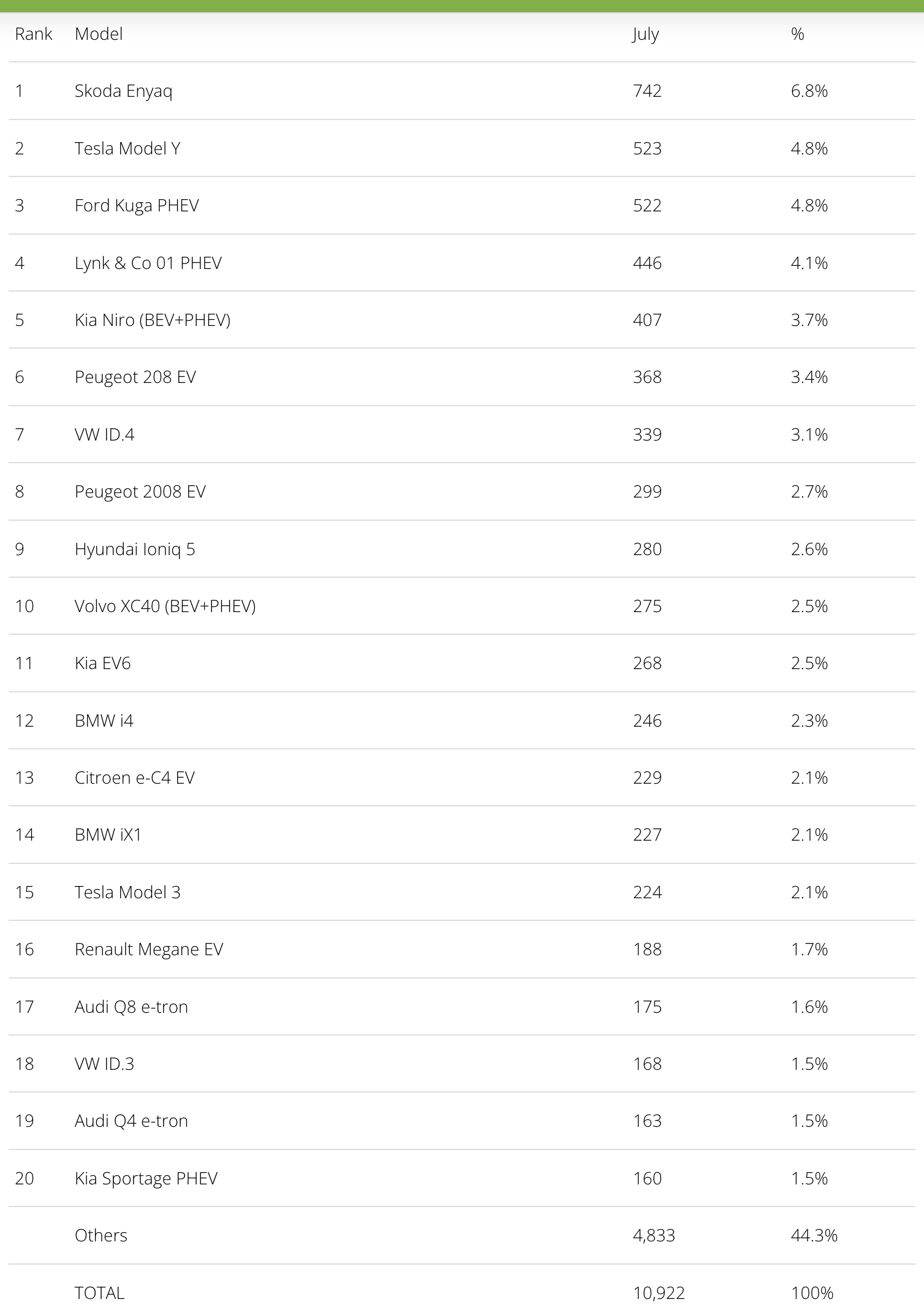

The Netherlands saw an increase in plugin registrations to 10,922 units in July, with the Dutch plugin vehicle (PEV) market reaching 38% last month. That kept the year-to-date (YTD) score at 42%. That’s mostly thanks to pure electrics (25% of new vehicle sales), which jumped 43% year over year (YoY). The overall market is also rising. It got up to 28,687 registrations, although at a slower rate (+31% YoY).

Expect the final plugin share for 2023 to end close to 50%, probably around 47%, which could mean that the Dutch market could have its EV transition finished before the end of the decade!

Looking at the BEV vs. PHEV breakdown, pure electrics had 65% of total plugin sales in July, dropping the YTD average to 68%. I do expect the BEV share to end the year at 80%, a significant advance over the 69% share of 2022, which might mean that PHEVs will lose relevance in this market by 2025 and it will become a BEV-based market from then on.

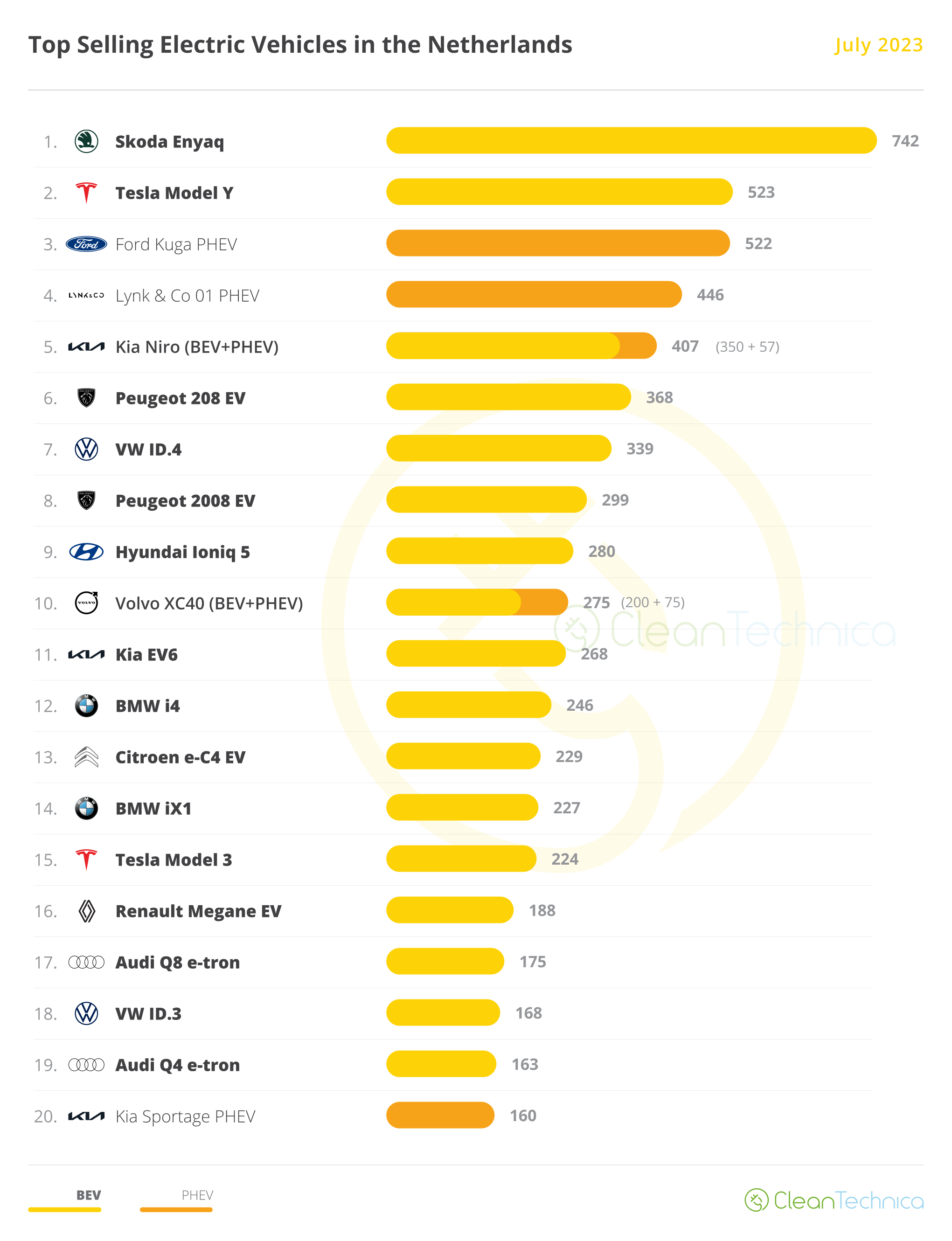

In July, the Skoda Enyaq was #1 in the EV race, with 742 registrations, its best result in 15 months. Overall, it was #2 in the overall auto market ranking as well.

The Czech model was followed by the #2 Tesla Model Y, which had 523 registrations, a positive result considering we are talking about the first month of the quarter. In 3rd, just one unit behind the US crossover, we have the Ford Kuga PHEV, which amazingly scored a record result in July — 522 registrations. That’s an awesome result considering that July is one of the slowest months of the year due to the holiday season!

It wasn’t just the top two shining — in the 13th spot, we have the Citroen e-C4, with a solid 229 deliveries, a good result for the quirky hatchback disguised as a crossover.

Further below, the highlight goes to the Audi Q8 e-tron, which had 175 registrations, allowing it to be #17 last month. The big Audi thus consolidated its position as the best seller in the full size category.

On the other hand, the Renault Megane EV was only #16 in July, with just 188 registrations, even ending behind the personal Citroen e-C4. I believe this is something for Renault management to think about, and maybe it is time for the French brand to slash the price of its hatchback if it wants to remain relevant until the arrival of the future Renault 5.

Outside the top 20, there wasn’t much to talk about, the only highlight being the Polestar 2, which delivered 154 units (only 6 units fewer than the #20 Kia Sportage PHEV).

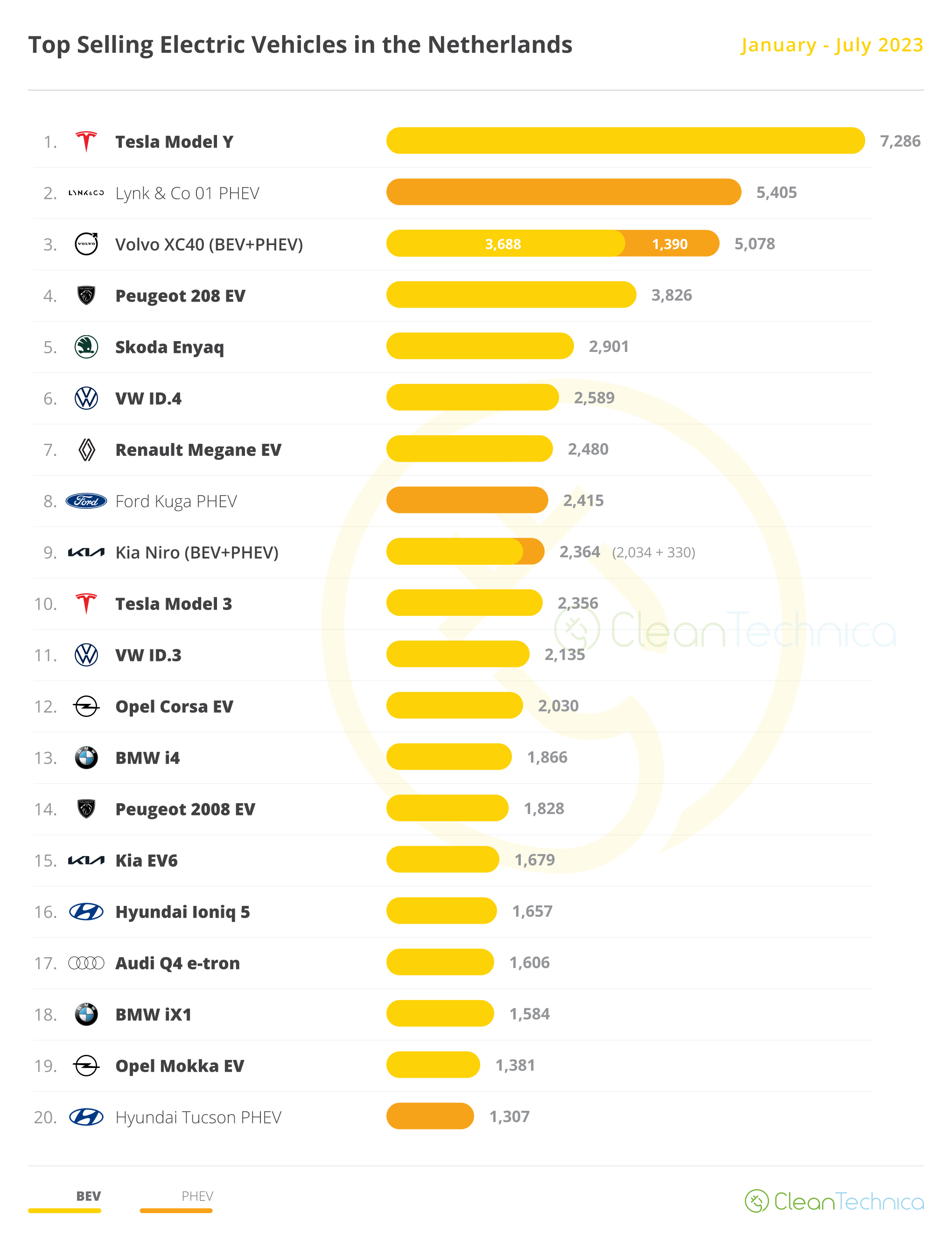

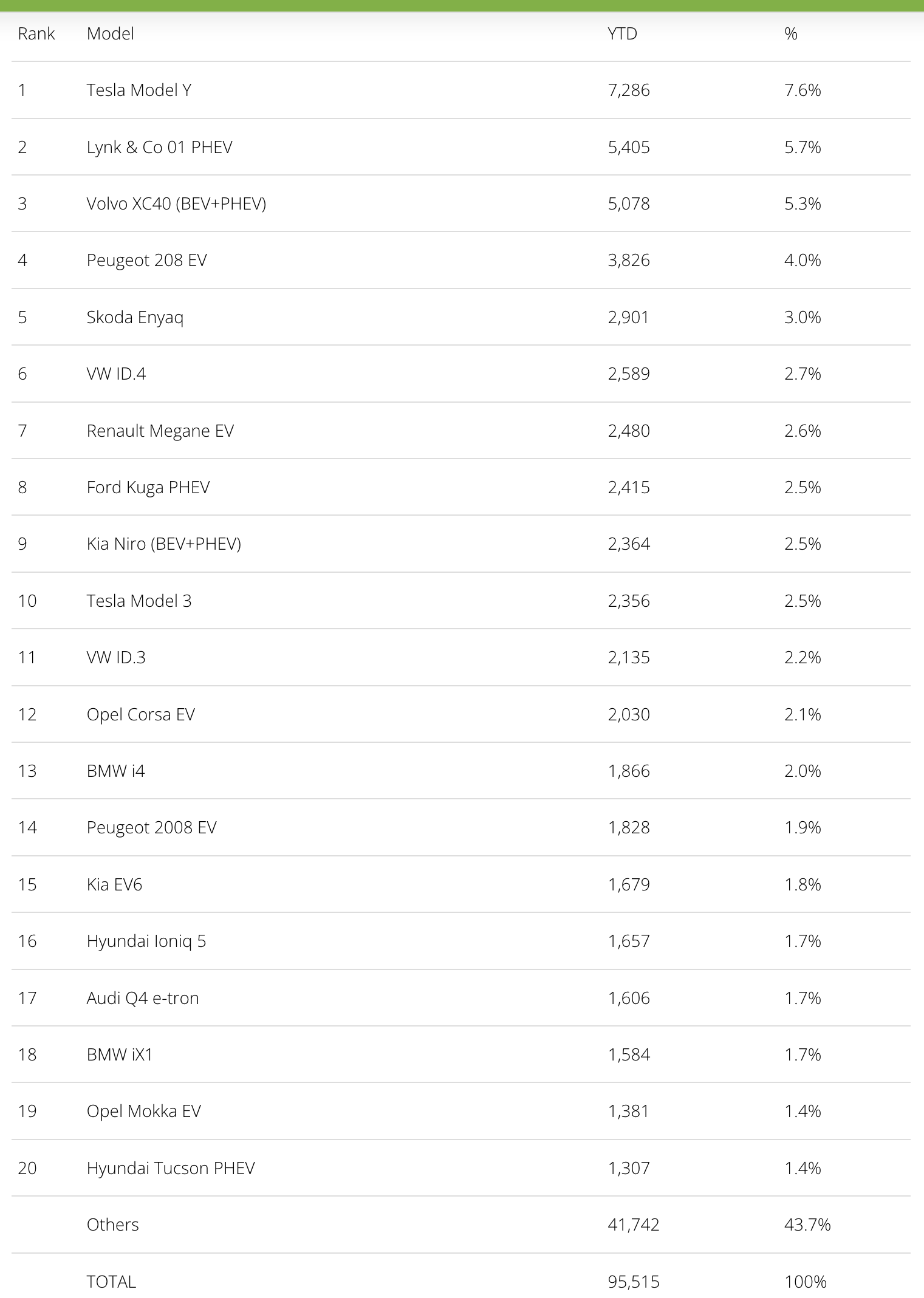

Looking at the 2023 ranking, the Tesla Model Y has enough distance over runner-up Lynk & Co 01 PHEV to remain comfortable in the lead. The compact Chinese SUV has gained important ground over its cousin, the #3 Volvo XC40, with the Swede now 327 units behind the Lynk & Co model.

Off the podium, the main news is the Skoda Enyaq benefitting from a strong month in July to jump two positions in the YTD table, to 5th.

The Ford Kuga PHEV was also up, benefitting from the fact that this Ford model is now PHEV-only in this market. That added to competitive leasing rates, a critical factor in all-important company car segments, and it allowed the plugin hybrid crossover to jump four positions to 8th.

In the second half of the table, the highlights come from Korea. The Kia EV6 climbed to 15th, while the rolling work of art Hyundai Ioniq 5 was up to #16.

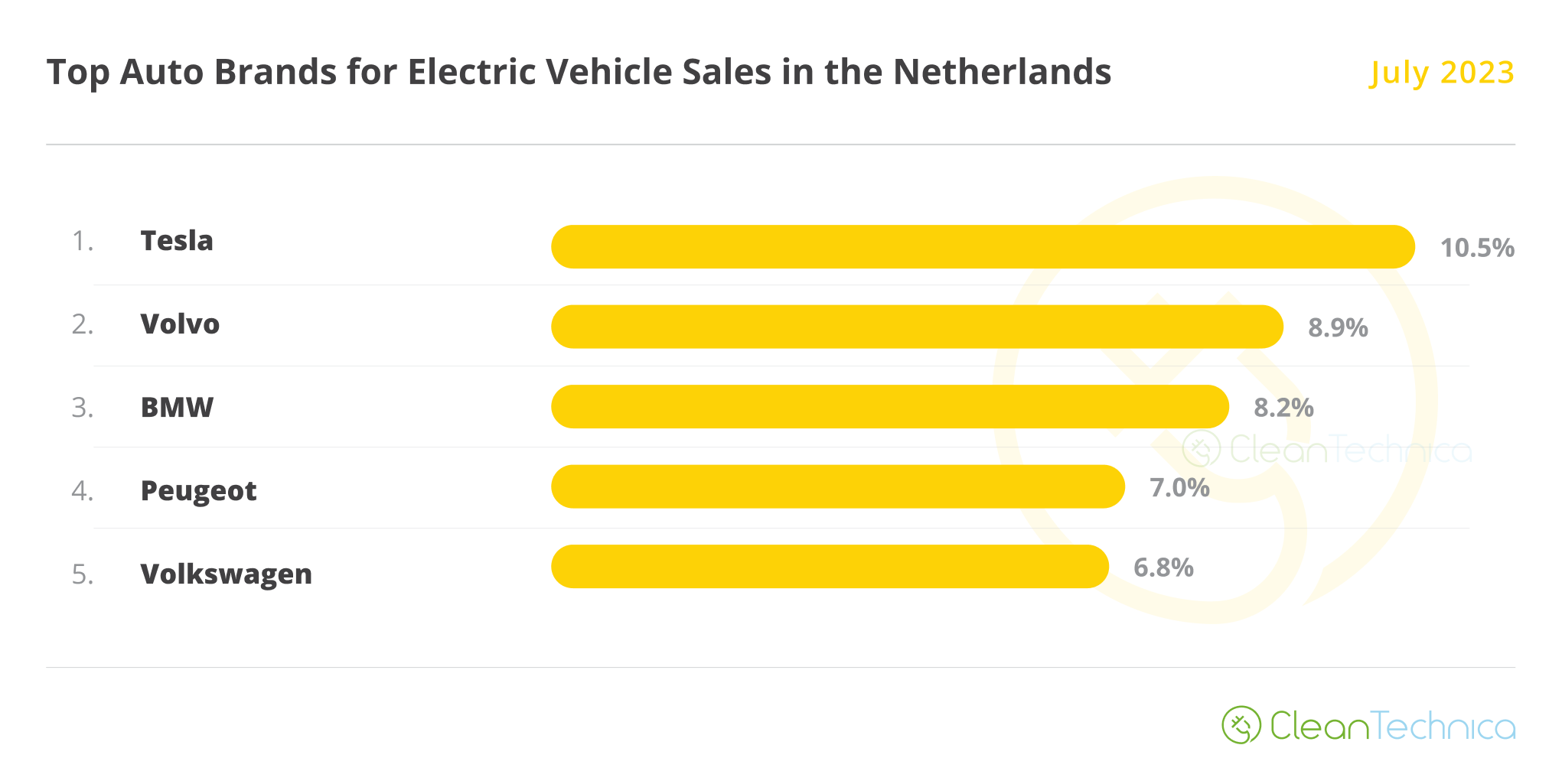

In the manufacturer ranking, both the leader Tesla (10.5%, down from 10.9%) and the runner-up Volvo (8.9%, down from 9.4%) lost share, but while that is not a concern for Tesla, as that was already expected due to the fact that July is usually a slow month for the brand (first month of the quarter), Volvo’s drop comes after a few other slow months. Is the future EX30 already drying up demand for the current XC40?

Meanwhile, BMW (8.2%, up from 8.0%) remained in 3rd, while Peugeot (7.0%, up from 6.9%) remained stable in 4th thanks to the good results of its 208/2008 small car family. The French make thus stayed ahead of #5 Volkswagen (6.8%).

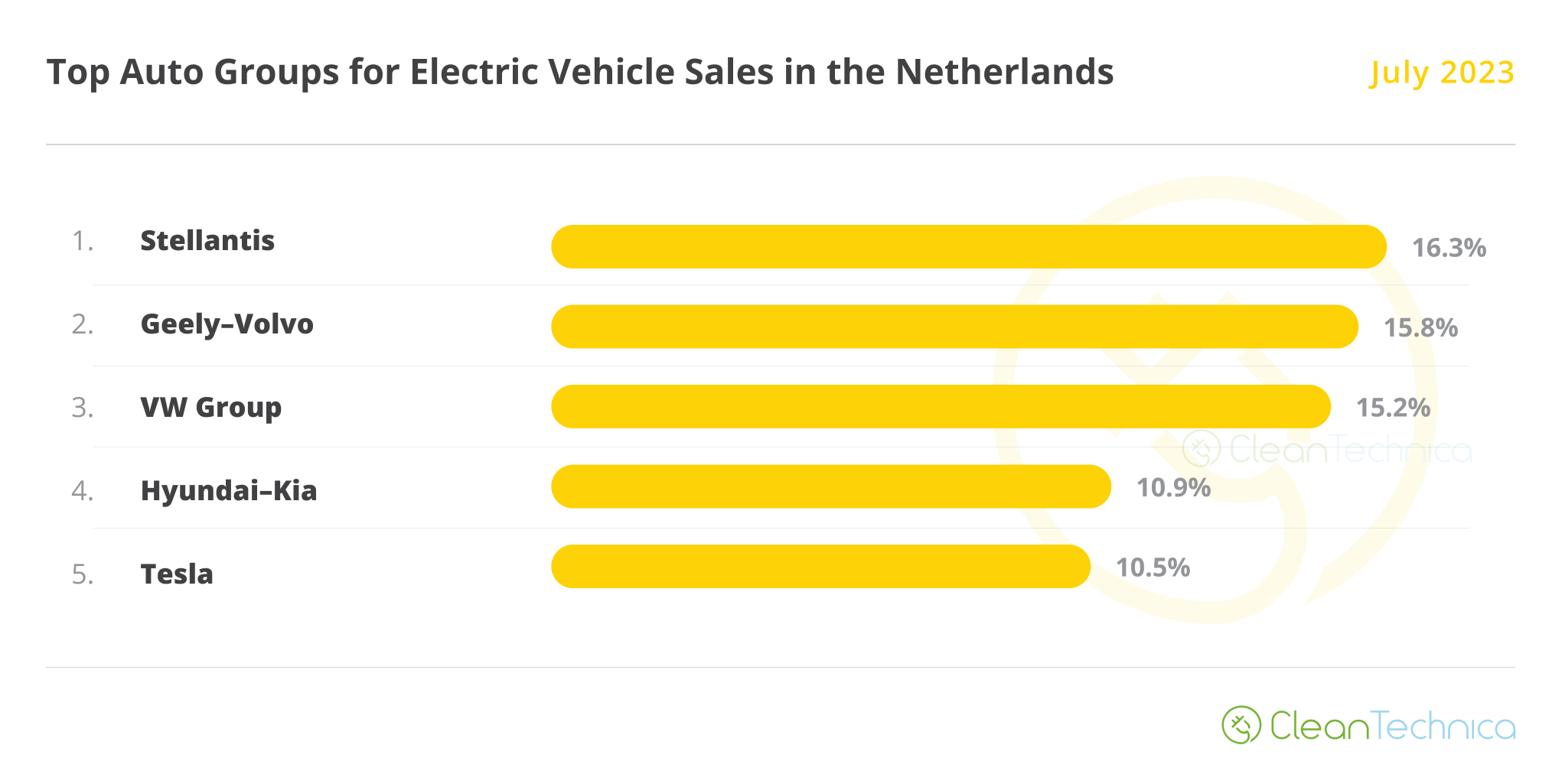

As for OEMs, the former leader, Geely–Volvo, again lost share, going from 16.5% down to 15.8%. That’s far from the 18.3% it had in May. That was mostly due to Volvo and Lynk & Co having a slow month. In fact, that allowed Stellantis to surpass them, despite also losing share (16.3%, down from 16.4%). Will the multinational conglomerate be able to keep the leadership position until the end of the year?

Worse still for Geely, #3 Volkswagen Group is rising (15.2%, up from 14.5%) and now has the #2 spot if not the #1 spot within target range. Another position change may happen here in a few months.

Finally, the Koreans, the Hyundai–Kia collab, benefitted from a positive month (10.9%, up 0.4%) and surpassed Tesla to climb into the #4 position.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …