Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

A few months ago, I wrote about a global peak ICEV fleet, and argued that we’re very close to it — perhaps even surpassed it by now. Despite the headline, I stand by that position, and that’s because the focus here is different: not about internal combustion engine vehicles (ICEV), but about the internal combustion engine (ICE).

As EV sales grow, economies of scale get better and prices — hopefully — maintain or even accelerate the downward trend we’ve been seeing for the last few years. For internal combustion engines, however, the effect is the inverse: as sales fall, economies of scale are lost, and prices are bound to increase at some point.

The main difference between the two articles centers on plug-in hybrids (PHEVs). PHEVs are considered EVs (because if used well, they mostly run on electricity and greatly reduce oil consumption), so they fall outside the “ICEV” group and lead to a significant portion of falling ICEV sales … yet they still have an internal combustion engine under their hood.

The internal combustion engine is not yet defeated…

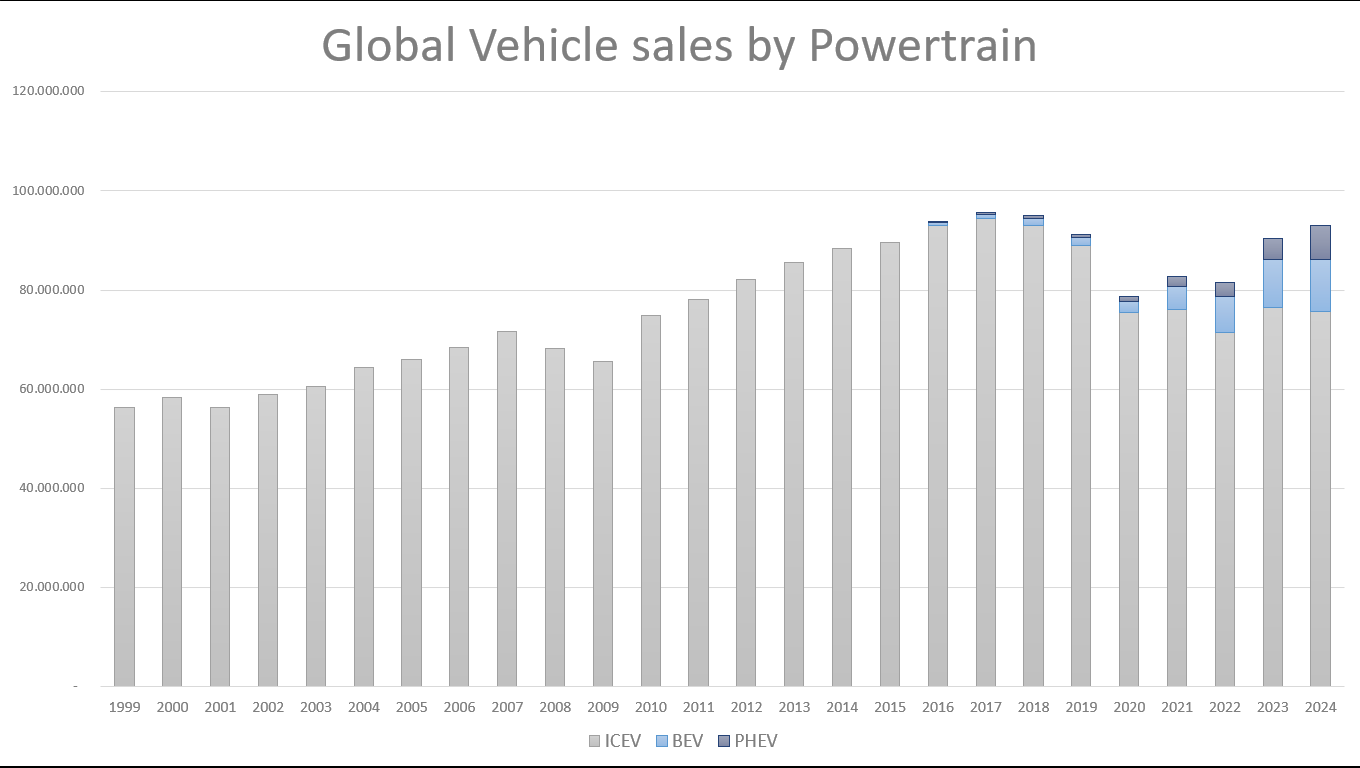

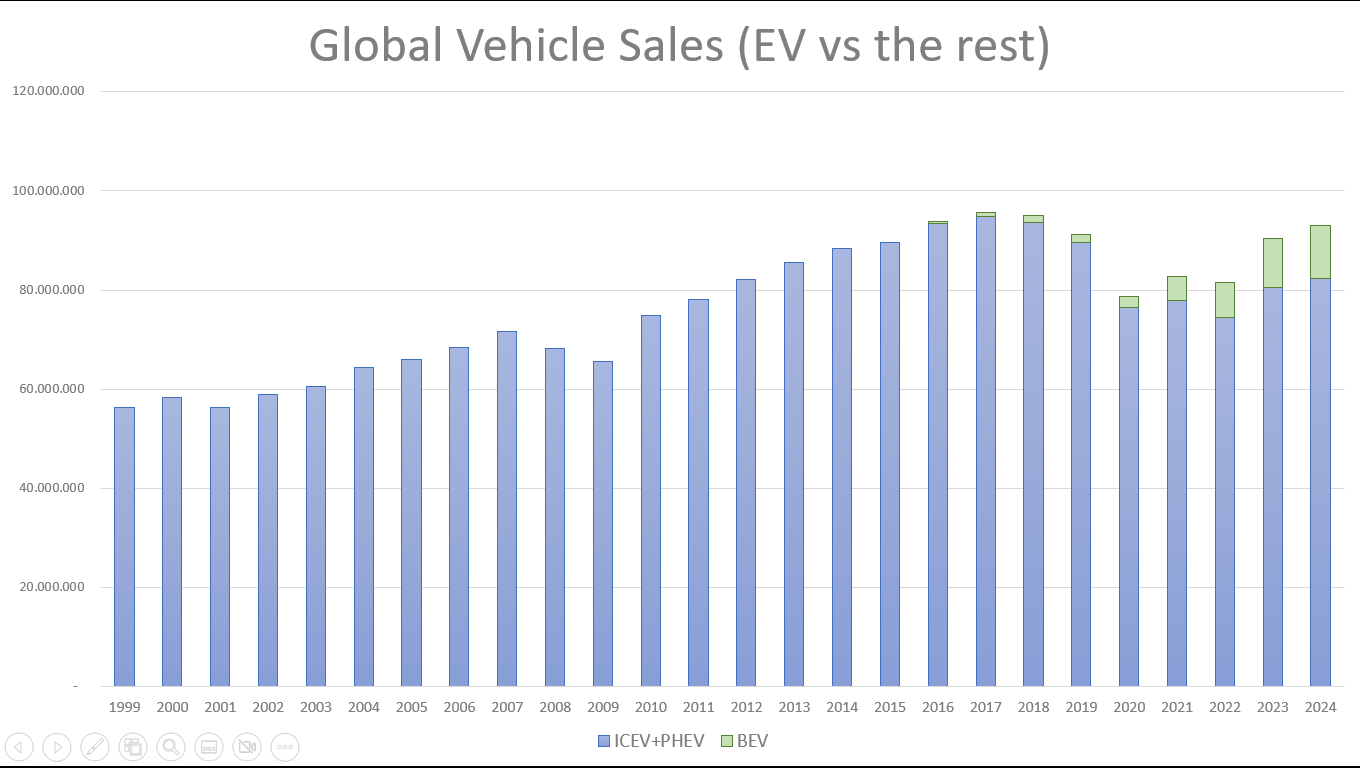

Let’s look at the data.

The exact number of vehicles sold in 2024 is hard to come by, but it seems that it will show small growth compared to 2023 (2.8% for light vehicles according to S&P). In rough terms, this could mean that total vehicle sales increased by some 2.5 million units worldwide.

Meanwhile, while we’re still waiting for José’s report on December, I think it’s already safe to claim that EV sales will end 2024 at above 17 million units, which is nearly 4 million more than in 2023. What this means, of course, is that despite a growing overall market, ICEV sales will fall by around 1 million units in 2024. If we put this data into a graph, in the long term we can see the 2021–2024 period as a stabilization of ICEV sales in the post-pandemic period, after the fall that came in 2018–2020. It’s extremely likely that a new period of decline will start in 2025 as EVs start eating into ICEV sales more.

And yet, the internal combustion engine remains resilient. Every single one of those PHEVs had one, after all, which means the number of vehicles sold with an ICE inside them grew by around 2 million in 2024.

Crucially, 2024’s EV growth was largely driven by PHEVs, and as China further perfects the manufacturing of affordable, long-range EREVs (which is the en vogue name for PHEVs without a direct link between the ICE and the wheels), I expect their share to keep growing. This means that more internal combustion engines, not fewer, are likely to be sold in following years.

Which means, if we’re counting on lower sales to affect ICE economies of scale and cause an increase in price, we’re likely to be disappointed in the medium term.

… but legacy auto could be doomed

It may be that more ICEs are being built than in years prior (though still fewer than in the all-time high of 2017). But, more and more, those who’re building them are no longer the companies of old, but newcomers from the Middle Kingdom*.

*In Chinese, China (中国) literally means something akin to “Intermediate Country,” or, as others have more poetically translated, the Middle Kingdom.

Speaking about total vehicle sales, preliminary data points to the top 6 global OEMs (Toyota, Volkswagen Group, Hyundai/Kia, Renault/Nissan, Stellantis, GM) cumulatively losing approximately a million sales in 2024 (despite this being a year or growth for the industry). Of this group, only Renault showed growth, whereas Stellantis sold nearly half a million fewer vehicles than in 2023.

North America remains protected through tariffs (though Rivian and Tesla could take market share there), and Europe, though contested, is still a stronghold for legacy auto. But China is now all but lost to its native companies, and the developing world plus Oceania, which account for almost 20% of global sales, are under severe threat.

Amidst the competition, we can see a trend emerging: smaller countries tend to favor BEVs, whereas larger countries prefer PHEVs, and in both cases, the Chinese have been able to arrive with compelling offers to which legacy auto has not a viable response other than expensive HEVs or the ICEVs of old. Worse even, Chinese OEMs are also arriving with hyper-affordable ICEV options which, even if not as reliable as their legacy counterparts, are still becoming popular due to their low cost.

Legacy auto is under threat from all fronts, and I’d wager 1 million fewer sales in 2024 could become 2 million in 2025 and perhaps 4–5 million by 2026.

Final thoughts

The economies of scale of the industry of internal combustion engines as a whole may not be shrinking, but for the companies most committed to the survival of the ICEV, it definitely is. China’s automakers know their bets are better placed on the EV technology they dominate, instead of the ICE technology that Japanese, European, and American companies have had over a century to master. Because of this, I am not concerned by the Chinese OEMs ramping up ICE manufacturing.

Now, for all the doom and gloom towards legacy automakers, it’s clear that they will not disappear … not all of them, at least. I wasn’t yet born when the Japanese threatened the supremacy of European and American car manufacturers, but it seems from what I’ve read that the onslaught was not too different to what we’re seeing now.

Most Chinese brands purchase their batteries from third parties, and it’s completely viable for VW or Renault to become competitive EV manufacturers by allying with CATL and purchasing from factories located within Europe. GM and Ford may not have this chance due to the beef between the US and China, but they can still do the same with LG, Panasonic, or SK On … as they’ve been doing in the past.

But I do expect that the pain will be considerable and that at least a few large companies will not survive, either disappearing or ending up purchased by a Chinese OEM. And as the influence and resources of these companies reduces, the political pressure towards maintaining an ICE ecosystem will also lose steam.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy