Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Plugin vehicles are all the rage in the Chinese auto market. Plugins scored more than 808,000 sales last month, up 41% year over year (YoY), which is this market’s third record month in a row. And expect the last two months of the year to continue this record streak. October sales pulled the year-to-date (YTD) tally to over 6.2 million units.

Share-wise, with October showing another record performance, plugin vehicles hit 39% market share! Full electrics (BEVs) alone accounted for 26% of the country’s auto sales. This kept the 2023 share at 36% (24% BEVs), and considering the current growth rate, we can assume that China’s plugin vehicle market share could end close to 40% by the end of 2023.

Another measure of the importance of this market is the fact that China alone represented over 60% of global plugin registrations in October!

Looking at October’s best sellers in the overall market, we see plugins populating the top positions. The top 4 positions all belonged to plugin models! The best selling ICE model showed up only in 5th. And to think: in other markets, we celebrate when one EV breaks into the overall top 10….

Looking at the overall leaders in each size category, there wasn’t significant news. All category leaders are already EVs. In the full size category, the Li Xiang L7 barged onto the category podium for the first time, ending the month in 2nd, just below the leader BYD Han. That leaves only one ICE representative on the podium, the #3 Audi A6, which registered around 14,000 units. With the two other Li Auto models, the L8 and L9, also scoring record results, and sitting just 2,000 units behind the Audi sedan, we can even foresee a 100% plugin podium in the full size category in December. And there goes another ICE stronghold….

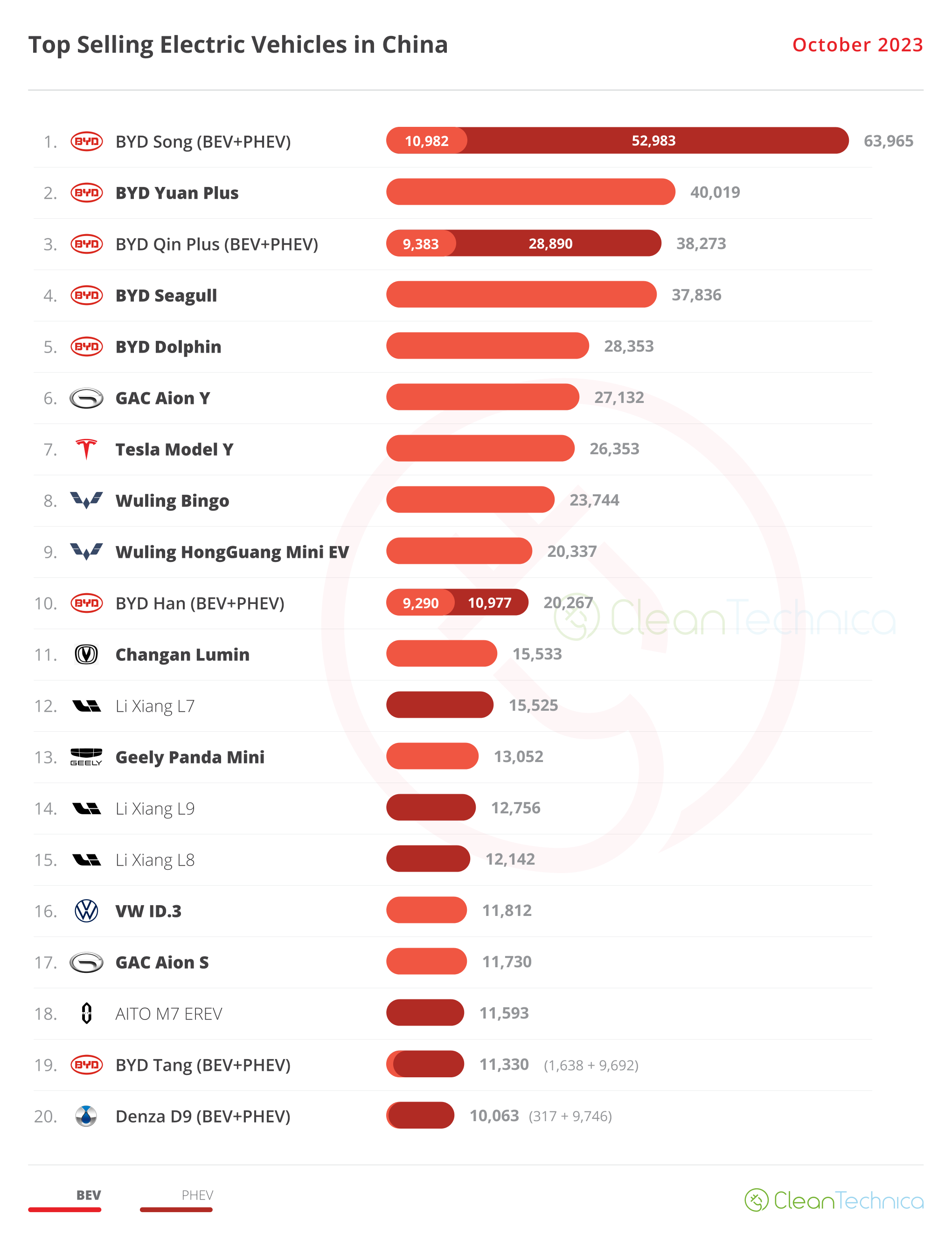

The 20 Best Selling Electric Vehicles in China — October 2023

Here’s more info and commentary on October’s top selling electric models, this time with only BYD models in the top 5! As if the top 5 wasn’t boring enough previously…

#1 — BYD Song (BEV+PHEV)

BYD’s midsize SUV was again top dog in the overall Chinese automotive market, with BYD’s current star player scoring 63,985 registrations, a new record, mostly thanks to the 10,982 of the BEV version, which is currently on a records streak. With this year’s title already in the bag, will the Song win the best selling model title again? Too early to know. The little BYD Seagull is ramping up, and it has the potential to disrupt the market. But BYD’s internal competition should also erode the Song’s career next year, in the form of the upcoming Sea Lion and Song L. So, while the midsize SUV is sure to revalidate last year’s title in 2023, next year’s race will be much harder.

#2 — BYD Yuan Plus

BYD’s star model in export markets hasn’t forgotten its domestic market, and in October it got 40,019 registrations, a new record for the compact crossover. At a time when there is a price war in the Chinese market, BYD’s representative in the compact category does not want to let go of the category leadership to GAC’s Aion Y, even if it hurts the Yuan’s profitability. By the way, with so many midsize models in BYD’s lineup fighting with each other, it is odd that below that category, BYD’s lineup offers much less diversity: Basically, it is the Yuan Plus, Dolphin, and the Seagull. What about a compact sedan? And a small crossover?

#3 — BYD Qin Plus (BEV+PHEV)

BYD Qin Plus sales were stable at a 40,000-ish cruising speed. The midsizer reached 38,273 registrations in October, with the BEV version alone scoring 9,383 registrations. With prices starting at 100,000 CNY ($15,000), demand is strong, despite the fierce internal competition (the BYD Seal for the BEV version and the Destroyer 05 for the PHEV version). Expect BYD’s lower priced midsize sedan to continue posting strong results, at the cost of its most expensive siblings. It should have no problem keeping its most direct competitors at a safe distance, with the likely exception of the refreshed Tesla Model 3 in December, but YTD, with the #2 BYD Qin Plus having almost twice the registrations of the category runner-up, the #6 GAC Aion S, the leadership spot in the midsize sedan category for the whole year of 2023 is assured for the BYD sedan.

#4 — BYD Seagull

With 37,836 registrations, BYD’s future star player continued to ramp up deliveries. The question now is: How high will it go? In its domestic market of China, could it win a best seller title by the end of 2024? But it is overseas that the little EV could be a true disruptive force: Latin America and Africa are waiting for a good, cheap EV that can push EVs into the mainstream, and the Seagull could be it. This could be the model that places BYD among the best sellers in places like India and Europe — where good, small, value-for-money BEVs are scarce. Sitting somewhere between the A and B segments, at 3.78 meters, and using a purposeful angular design, it profits from the brand’s leading Blade batteries, in 30 kWh and 39 kWh sizes. It starts at 74,000 CNY (+-$10,500 USD). The only model rivaling it is the slightly larger (3.95 meters) Wuling Bingo, which starts at 60,000 CNY (+-$8,200 USD), but at that price, it comes with a battery of just 17 kWh capacity and no DC charging. For a similar-spec Bingo, equipped with a 32 kWh battery & DC charging, the starting price is 74,000 CNY, the same price as the Seagull. So, spec-wise, the two seem equally competitive, but the Seagull benefits from the current strength of the BYD brand, something that the Wuling EV lacks. In overseas markets, BYD also profits from the fact that neither SAIC or GM have export plans for their small EV.

#5 — BYD Dolphin

The small-to-compact hatchback scored 28,353 registrations, allowing it to be 5th, making for a 100% BYD top 5. With the Dolphin now focused on sending units to export markets, it seems that BYD is happy to have it running at around 25,000–30,000 units/month in its domestic market. This should still allow the model regular presences in the Chinese top 5. The Dolphin is one of BYD’s Musketeers in overseas markets, joining the Yuan Plus/Atto 3 hatchback and the Seal sedan, which will stand as a solid honor guard to the future D’Artagnan of the lineup, the BYD Seagull.

Looking at the rest of the table, and with this being a record month, it was records galore throughout the table, starting with the #6 GAC Aion Y scoring 27,132 sales — again, a new record performance. Will the MPV-disguised-as-a-crossover reach the top 5 soon and break the spell BYD/Tesla duopoly? That would be positive news for the market, considering that these two brands have been monopolizing the top positions for several months now….

And we all know the mantra: “Diversity breeds innovation.”

Still on the top 10, the Wuling Bingo also scored a record month, 23,744 units, ending the month in #8 and ahead of its littlest sibling, the Wuling Mini EV, which finished just below, in 9th, with 20,337 units.

Further down the table, Li Auto saw all of its three models hit record scores. The L9 seven-seater — the startup’s biggest model — scored its third record month (12,756 registrations) in a row! Imagine that, a Cadillac Escalade–like plugin selling over 10,000 units per month….

Note that the L9, L8, and L7 are all full-size SUVs. Last month, there were five models longer than 5 meters in the top 20 — the Li Xiang L9, L8, & L7 as well as the Denza D9 and the AITO M7. Talk about automotive obesity….

Speaking of this last model, the result of cooperation between Huawei and Seres, it was the SUV’s best result ever, 11,593 registrations. Expect this model to start showing up more in the table.

On the opposite side of the automotive spectrum, the small Changan Lumin and Geely Panda Mini also hit record sales, allowing them to be 11th and 13th, respectively.

Still on the topic of the top 20, the other big news is VW’s ID.3 reaching the 16th position, with 11,812 registrations, a new record for the German hatchback that once again proves the mantra “lower price, higher sales.”

Outside the top 20, the highlights are varied, proving the diversity of the Chinese EV market. In the fresh blood startup category, XPeng’s take on the Model Y theme G6 midsize SUV got 8,741 registrations, continuing its ramp-up. The new model should join the top 20 soon (December?) as its production ramp-up continues. The struggling startup threw everything but the kitchen sink at its new model, so that it finally has a winner on its hands.

Leap Motor’s T03 city car had its best result since June ’22, with 6,381 registrations, while the midsize C11, stayed at near record levels, with 8,769 registrations.

FAW saw its Hongqi E-QM5 luxury sedan end the month at #21, with 10,021 registrations, just 42 units short of joining the ranking. Meanwhile, Geely had good news across its long list of brands, with the Zeekr 001 posting a solid 8,517 registrations, the Lynk & Co 08 PHEV ramping up deliveries to 8,038 units in only its 3rd month on the market, and the sub-brand Galaxy having its L6 sedan reach 4,374 registrations, also in its 3rd month.

Looking at SGMW’s youth sub-brand, Baojun, its new compact MPV, the Yunduo, is also ramping up, hitting 5,439 registrations. So, fingers crossed that this will be the first of many compact-to-midsize MPVs to reach success, as the market for larger-than-life-and-with-anger-issues MPVs seems already saturated in China. If MPVs want to rise again, and I want them to, then smaller and more friendly looking MPVs need to appear and succeed.

Great Wall’s investment in PHEV models is starting to pay off, with a few models having a record month, like the Haval Raptor PHEV midsize SUV, with 5,084 registrations, and the Toyota Land Cruiser lookalike Tank 500 PHEV getting 5,065 registrations. And with the Mini-Hummer EV military-grade Tank 400 PHEV landing in October with an already significant 3,102 units, expect this side of Great Wall to start posting some serious volumes.

Finally, from foreign OEMs, the highlights are the VW ID.4’s 7,209 registrations, a new year best for the German crossover in the Middle Kingdom, confirming that price cuts can do miracles to one’s career. Another model from a foreign make on the rise is the BMW 3-Series converted into a BEV, called the i3. With 5,763 registrations, the midsize BMW is helping the brand to recover some traction in the plugin market.

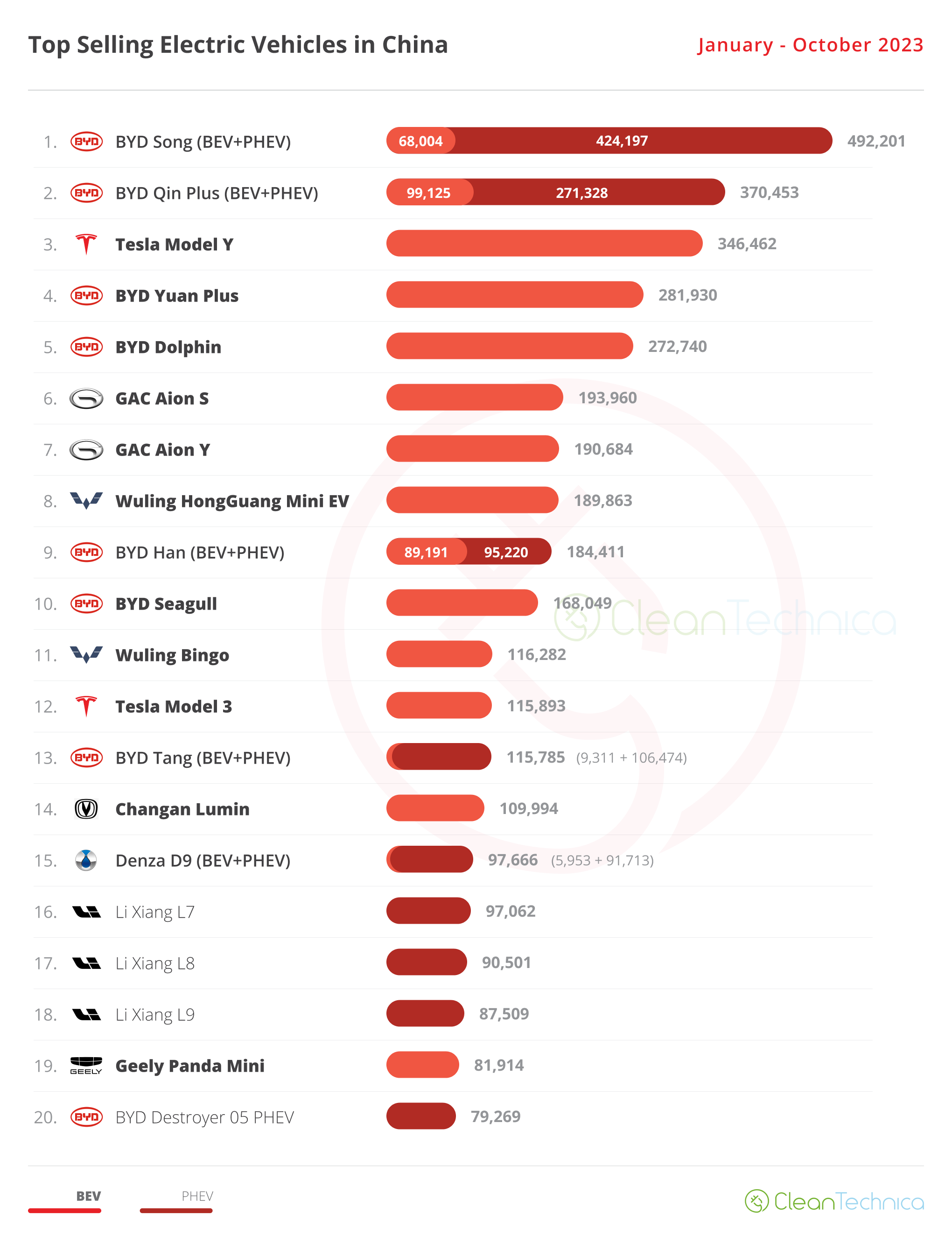

The 20 Best Selling Electric Vehicles in China — January–October 2023

Looking at the 2023 ranking, the BYD Song is well above the competition, while the runner-up BYD Qin Plus has kept the #3 Tesla Model Y at bay. Will the Chinese sedan resist the US crossover’s pressure in the last two months of Q4?

Or will the Tesla Model Y recover the silver medal in December, thus recovering the runner-up spot that it had lost in 2022?

Off the podium, the 4th position saw a position change, with the BYD Dolphin being surpassed by its sibling Yuan Plus, while a couple of steps below, another fraternal position change is close to happening, with the #6 Aion S losing significant ground to its crossover sibling, the Aion Y, which has jumped to 7th in October and is now just 3,000 units behind.

Another model on the rise is the BYD Seagull. Despite not moving from the 10th spot, it has recovered significant ground on the #9 BYD Han and should surpass it in November, with the little BYD looking to even reach the 6th spot by the end of December.

In the second half of the table, the Wuling Bingo continues on the rise, having jumped three positions in October, to #11.

We should mention that all three Li Auto models are in the top 20. And the smallest of them, the 5-seat L7, should climb one position in November to #15. Apart from the all-mighty BYD, no one else has that many models in the top 20, and it helps to explain why this is the hottest EV startup right now.

Finally, the last position change in the table happened at #19, where the Geely Panda Mini surpassed the BYD Destroyer 05. Interestingly enough, all models that moved up in the table were either compact models (BYD Yuan Plus, Aion Y) or smaller (Wuling Bingo, Geely Panda Mini), which is definitely good news in the current context of oversized SUVs….

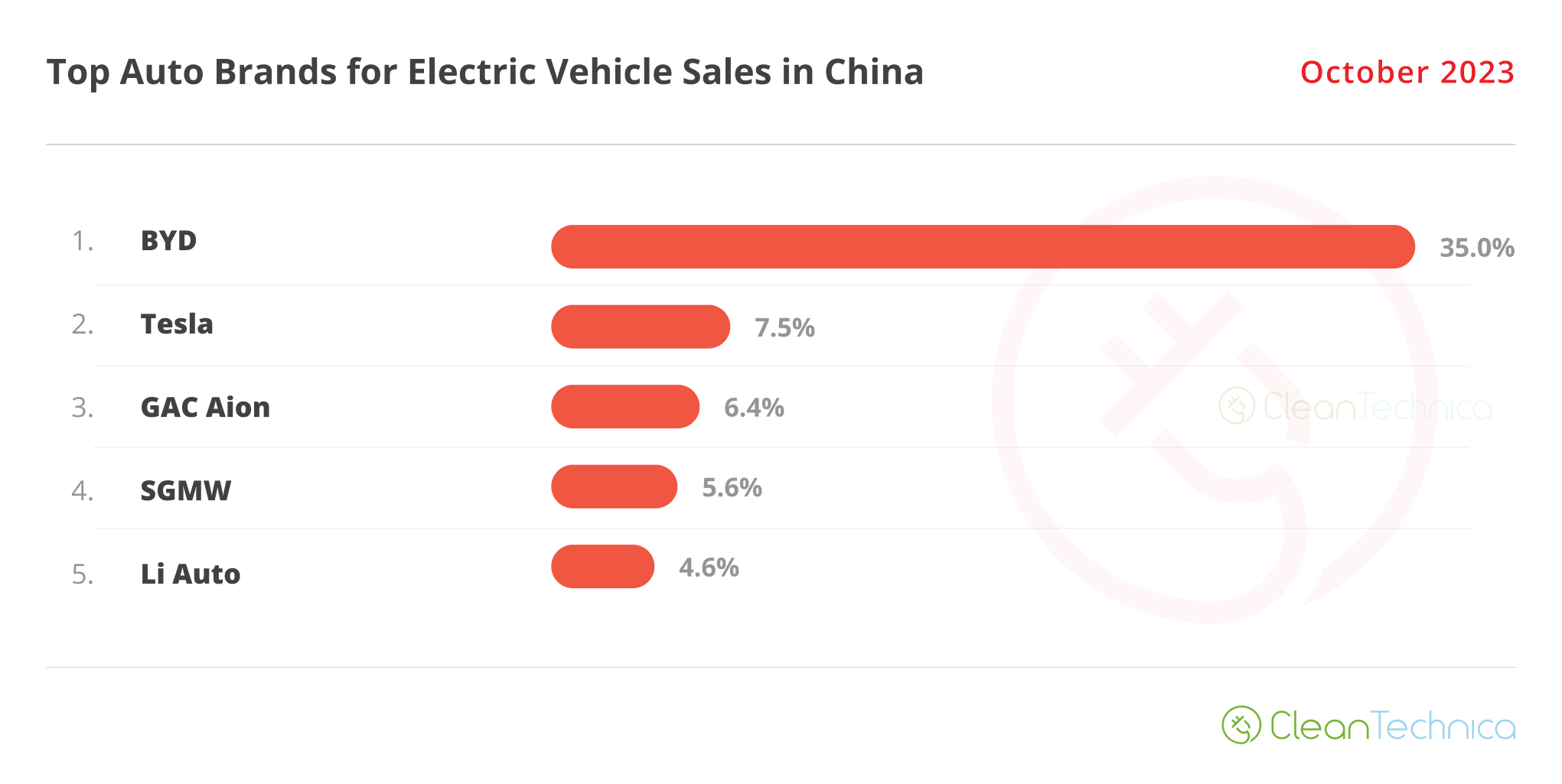

Looking at the auto brand ranking, there’s no major news. BYD (35.0%) remains stable in its leadership position and is looking to win its 10th plugin automaker title this year, while in transition Tesla (7.5%, down from 8.1% in September) is stable in second place.

Third-placed GAC Aion was surprisingly down by 0.2% share, to 6.4%, due to the slow month of the Aion S; while the SGMW joint venture’s performance was back in black, pulling its share from 5.4% in September to its current 5.6%.

Finally, 5th placed Li Auto continued to grow, now at 4.6% share, up from 4.5% in September. The startup is looking set to become a force to be reckoned with in the future.

Behind the startup, #6 Changan (4.3%, up 0.1%) and #7 Geely (4%, up from 3.8% in September) are looking to return to the best sellers table.

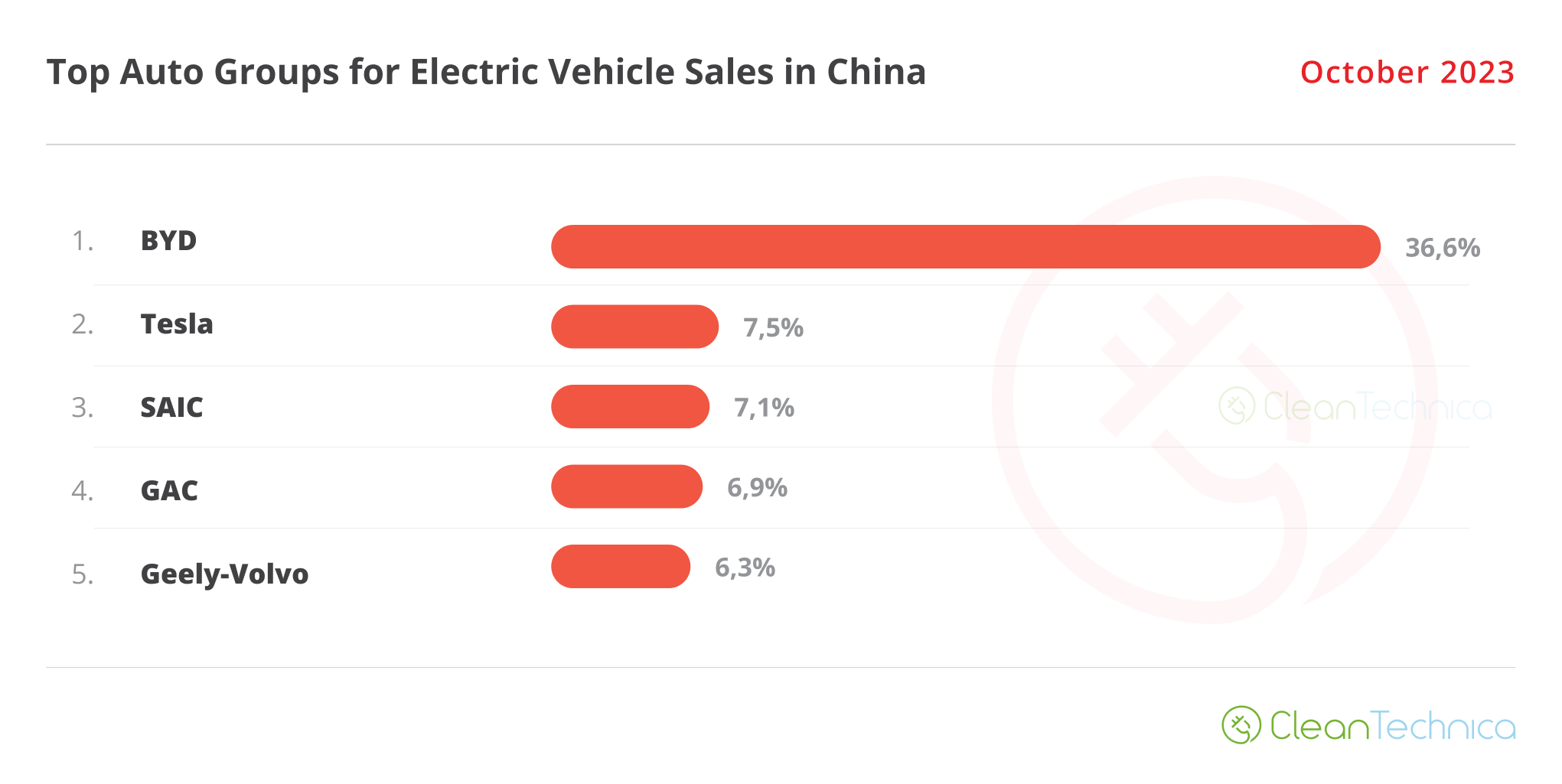

Looking at OEMs/automotive groups/alliances, BYD is comfortably leading with 36.6% share of the market, down 0.1% in October, while Tesla (7.5%) remains firm (for now, at least) ahead of #3 SAIC (7.1%) and #4 GAC (6.9%, down 0.2%). The Shanghai OEM profited from SGMW’s good results to gain a precious advantage over its competitor from Guangzhou.

One step down, #5 Geely–Volvo is growing, now at 6.4% share, up 0.5% share compared to the previous month.

Below it, #6 Changan (4.8%, up from 4.6% in September) has gained some precious ground over also rising #7 Li Auto (4.6%), but the distances are short between these two, so next month could bring a position change between them.

Finally, a mention is due for Volkswagen Group, which has grown its share to … 2.9%. Yep, it has a LOT of work ahead if it wants to regain any kind of relevance in the Chinese plugin market.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

CleanTechnica Holiday Wish Book

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.