Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

While the overall automotive market had a (barely) positive year (+1%), December saw promising signs — it was up 4% compared to December 2023. With 13 million passenger cars registered in 2024, this was the best year since the pandemic, but nevertheless, it was still down 2.9 million units compared to 2019.

Looking at the European plugin market, while December was a positive month, up 4% YoY with its 306,000 registrations, it was still quite far from the 413,500 registrations of December 2022. Also, despite the positive numbers in December, the full year performance wasn’t as good. Plugins dropped by 1% to three million units, which meant that plugin share slipped in the overall market.

Although … if we take out the German market, still reeling from the end of incentives in late 2023, Europe’s BEV market was up a significant 8%.

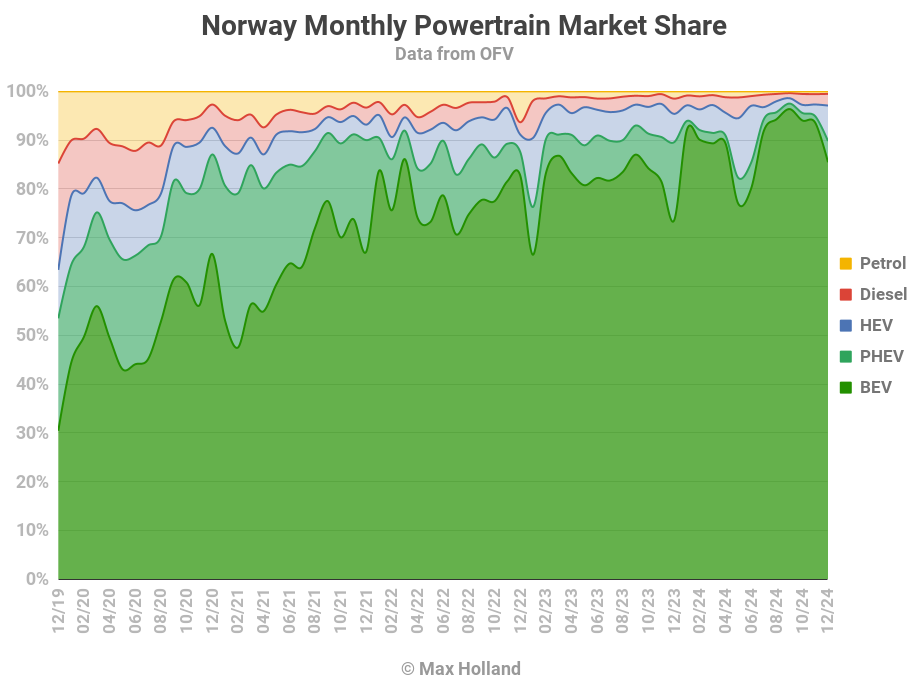

These results influenced the market share numbers. In December, plugin vehicles ended at 28% share, the same number they had 12 months ago, but far from the 38% of December ’22.

Looking at the full year, the 2024 PEV share ended at 23% (16% BEV), more or less aligned with the previous year’s result — 24% PEV (16% BEV), which itself was more or less on par with the 2022 result of 23% (14% BEV).

And 2022 also had a small jump from the 19% share of 2021 (10% for BEVs alone), so one could say that to find another significant rise, one has to go back to 2021, when it jumped from the 11% of 2020 to 19% PEV share.

If one would be cynical here, one would say that it’s like the market is moving only to comply with the EU’s CO2 mandates….

With 2025 including a new step in the EU’s CO2 mandate, expect a year of growth, with BEVs crossing 20% market share while PHEVs marginally grow, not only thanks to new, longer range models (just look at the new generation of PHEVs from Volkswagen Group), but also thanks to the likely addition of several PHEV models coming from Chinese OEMs. If all goes well, expect plugin share to end the year above the 33% mark in 2025.

For comparison, the Chinese market ended 2024 at 48%….

Regarding countries that grew their EV sales the fastest, in 2024, the top two were Malta (+91%) and Czechia (+64%), while on the other side, the ones that fell the most were Iceland (-70%!) and Romania (-32%).

These last two countries saw their EV markets fall due to policy decisions — in the case of Iceland, higher taxes on cars were the reason (the overall market in Iceland was also down a harsh 42% in 2024), while in Romania, an EV subsidies cut was the main reason, proving once again that policymaking has a decisive influence in EV adoption.

As for countries with the highest BEV adoption in Europe, as expected, Norway led the way, with 88% share in 2024, Denmark (51%) took the runner-up spot from Iceland, and Sweden and the Netherlands shared the 3rd spot, with 35% BEV share each.

Looking at the BEV vs. PHEV breakdown, while PHEVs ended 2021 and 2020 with almost half of the plugin market (46%), 2023 saw its share fall to just 33%, which is exactly the same result that 2024 brought to plugin hybrids. Expect PHEV sales to rebound in 2025, with the question now being — Will they grow faster than BEVs? Unlikely, but you never know…

Looking at the remaining powertrains, HEVs grew from 10% in 2023 to 12% in 2024, while diesel was down from 16% to 14% in the same period and petrol stayed at 48% share. This means that 35% of cars sold in Europe in 2024 had some form of electrification, while diesel is on its way to disappearing sometime around 2030….

Having a quick look at the overall best selling models in 2024, we a have a new winner, with the value-for-money king Dacia Sandero winning the 2024 title, a first for the Romanian brand. Confirming that we are not in Kansas anymore, this is the third consecutive year that the previously perennial leader of the European car market, the VW Golf, has lost the trophy. It first happened in 2022, to the Peugeot 208, then in 2023, to the Tesla Model Y, and now to the Dacia Sandero. So, there have been four different winners in the last four years.

One can say that the market is now more open than it has been in decades.

Looking to the mainstream market from a broader perspective, city cars (A segment) dropped significantly (-22% YoY), which is bad news for sustainability (but I guess it’s good news for OEM profits?…), while SUVs/crossovers continued their slow but irresistible rise (+4% YoY), at the expense of everything else.

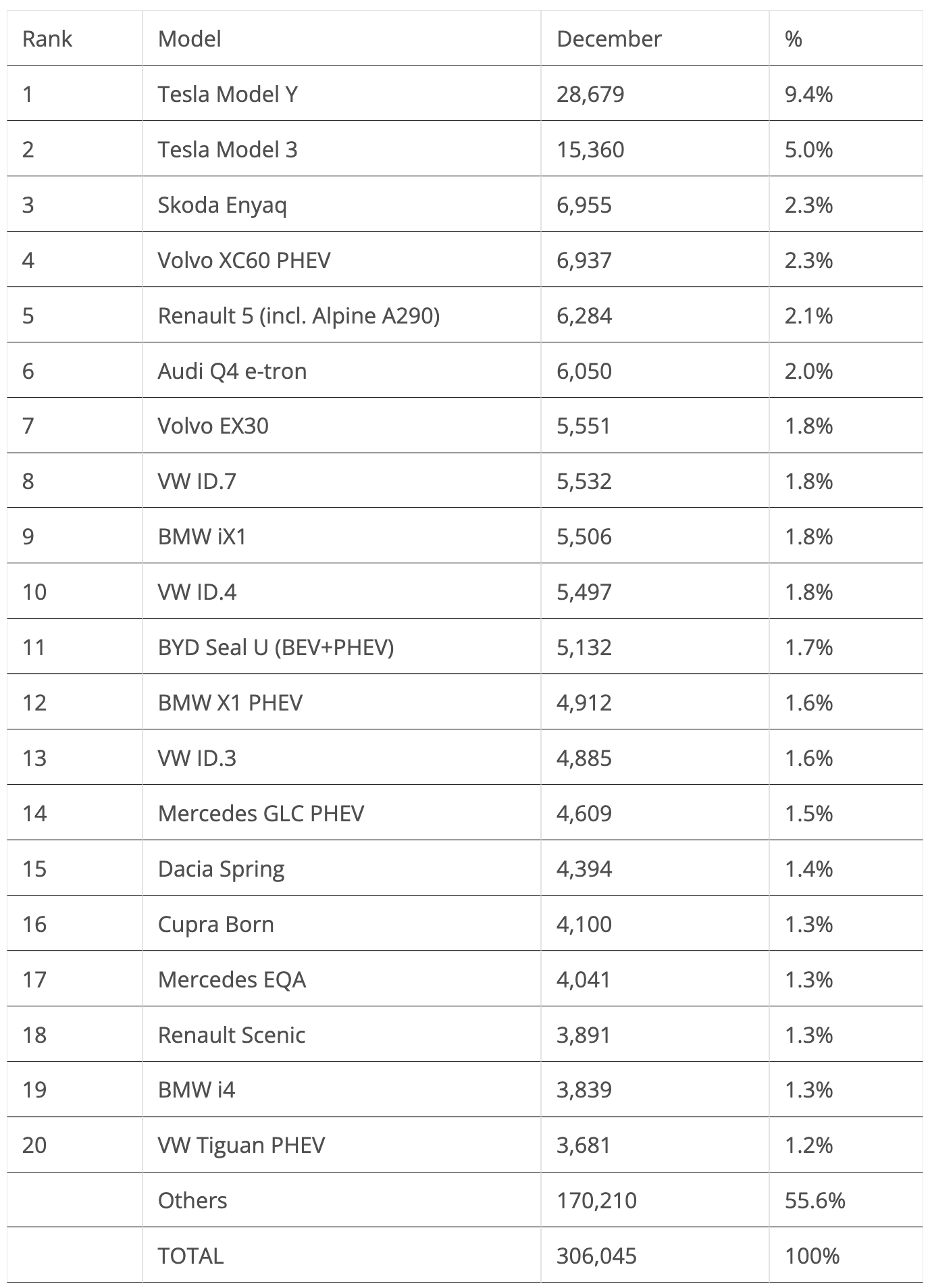

Back to plugins, in December, Tesla won #1 and #2, followed by the Skoda Enyaq, thus replicating the 2024 podium in December. But the big highlight is the Renault 5 showing up for the first time in the top 5.

Looking at December’s top 5 models in the electric car market:

#1 Tesla Model Y — The 2022 (and 2023, and 2024…) best selling EV in Europe had a solid 28,679 deliveries in December, a 15% improvement over the same month last year. With a refreshed Model Y coming soon, with incremental improvements in all the right places (although the design could be considered debatable), expect the crossover’s domination to continue in Europe throughout 2025. Although, with competition getting stronger by year end, 2026 might be the first year when the Model Y will have to work hard to keep the throne.

#2 Tesla Model 3 — Tesla’s sedan had 15,360 deliveries in December, which was a 17% improvement YoY. With its sibling Model Y going through a refresh soon, expect the sedan’s sales to drop in 2025. It could possibly end the year at around 105,000–110,000 sales. Expect the Model 3 to continue competing for silver throughout 2025, and with no models seemingly able to run at 9,000 units/month (maybe the Renault 5?), expect Tesla’s smaller sedan to be the favorite to win the runner-up spot.

#3 Skoda Enyaq — The Czech EV was the best selling Volkswagen Group model in the table, with 6,955 registrations in December. An impressive result for the compact crossover, especially considering that its younger, slightly smaller, and cheaper Elroq sibling is landing soon. Even if Enyaq sales drop from now on, the potential for Skoda to become a serious contender in the European EV market has been demonstrated. Now, about the Elroq … bronze medal candidate for 2025? With its prices starting at the same level as the smaller ID.3, the Elroq could well be the ace up Volkswagen Group’s sleeve in order to keep sales growing in 2025. One thing is for certain — the Elroq is the new value-for-money king within Volkswagen Group.

#4 Volvo XC60 PHEV — The Swedish SUV ended the month on a high note again, getting 6,937 registrations, which is a new record for the 8-year-old model and a good omen for the 2026 Volvo EX60…. It was performances like this one that allowed the XC60 to win the best seller title in the PHEV category in 2024. But, with an ever-expanding list of competitors showing up in 2025, the Volvo model will have a hard time keeping the trophy, especially considering that its battery size (19 kWh)/electric range is starting to look small compared to other midsize SUVs (for example, the Mercedes GLC has a 31 kWh battery).

#5 Renault 5 — The small Renault EV is now in full production ramp-up mode, and it shows, with the cheeky hatchback having another record month in December — 6,284 units registered. That allowed Renault’s first top 5 presence in years. After a ride through the desert, following the sunset of the Zoe, the French brand finally has its replacement charging ahead. In 2025, Renault will have a busy year. Not only will it have to finish the ramp-up of the 5 (up to podium levels?), but it will also have to quickly ramp up the new 4 crossover and refresh the Megane. With the Scenic crossover now a regular in the top 20, Renault’s ambition is to have four models (4, 5, Megane, Scenic) becoming regulars at the best sellers table. So, great things are expected from the French brand.

Looking at the remaining December best sellers, besides the aforementioned record results, a mention also goes out to the VW ID.7, which scored 5,532 registrations, a new record for the German, which allowed it to be 8th on the table and the best selling Volkswagen.

But the big news this month was the BYD Seal U (BYD Song in Euro-spec), which surged to 11th thanks to a record 5,132 units, a new record for any BYD and the highest position ever for a model from the brand.

This can become a watershed moment for the Shenzhen brand in Europe and a template for its success in Europe, because, of the 5,132 units sold, only 835 belonged to the BEV version, with the remaining belonging to the PHEV version. So, like in China, mainstream success for the SUV will likely come from the PHEV version — which, by the way, is unaffected by the EU’s recent tariff increases, meaning higher profits and lower prices for the PHEV version compared to the tariff-hit BEV version.

As such, expect other models, from BYD and other Chinese OEMs, to start landing on European shores in 2025.

Another surprise was the Dacia Spring. After a slow 2024, hit by a slow ramp-up of the refreshed version and the increased China tariffs, it managed to score 4,394 sales in December, a new year best. Will 2025 become a positive year for the small EV Dacia really hopes so, as the make’s big EV plans (Sandero EV in 2027, new generation Spring in 2028) are still a couple of years away.

Outside the top 20, there is a lot of stuff to talk about, starting in the full size category. The refreshed Volvo XC90 PHEV took the category’s monthly title, with 3,518 sales, which is a new record for the 10-year-old model! So, it looks like the BMW i5 (2,629 units) will have another strong contender for the category title, besides the new Audi A6 e-tron.

One category below, the Audi Q6 e-tron continued its slow ramp-up, hitting 3,569 units. That allowed it to finally outsell the Porsche Macan (3,422 units), its cousin, which is now at cruising speed.

In the compact category, the sensible Kia EV3 is ramping up, having reached 2,756 units. The sporty Cupra Tavascan has reached a surprising result, ramping up to 2,154 units, which is already above the Peugeot 3008 (which, with around 2,000 units, is not fulfilling expectations). This is especially true considering that its arch rival, the Renault Scenic, had 3,891 deliveries in the same period, allowing it to be #18 in December.

Still on the Renault vs. Stellantis rivalry, not only is the Peugeot 3008 trailing its Renault rival, but the Citroen e-C3’s registrations are significantly behind the Renault 5’s, with the small Citroen scoring just 2,266 deliveries — versus close to 7,000 of the Renault EV. Production issues? Or were they starving registrations in 2024 and preparing for a thundering start to 2025? Let’s hope it is the latter.

Finally, a mention goes out to the ramp-up of the Mini Aceman, which scored 1,773 registrations, allowing the British make to have three models (Cooper EV, Countryman EV, and Aceman) in full production and increasing the speed of electrification of the posh brand.

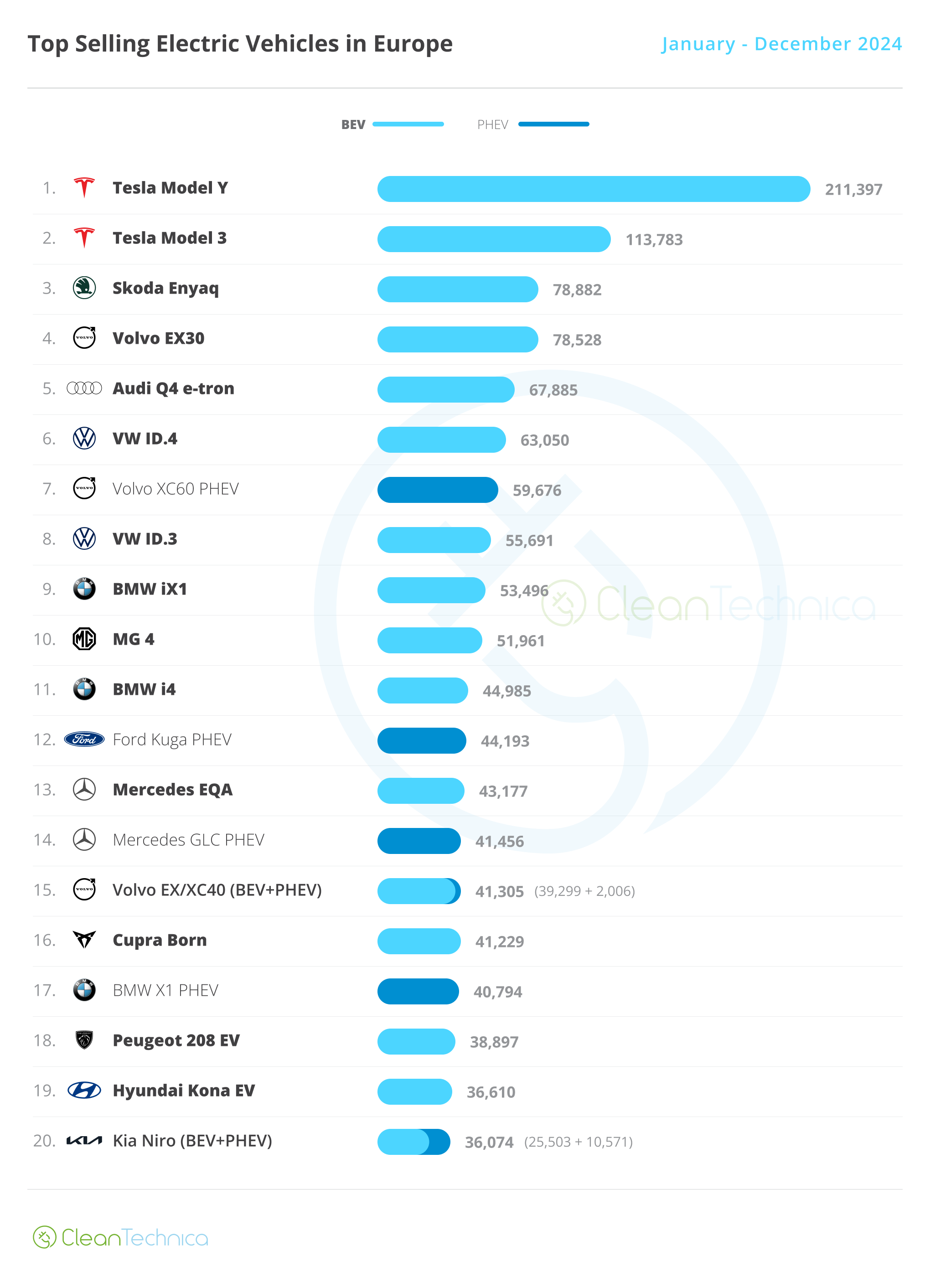

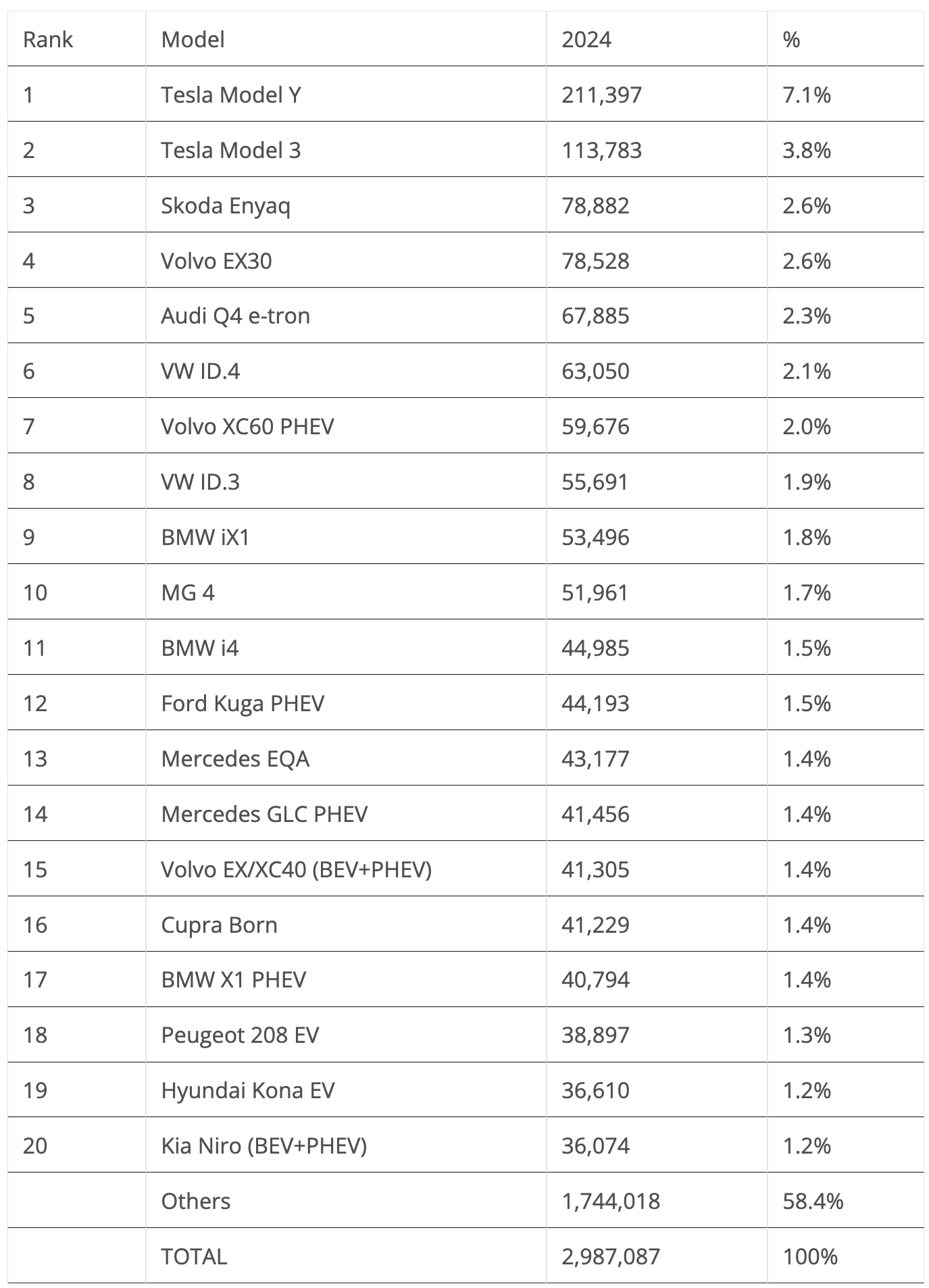

Looking at the 2024 ranking, the Tesla Model Y won the best seller title again, its third in a row, and the Tesla Model 3 stayed in the runner-up position. So, Tesla won 1st and 2nd place in Europe for the third consecutive year.

Interestingly, this is the Model 3’s 6th podium in a row, after gold in 2019, silver in 2020, gold again in 2021, and three silver medals in 2022, 2023, and 2024.

Expect the Model Y to win this title again in 2025. Although, it will be difficult to beat the 2023 score of 255,000 units. Regarding the #2 position of the Model 3 — while it remains the favorite for that position, it will be harder for Tesla to repeat the #1, #2 titles that it has been winning so far.

The Skoda Enyaq surpassed the Volvo EX30 in December and replaced it in the bronze position, with the Czech brand winning its first podium position. Will Skoda score another medal in 2025? It will be hard, as the Renault 5 is expected to become a sales success, but the new Elroq could pull a surprise….

Regarding other last-minute position changes, Mercedes had a good month, with the EQA and GLC PHEV rising to #13 and #14, respectively, while the Peugeot e-208 EV and Hyundai Kona EV profited from the career end of the Kia Niro to climb one position each, to #18 and #19.

But the dark horses of 2025 lie in the B- and C-segments/subcompact and compact categories. While growth in the top half of the automotive ecosystem is still possible, the biggest opportunities sit on the more competitively priced end of it.

Not only will the new Stellantis small EVs and Renault 4 & 5 push B-segment sales up in a significant way, blasting past the current category leader Peugeot e-208, but in the category above, the much awaited Skoda Elroq could have enough demand to scare the category leaders.

In the PHEV league, the Volvo XC60 PHEV overcame the Ford Kuga PHEV, without any major effort. However, it should have a harder time retaining the title in 2025, especially from the hands of the new Mercedes GLC PHEV (and Chinese PHEVs?).

Looking at the size categories, the Fiat 500e again took the city car title — but at 32,000 units, it sold less than half of what it did in 2023. With the runner-up Dacia Spring apparently back in form, the Italian EV will need a significant refresh (lower prices, LFP batteries…) if it wants to stay in the race.

In the size above, the prize again went to the Peugeot e-208, with the hatchback beating the competition. Expect lots of new competition in 2025, though, starting with the new Citroen e-C3 and Fiat Grande Panda — and the Renault 5 on top, kicking the Pug off the throne.

In the compact category, the VW ID.4 lost the title this time, to its Czech cousin the Skoda Enyaq. 2025 will be an interesting year in this category. There are plenty of candidates, but if I had to pick one, I would bet on the Skoda Elroq.

In the category above, the Teslas Model Y and Model 3 have no real competition among midsizers, but towards the end of the year, we saw the VW ID.7 gaining pace, so the VW EV could shorten the distance between it and the Tesla best sellers in 2025.

In the full size category, it was a close call, but the BMW i5 managed to sprint pass the competition with some 23,000 deliveries, ending ahead of a pack of competitors (BMW X5 PHEV, Volvo XC90 PHEV, Mercedes E-Class PHEV, Mercedes EQE, Porsche Cayenne PHEV). If 2024 was unpredictable, expect 2025 to remain the same! Although the recent refresh of the Volvo XC90 PHEV might give it that slight edge over the competition.

Comparing the segment composition of the EV market with that of the mainstream market, one big difference is apparent — while we have five B-segment/subcompact models in the overall top 10, in the EV top 10, we have … zero, nada, niente.

And here is the final frontier for EVs to become mainstream in Europe: we need small, affordable, but competitive EVs, that people want to buy. The Renault 5 is one of them, but we need more.

Before looking at the EV brand ranking, a couple of notes on the overall ranking: Among the top 20 brands, the one that grew fastest was heavily electrified Volvo (+28%), while the one that fell the most was FIAT (-21%), which saw sales of its only EV, the Fiat 500e, to drop by half.

Outside the top 20, the highlight was BYD, which showed up on the radar at #31 with 50,000 sales and a 220% growth rate.

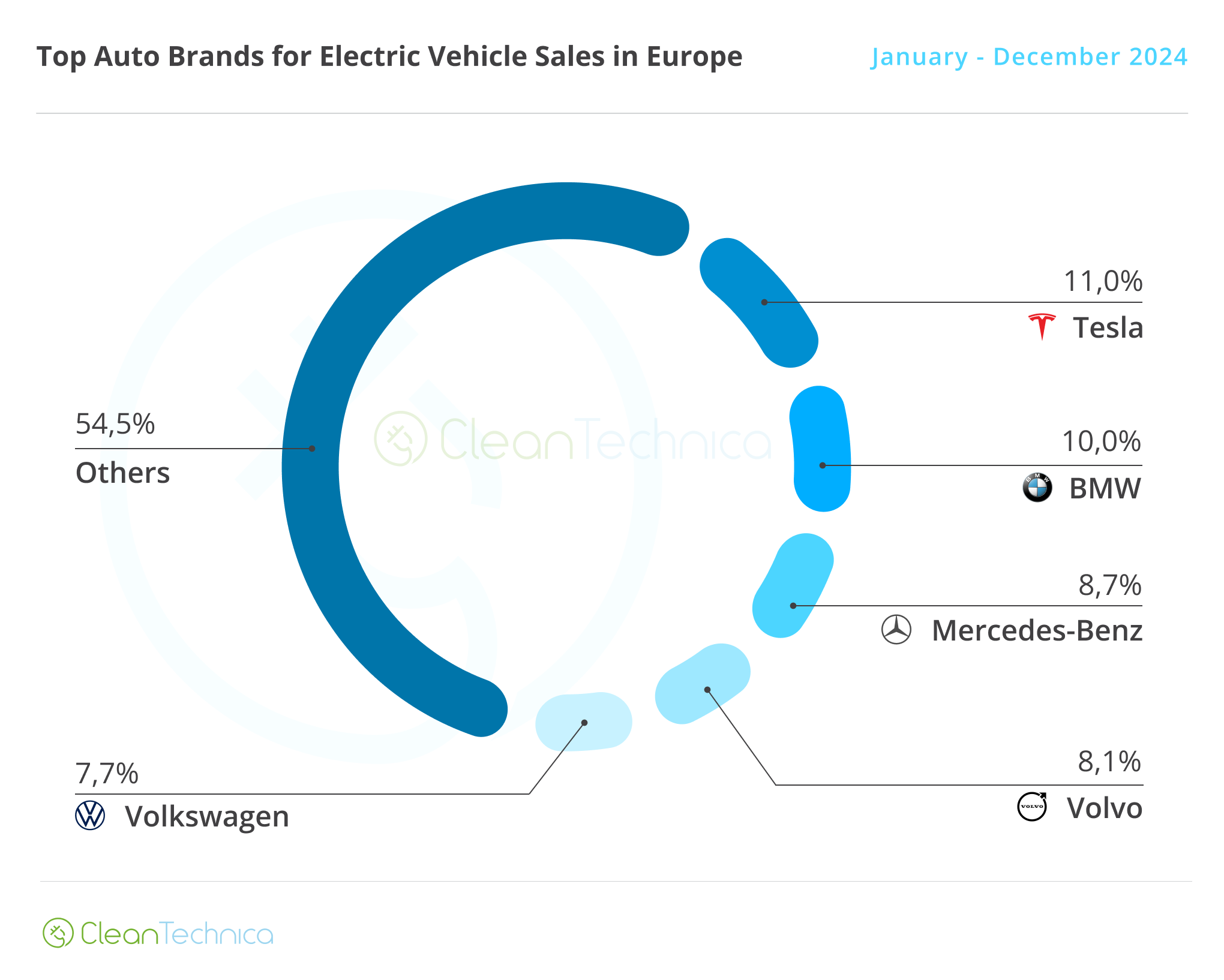

In the passenger vehicle EV brand ranking, Tesla (11%) renewed its best seller title, which is its 4th in Europe and 3rd in a row. But in 2023 it won with 12.1% share…. Expect it to remain the main candidate for the 2025 title, even though it should lose some market share on the way, which might endanger its leadership position.

A rising BMW (10%, up from 8.8% in 2023) once again won the runner-up spot, and is also the main candidate trying to displace Tesla in 2025.

Mercedes (8.7%) ended in 3rd, returning to the podium for the first time since 2021, while a rising Volvo (8.1% in 2024 vs 5.6% in 2023) ended in 4th.

Volkswagen (7.7% share) dropped from the 3rd position in 2023 to 5th in 2024, in no small part due to its slow first half of the year, but expect the German make to have a go at returning to the podium in 2025. Although, it will have to contend with a dark horse called … Renault.

With the 5 expected to be a best seller and the 4, Megane, and Scenic expected to make up a strong remaining lineup, the French brand has the potential to disrupt the top 5 in 2025. It will be interesting to see how high it will reach. Podium maybe?

Top Auto Groups/Alliances for Electric Vehicle Sales in Europe — 2024

Finally, looking at the OEM level, #1 Volkswagen Group (21.9% vs 21.2% in 2023) had no problem winning the electric car market’s top spot again.

Tesla was 3rd, with 11% share, behind rising #2 BMW Group (11.3% in 2024 vs 10.4% in 2023), which joined the podium in 2024. In fact, the Bavarian OEM reached its highest position since 2019!

Expect a close race between these two in 2025. BMW Group should start as the favorite considering the growth potential of its namesake brand and also all the fresh EVs coming from the British brand Mini.

Stellantis (10% vs. 13.1% in 2023) was the loser of the year, dropping from 2nd in 2023 to its current 5th position. Expect Stellantis to recover share in 2025, considering the large number of new EVs that will launch in the next few months.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy