Plugin vehicles are all the rage in the Chinese auto market. Plugins scored 600,000 sales last month, up 54% year over year (YoY). That pulled the year-to-date (YTD) tally to over 2.5 million units.

Share-wise, with May showing another great performance, plugin vehicles hit 35% market share! Full electrics (BEVs) alone accounted for 24% of the country’s auto sales. This pulled the 2023 share to 35% (24% BEVs), and considering the current growth rate, we can assume that China’s plugin vehicle market share will end over 40% by the end of 2023.

Another measure of the importance of this market is the fact that China alone represented around 60% of global plugin registrations last month!

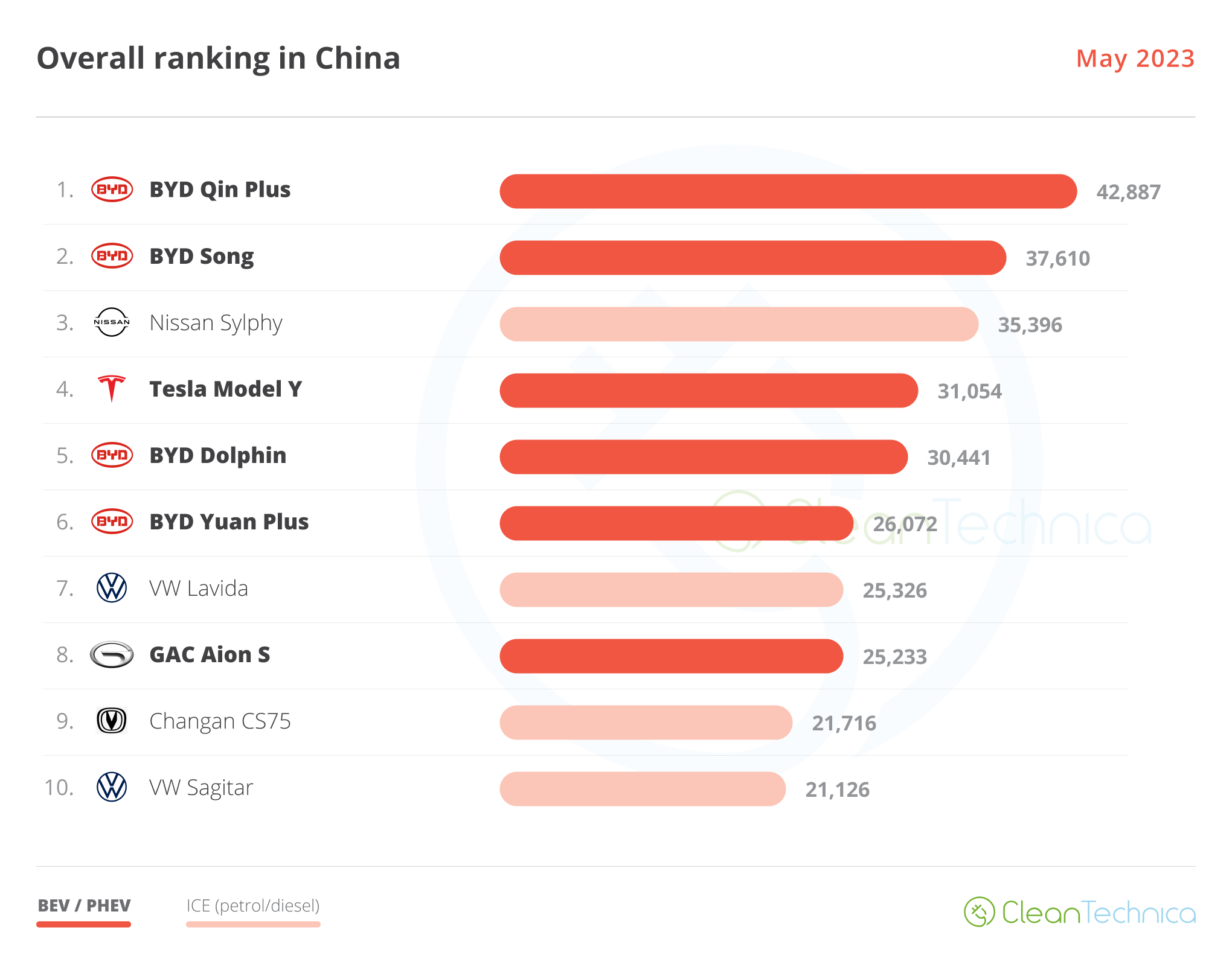

Looking at May’s best sellers in the overall market, we see plugins populating most of the top 10, with 6 plugin models in the overall top 10. In the top 6, the only pure ICE model was the Nissan Sylphy. And to think: in other markets, we celebrate when one EV breaks into the overall top 10….

But looking at the best sellers by category, we see that some still need a heavy dose of electrification:

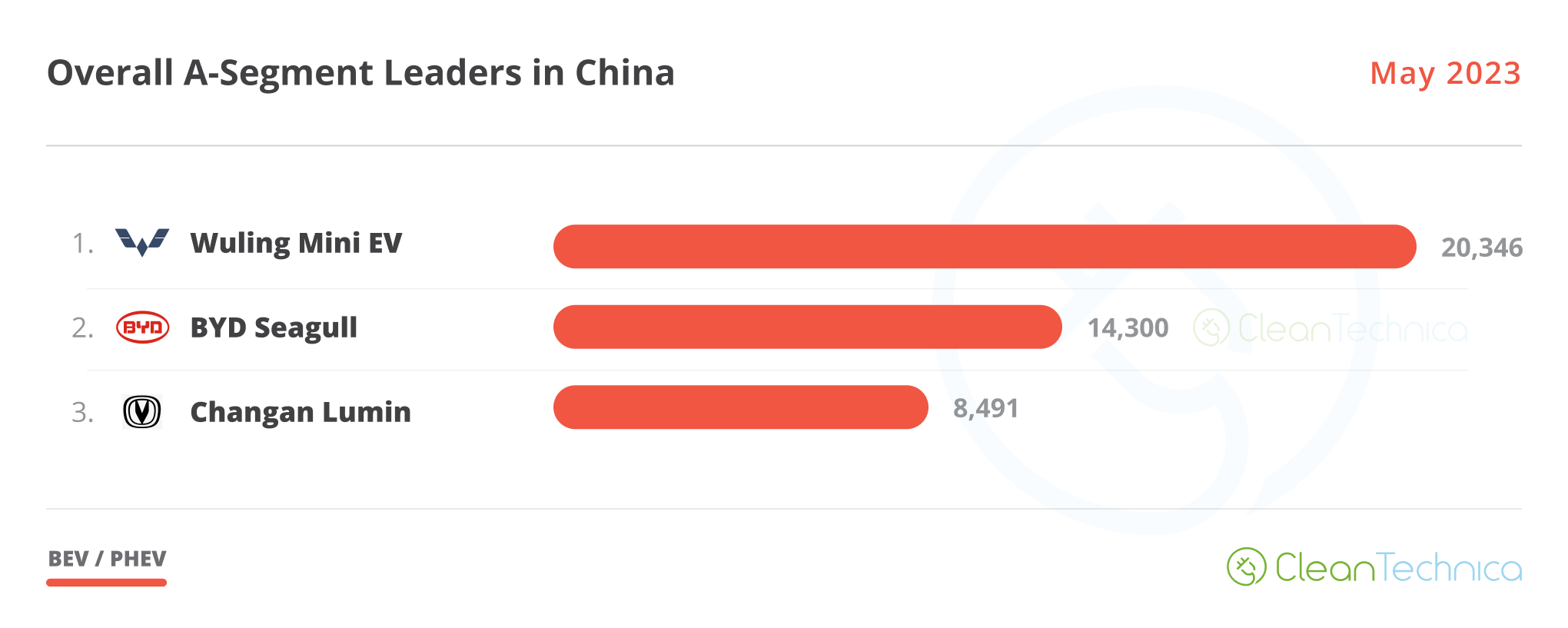

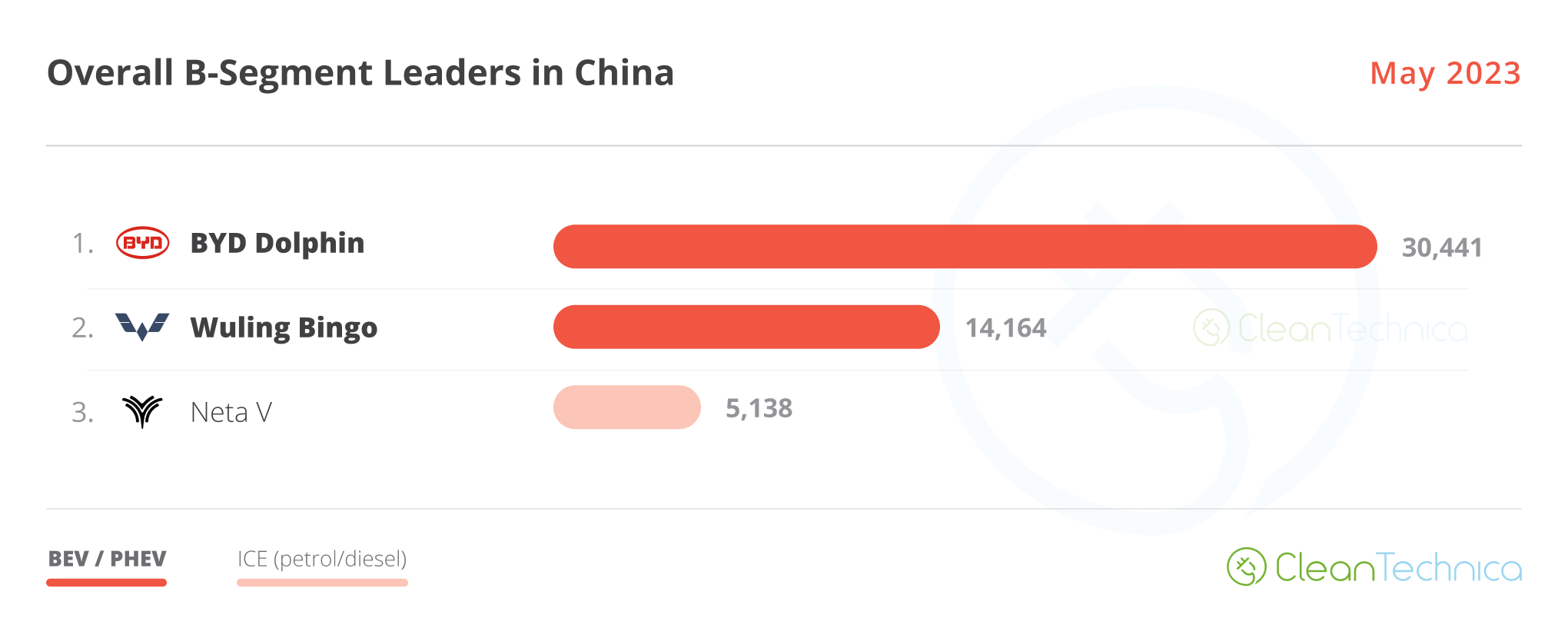

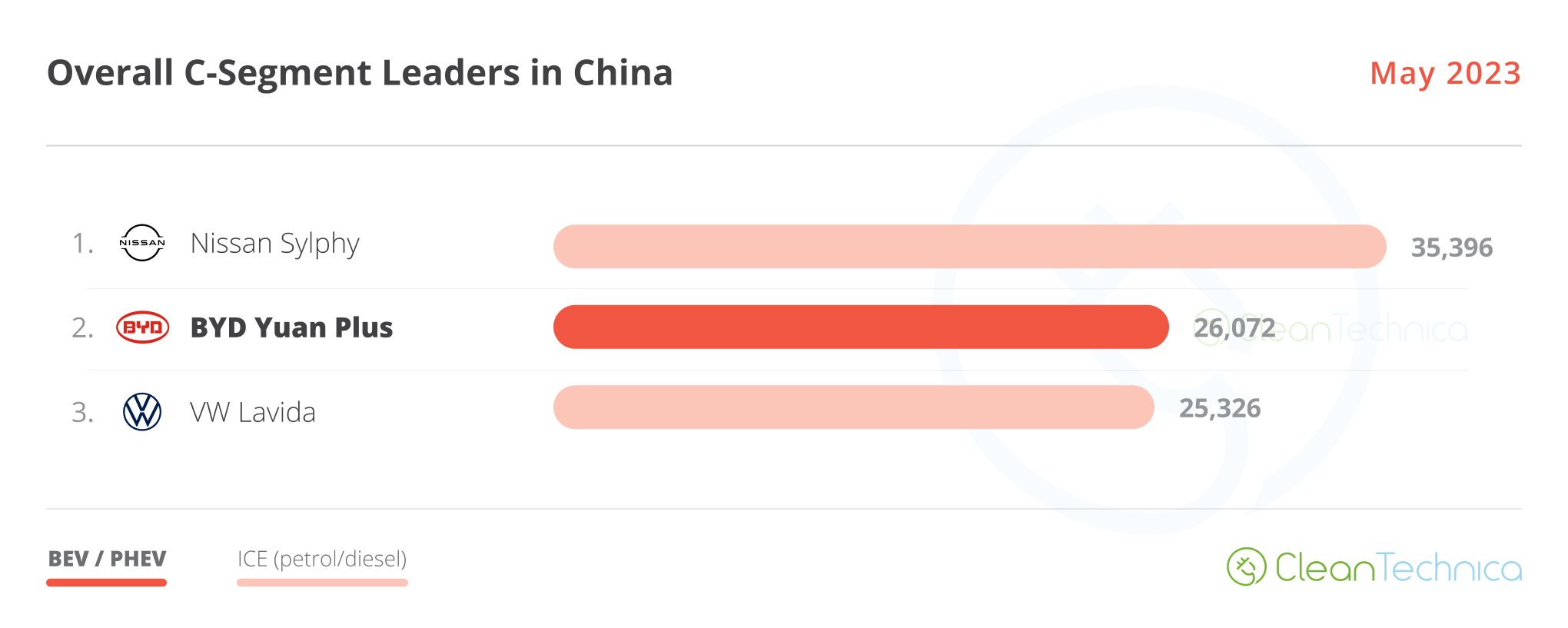

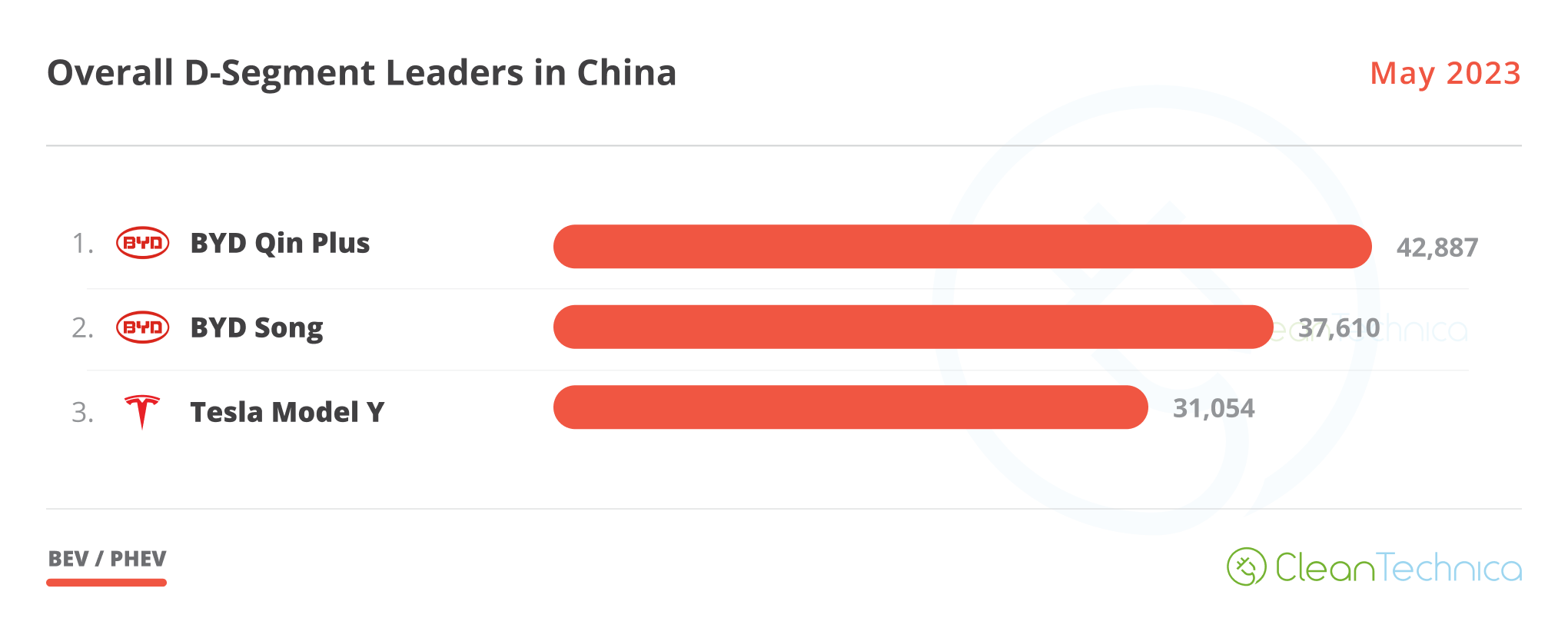

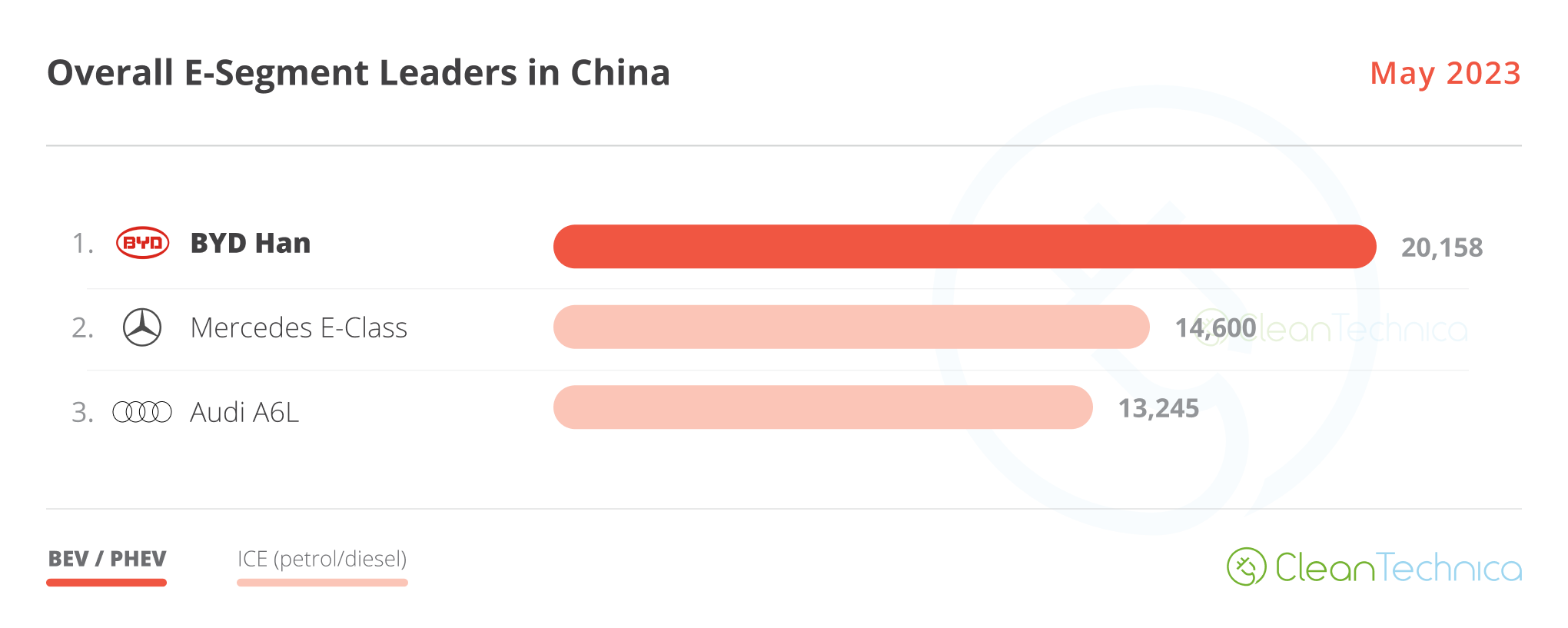

As we can see, while city cars (A-segment), subcompacts (B-segment), and the midsize category (D-segment) are heavily electrified, compacts (C-segment) and full size (E-segment) models still have some work to do.

The full size category is a real case study, as the premium German models continue to be on top despite the fact that they are essentially ICE-based models, and in the case of Mercedes, while the corresponding BEV model (EQE) is struggling to reach 1,000 units per month, the bread and butter E-Class continues to easily surpass the 5-digit mark every month. Is it a case that having a big, luxurious ICE car in China is the ultimate synonym of luxury?

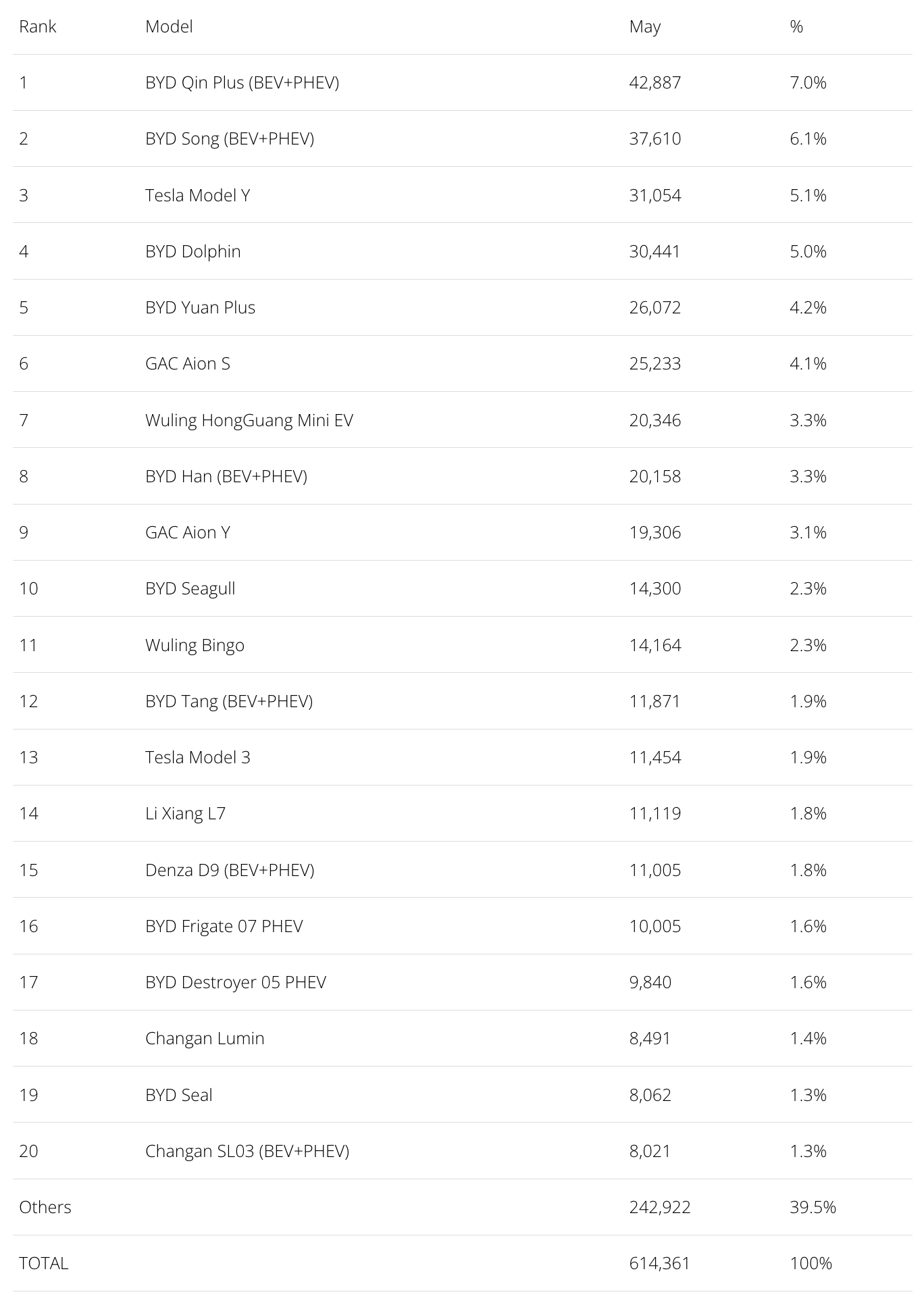

The 20 Best Selling Electric Vehicles in China — May 2023

Here’s more info and commentary on May’s top selling electric models:

#1 — BYD Qin Plus (BEV+PHEV)

Thanks to a recent refresh, and especially a price cut, the BYD Qin Plus has been rejuvenated and its sales have jumped again, winning the best seller prize in May. The midsizer reached 42,887 registrations in May, with the BEV version alone scoring 10,816 registrations. With prices now starting at 100,000 CNY ($15,000), demand is strong again, despite the strong internal competition (the BYD Seal for the BEV version and the Destroyer 05 for the PHEV version). Expect BYD’s lower priced midsize sedan to continue posting strong results, at the cost of its most expensive siblings. It should have no problem keeping its most direct competitors, the Tesla Model 3 and GAC Aion S, at a safe distance.

#2 — BYD Song (BEV+PHEV)

BYD’s midsize SUV was second in the Chinese automotive market, with BYD’s current star player scoring 37,610 registrations. So, will the Song end the year as the best selling model in the Chinese automotive market? Well, it depends on the competition, especially the internal competition. Currently, the Song only has the recently introduced Frigate 07 PHEV as internal competition, but the upcoming Sea Lion (BYD’s take on the Tesla Model Y theme) and the premium car-on-stilts Denza N7 (a car that sits somewhere between the Tesla Model Y and the Zeekr 001) are both set to land this year. This is probably too much competition inside BYD’s midsize SUV portfolio (the Song as the lower priced model, the Frigate 07 & Sea Lion as mid-priced models, and finally the more upmarket Denza N7). Also, the current wave of price cuts, which is spreading through the local market, will be a decisive factor. BYD has just reduced prices of its Song model, just like it did with the Qin Plus, but will this be enough? All of these factors will be decisive for the Song to continue clocking 40,000-plus sales/month, a necessary threshold to continue leading the cutthroat Chinese auto market.

#3 — Tesla Model Y

Tesla’s star model got 31,054 registrations, which, considering it was an off-peak month, should be considered a positive result. It seems the price cuts have gone well for the US crossover, with the midsizer being able to run at the same pace as the best of the BYD pack. Watching the Model Y’s Q1 sales on an average quarterly basis, thus removing the Tesla factor of valley/peak months, the Model Y ended the quarter with a 31,500 unit/month average, which is a great result for a foreign model in China. In a time when Chinese automakers are in peak form, Tesla is currently the only foreign OEM able to follow the amazing pace of the domestic carmakers.

#4 — BYD Dolphin

The small-to-compact Dolphin scored 30,441 registrations. In the past, one could say that the Dolphin had its class all to itself, as its most direct competitors in this category were selling significantly less. This success is now being tested by the recently introduced Wuling Bingo, which is clocking 15,000-ish monthly performances. If the Bingo reaches the 20,000 units/month threshold, then it could give the Dolphin a run for its money. The race in the small hatchback category could become even more entertaining to follow, if the upcoming JAC Yiwei 3, said to receive sodium-ion batteries later this year, also becomes a success.

#5 — BYD Yuan Plus

With 26,072 registrations last month, BYD’s current star player in export markets is also not neglecting its sales in the domestic market, allowing it to be 5th in the overall auto market. Will the compact crossover continue to grow, both internally and overseas? Outside China, the answer is a resounding “YES,” with the compact EV just starting its career in several markets and still to land in many more. The answer in its home market is …”Maybe.” Considering the current price war in China and the ever increasing competition (the upcoming Zeekr X being just one of many), I believe BYD will direct production of its crossover to export markets, where competition is less blood thirsty and margins are higher.

Looking at the rest of the table, below BYD and Tesla’s best sellers, GAC’s Aion S continue to impress, with the sedan ending the month in 6th. Will GAC’s sedan model continue to grow and reach the top spots? That would at least bring some extra color to the boring and predictable BYD–Tesla domination in the top 5. To be continued….

The main highlight in the top half of the table is the BYD Seagull landing in the table, immediately in 10th, with 14,033 units. That’s a great performance for the little EV’s first full month on the market, and expect it to jump into the top 5 during the summer months.

Just below the future star of the BYD lineup, we find another recent model. The Wuling Bingo is in 11th with 14,164 sales, giving the SAIC–GM joint venture lineup some much needed help now that the tiny Muling Mini EV is showing signs of slowing down (it was 7th last month).

Further below in the table, a highlight was #14, the Li Xiang L7 — the startup’s new full-size 5-seat SUV (the L9/L8/L7 are all full-size SUVs). The new model had another record month (11,119 registrations). It seems the hot startup brand has another winner on its hands. The cheapest model in the startup lineup (it starts at $49,000) should continue to improve its standing in the near future, with the startup make setting a bullish sales target of 400,000 units this year. All of that with full-size EVs….

Once the smaller (and cheaper) midsize L6 goes into production, sometime next year, expect much higher sales outputs, and all of a sudden, the 2025 target of 1.6 million units starts to make sense….

Still, the other Li Auto models dropped to 7,000-ish performances in May. No doubt, some cannibalization is at play here, but hey, close to 30,000 sales per month in the full-size category is nothing to feel sad about. After all, that is almost as much as BYD does in that category, adding the Han and Tang together.

Speaking of BYD, both the Seal (8,062 units) and the Destroyer 05 (9,840 units — new record) reached the top 20, a positive sign, complemented by Denza’s continued ramp-up of its D9 large MPV (11,005 units).

Outside the top 20, a highlights were the recovery of some models, like the VW ID.4 (6,260 units), which had its best score all year (so there might be some hope for the German crossover after all). Meanwhile, Leap Motor’s C11 midsize SUV scored a record 7,121 registrations, no doubt helped by the introduction of a range-extended version that is now sold along the regular BEV version.

Last, but not the least, May saw Great Wall’s WEY premium brand deliver 5,136 units of its new Blue Mountain flagship SUV, in only its second month on the market. With a 45 kWh battery, extended-range technology, and full-size length, it is hoping to capture some of Li Auto’s mojo in that category. A future best seller?

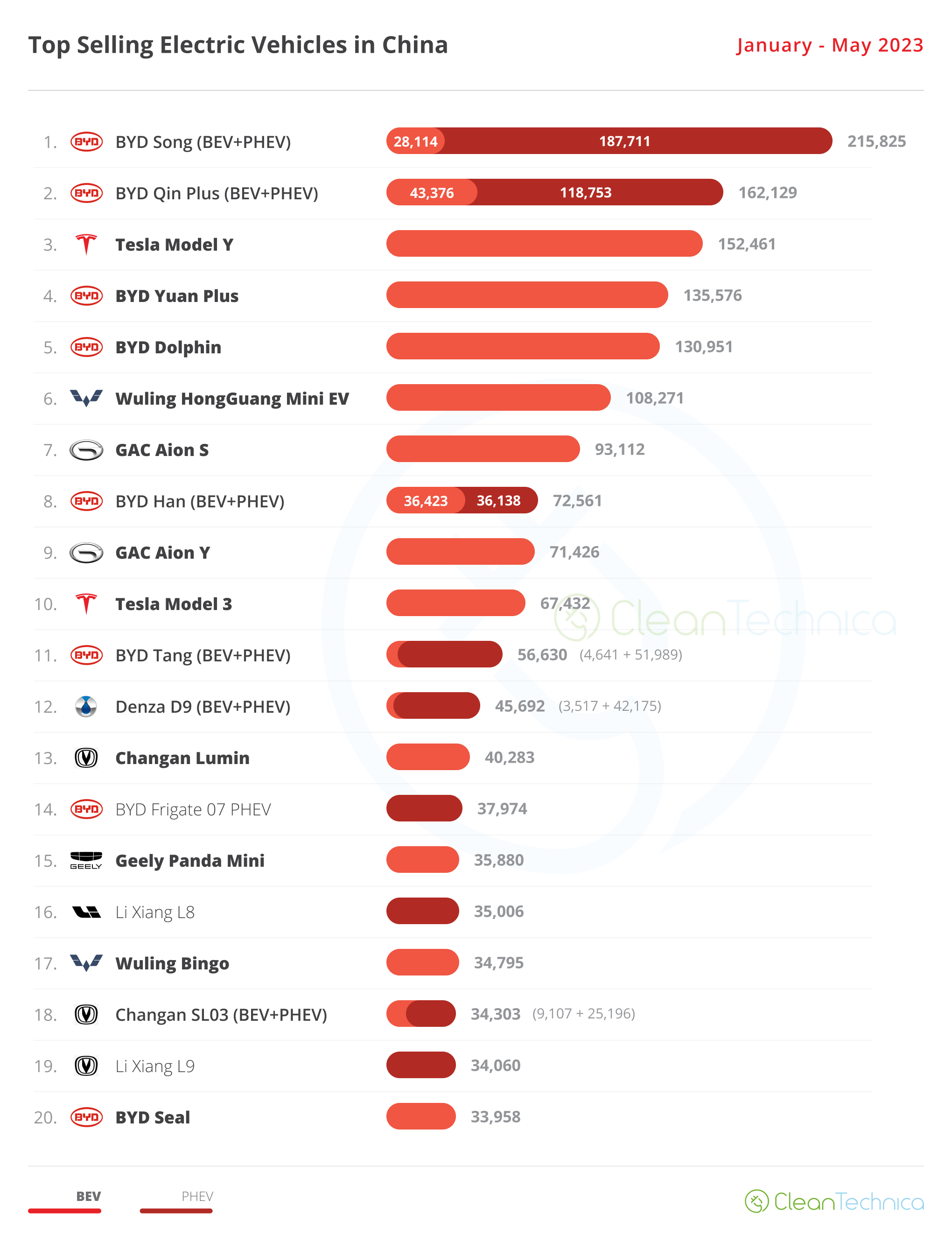

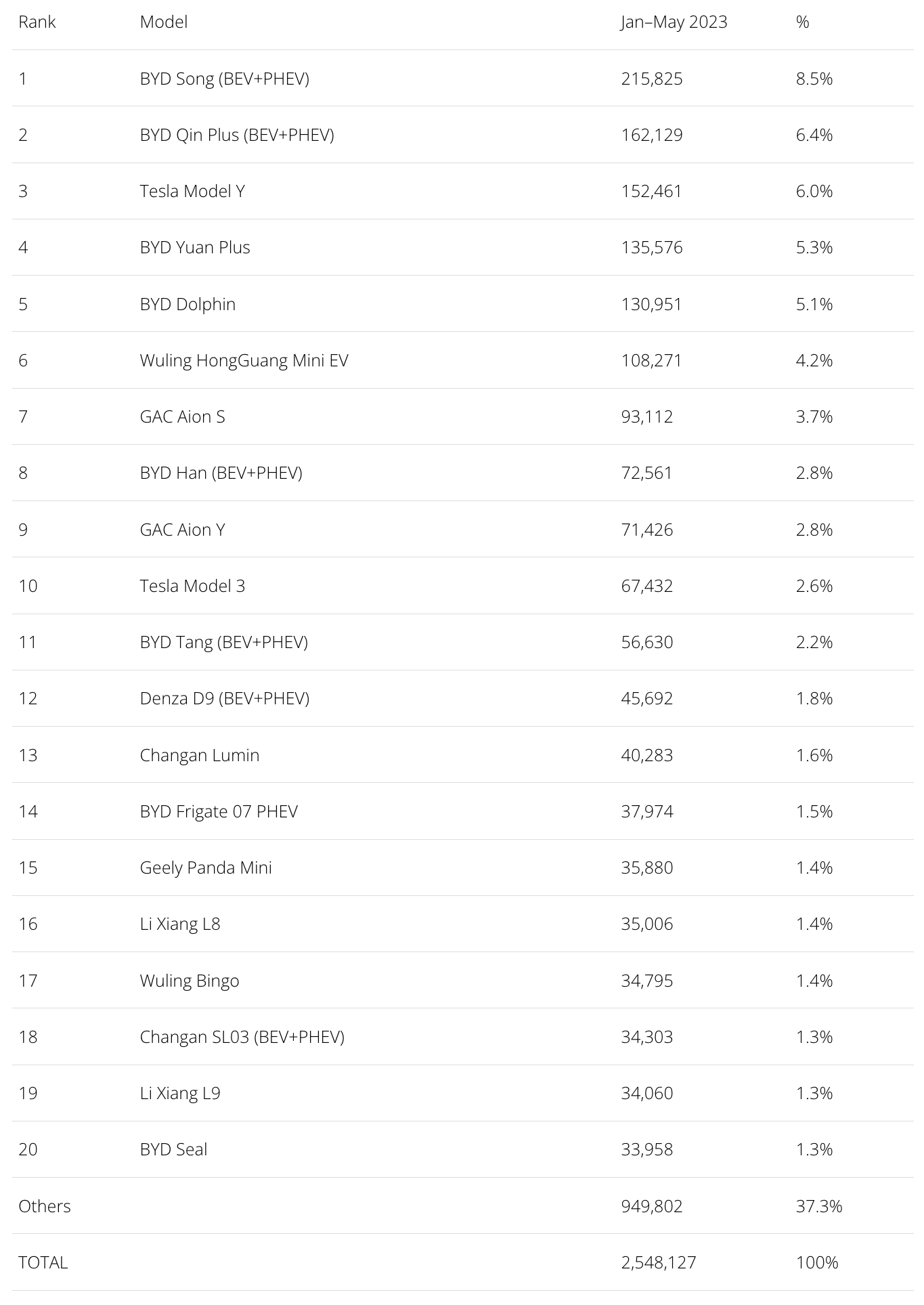

The 20 Best Selling Electric Vehicles in China — January–May 2023

Looking at the 2023 ranking, the leading BYD Song is well above the competition, while the Tesla Model Y has not resisted the strong sales of the BYD Qin Plus, with the Chinese sedan pushing the US crossover to 3rd.

Still, this should be a temporary standing, as the Model Y should recover the runner-up position in June thanks to its end-of-quarter peak.

Off the podium, the highlight was the two-position drop of the Tesla Model 3, to 10th, allowing the BYD Han and GAC Aion Y to climb one position each, to 8th and 9th, respectively.

Until the refreshed Model 3 shows up, do not expect great improvements in the Model 3’s positioning in China, but after the refresh, the sporty sedan can go after the #7 GAC Aion S, and probably even higher than that, with the big question mark then being: Will the refreshed Model 3 hurt the unchanged Model Y’s sales performance?

In the second half of the table, there isn’t much to talk about, with the highlights being the BYD Frigate 07, which climbed to #14, and the Wuling Bingo showing up in #17. The small EV hopes to reach higher standings (#13? #12?) soon.

Finally, in #21, we now have the Li Auto L7, which should join the table in June. That could make three Li Auto models in the top 20, which apart from the all-mighty BYD, no one has, and speaks volumes about the startup’s current strength.

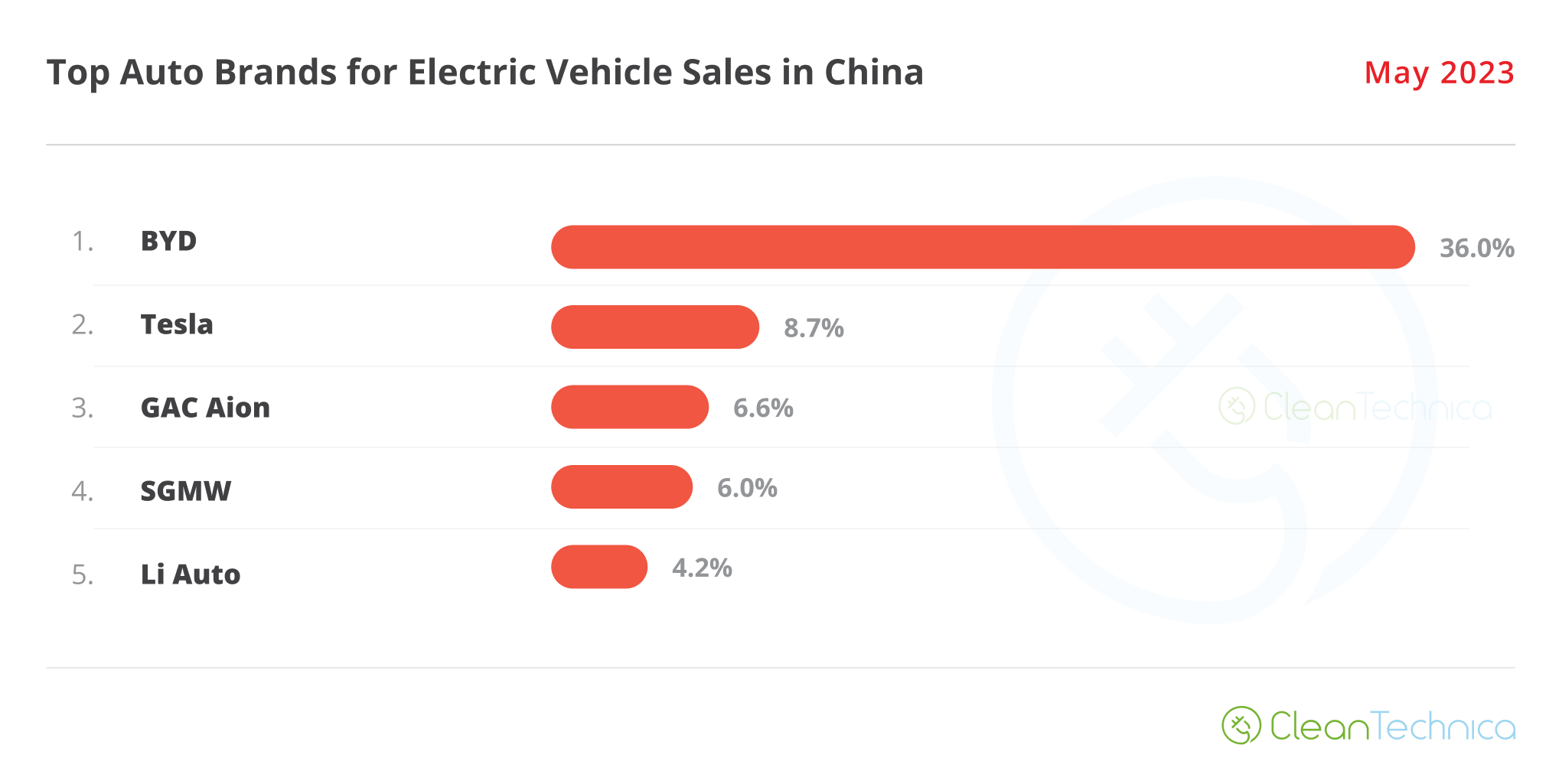

Top Selling Auto Brands & Auto Groups in Chinese EV Market

Looking at the auto brand ranking, there’s no major news. BYD (36%) remains stable in its leadership position and is looking to win its 10th plugin automaker title this year, while Tesla (8.7%, down from 9.3%) is stable in second place.

The third-placed GAC Aion continues to rise (6.6%, up 0.3%), while after a long period of bleeding sales, the SGMW joint venture is starting to benefit from the Bingo-effect, growing its share from 5.9% in April to its current 6%.

With the Wuling Bingo helping considerably to soften the sales drop of the Wuling Mini EV, we also get the recent landing of the cutesiest crossover ever, the Baojun Yep. It is a sort of electric Suzuki Jimny (I want a Yep — just add AWD, some 120 hp, and I am done…). The first 2,279 units were delivered this May. Expect Wuling to start recovering soon, possibly reaching the 3rd position by the end of the year.

Finally, the big news of this month is the rise of Li Auto (4.2%, up from 4.1%) to the 5th spot, switching places with Changan (4.1%). This three-year-old startup is already reaching significant sales levels and will surely become a force to be reckoned with in the future.

Just to put the company’s amazing growth curve into context, in 2015, three years after the Model S launch, Tesla was celebrating a record 50,000 unit sales a year. At the same age, Li Auto does more than that in two months….

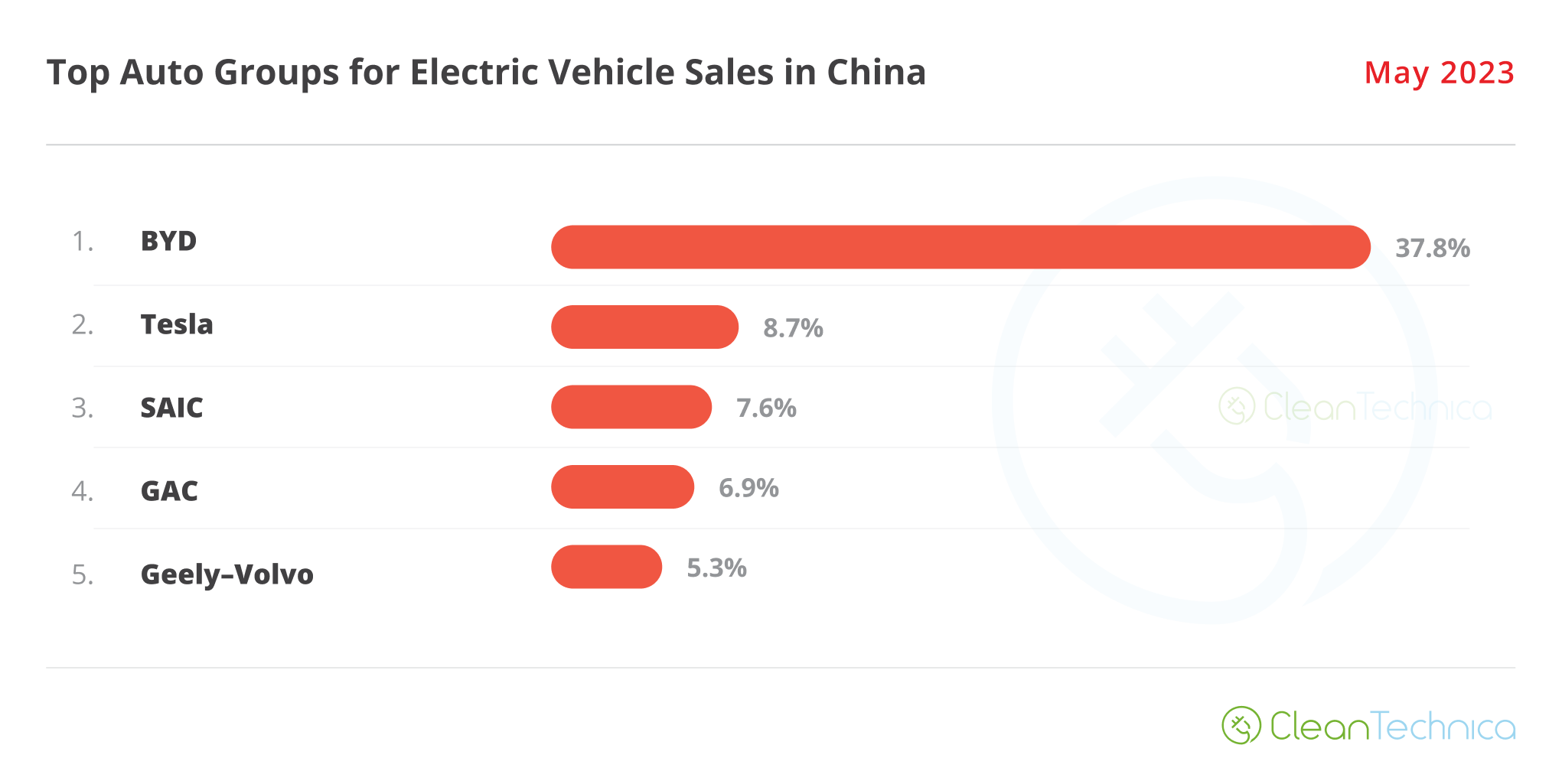

Looking at OEMs/automotive groups/alliances, BYD is comfortably leading with 37.8% share of the market, while #2 Tesla (8.7%) also remains stable. With the SAIC mothership still in crisis, the new Wuling Bingo was nevertheless enough to stop the current sales bleed — the Shanghai-based OEM kept the 7.6% share it held in April, allowing it to retain the last position on the podium.

#4 GAC profited from strong performances of its dynamic duo to jump from 6.6% to 6.9% in May; one step down, Geely–Volvo is stable, at 5.3% share.

With #6 Changan losing ground (4.5%, down 0.1%), Geely can rest on its laurels. The “Chinese Volkswagen Group” is performing way better than the actual Volkswagen Group (2.8%).

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …