Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

1 in 5 cars now sold in November was a BEV

Thanks to upcoming subsidy changes, plugin vehicles continue to rise in France, with last month’s plugin vehicle registrations ending at 45,281 units. That total was divided between 30,769 BEVs (or 20% share of the overall auto market) and 14,512 PHEVs (10% share of the auto market). The former jumped 52% year over year (YoY), while the latter were up by 18%.

Looking at the remaining powertrains, while plugless hybrids were up a robust 37%, petrol was up by just 1%, and diesel continued to be in freefall (-28% YoY) — the black fuel’s new car sales could be dead in two years in France! And to think France had 72% diesel share in 2012….

This means that it’s the electrified powertrains (BEV, PHEV, HEV) that are pushing the market upwards, with the overall market growing 14% this November to 152,713 units.

Still, the overall market recovery hasn’t yet allowed it to reach pre-pandemic levels, as November 2023 was still down 12% compared to November 2019, the last normal November.

Looking at the YTD plugin share, plugin vehicles climbed to 26% share of the market (16% BEV) through the first 11 months of the year. With a delivery peak expected in December, due to new CO2 emission-related subsidies coming in 2024 that will especially hit models coming from China (like the Dacia Spring, MG4, and Tesla Model 3), the final PEV share could end at 27%, which would be 2% above the 2022 final score of 25%.

In November, pure electrics once again outsold PHEVs — 68% share of the plugin market vs. 32% — keeping the BEV share at 64% vs. 36% PHEV in 2023.

Also considering a slight increase in plugin share, this could mean that the French plugin market has reached the ceiling of what current models can offer — and new, cheaper EVs will be needed to break it open further in order for the EV transition to reach new heights.

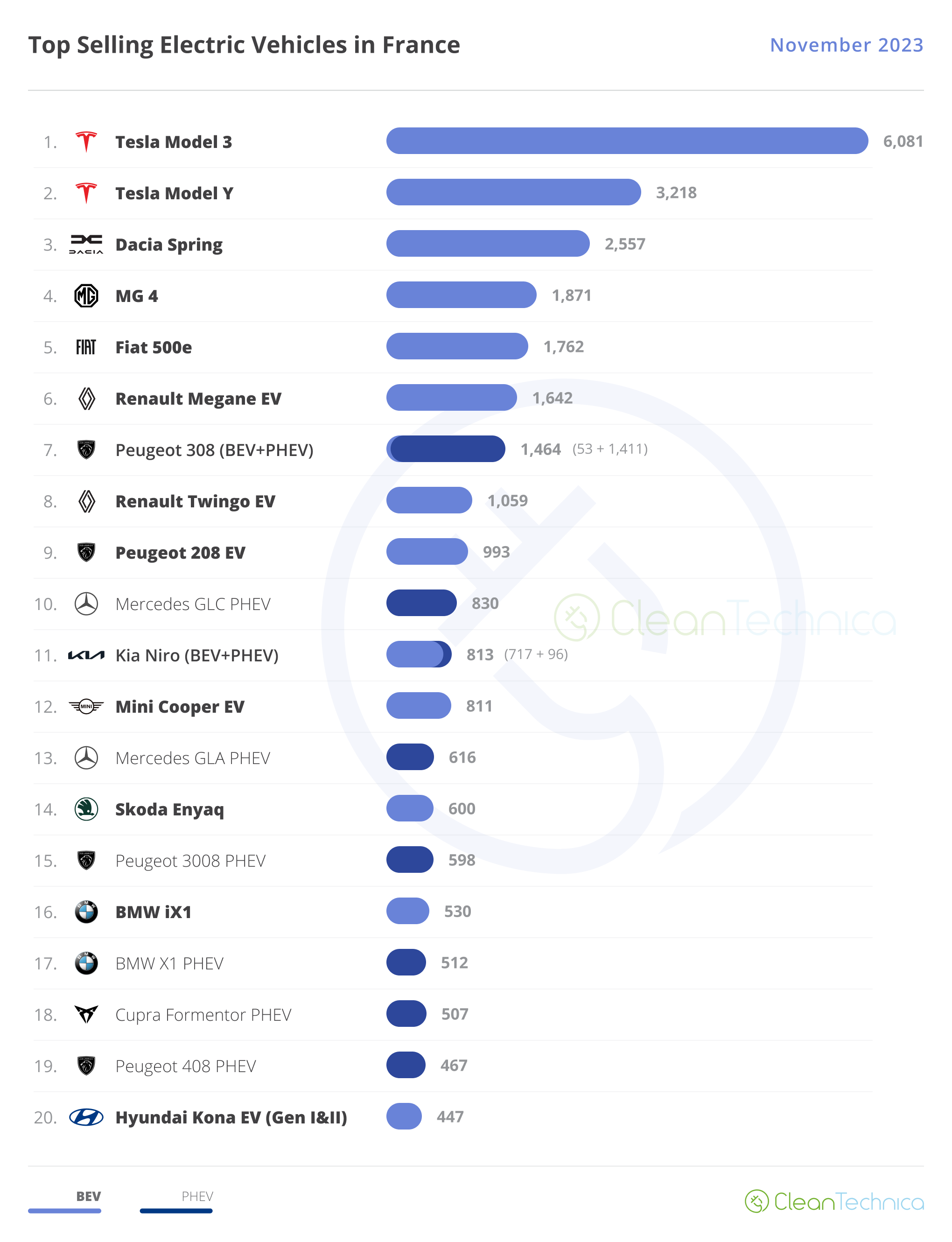

The 20 Best Selling Electric Vehicles in France — November 2023

Last month, Tesla was the shiniest star in the French EV market, thanks to a #1 and #2 win. The Tesla Model 3 scored a record performance, 6,081 units, pulling it to the runner-up spot in the overall market, a new high for any Tesla model in France. Will we see Tesla’s sedan being crowned as the overall best selling car in December? I mean, November’s best seller, the Renault Clio, did it with 7,472 units, so it’s not really that much of a stretch when you already landed 6,081 units in an off-peak month….

The Tesla Model Y was #2, with a strong 3,218 registrations. That figure put Tesla’s crossover in 10th in the overall auto market, thus placing two Teslas in the overall top 10. Expect the crossover to stay as a regular in the highest place in the podium next year, because the Model 3 will lose access to subsidies, allowing the crossover to cannibalize sales from its sedan sibling.

The bronze medalist was the Dacia Spring, another model experiencing an end of incentives deliveries peak. The same can be said about the #4 MG4.

Amazingly, the best selling domestic model was only 6th, with the Renault Megane EV barely beating its Peugeot 308 rival. But not all was bad for the lion make, as the PHEV version of the 308 hatchback scored another record, 1,411 registrations. On the other hand, the electric version of the same model had only 53 deliveries … which is strange, really strange, as it already had plenty of time to ramp up deliveries. Demand or production issues?

A model that had a surprisingly strong month was the Renault Twingo EV, with the 9-year-old veteran scoring 1,059 registrations, its best result in over a year.

With most major brands now focused on more expensive (and profitable) SUVs, the common, small supermini is having its transition into the electric era delayed, thus also delaying the progress of market electrification in many places. The 2024 Citroen e-C3 has the market’s doors open wide for it. Will the Stellantis mothership be able to profit from it?

In the second half of the table, there were several models shining. Starting with record performances, Skoda saw its value for money king Enyaq crossover reach 600 units, allowing it to end the month in #14 as the best selling model coming from Volkswagen Group. Highlighting a positive month for BMW, the iX1 scored 530 registrations, its second record performance in a row, as it continued its delivery ramp-up. Finally, the Peugeot 408 PHEV scored its first top 20 presence, with a record 467 registrations, allowing it to be #19 in the ranking. This helped to partly disguise the slow delivery ramp-up of the refreshed 208 & 2008 EV versions.

Now, let’s look at year-best performances. We have the #13 Mercedes GLA PHEV, which scored 616 registrations. The compact crossover joined the German OEM’s best selling model, the Mercedes GLC PHEV (#10 with 830 registrations), putting two Mercedes in the top 20.

Below the top 20, we have the BMW i4 deserving a mention. The liftback model hit a near-record score of 387 registrations, highlighting BMW’s current good moment. The Polish-built Fiat 600e crossover registered 352 units in its third month on the market, so expect Fiat’s bigger sibling to the 500e star player join the top 20 sometime next year.

A rather surprising score was the 391 registrations of the Ford Mustang Mach-E. In the Volkswagen Group mothership, something strange is happening, with both Skoda and Cupra models now outperforming their Volkswagen counterparts, as evidenced by the Skoda Enyaq (600 units vs. the 405 of the VW ID.4), and the Cupra Born (431 vs 370 of the VW ID.3).

It seems Volkswagen’s demand issues are not happening in its subsidiary brands, so maybe the problem isn’t in the MEB-platform itself, but in what the Volkswagen brand made out of it? (As in, they’re too vanilla-like?)

Will the recently landed VW ID.7 (117 units in November) suffer the same fate?

The 20 Best Selling Electric Vehicles in France — January–November 2023

Looking at the 2023 ranking, the top position is already taken, with the Tesla Model Y ending as the best seller. If that comes to be, that would be a first for the crossover but the second trophy for Tesla (having previously won the title in 2021 with the Model 3).

Still on the topic of the podium positions, the Dacia Spring also seems to have its second position secured, but the race for bronze could have a surprise in the last stage of the year, with the Tesla Model 3 taking the bronze medal. With the Peugeot e-208 experiencing a slow delivery ramp-up of the refreshed version, and the Fiat 500e suffering from a light case of cannibalization, coming from the 600e crossover, do not expect both models to surpass some 23,000 units by year end, while on the Model 3 side, expect a surge in December, to 6-7,000 units, which should pull the sedan into some 26,000 units by year end, thus securing the 3rd position in the last month of the year.

As for November, the MG4 surpassed the Renault Megane EV and is now the best selling compact model in the ranking, and profiting from the aforementioned year-end peak, the Sino-British model should end the year as the leader in its category.

This is a small earthquake in the French EV market, not only Tesla has disrupted the market, but now the MG 4 is beating the local competition in their own game!

So, is the compact category already lost for the local brands?

Pas si vite! – Says Renault.

While the Megane EV has been stuttering, due to its high pricing, its MPV crossover sibling, the upcoming Scenic EV, is landing with some killer prices, the base version (60 kWh battery, 430 km WTLP range) is starting at 40,000 EUR, while the long range version (87 kWh, 625 km) starts at 47,000 EUR. (For reference, the leader Tesla Model Y starts at 46,000 EUR, with 455 km range)

With the Megane EV now starting at €38,000, with a small 40 kWh battery and 300 km of range, it is clear that once the Scenic EV lands, the Megane EV price will have to drop significantly, or else the new crossover will just eat up all of the hatchback’s sales.

So, expect the hatchback’s price to drop to some €32,000, which will be closer to where the Megane EV price should be. Better still: Pick up the 52 kWh battery of the upcoming Renault 5 long range, place it in the Megane EV, which would give some 380 km range, and sell it as a base version at €32,000. That is the recipe to fight the MG and the upcoming wave of competition.

But back to the ranking … in the second half of the table, the highlight was the rising Mini Cooper EV, which jumped three positions to #11, while the Kia Niro was also up, in this case to #14.

Interestingly, only 71 units separate the #20 Volvo XC40 from the #22 VW ID.3, and with the #21 DS 4 PHEV just 18 units behind the Swede. Entering the last stage of the race, expect a close race between these three models for the last position in the table, with no clear favorite.

Auto Brands Selling the Most Electric Vehicles in France

Looking at the brand ranking, Tesla was the big winner, pulling its share from 12.4% in October to its current 13.1%. As for #2 Peugeot (11.9%, down from 12.3%), it lost most chances to recover the leadership due to the e-208’s slow month. With Tesla likely prioritizing Model 3 deliveries to the French market in December due to the end of subsidies for Chinese-made vehicles in 2024, the US automaker is now the clear favorite to win this year’s title.

As a reminder, this is a historical event — no other foreign brand has ever ended ahead of the local heroes in France!

In the last place on the podium, Renault (7.5%, down 0.6%) also lost share. 2023 will see the French brand end the year in 3rd place, its worst standing since 2012. But this Annus Horribilis for the French brand might have a silver lining — 2024 will surely look better.

Not only will the new subsidy scheme help it, as it prevents many of its foreign competitors from accessing EV subsidies, but the competitive pricing of the Scenic EV (and Megane EV?) will also help it to recover some ground in the compact category. But the upcoming Renault 5 will surely do much better than the current 16th spot of the Renault Zoe. Now, the question is: How high will it go?

The future of the 8-time winner of the French EV brand depends on it.

Dacia was stable in 4th, with 6.6% share, while in 5th, SAIC’s MG (5.9%, down from 6%) has lost some advance over the new #6 BMW (5.4%, up from 5% in October), which surpassed Fiat (5.4%).

Another German make on the rise was #8 Mercedes, which increased its share to 5.2% and is looking to follow up on arch-rival BMW’s footsteps to become relevant again in France.

Auto Groups Selling the Most Electric Vehicles in France

As for OEMs, Stellantis (27%, down from 27.9%) is the major force in this market, but with Peugeot, DS, Citroen, and Opel experiencing slow months, the remaining brands in the conglomerate weren’t enough to stop the bleeding of market share.

The same can be said about the Renault–Nissan–Mitsubishi Alliance (14.7%, down from 15.1%). While Dacia had a good month, the remaining lineup hasn’t followed through, and it dragged the OEM into the red.

3rd placed Tesla (13.1%) and 4th placed Volkswagen Group (11.6%, up from 11%) were up, and in this last case, while it suffered from a slow month from the namesake brand, the positive outcame coming from Skoda, and Cupra more than compensated for it.

Finally, #5 BMW Group (7.8%, up from 7.4%) secured its top 5 spot thanks to a strong performance in November, benefitting also from the slight drop of #6 Hyundai–Kia (6.4%, down 0.1%).

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.

.jpg)