Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Newly released data compilation from Berkeley Lab tracks operational and proposed plants

Improving battery technology and the growth of variable renewable generation are driving a surge of interest in “hybrid” power plants that combine, for example, utility-scale wind and/or solar generating capacity with co-located batteries. A newly released briefing from Berkeley Lab tracks and maps both operational and proposed hybrid plants >1 MW in size across the United States while also synthesizing data mined from power purchase agreements (PPAs).

This briefing is accompanied by two data visualizations, one focused on online plants and the other on those in interconnection queues, and an Excel data file with detail on individual plants. We will present this report during a free one-hour webinar on September 30, 1:00 PM Eastern. To register, go to: https://lbnl.zoom.us/webinar/register/WN_Mw5i4a5ZQKuUJRKkBPvGgg

Operational hybrid growth continued at a healthy pace in 2023, especially for PV+Storage

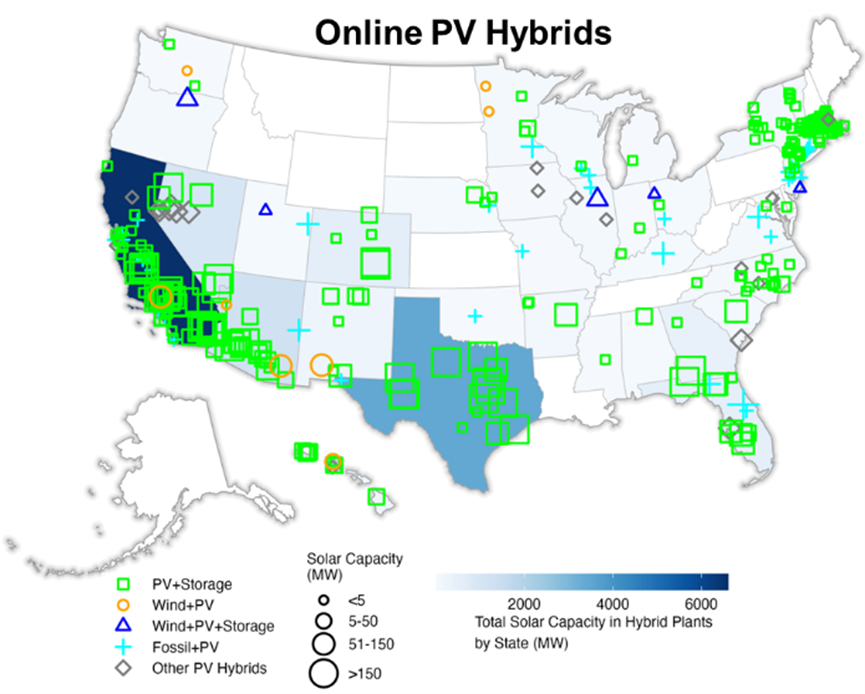

80 new hybrid plants (>1 MW) began operating across the United States in 2023, totaling nearly 7.9 GW of generating capacity and 3.6 GW/11.6 GWh of energy storage. PV+storage plants are the most common and can be found throughout much of the country (see map for all PV Hybrids installed by the end of 2023), though the largest such plants are in California and the West, as well as Texas and Florida. But there are nearly twenty other hybrid plant configurations we track as well, including several different fossil hybrid categories (each dominated by the fossil component) as well as wind+storage, wind+PV, wind+PV+storage, geothermal+PV, and others.

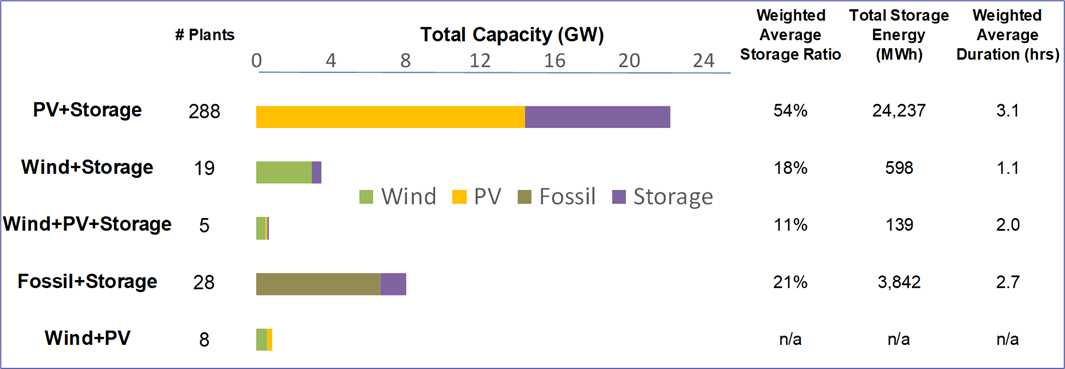

Among the operational generator+storage hybrids, PV+storage dominates in terms of plant number (288), storage capacity (7.8 GW/24.2 GWh), storage:generator capacity ratio (54% or 0.54 GW of storage per GW of solar), and storage duration (3.1 hours). This relatively high storage ratio and duration in particular suggest that storage is providing resource adequacy (i.e., capacity firming) and energy arbitrage (i.e., shifting power sales from lower- to higher-priced periods) capabilities to PV+storage plants. In contrast, the relatively low storage ratio and short duration of wind+storage plants suggests that they are primarily targeting the ancillary services markets (e.g., providing regulation and/or reserves).

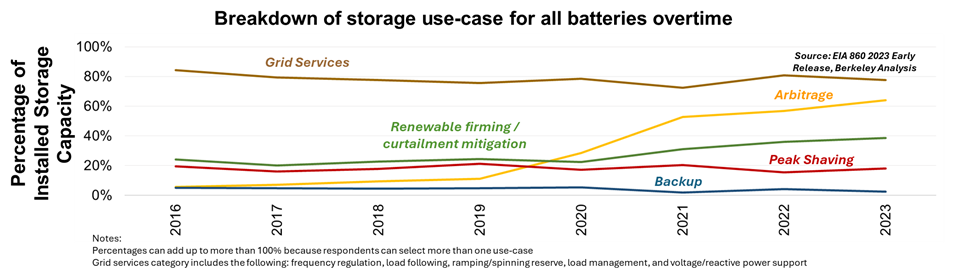

66 of the 80 hybrids added in 2023 were PV+storage. As of the end of 2023, there was roughly as much storage capacity operating in PV+storage hybrids as in standalone storage plants (~7.5 GW each). In storage energy terms, however, PV+storage edged out standalone storage by ~7 GWh (24.2 GWh vs. 17.5 GWh, respectively). Provision of grid services remains the most popular use case for storage, but energy arbitrage has increased in popularity in the last 4 years.

Interconnection queues also show growth in hybrid proposals in 2023

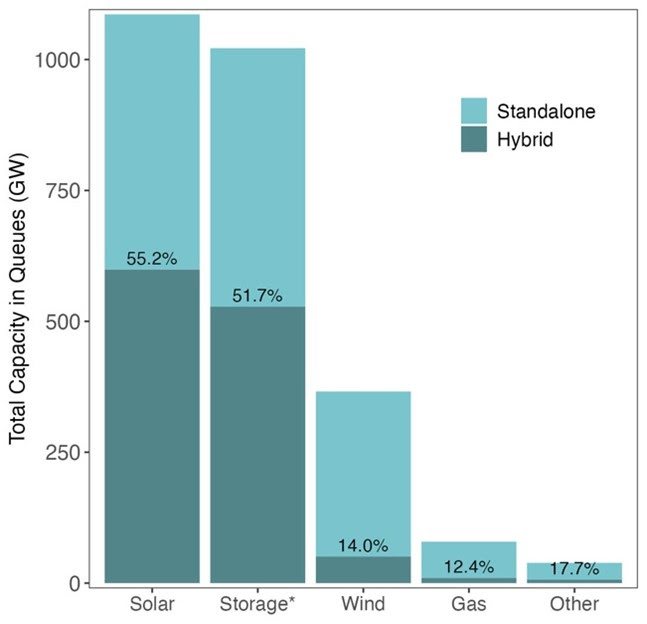

Data on plants under development from the interconnection queues of all seven ISOs/RTOs plus 44 non-ISO balancing areas (including utilities and Power Marketing Administrations) show continued strong developer interest in hybridization. At the close of 2023, there was roughly 1,086 GW of solar plants in the nation’s queues; 599 GW (~55%) of this capacity was proposed as a hybrid, most typically pairing PV with battery storage (PV+storage represented 86% of all hybrid capacity in the queues). For wind, 366 GW of capacity sat in the queues, with 51 GW (~14%) proposed as a hybrid, again most-often pairing wind with storage (wind+storage represented ~5% of all hybrid capacity in the queues). More than half of all storage in the queues is estimated to be part of a hybrid plant.

At the end of 2023, there were 18% more hybrid plants—representing 33% more generating capacity—in the queues than there were at the end of 2022. Storage capacity in hybrid form increased by 48% from 2022 to 2023; by comparison, standalone storage capacity in the queues increased by 52% year-over-year. This relative growth is particularly notable given that the Inflation Reduction Act (IRA), which became law in August 2022, provides standalone storage with access to the investment tax credit (ITC) for the first time, thereby removing some of the impetus to couple battery storage with solar in a hybrid configuration. It is therefore somewhat surprising to see roughly equal growth of both hybrid and standalone storage capacity reflected in this year’s report (both for projects coming online in 2023 as well as being proposed in the queues). It could be that the market still needs more time to react, but there are several countervailing reasons why the trend of hybridization might continue despite the standalone storage ITC, such as bypassing clogged queues or boosting a PV plant’s capacity credit, which ultimately might outweigh other considerations. We will continue to track this trend in future reports.

While many of the plants proposed in the queues will not ultimately reach commercial operations, the depth of interest in hybrid plants—especially PV+storage—is notable, particularly in certain regions. For example, in CAISO, 98% of all solar capacity and 34% of all wind capacity in the queues is proposed as a hybrid. Commercial interest in California no doubt derives from the state’s need for capacity resources to meet resource adequacy requirements, but it is also driven by the pronounced daily wholesale pricing patterns induced by high solar penetrations that create arbitrage opportunities for storage that do not yet exist in the same magnitude in most other wholesale markets.

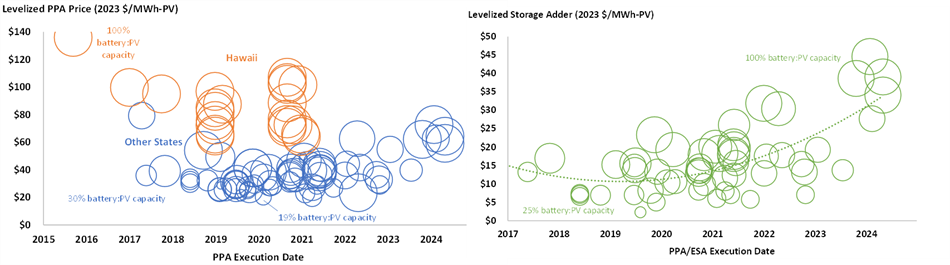

PPA prices for PV+storage are increasing

Finally, we survey pricing data from 105 PV+storage PPAs in 10 states totaling 13 GW of PV and 7.8 GW/30.9 GWh of batteries. Sixty-eight of these 105 PPAs are from operating PV+storage plants, while the other 37 plants are still under construction or in development. PV+storage PPA prices have started to increase since 2020 (left graph, below), though such price increases do not seem to have put a damper on interest in developing these hybrids. The “levelized storage adders” have also increased to ~$10000/MW-month, ~$80/MWh-stored (assuming one full cycle per day), or ~$35/MWh-PV (as shown in the right graph, below). Some of the recent price increase could simply reflect a trend towards higher battery:PV capacity ratios on the mainland over time (whereas this ratio is typically pegged at 1 to 1 in Hawaii), which will increase costs, all else being equal. The well-publicized impact of inflationary and supply chain pressures on prices in 2022 could also be a short-term contributor, though battery prices have more recently hit all-time lows.

For further details on these and other findings, along with new analysis on battery roundtrip efficiencies, please refer to the PowerPoint-style data compilation, which can be downloaded here. The briefing is also accompanied by two data visualizations, one focused on online plants and the other on those in interconnection queues, and an Excel data file with detail on individual plants.

Finally, once again we will present this report during a free one-hour webinar on September 30th, 1 PM Eastern. To register, go to: https://lbnl.zoom.us/webinar/register/WN_Mw5i4a5ZQKuUJRKkBPvGgg

Courtesy of Will Gorman & Joe Rand, Lawrence Berkeley National Laboratory

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy