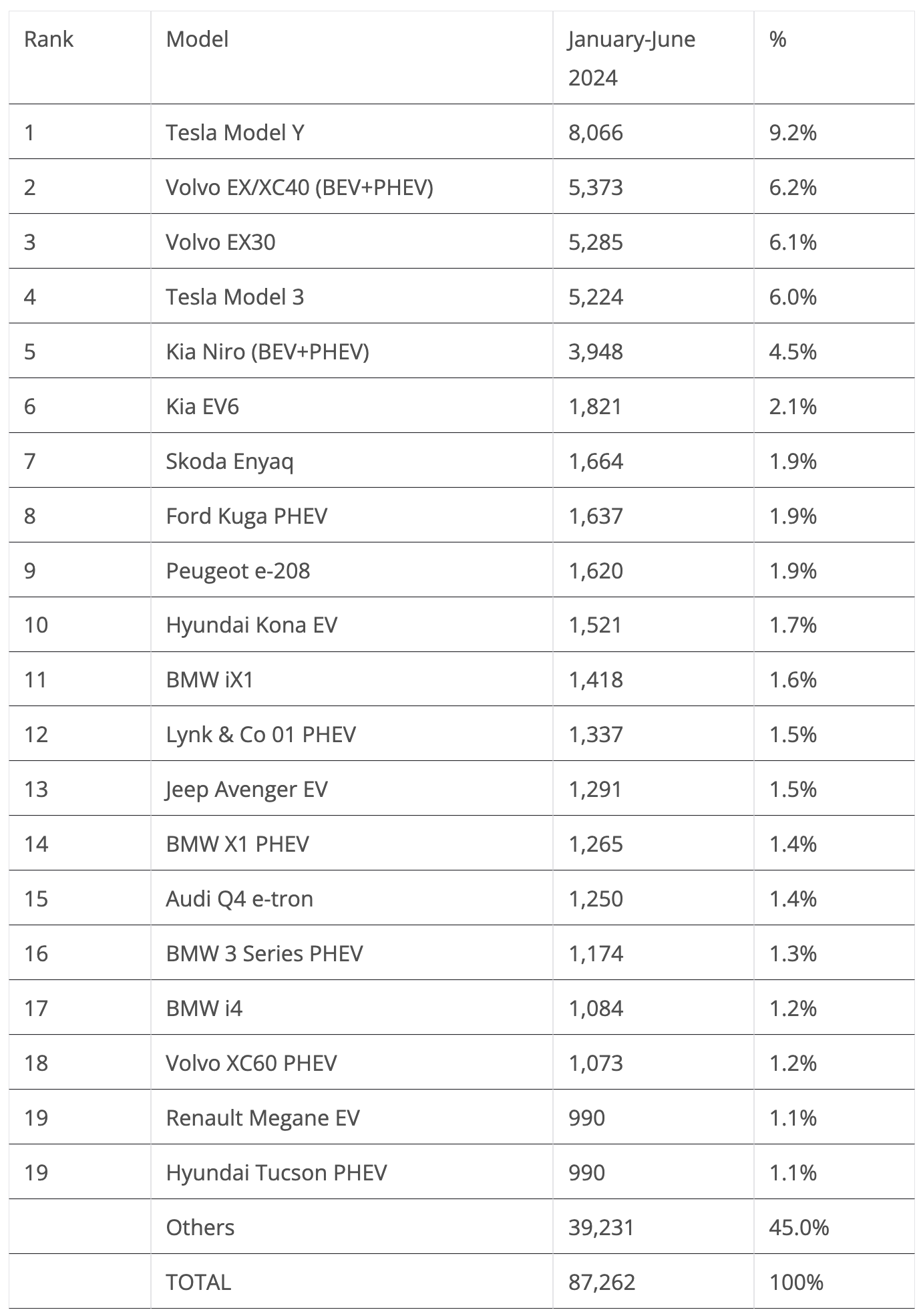

Looking at the 2024 ranking, the Tesla Model Y has over 2,500 units of advance over the runner-up Volvo EX/XC40, which should be enough to remain comfortable in the lead and renew its 2023 best seller title.

But the runner-up spot is open for discussion. With the EX/XC40 showing its wrinkles (it has been on the market since 2017), and with its younger sibling EX30 and the Tesla Model 3 fewer than 150 units behind the Belgian-made Swede, expect these last two to surpass it soon and battle for the 2nd position between themselves. With both models being hit by the tariffs increase, it will be interesting to see how these two Made-in-China models will behave under the new rules.

One thing is for sure — with the Tesla Model 3 sure to end the year on the podium, it will be the first time since 2020 that the midsize sedan ends on the Dutch podium.

The Kia Niro closes out the top five, with no real competition in sight.

The Ford Kuga PHEV was up one spot, to 8th, cementing its leadership position in the plugin hybrid category, especially since the category runner-up, the Lynk & Co 01 PHEV, is slowly walking into PHEV Heaven.

In the second half of the table, it’s a BMW bonanza, with three Beemers on the rise. The popular iX1 continued to go up, now to 11th; the bread and butter 3 Series PHEV climbed to 16th; all while its BEV cousin, the sportier i4 fastback, is now 17th. BMW is on a roll — not only does it now have the big i5 taking over the full size category, but it is also ahead of its German arch rivals in the two categories below. Not bad, considering it is the only of the three using multi-energy platforms.

Finally, a note is warranted on the #21 Porsche Cayenne PHEV (936 registrations) and the #22 Polestar 2 (929 registrations), which are both quite close to the #19 Renault Megane EV & Hyundai Tucson PHEV, both with 990 registrations. So, we might see some position changes here in July.

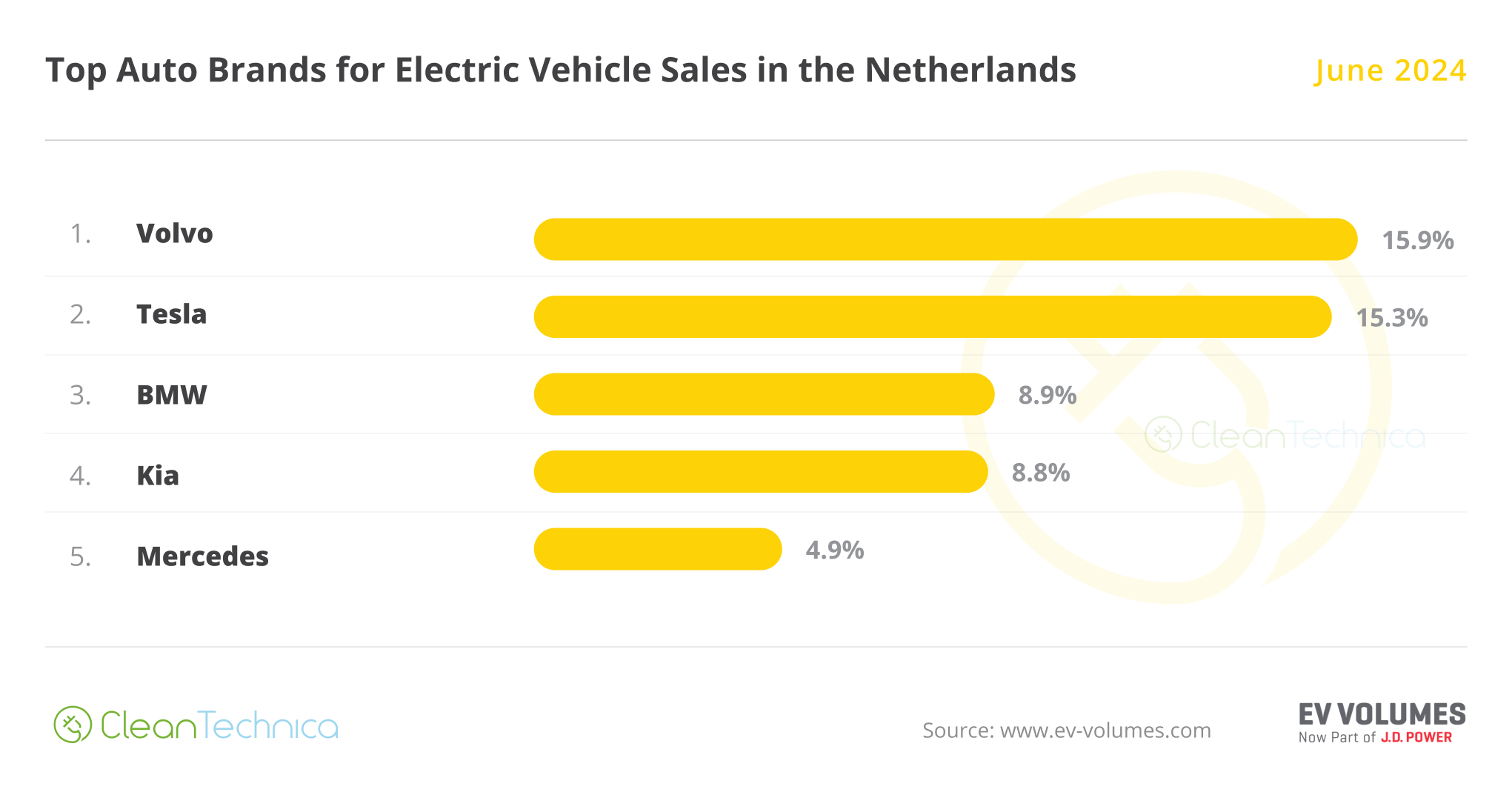

In the manufacturer ranking, leader Volvo continued to rise, now at 15.9%, up 0.2% from May, while runner-up Tesla is at 15.3%, up 1.9%, thanks to its expected end-of-quarter peak. It looks like the Swedish brand could recover the manufacturer title, which it had already won in 2022 but then lost to Tesla in the following year.

Meanwhile, we have a position change in 3rd, with Kia (8.8%, down from 8.9%) being surpassed by a strong BMW (8.9%, up 0.2%) as the German make seems set to repeat another podium presence in the Dutch ranking.

Finally, in 5th, we have a falling Mercedes (4.9% share, down 0.4%), which hasn’t managed to place any model in May’s top 20. It’s possible that rising Hyundai, now 6th, with 4.2% share, could surpass Mercedes soon.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Having a quick look at June’s overall top 20, we can see the different dynamics currently happening, with the heavily electrified #3 Volvo being the fastest growing brand (+156% YoY!) while #15 Opel (-55% YoY) and … #6 Volkswagen (-57% YoY!!!) were the hardest hit with falling sales, and while Opel has new models coming soon (new Grandland and new Frontera) to help sales, Volkswagen has … crickets?

Although this could have been an allocation issue — after all, May was a positive month for the German make — it will be interesting to see how the following months go for Volkswagen to know better its future in this market.

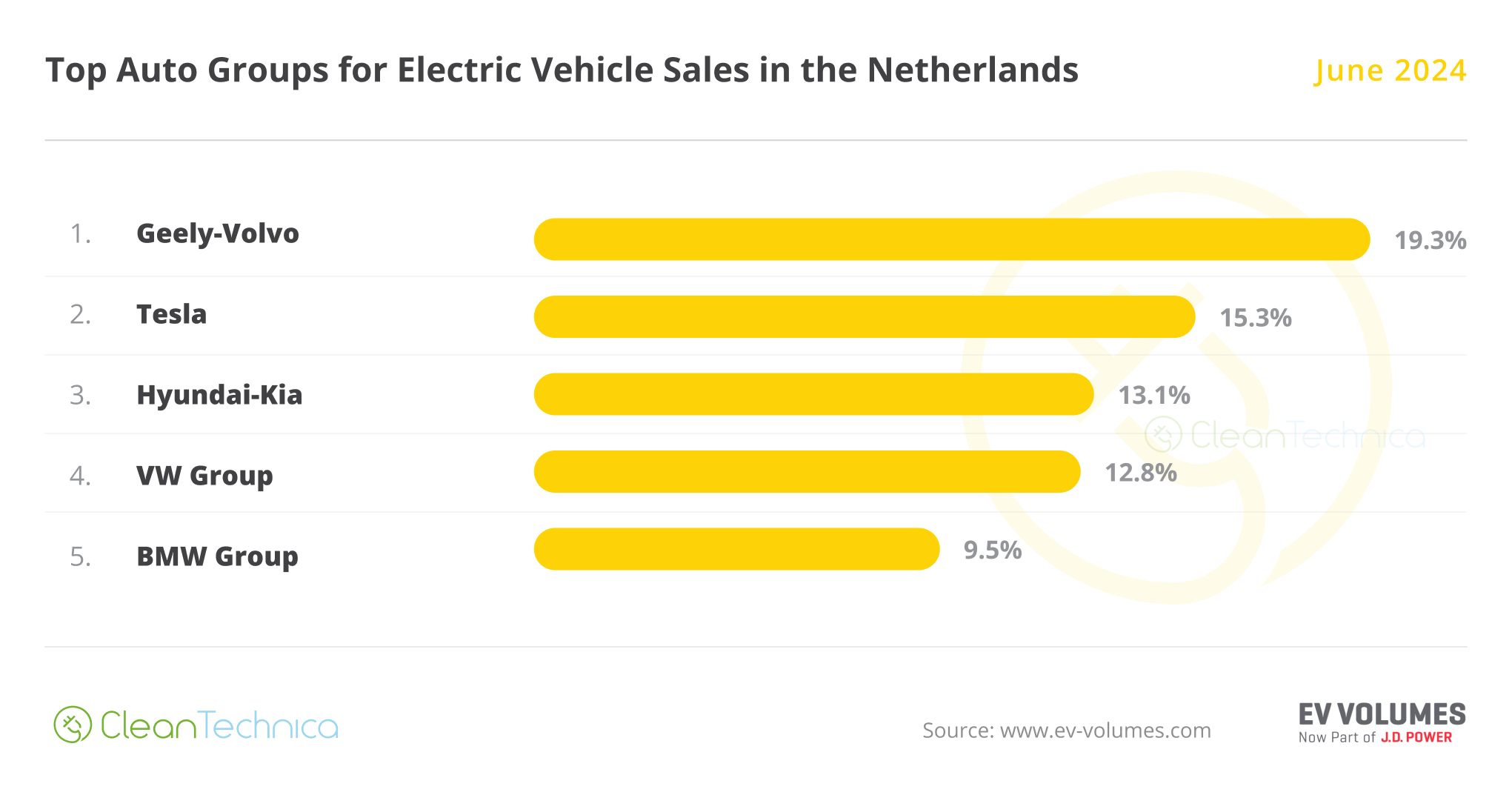

As for OEMs, the leader, Geely–Volvo, is at 19.3% share, which is slightly above the previous month (19.1%) thanks to positive performances from Polestar and, above all, Volvo, which managed to offset Lynk & Co’s current sales blues.

Tesla is second, with 15.3% share, and behind it, we have a surprise, with a weak month from Volkswagen Group (12.8%, down from 13%), allowing Hyundai–Kia (13.1%) to surpass the German OEM and jump into third, which is something of a small feat, as the Korean OEM was 5th a year ago.

BMW Group (9.5%, up 0.3%) is 5th and continues on the rise, all while #6 Stellantis (7.9% down from 8.2% in May) continues to slide, and it is important not to forget that the multinational conglomerate was in 2nd place in this market just a year ago.

True, Stellantis has a lot of high-volume models coming in (Citroen e-C3 EV, Citroen e-C3 Aircross EV, Opel Frontera EV, Fiat Grande Panda EV, etc.), but they will need to hit the ground running, not only because they need to stop the current sales bleed, but also because the recent tariffs increase is a bandaid that grants European OEMs just a couple more years to develop their efforts in the lower end of the market. And with Renault only delivering high volumes of its Renault 5 next year and Volkswagen Group’s small EV models only landing in 2026, this is a golden opportunity to gain an early lead over their local competition and establish enough scale in the next couple of years to be able to have a fighting chance to face the Chinese competition head on — not only in Europe, but also in Latin America, where Chinese OEMs are already making significant inroads in markets where Stellantis is traditionally a major player.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy