Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

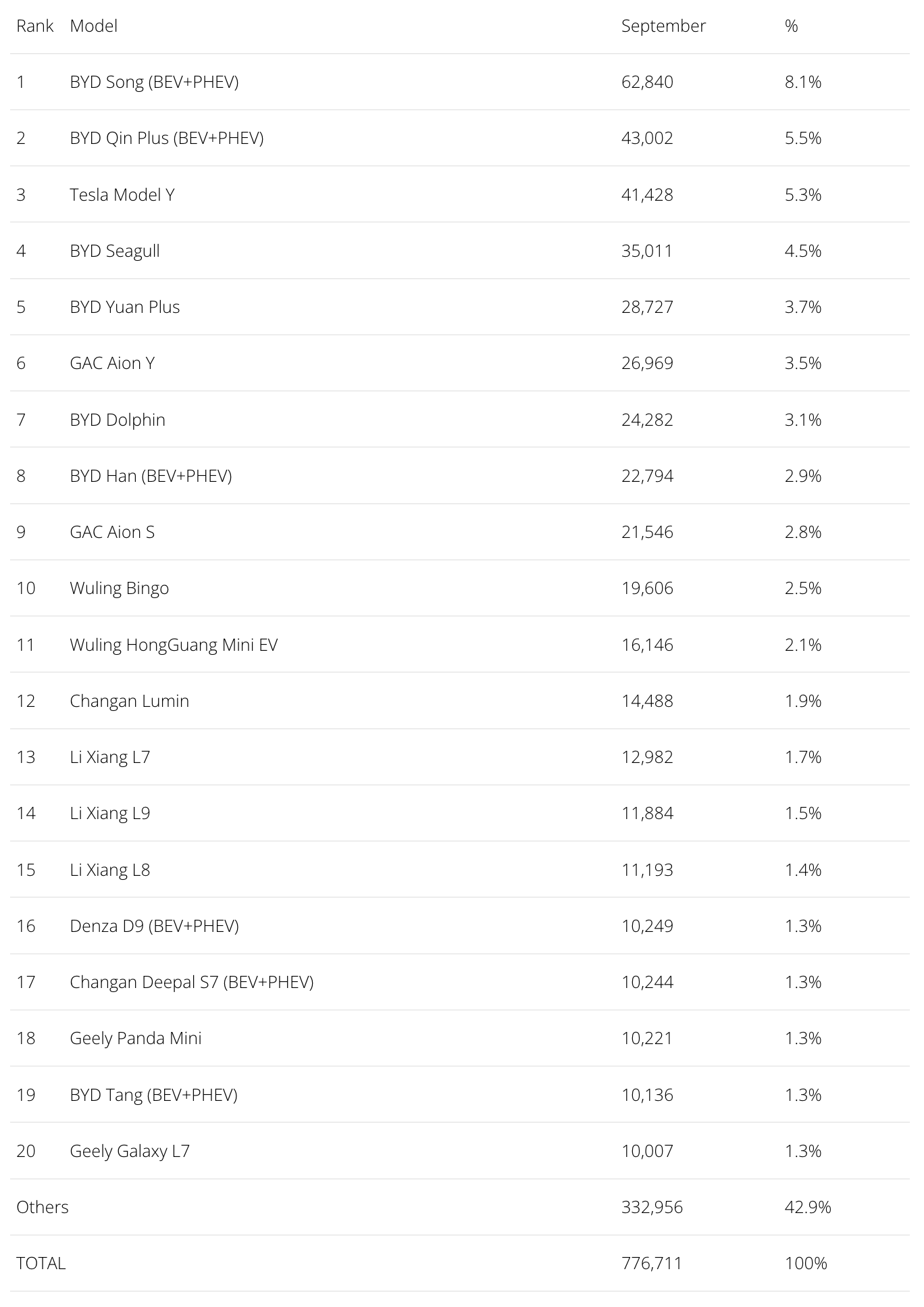

Plugin vehicles are all the rage in the Chinese auto market. Plugins scored more than 776,000 sales last month, up 22% year over year (YoY), which is this market’s second record month in a row. And expect the last quarter of the month to continue this record streak. The September sales pulled the year-to-date (YTD) tally to over 5.4 million units.

Share-wise, with September showing another great performance, plugin vehicles hit 37% market share! Full electrics (BEVs) alone accounted for 25% of the country’s auto sales. This kept the 2023 share at 36% (24% BEVs), and considering the current growth rate, we can assume that China’s plugin vehicle market share could end close to 40% by the end of 2023.

Another measure of the importance of this market is the fact that China alone represented over 60% of global plugin registrations in September!

Looking at September’s best sellers in the overall market, we see plugins populating the top positions, with the top 4 positions all belonging to plugin models! The best selling ICE model showed up only in 5th. And to think: in other markets, we celebrate when one EV breaks into the overall top 10….

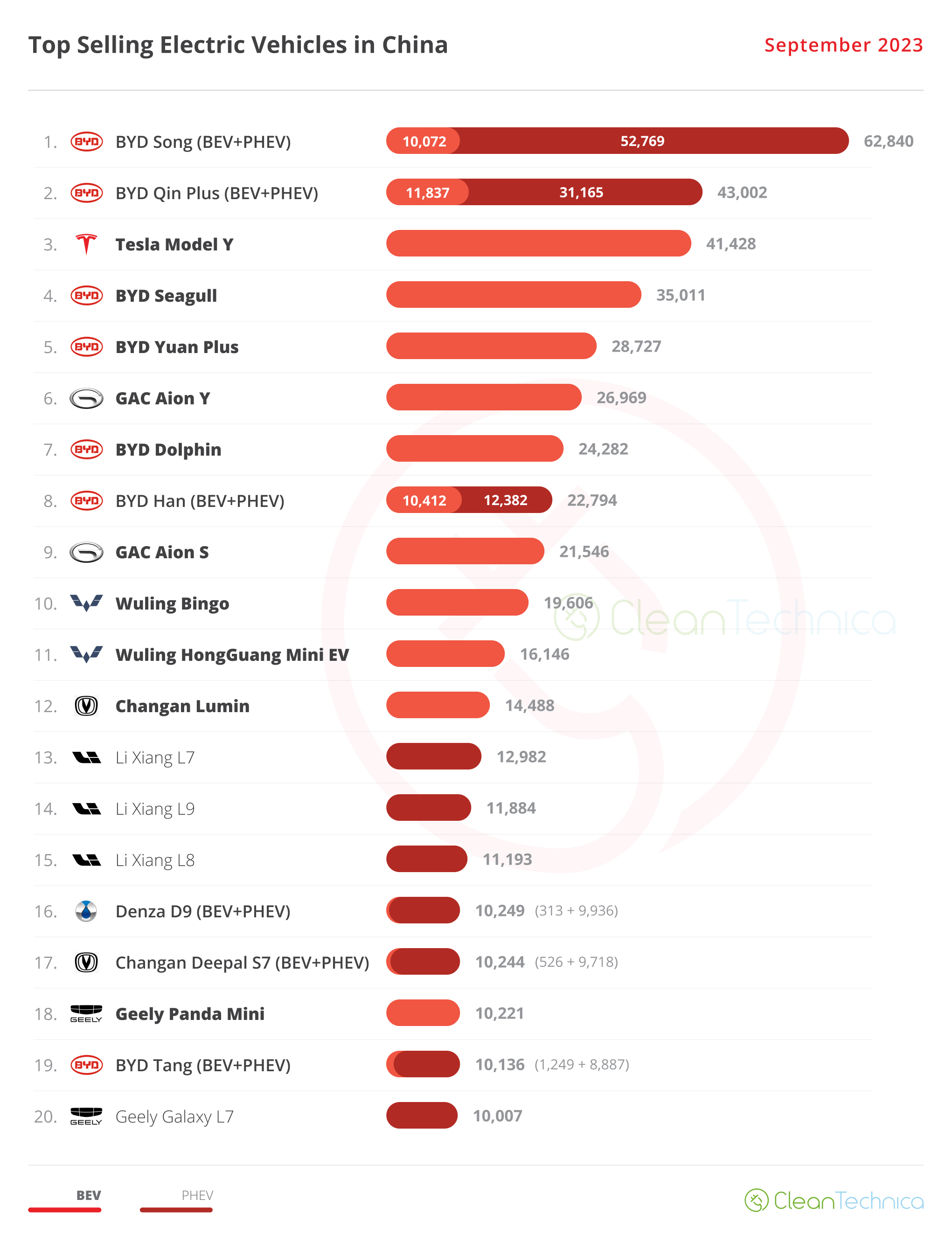

The 20 Best Selling Electric Vehicles in China — September 2023

Here’s more info and commentary on September’s top selling electric models, again with only BYDs and Teslas in the top 5.

#1 — BYD Song (BEV+PHEV)

BYD’s midsize SUV was again top dog in the overall Chinese automotive market, with BYD’s current star player scoring 62,840 registrations, 10,072 of them belonging to the BEV version, which is the first time the BEV version has crossed into five-digit territory. Will the Song end the year as the best selling model in the Chinese automotive market? At this point, it is most likely. Looking at the internal competition, the Frigate 07 PHEV has failed to make a dent in its sales, while its premium cousin, the Denza N7, also doesn’t seem able to divert a sizable level of demand away from it — if nothing else, because it lacks a PHEV version. The real internal competition could come in the form of the upcoming Song L, BYD’s take on the Model Y theme, but that should only impact sales next year, not this year. With the Song’s current trend of selling 50,000+ sales/month, there is no major reason why it won’t continue leading the cutthroat Chinese auto market this year.

#2 — BYD Qin Plus (BEV+PHEV)

Thanks to a refresh and price cut, the BYD Qin Plus has been rejuvenated and its sales returned to a 40,000+ cruising speed. The midsizer reached 43,002 registrations in September, with the BEV version alone scoring 11,837 registrations. With prices starting at 100,000 CNY ($15,000), demand is strong, despite the fierce internal competition (the BYD Seal for the BEV version and the Destroyer 05 for the PHEV version). Expect BYD’s lower priced midsize sedan to continue posting strong results, at the cost of its most expensive siblings. It should have no problem keeping its most direct competitors at a safe distance, with the likely exception of the refreshed Tesla Model 3 in November or December, but YTD, with the #2 BYD Qin Plus having almost twice the registrations of the category runner-up, the #6 GAC Aion S, the leadership spot in the midsize sedan category for the whole year of 2023 is assured for the BYD sedan.

#3 — Tesla Model Y

Tesla’s star model got 41,428 registrations, which is down some 10,000 units compared to the previous month, so it seems Tesla has changed allocation policies, with the strongest month in China now happening in the middle of the quarter. At a time when Chinese automakers are in peak form, Tesla is currently the only foreign OEM able to follow the amazing pace of domestic carmakers. The Model Y’s most immediate threat is actually coming from its own stable in the form of the refreshed Tesla Model 3. While the refresh on the sedan wasn’t as deep or disruptive as some expected, the new interior and updated specs could allow the sedan to start cannibalizing some volume from its crossover sibling during the coming months…. Watch this space in Q4.

#4 — BYD Seagull

With 35,011 registrations, BYD’s future star player continues to ramp up deliveries. The question now is: How high will it go? In its domestic market of China, could it win a best seller title by the end of the year? But it is overseas that the little EV could be a true disruptive force: Latin America and Africa are waiting for a good, cheap EV that can push EVs into the mainstream, and the Seagull could be it. And this could be the model that places BYD among the best sellers in places like India and Europe — where good, small, value-for-money BEVs are scarce. Sitting somewhere between the A and B segments, at 3.78 mt, and using a purposeful angular design, it profits from the brand’s leading Blade batteries, in 30 kWh and 39 kWh sizes. It starts at 74,000 CNY (+-$10,500 USD). The only model rivaling it is the slightly larger (3.95 mt) Wuling Bingo, which starts at 60,000 CNY (+-$8,200 USD), but at that price, it comes with a battery of just 17 kWh capacity and no DC charging. For a similar-spec Bingo, equipped with a 32 kWh battery & DC charging, the starting price is 74,000 CNY, the same price as the Seagull. So, spec-wise, both seem equally competitive, but the Seagull benefits from the current strength of the BYD brand, something that the Wuling EV lacks. Also, does SAIC (or GM) have export plans for this small EV?

#5 — BYD Yuan Plus

The compact crossover Yuan Plus scored 28,727 registrations, allowing it to surpass its Dolphin sibling and return to the top 5. With the compact EV focused in sending units to export markets, it seems that BYD is happy to have it running at around 25,000–30,000 units/month in its domestic market. This should still allow the model regular presences in the Chinese top 5. The Yuan Plus is one of BYD’s Musketeers in overseas markets, joining the Dolphin hatchback and the upcoming Seal sedan, which will stand as a solid honor guard to the future D’Artagnan of the lineup, the BYD Seagull.

Looking at the rest of the table, the main highlight in the top half is the #6 GAC Aion Y scoring 26,969 sales, again a new record performance. Will the MPV-disguised-as-a-crossover reach the top 5 soon and break the spell BYD/Tesla duopoly? That would be positive news for the market, considering that these two brands have been monopolizing the top positions for several months now…

And we all know the mantra: “Diversity breeds innovation.”

Further below in the table, Li Auto once again placed all three of its models in the top 20, with the L9 seven-seater — the startup’s biggest model — having another record month (11,844 registrations). Imagine that, a Cadillac Escalade–like plugin selling over 10,000 units per month….

Note that the L9, L8, and L7 are all full-size SUVs. Last month, there were four models longer than 5 meters in the top 20 — the Li Xiang L9, L8, & L7 as well as the Denza D9. Talk about automotive obesity….

The hot startup brand has a winner trio on its hands. The cheapest model in the startup’s lineup (starting at $49,000) should continue to improve its standing in the near future, with Li Auto setting a bullish sales target of 400,000 units this year! And 800,000 in 2024!! And 1.6 million in 2025!!! :0

For these targets to be met, the midsize L6 SUV, due to be launched sometime next year, will be a critical part of the puzzle, as well as the upcoming Mega MPV. You know, that one that looks like a Tesla CyberVan and charges at the ridiculously fast rate of 552 kW….

552kW!!! This model puts 500 km of driving range in its battery in 12 minutes! 10% to 80% in 10 minutes!! And has a 315 kW charging rate at 80%!!!

As someone famously said back in 2016, (charging at) “a mere 350 kW … what are you referring to, a children’s toy?“ Interestingly, 7 years later, it is Li Auto that is the first to make an EV that makes a 350 kW charging rate seem … boring.

Still on the topic of the top 20, the other big news is Changan’s midsize SUV joining the table, in #17, with a record 10,244 registrations. That’s mostly thanks to the EREV version, which amassed a record 9,718 registrations, confirming Changan’s high hopes for its BYD Song/Tesla Model Y fighter.

In the last position in the table, we have Geely’s Galaxy L7 sedan, making it the second Geely model in the table and allowing Geely to be one of the six brands with more than one model in the top 20 (BYD — 7 models; Li Auto — 3 models; GAC Aion, Wuling, Changan, Geely — 2 models each).

Outside the top 20, the highlights are varied, proving the diversity of the Chinese EV market. In the fresh blood startup category, XPeng’s take on the Model Y theme G6 midsize SUV got 8,132 registrations in only its third month on the market. The new model should join the top 20 soon (October? November?) as production ramp-up continues. The struggling startup threw everything but the kitchen sink at its new model, so that it finally has a winner on its hands.

NIO has the new-generation ES6 midsize SUV selling quite well (7,896 registrations), and the same can be said about another startup midsize SUV, Leap Motor’s C11, with 9,071 registrations (yes, it’s that one from the Stellantis deal). Expect this BEV/EREV model to show up sometime in the future in Stellantis dealerships.

BYD celebrated the landing of the Seal PHEV, which had been previously shown as the Destroyer 07, and which is basically a reskinned and younger looking BYD Han PHEV. It had a strong 7,444-unit performance. Could this mean that BYD has another winner on its hands? And at what point will all these models start cannibalizing themselves?

Looking at Changan’s new premium sub-brand, Deepal, besides the aforementioned success of the new S7 midsize SUV, its sedan sibling, the SL03, also had a positive performance, 7,126 registrations, contributing to Changan’s overall positive month.

Chery saw its QQ Ice Cream reach 7,235 registrations, its best result in a year, while the Zeekr 001 scored 8,701 registrations, a new year best for Geely’s Porsche premium model.

Finally, from foreign OEMs, the highlights are the VW ID.3’s 9,650 registrations, a new record for the German hatchback in the Middle Kingdom, confirming that price cuts can do miracles to one’s career. The same can be said about its crossover variant, that saw its sales climb to 6,938 units, a new year best for the German model. Once again, the mantra is proven: Lower prices = Higher sales…

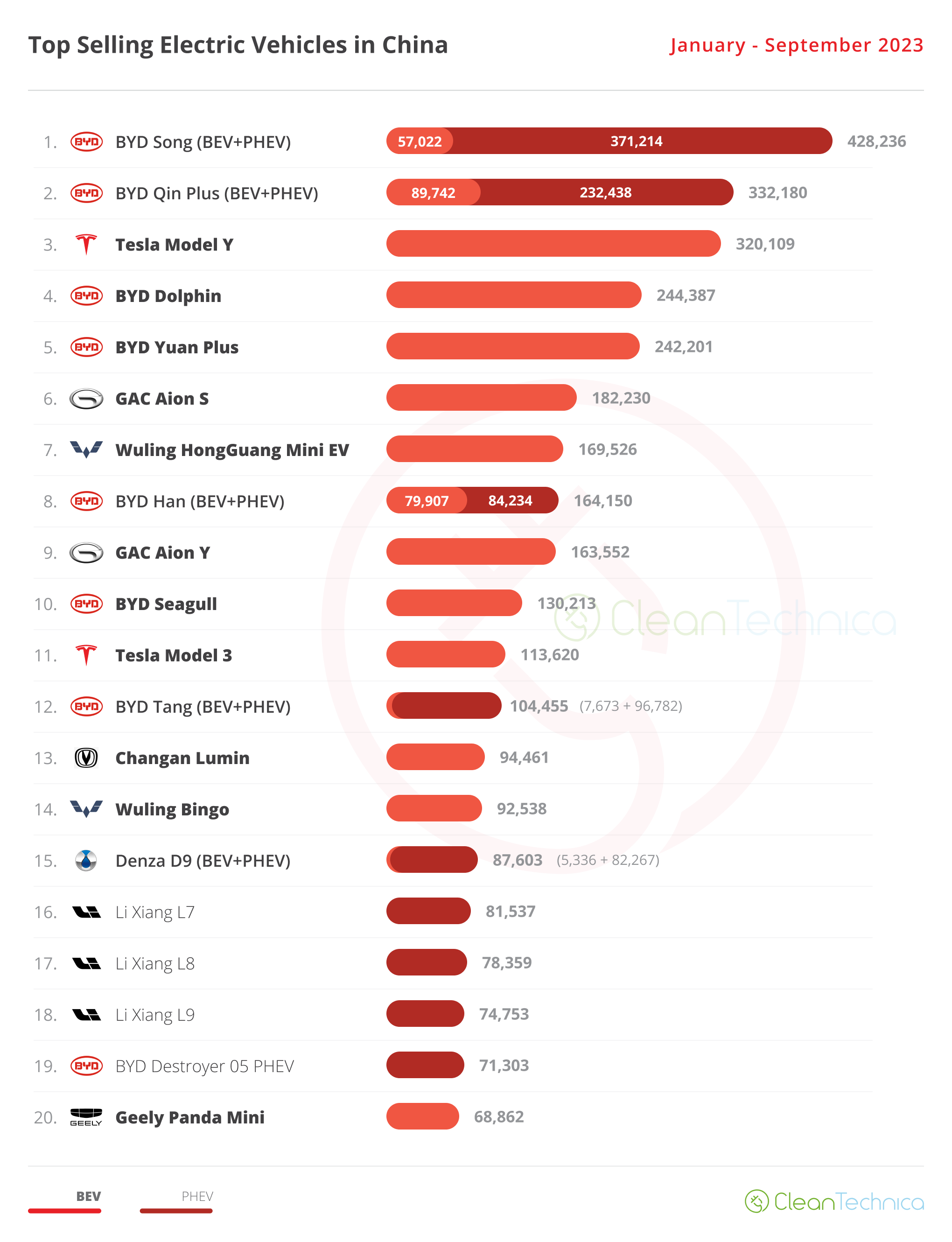

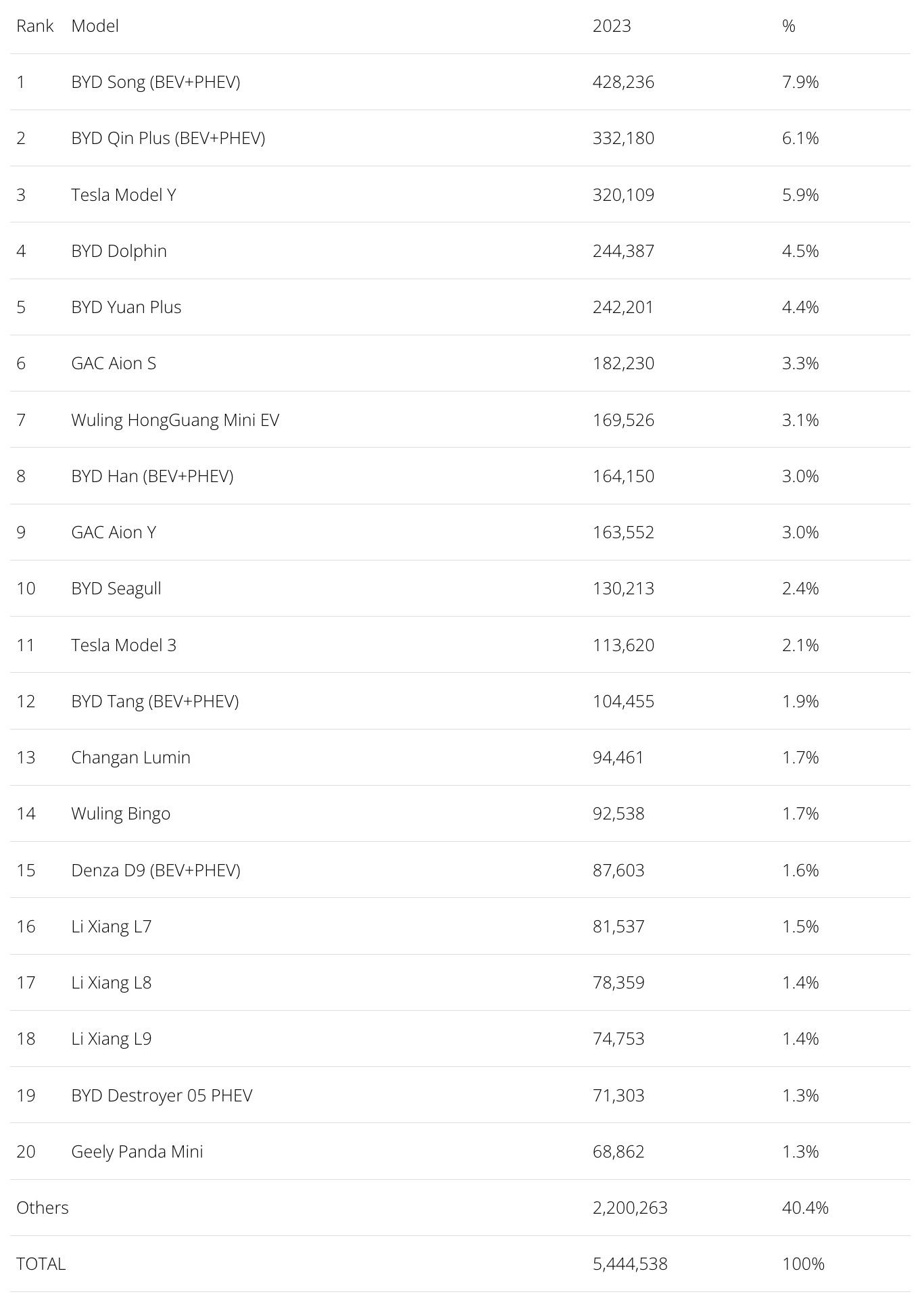

The 20 Best Selling Electric Vehicles in China — January–September 2023

Looking at the 2023 ranking, the BYD Song is well above the competition, while the runner-up BYD Qin Plus has kept the #3 Tesla Model Y at bay. Will the Chinese sedan resist the US crossover’s pressure in the last two months of Q4?

Off the podium, the #4 BYD Dolphin now has its sibling Yuan Plus some 2,000 units behind, so we might see a position change between these two in October.

The #9 GAC Aion Y is closing in on the #8 BYD Han and #7 Wuling Mini EV, so we might see GAC’s EV jump two positions next month, thus placing Aion’s dynamic duo in 6th (Aion S) and 7th (Aion Y).

Another model on the rise is the BYD Seagull, climbing one position in September to #10. Expect it to jump a few more positions by the end of the year.

In the second half of the table, the #14 Wuling Bingo is closing in on the #13 Changan Lumin, so there might me a position change between these two in the near future.

Finally, we must mention that all three Li Auto models are in the top 20. And the largest of them, the flagship L9, even managed to climb one position, to #18!

Apart from the all-mighty BYD, no one else has that many models in the top 20, and it helps to explain why this is the hottest EV startup right now. In just four years, Li Auto went from 0 to 500,000 units delivered!

Top Selling Auto Brands & Auto Groups in Chinese EV Market

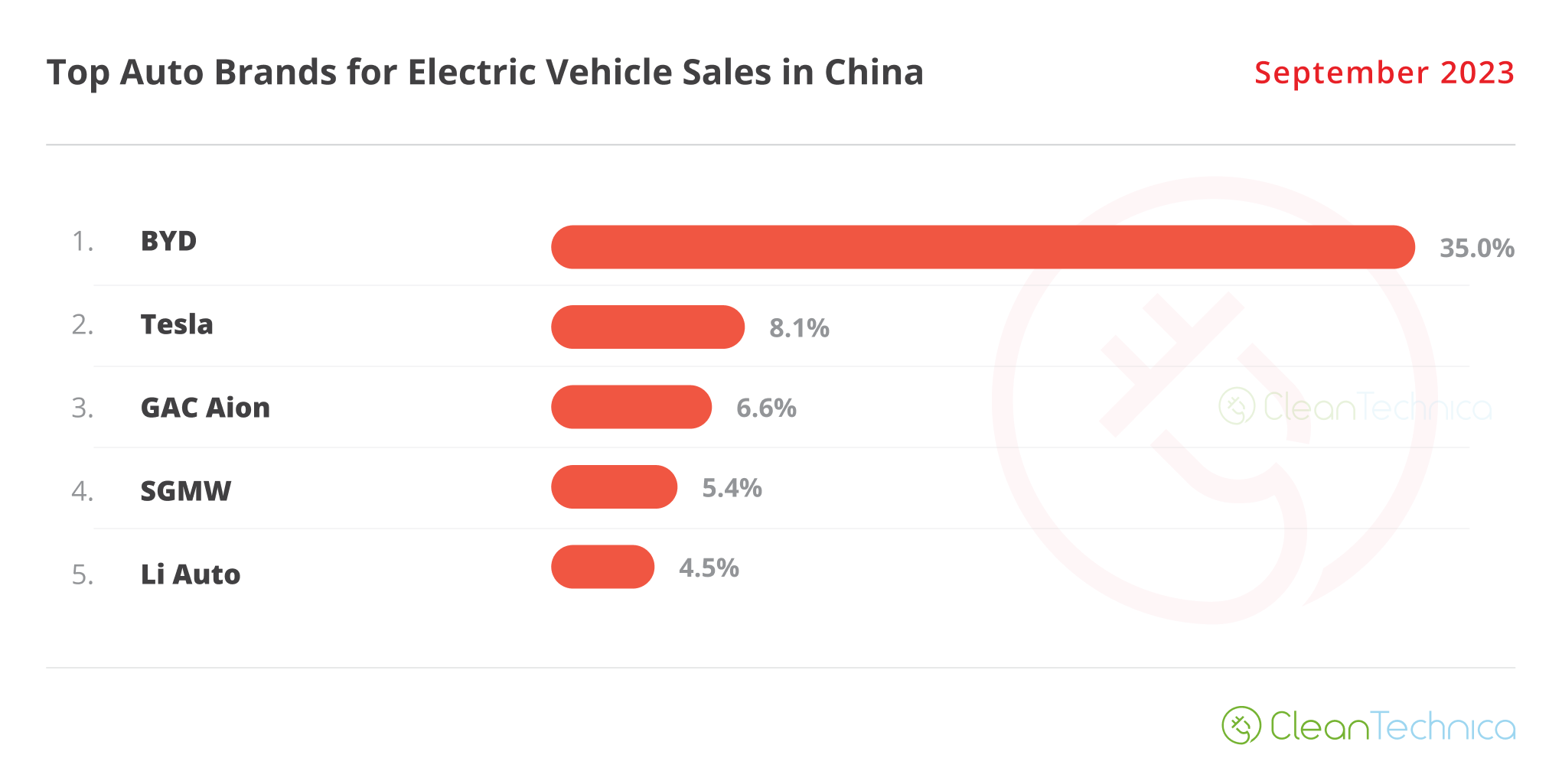

Looking at the auto brand ranking, there’s no major news. BYD (35.0%, down 0.2%) remains stable in its leadership position and is looking to win its 10th plugin automaker title this year, while in transition Tesla (8.1%, down from 8.4% in August) is stable in second place.

The third-placed GAC Aion was stable at 6.6%, while the SGMW joint venture’s performance was back in the red, dropping its share from 5.6% in August to its current 5.4%.

Finally, 5th placed Li Auto remained stable, at 4.5% share. The startup is looking set to become a force to be reckoned with in the future.

The major brands have lost share to those below the top 5, proving once again the diversity of the Chinese market. One final note: #6 Changan (4.2%, up 0.1%) is now looking to return to the best sellers table.

Looking at OEMs/automotive groups/alliances, BYD is comfortably leading with 36.7% share of the market, down 0.2% in September, while Tesla (8.1%) remains firm (for now, at least) a full one point share ahead of #3 SAIC and #4 GAC.

But the dynamics on these last two OEMs are quite different. While the SAIC mothership was in the red (7.1%, down from 7.2% in August) due to (another) slow month from the SGMW JV, the #4 GAC (7.1%) continued its slow rise and was getting dangerously close to SAIC. We could have a new bronze medalist by October.

One step down, #5 Geely–Volvo is slowly growing, now at 5.9% share, up 0.1% share compared to the previous month.

Just below it, #6 Changan (4.6%, up from 4.5% in August) has gained some precious ground over #7 Li Auto (4.5%), but the distances are short between these two, so next month could bring a position change between them.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Community Solar Benefits & Growth

CleanTechnica uses affiliate links. See our policy here.